Answered step by step

Verified Expert Solution

Question

1 Approved Answer

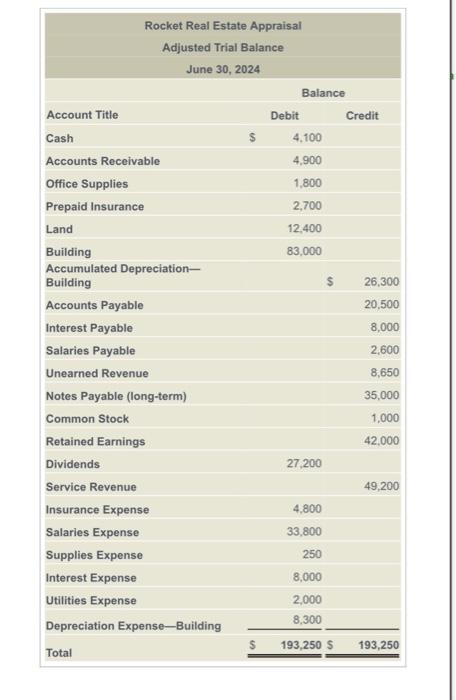

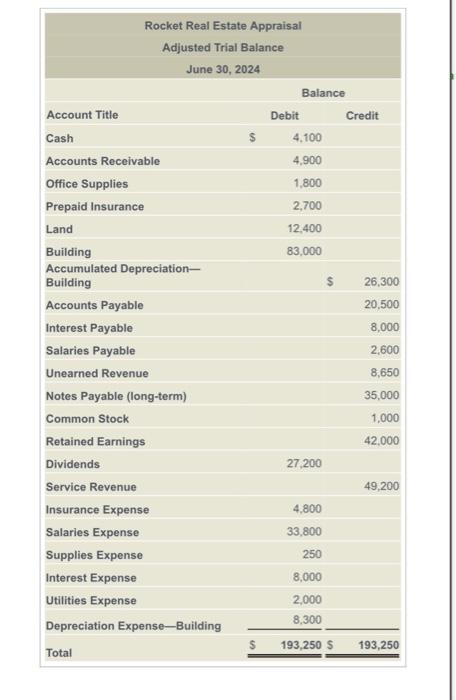

complete requirements 5&6 fill in T-accounts Rocket Real Estate Appraisal Adjusted Trial Balance June 30, 2024 Balance Account Title Debit Credit Cash 4,100 Accounts Receivable

complete requirements 5&6

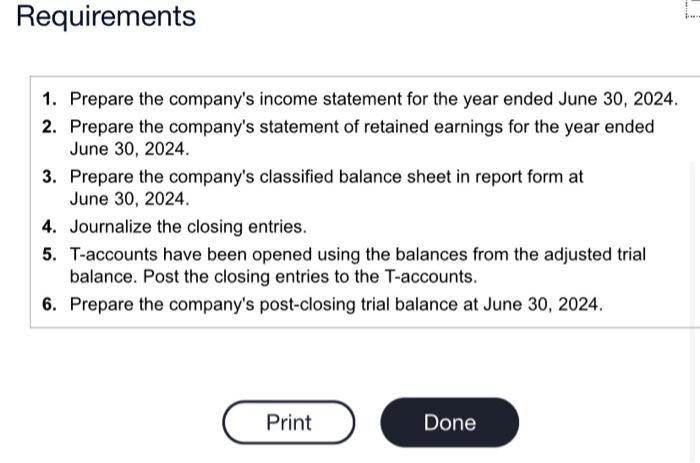

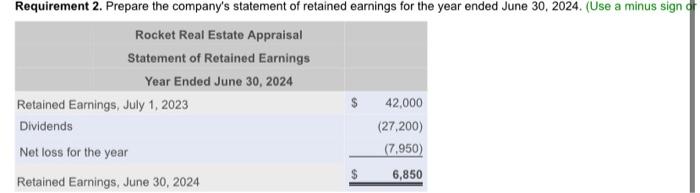

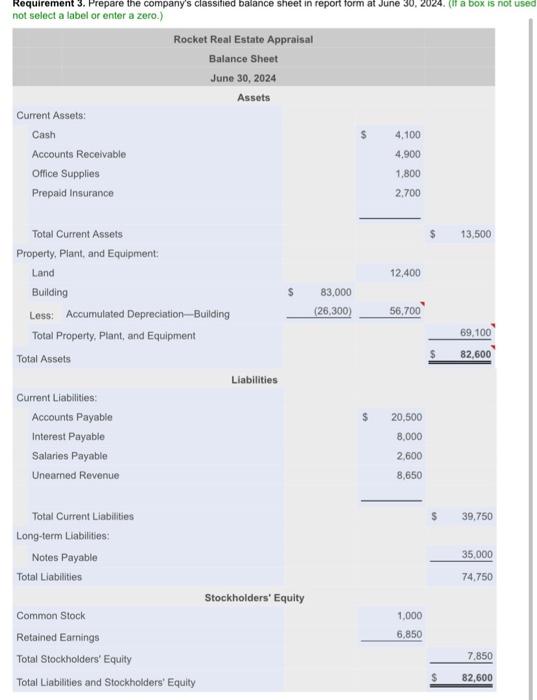

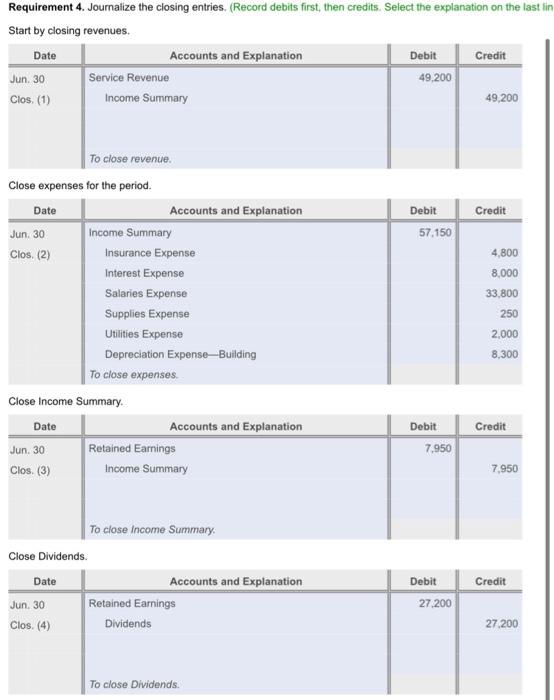

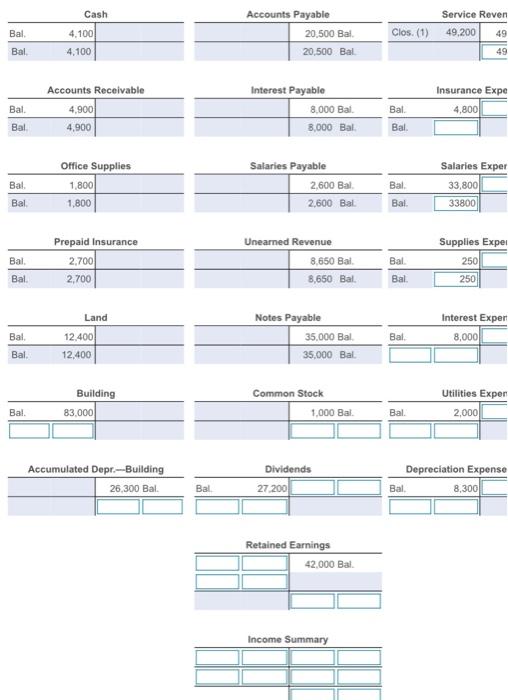

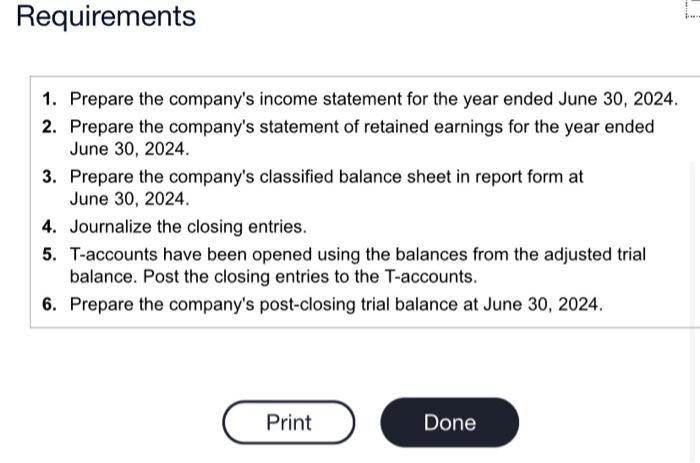

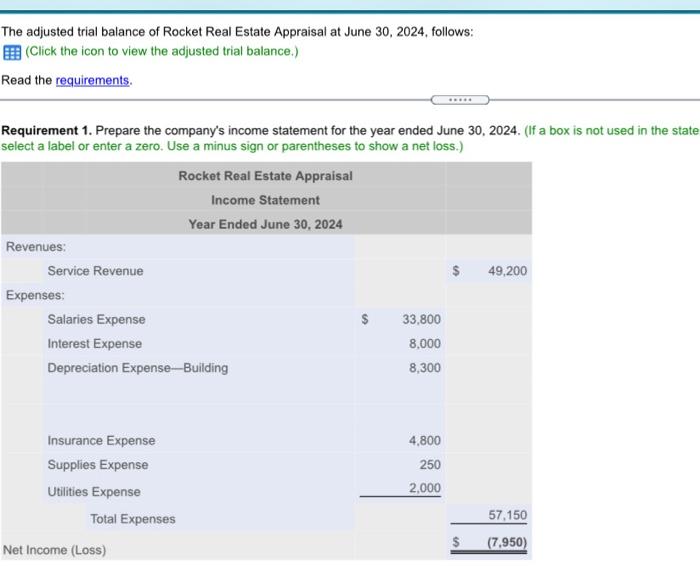

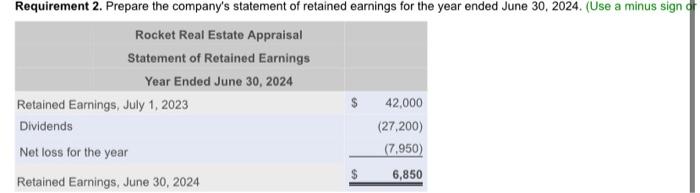

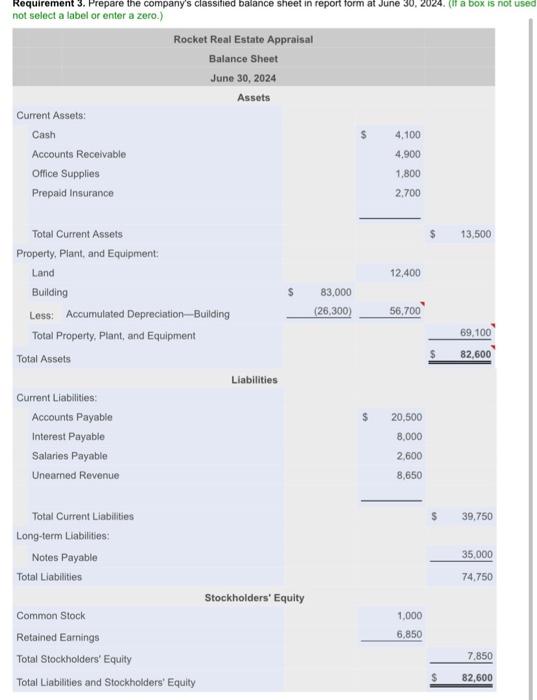

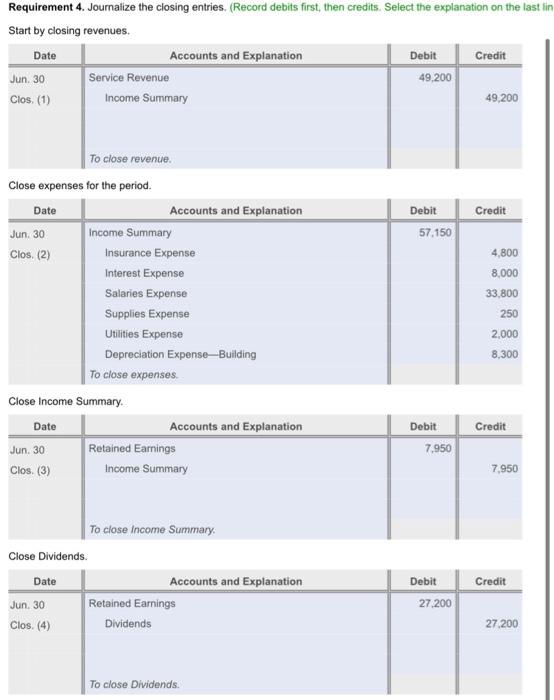

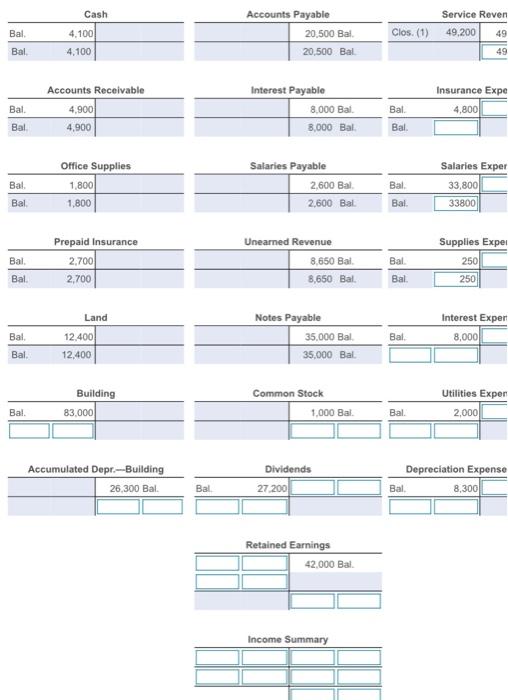

Rocket Real Estate Appraisal Adjusted Trial Balance June 30, 2024 Balance Account Title Debit Credit Cash 4,100 Accounts Receivable 4,900 Office Supplies 1.800 Prepaid Insurance 2.700 Land 12.400 Building 83,000 Accumulated Depreciation- Building 26,300 Accounts Payable 20,500 Interest Payable 8,000 Salaries Payable 2,600 Unearned Revenue 8,650 Notes Payable (long-term) 35,000 Common Stock 1,000 Retained Earnings 42.000 Dividends 27,200 Service Revenue 49,200 Insurance Expense 4,800 Salaries Expense 33,800 Supplies Expense 250 Interest Expense 8,000 Utilities Expense 2.000 Depreciation ExpenseBuilding 8.300 $ 193,250 S 193,250 Total Requirements 1. Prepare the company's income statement for the year ended June 30, 2024. 2. Prepare the company's statement of retained earnings for the year ended June 30, 2024. 3. Prepare the company's classified balance sheet in report form at June 30, 2024. 4. Journalize the closing entries. 5. T-accounts have been opened using the balances from the adjusted trial balance. Post the closing entries to the T-accounts. 6. Prepare the company's post-closing trial balance at June 30, 2024. Print Done The adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2024 follows: (Click the icon to view the adjusted trial balance.) Read the requirements. Requirement 1. Prepare the company's income statement for the year ended June 30, 2024. (If a box is not used in the state select a label or enter a zero. Use a minus sign or parentheses to show a net loss.) Rocket Real Estate Appraisal Income Statement Year Ended June 30, 2024 Revenues: Service Revenue 49,200 Expenses Salaries Expense 33,800 Interest Expense 8,000 Depreciation Expense-Building 8,300 Insurance Expense Supplies Expense Utilities Expense Total Expenses Net Income (Loss) 4,800 250 2,000 57,150 $ (7,950) Requirement 2. Prepare the company's statement of retained earnings for the year ended June 30, 2024. (Use a minus sign of Rocket Real Estate Appraisal Statement of Retained Earnings Year Ended June 30, 2024 Retained Earnings, July 1, 2023 $ 42,000 Dividends (27,200) Net loss for the year (7,950) 6,850 Retained Earnings, June 30, 2024 Requirement 3. Prepare the company's classified balance sheet in report form at June 30, 2024. (If a box is not used not select a label or enter a zero.) Rocket Real Estate Appraisal Balance Sheet June 30, 2024 Assets Current Assets: Cash 4,100 Accounts Receivable 4,900 Office Supplies 1.800 Prepaid Insurance 2.700 13,500 12,400 83.000 (26,300) 56,700 Total Current Assets Property, Plant, and Equipment: Land Building Less: Accumulated Depreciation-Building Total Property, Plant, and Equipment Total Assets Liabilities Current Liabilities: Accounts Payable Interest Payable Salaries Payable Unearned Revenue 69.100 82,600 $ 20,500 8,000 2,600 8,650 39.750 Total Current Liabilities Long-term Liabilities: Notes Payable Total Liabilities 35,000 74.750 Stockholders' Equity 1.000 6,850 Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 7.850 82,600 Requirement 4. Journalize the closing entries (Record debits first, then credits. Select the explanation on the last tin Start by closing revenues. Accounts and Explanation Debit Credit Jun 30 Service Revenue 49,200 Clos (1) Income Summary 49,200 Date Debit Credit 57.150 4,800 8,000 33.800 To close revenue Close expenses for the period. Date Accounts and Explanation Jun 30 Income Summary Clos. (2) Insurance Expense Interest Expense Salaries Expense Supplies Expense Utilities Expense Depreciation ExpenseBuilding To close expenses Close Income Summary Date Accounts and Explanation Jun. 30 Retained Earnings Clos. (3) Income Summary 250 2.000 8,300 Debit Credit 7.950 7,950 To close Income Summary Close Dividends. Date Accounts and Explanation Jun 30 Retained Earnings Clos. (4) Dividends Debit Credit 27.200 27.200 To close Dividends. Cash Service Reven 49,200 49 Bal Accounts Payable 20.500 Bat. 20,500 Bal 4,100 Clos. (1) Bal 4,100 49 Accounts Receivable Insurance Expo Bal. Interest Payable 8.000 Bal. 3,000 Bal Bal 4.900 4,900 4,800 Bal Bal Salaries Exper Bal Office Supplies 1,800 1,800 Salaries Payable 2,600 Bal 2,600 Bal Bal 33,800 Bal Bal. 33800 Bal Prepaid Insurance 2.700 2.700 Unearned Revenue 8,650 Bal 8,650 Bal. Bal Supplies Expei 250 250 Bal Bal Land Interest Expert Bal Notes Payable 35,000 Bal 35,000 Bai Bal 12.400 12,400 8,000 Bal. Utilities Exper Building 83.000 Common Stock 1,000 Bal. Bal. Bal 2.000 Dividends Accumulated Depr.-Building 26,300 Bal. Depreciation Expense Bal 8,300 Bal 27.200 Retained Earnings 42,000 Bal. Income Summary fill in T-accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started