Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete tables in the same format with the information from the last image. The annual data that follow pertain to Rick's Radical Eyewear, a manufacturer

Complete tables in the same format with the information from the last image.

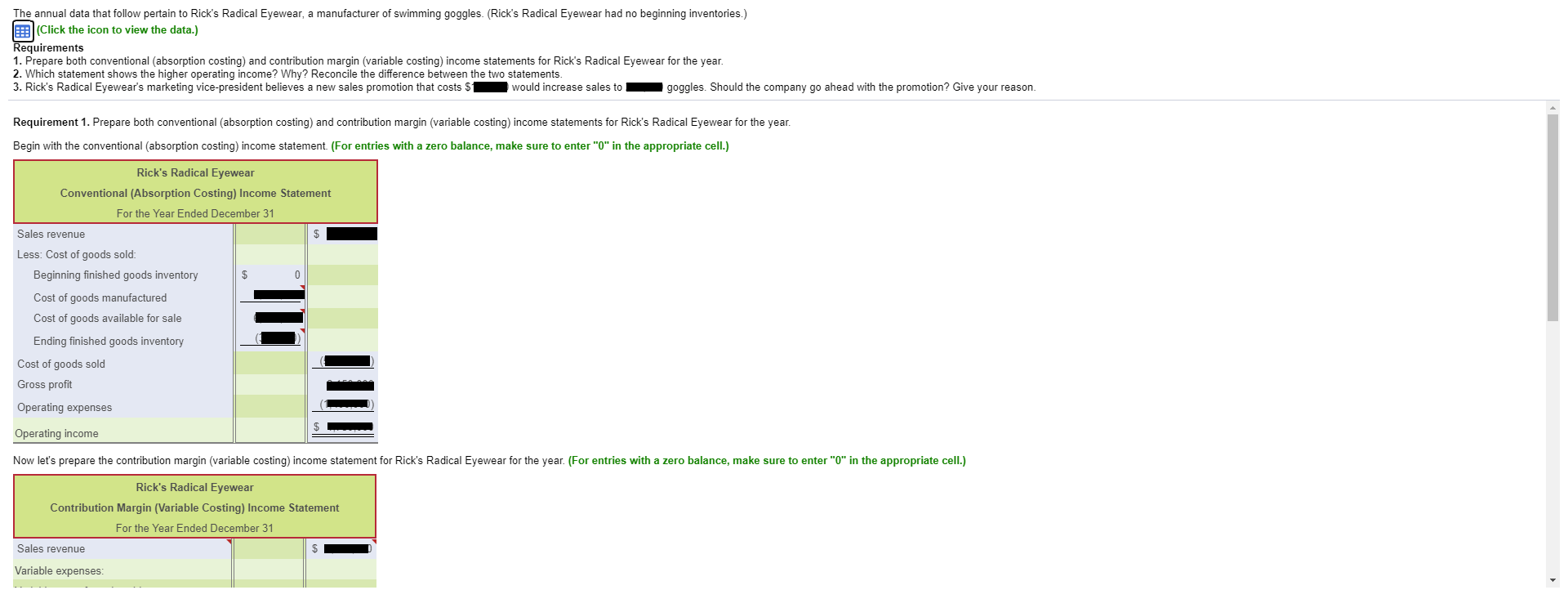

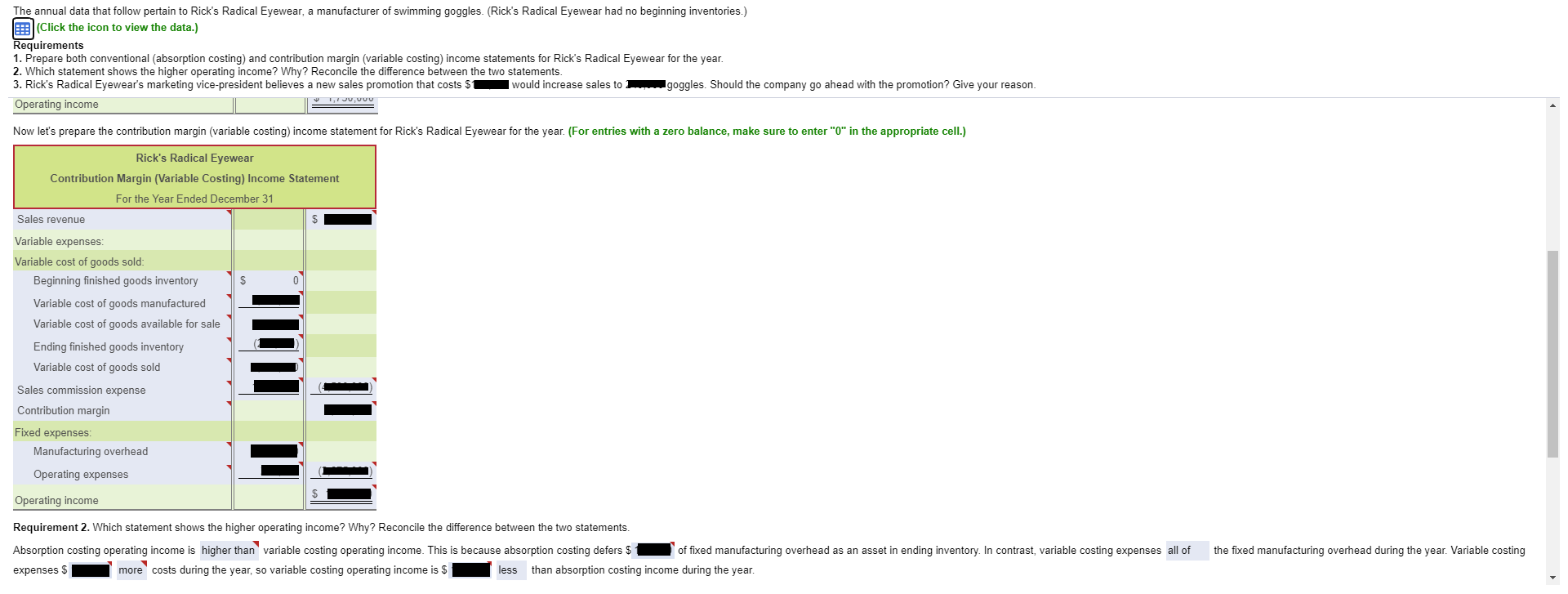

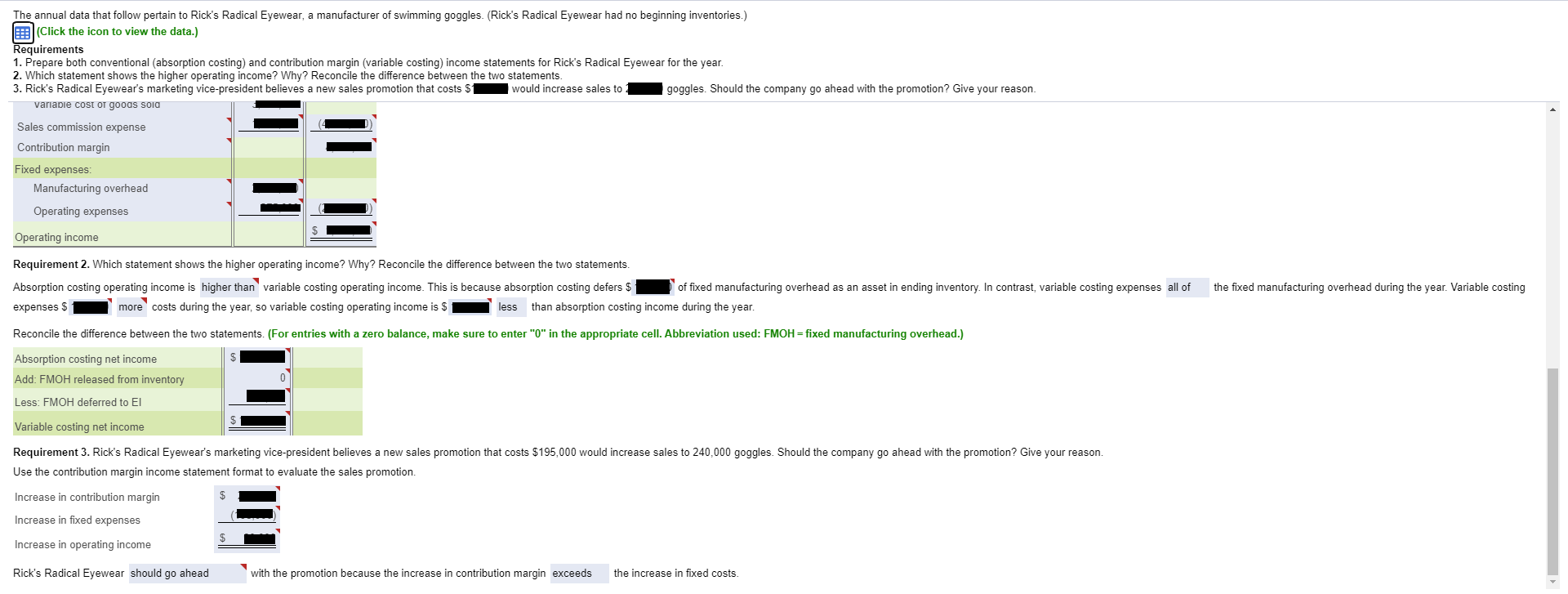

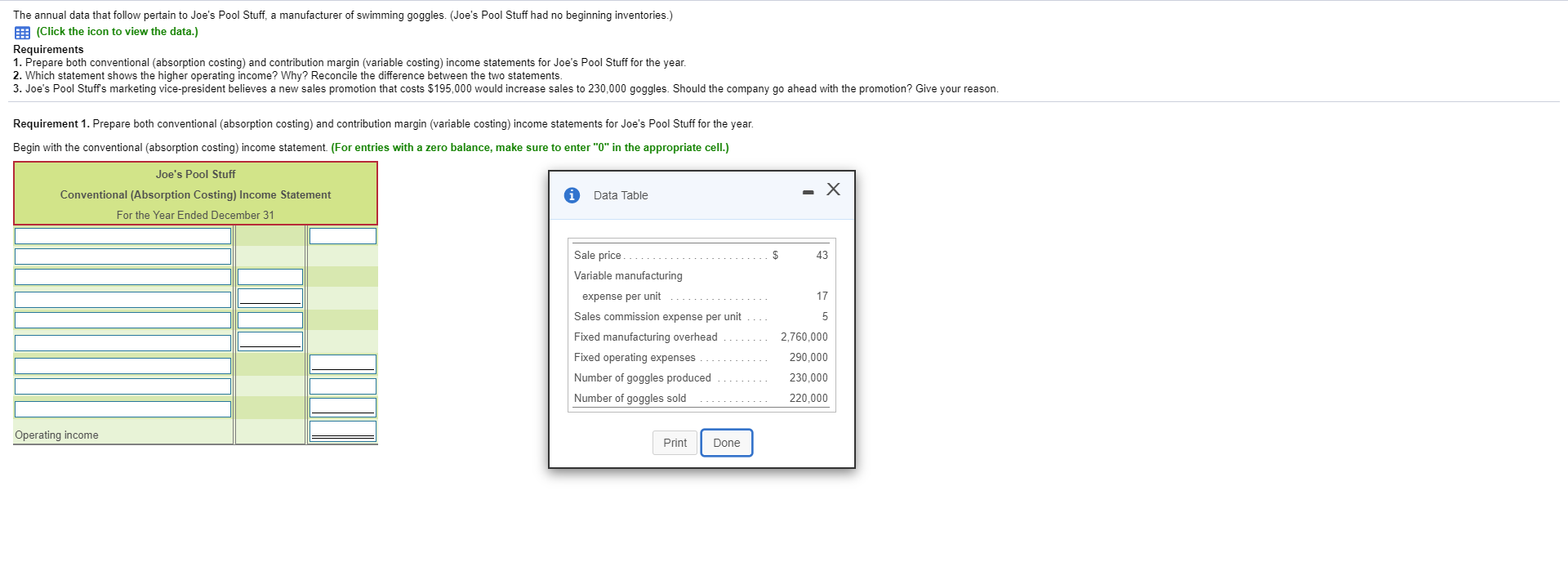

The annual data that follow pertain to Rick's Radical Eyewear, a manufacturer of swimming goggles. (Rick's Radical Eyewear had no beginning inventories.) Click the icon to view the data.) Requirements 1. Prepare both conventional absorption costing) and contribution margin (variable costing) income statements for Rick's Radical Eyewear for the year. 2. Which statement shows the higher operating income? Why? Reconcile the difference between the two statements. 3. Rick's Radical Eyewear's marketing vice-president believes a new sales promotion that costs $ would increase sales to goggles. Should the company go ahead with the promotion? Give your reason. Requirement 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for Rick's Radical Eyewear for the year. Begin with the conventional (absorption costing) income statement. (For entries with a zero balance, make sure to enter "0" in the appropriate cell.) Rick's Radical Eyewear Conventional (Absorption Costing) Income Statement For the Year Ended December 31 $ Sales revenue Less: Cost of goods sold: Beginning finished goods inventory Cost of goods manufactured Cost of goods available for sale Ending finished goods inventory Cost of goods sold Gross profit Operating expenses Operating income Now let's prepare the contribution margin (variable costing) income statement for Rick's Radical Eyewear for the year. (For entries with a zero balance, make sure to enter "O" in the appropriate cell.) Rick's Radical Eyewear Contribution Margin (Variable Costing) Income Statement For the Year Ended December 31 Sales revenue Variable expenses The annual data that follow pertain to Rick's Radical Eyewear, a manufacturer of swimming goggles. (Rick's Radical Eyewear had no beginning inventories.) E: (Click the icon to view the data.) Requirements 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for Rick's Radical Eyewear for the year. 2. Which statement shows the higher operating income? Why? Reconcile the difference between the two statements. 3. Rick's Radical Eyewear's marketing vice-president believes a new sales promotion that costs would increase sales to goggles. Should the company go ahead with the promotion? Give your reason. Operating income Now let's prepare the contribution margin (variable costing) income statement for Rick's Radical Eyewear for the year. (For entries with a zero balance, make sure to enter "O" in the appropriate cell.) 1,JU,VUU Rick's Radical Eyewear Contribution Margin (Variable Costing) Income Statement For the Year Ended December 31 Sales revenue $ 0 Variable expenses: Variable cost of goods sold: Beginning finished goods inventory Variable cost of goods manufactured Variable cost of goods available for sale Ending finished goods inventory Variable cost of goods sold Sales commission expense Contribution margin Fixed expenses Manufacturing overhead Operating expenses Operating income Requirement 2. Which statement shows the higher operating income? Why? Reconcile the difference between the two statements. Absorption costing operating income is higher than variable costing operating income. This is because absorption costing defers $ of fixed manufacturing overhead as an asset in ending inventory. In contrast, variable costing expenses all of expenses $ more costs during the year, so variable costing operating income is $ less than absorption costing income during the year. the fixed manufacturing overhead during the year. Variable costing The annual data that follow pertain to Rick's Radical Eyewear, a manufacturer of swimming goggles. (Rick's Radical Eyewear had no beginning inventories.) (Click the icon to view the data.) Requirements 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for Rick's Radical Eyewear for the year. 2. Which statement shows the higher operating income? Why? Reconcile the difference between the two statements. 3. Rick's Radical Eyewear's marketing vice-president believes a new sales promotion that costs $1 would increase sales to goggles. Should the company go ahead with the promotion? Give your reason. variable cost of goods sold Sales commission expense Contribution margin Fixed expenses: Manufacturing overhead Operating expenses Operating income the fixed manufacturing overhead during the year. Variable costing Requirement 2. Which statement shows the higher operating income? Why? Reconcile the difference between the two statements. Absorption costing operating income is higher than variable costing operating income. This is because absorption costing defers $ of fixed manufacturing overhead as an asset in ending inventory. In contrast, variable costing expenses all of expenses 5 more costs during the year, so variable costing operating income is $ less than absorption costing income during the year. Reconcile the difference between the two statements. (For entries with a zero balance, make sure to enter "0" in the appropriate cell. Abbreviation used: FMOH= fixed manufacturing overhead.) Absorption costing net income Add: FMOH released from inventory Less: FMOH deferred to El Variable costing net income Requirement 3. Rick's Radical Eyewear's marketing vice-president believes a new sales promotion that costs $195,000 would increase sales to 240,000 goggles. Should the company go ahead with the promotion? Give your reason. Use the contribution margin income statement format to evaluate the sales promotion. Increase in contribution margin Increase in fixed expenses Increase in operating income Rick's Radical Eyewear should go ahead with the promotion because the increase in contribution margin exceeds the increase in fixed costs. The annual data that follow pertain to Joe's Pool Stuff, a manufacturer of swimming goggles. (Joe's Pool Stuff had no beginning inventories.) 5 Click the icon to view the data.) Requirements 1. Prepare both conventional absorption costing) and contribution margin (variable costing) income statements for Joe's Pool Stuff for the year. 2. Which statement shows the higher operating income? Why? Reconcile the difference between the two statements. 3. Joe's Pool Stuff's marketing vice-president believes a new sales promotion that costs $195,000 would increase sales to 230,000 goggles. Should the company go ahead with the promotion? Give your reason. Requirement 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for Joe's Pool Stuff for the year. Begin with the conventional (absorption costing) income statement. (For entries with a zero balance, make sure to enter "0" in the appropriate cell.) Joe's Pool Stuff Conventional (Absorption Costing) Income Statement For the Year Ended December 31 x Data Table $ 43 Sale price Variable manufacturing expense per unit 17 5 2,760,000 Sales commission expense per unit Fixed manufacturing overhead Fixed operating expenses Number of goggles produced Number of goggles sold 290,000 230,000 220.000 Operating income Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started