Complete Steps 1-7.

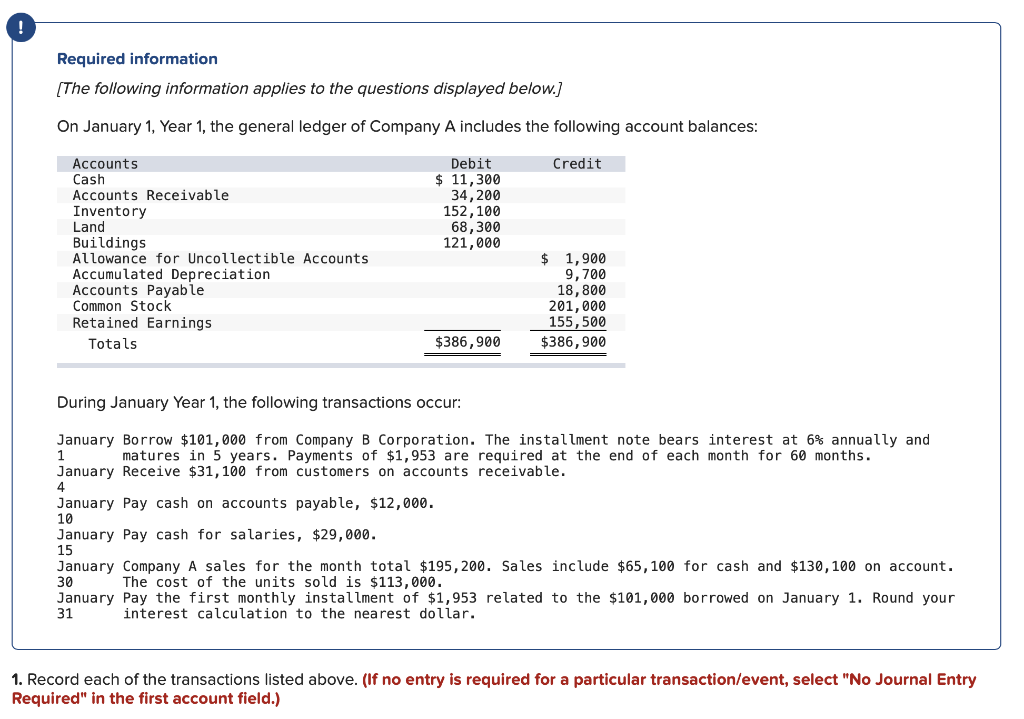

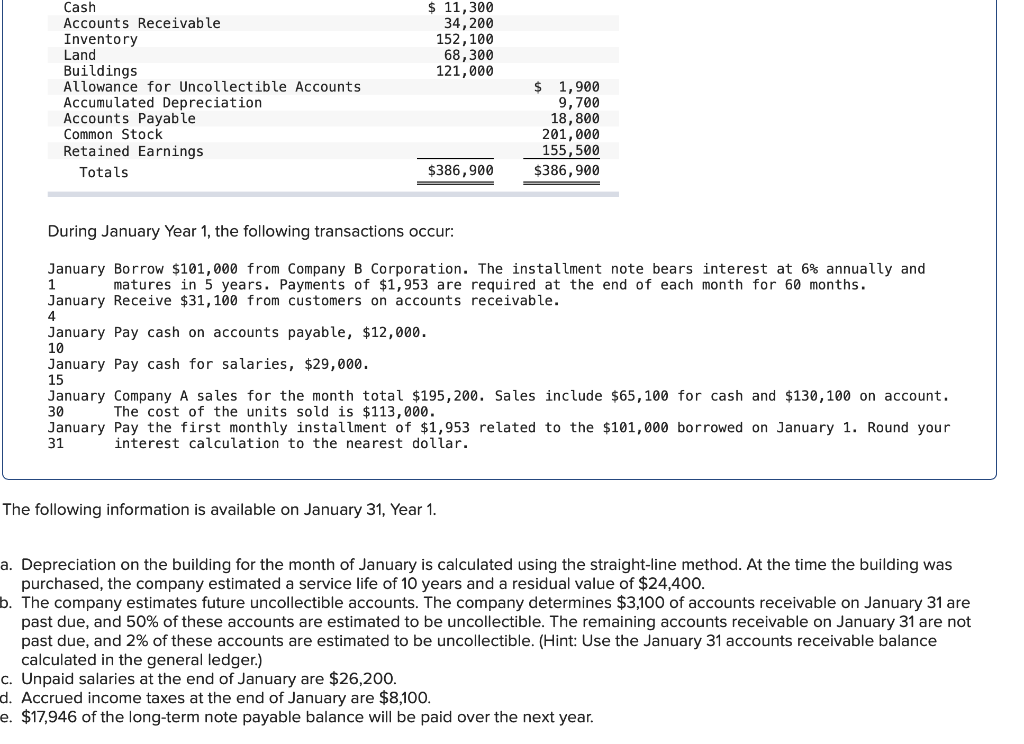

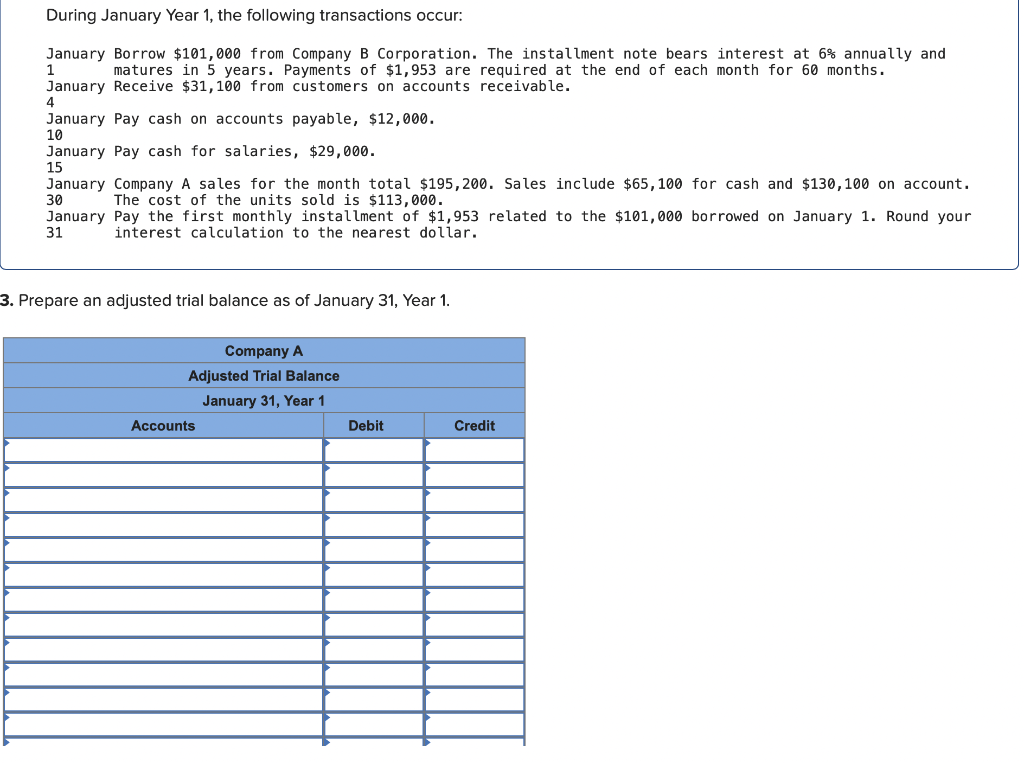

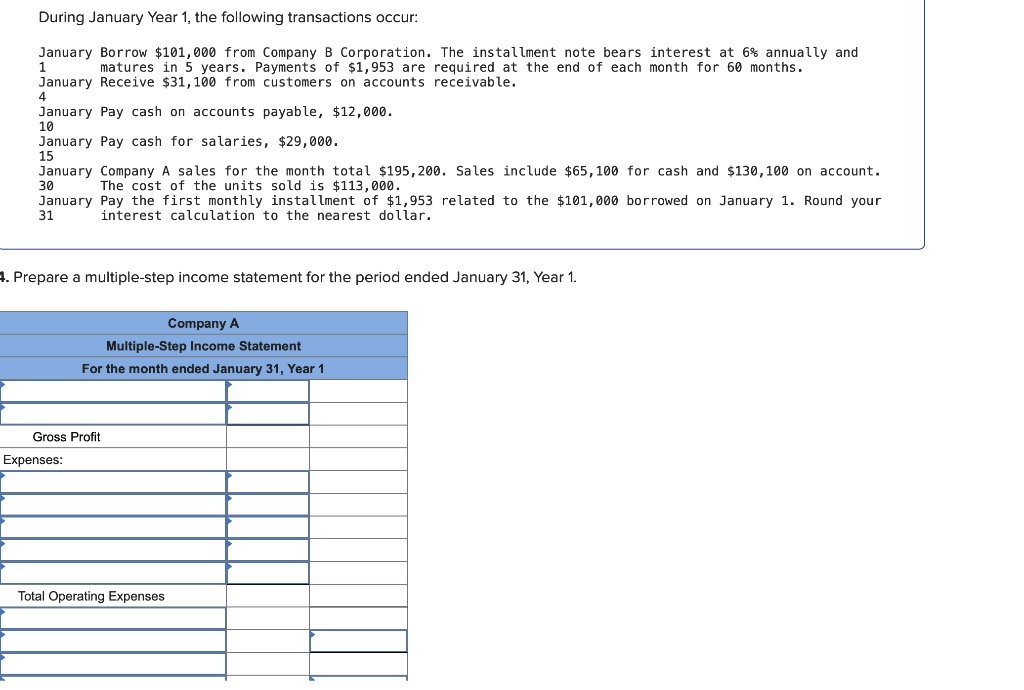

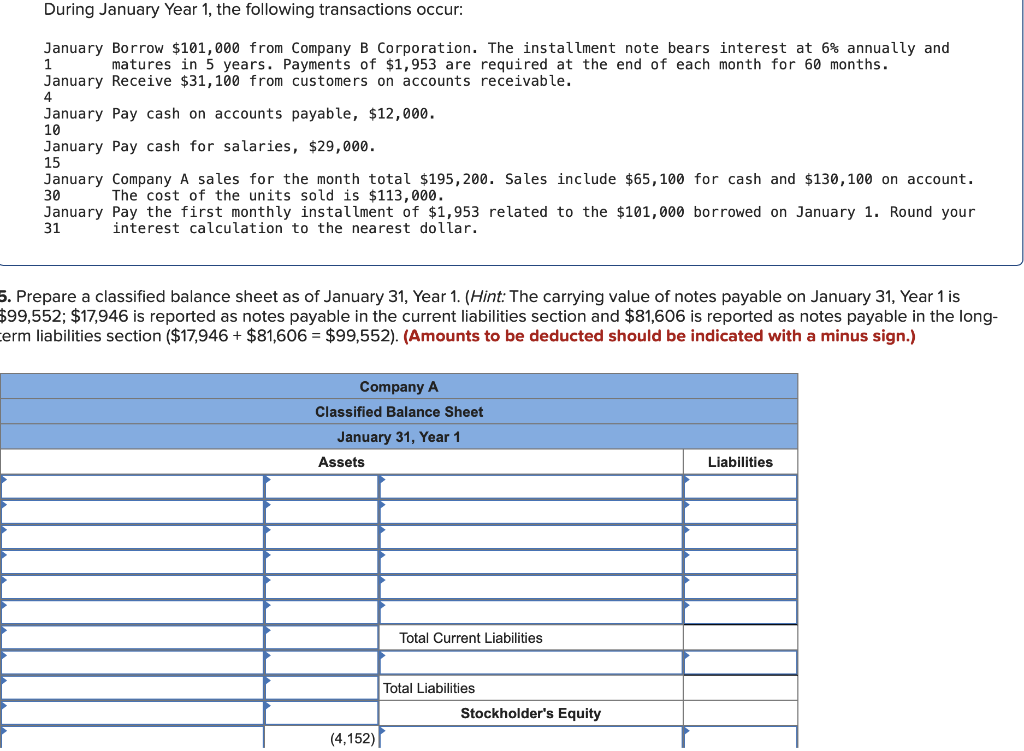

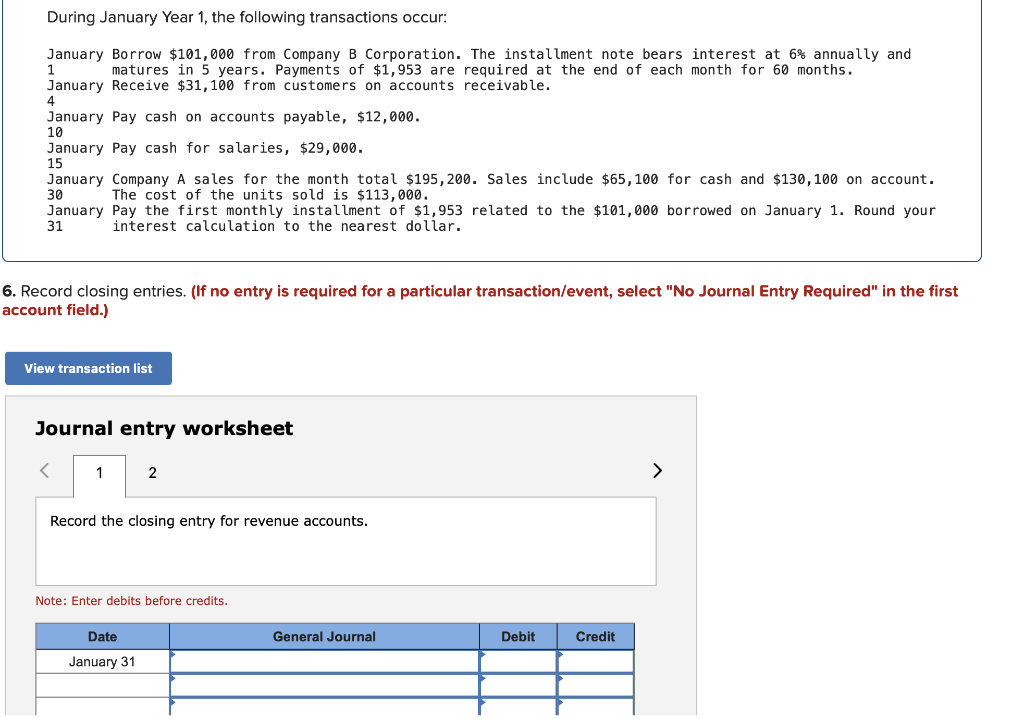

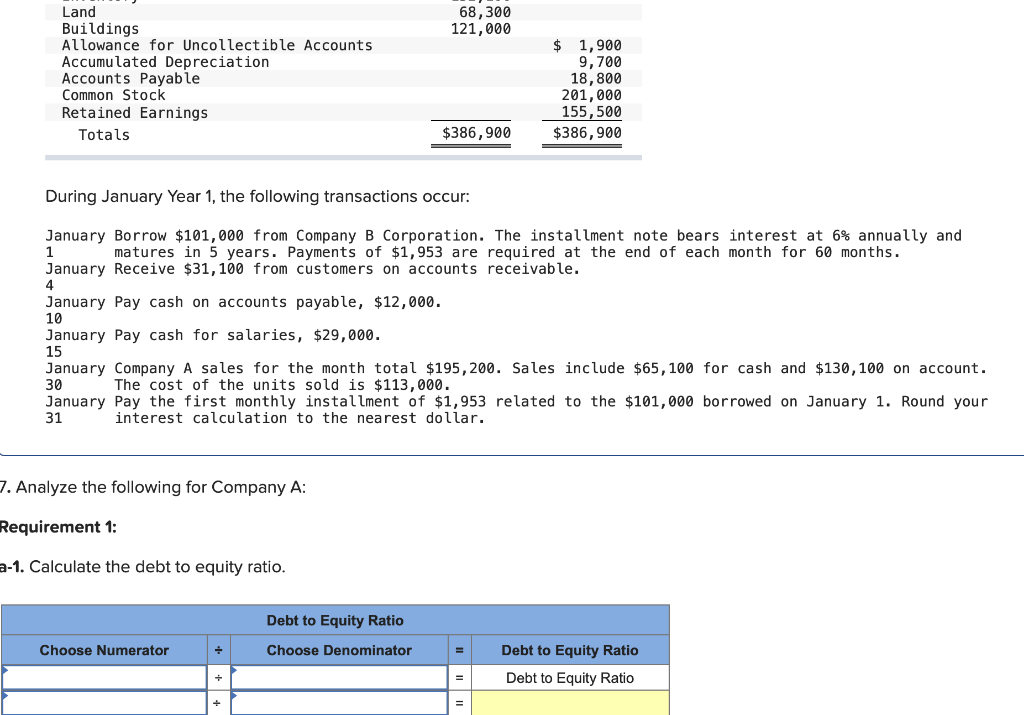

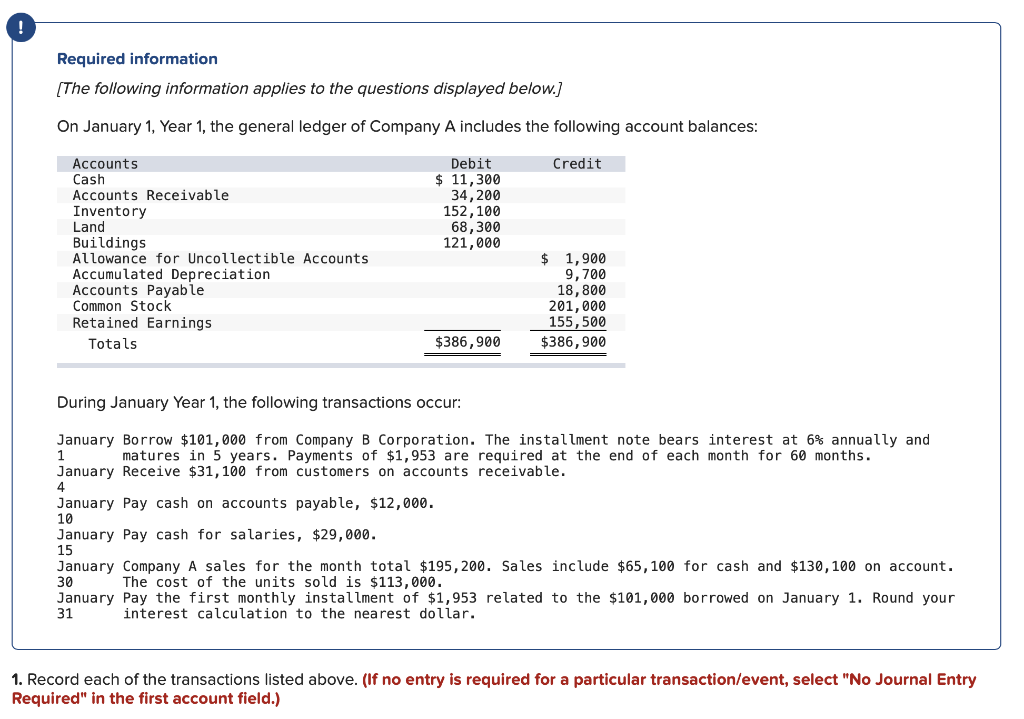

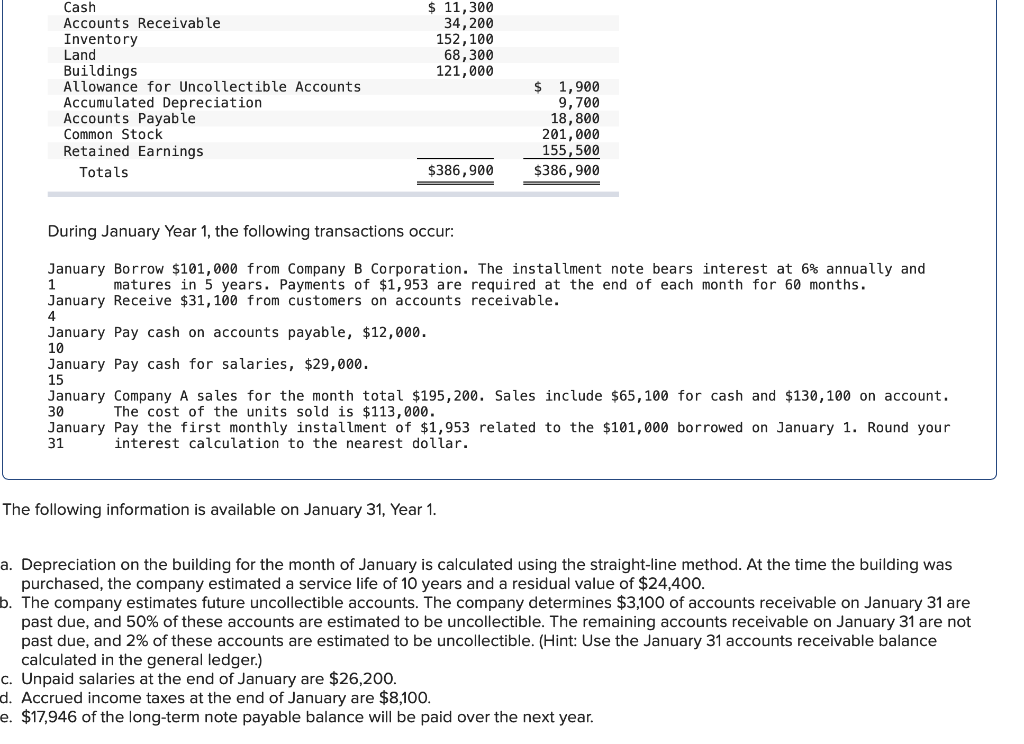

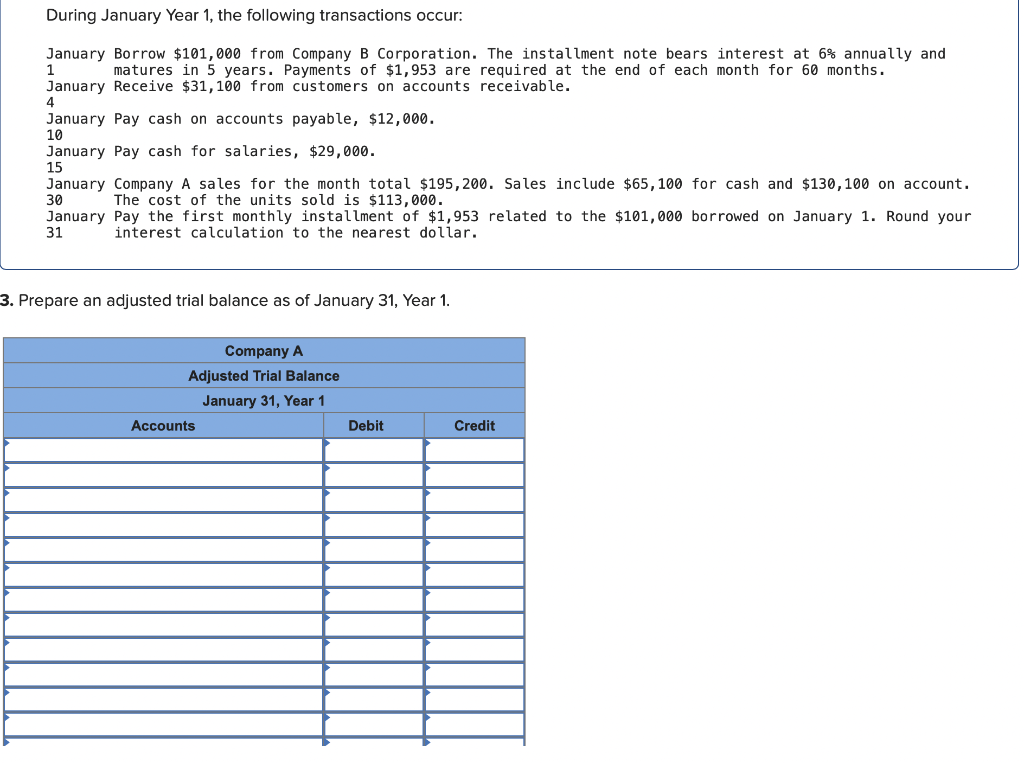

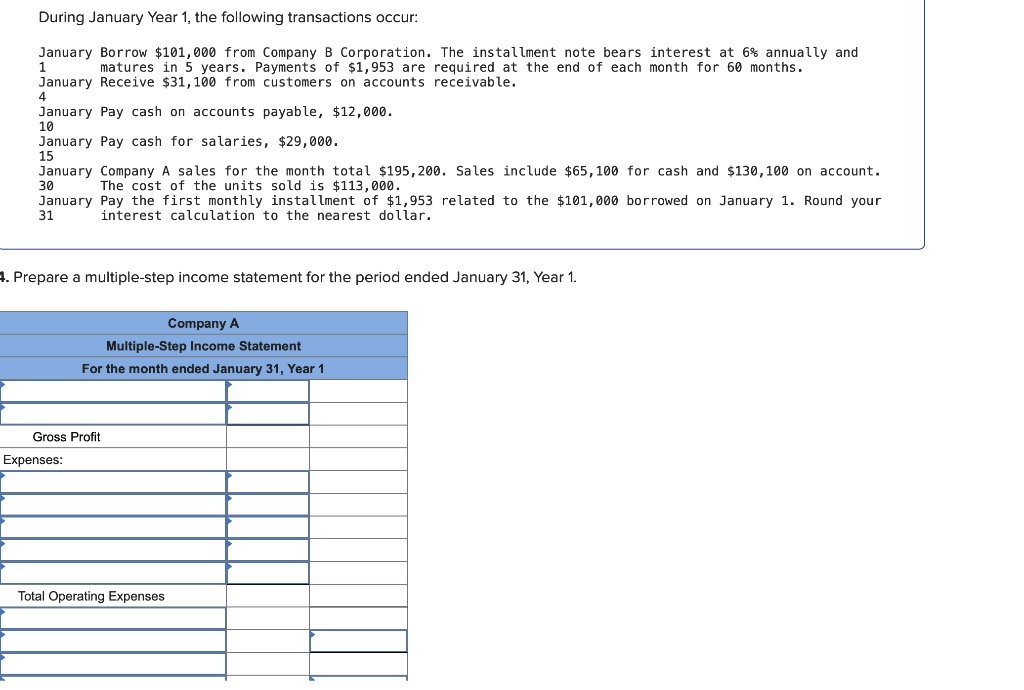

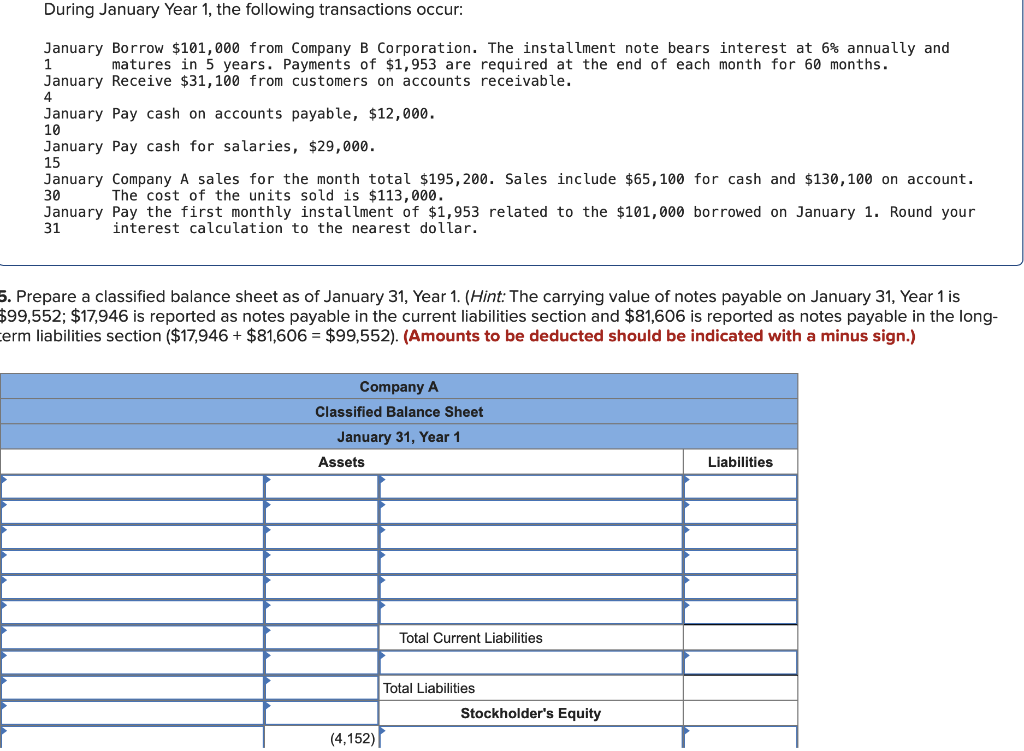

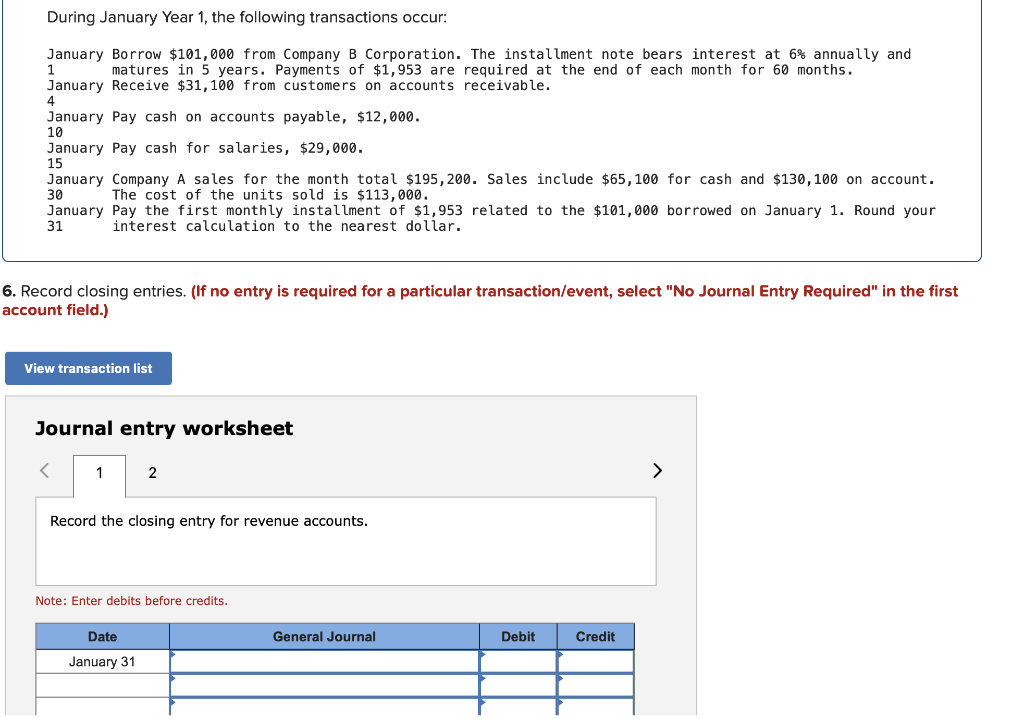

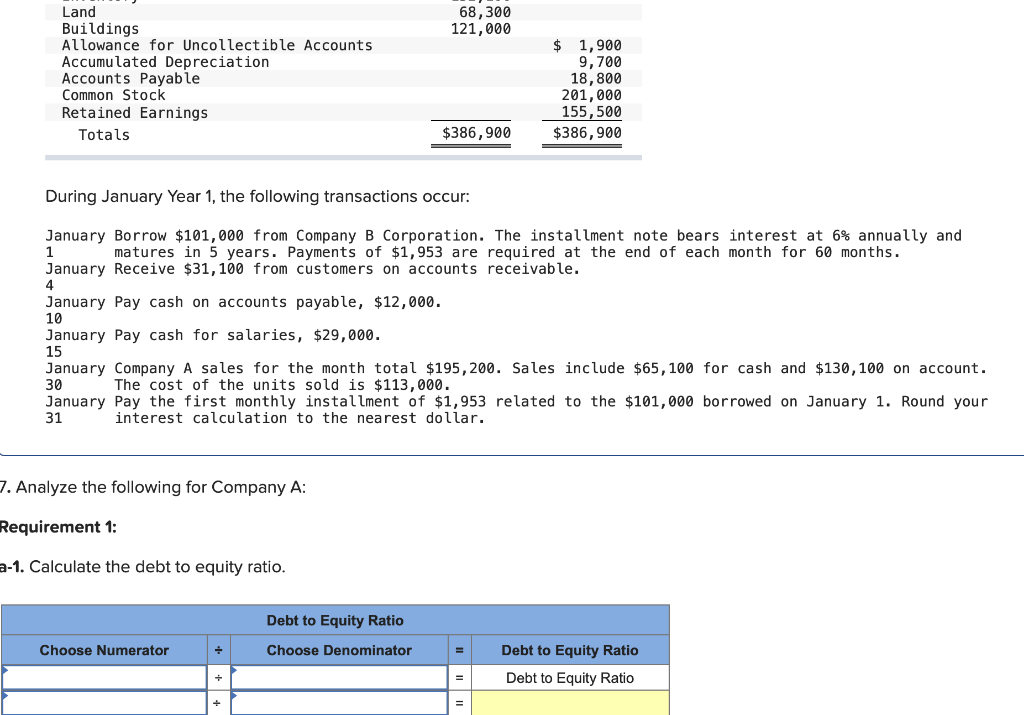

! Required information [The following information applies to the questions displayed below.] On January 1, Year 1, the general ledger of Company A includes the following account balances: Credit Accounts Cash Accounts Receivable Inventory Land Debit $ 11,300 34,200 152, 100 68,300 121,000 Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $ 1,900 9,700 18,800 201,000 155,500 $386,900 $386,900 During January Year 1, the following transactions occur: January Borrow $101,000 from Company B Corporation. The installment note bears interest at 6% annually and 1 matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January Receive $31,100 from customers on accounts receivable. 4 January Pay cash on accounts payable, $12,000. 10 January Pay cash for salaries, $29,000. 15 January Company A sales for the month total $195, 200. Sales include $65, 100 for cash and $130, 100 on account. 30 The cost of the units sold is $113,000. January Pay the first monthly installment of $1,953 related to the $101,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. 1. Record each of the transactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) $ 11,300 34,200 152, 100 68,300 121,000 Cash Accounts Receivable Inventory Land band Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $ 1,900 9,700 18,800 201,000 155,500 $386,900 $386,900 During January Year 1, the following transactions occur: January Borrow $101,000 from Company B Corporation. The installment note bears interest at 6% annually and 1 matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January Receive $31, 100 from customers on accounts receivable. 4 January Pay cash on accounts payable, $12,000. 10 January Pay cash for salaries, $29,000. 15 January Company A sales for the month total $195,200. Sales include $65,100 for cash and $130, 100 on account. 30 The cost of the units sold is $113,000. January Pay the first monthly installment of $1,953 related to the $101,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. The following information is available on January 31, Year 1. a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $24,400. b. The company estimates future uncollectible accounts. The company determines $3,100 of accounts receivable on January 31 are past due, and 50% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 2% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Unpaid salaries at the end of January are $26,200. d. Accrued income taxes at the end of January are $8,100. e. $17,946 of the long-term note payable balance will be paid over the next year. During January Year 1, the following transactions occur: January Borrow $101,000 from Company B Corporation. The installment note bears interest at 6% annually and 1 matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January Receive $31, 100 from customers on accounts receivable. 4 January Pay cash on accounts payable, $12,000. 10 January Pay cash for salaries, $29,000. 15 January Company A sales for the month total $195,200. Sales include $65, 100 for cash and $130, 100 on account. 30 The cost of the units sold is $113,000. January Pay the first monthly installment of $1,953 related to the $101,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. 3. Prepare an adjusted trial balance as of January 31, Year 1. Company A Adjusted Trial Balance January 31, Year 1 Accounts Debit Credit During January Year 1, the following transactions occur: January Borrow $101,000 from Company B Corporation. The installment note bears interest at 6% annually and 1 matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January Receive $31,100 from customers on accounts receivable. 4 January Pay cash on accounts payable, $12,000. 10 January Pay cash for salaries, $29,000. 15 January Company A sales for the month total $195,200. Sales include $65, 100 for cash and $130, 100 on account. 30 The cost of the units sold is $113,000. January Pay the first monthly installment of $1,953 related to the $101,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. 4. Prepare a multiple-step income statement for the period ended January 31, Year 1. Company A Multiple-Step Income Statement For the month ended January 31, Year 1 Gross Profit Expenses: Total Operating Expenses During January Year 1, the following transactions occur: January Borrow $101,000 from Company B Corporation. The installment note bears interest at 6% annually and 1 matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January Receive $31,100 from customers on accounts receivable. January Pay cash on accounts payable, $12,000. 10 January Pay cash for salaries, $29,000. 15 January Company A sales for the month total $195,200. Sales include $65, 100 for cash and $130, 100 on account. 30 The cost of the units sold is $113,000. January Pay the first monthly installment of $1,953 related to the $101,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. 5. Prepare a classified balance sheet as of January 31, Year 1. (Hint: The carrying value of notes payable on January 31, Year 1 is $99,552; $17,946 is reported as notes payable in the current liabilities section and $81,606 is reported as notes payable in the long- erm liabilities section ($17,946 + $81,606 = $99,552). (Amounts to be deducted should be indicated with a minus sign.) a Company A Classified Balance Sheet January 31, Year 1 Assets Liabilities Total Current Liabilities Total Liabilities Stockholder's Equity (4,152) During January Year 1, the following transactions occur: January Borrow $101,000 from Company B Corporation. The installment note bears interest at 6% annually and 1 matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January Receive $31,100 from customers on accounts receivable. January Pay cash on accounts payable, $12,000. 10 January Pay cash for salaries, $29,000. 15 January Company A sales for the month total $195,200. Sales include $65, 100 for cash and $130,100 on account. 30 The cost of the units sold is $113,000. January Pay the first monthly installment of $1,953 related to the $101,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. 6. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the closing entry for revenue accounts. Note: Enter debits before credits. Date General Journal Debit Credit January 31 68,300 121,000 Land Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $ 1,900 9,700 18,800 201,000 155,500 $386,900 $386,900 During January Year 1, the following transactions occur: January Borrow $101,000 from Company B Corporation. The installment note bears interest at 6% annually and 1 matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January Receive $31,100 from customers on accounts receivable. 4 January Pay cash on accounts payable, $12,000. 10 January Pay cash for salaries, $29,000. 15 January Company A sales for the month total $195,200. Sales include $65, 100 for cash and $130, 100 on account. 30 The cost of the units sold is $113,000. January Pay the first monthly installment of $1,953 related to the $101,000 borrowed on January 1. Round your 31 interest calculation to the nearest dollar. 7. Analyze the following for Company A: Requirement 1: a-1. Calculate the debt to equity ratio. Debt to Equity Ratio Choose Numerator Choose Denominator + + + Debt to Equity Ratio Debt to Equity Ratio = =