Question

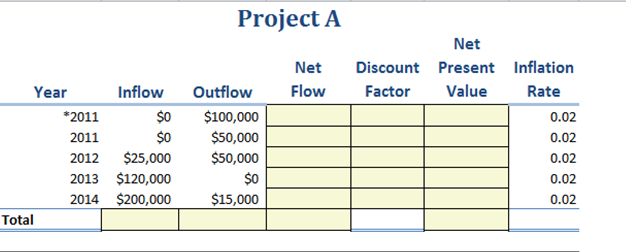

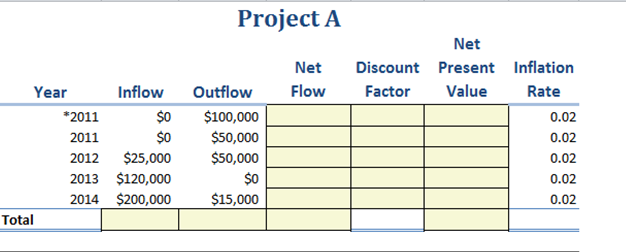

Complete Table 1 to calculate Project A's NPV. The net cash flow of Project A is calculated by taking the total of all years' net

Complete Table 1 to calculate Project A's NPV. The net cash flow of Project A is calculated by taking the total of all years' net flow, and when discounted at the rate of 12% (required rate of return for project selection) plus the annual inflation rate of 2%, the net present value of the project's cash flow can be estimated. So, at first glance, the project would seem to be a good candidate for selection. But there are uncertainties to this scenario. What if Project A does not generate the cash inflows estimated here, or at the time the inflows are expected? Perhaps the annual inflation rate is 3% rather than 2%.

1.Enter data for cash inflow, cash outflow, and inflation rate.

Calculate net cash flow, discount value, and NPV (yellow highlighted cells)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started