Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete solution Challenge: Vince, James, Albert and Kath are partners of a very successful auditing firm. However, due to disagreements in managing the firm, they

complete solution

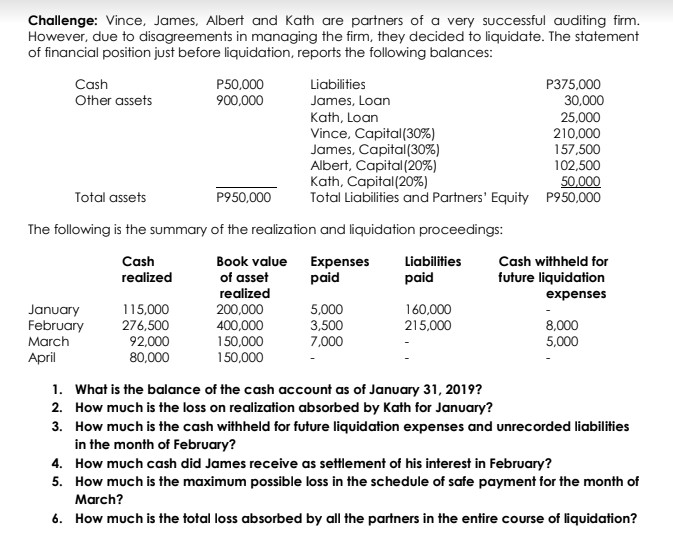

Challenge: Vince, James, Albert and Kath are partners of a very successful auditing firm. However, due to disagreements in managing the firm, they decided to liquidate. The statement of financial position just before liquidation reports the following balances: Cash P50,000 Liabilities P375,000 Other assets 900,000 James, Loan 30,000 Kath, Loan 25,000 Vince, Capital (30%) 210,000 James, Capital (30%) 157,500 Albert, Capital (20%) 102,500 Kath, Capital (20%) 50.000 Total assets P950,000 Total Liabilities and Partners' Equity P950,000 The following is the summary of the realization and liquidation proceedings: Cash Book value Expenses Liabilities Cash withheld for realized of asset paid paid future liquidation realized expenses January 115,000 200,000 5,000 160,000 February 276,500 400,000 3,500 215,000 8,000 March 92,000 150,000 7,000 5,000 April 80,000 150,000 1. What is the balance of the cash account as of January 31, 2019? 2. How much is the loss on realization absorbed by Kath for January? 3. How much is the cash withheld for future liquidation expenses and unrecorded liabilities in the month of February? 4. How much cash did James receive as settlement of his interest in February? 5. How much is the maximum possible loss in the schedule of safe payment for the month of March? 6. How much is the total loss absorbed by all the partners in the entire course of liquidationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started