Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete the 941 for the 4th quarter. note that based on the look back period.. complete Form 941 for the 4th quarter. Note that based

complete the 941 for the 4th quarter. note that based on the look back period..

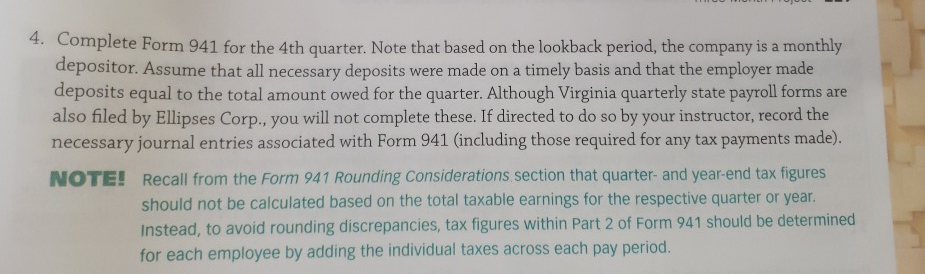

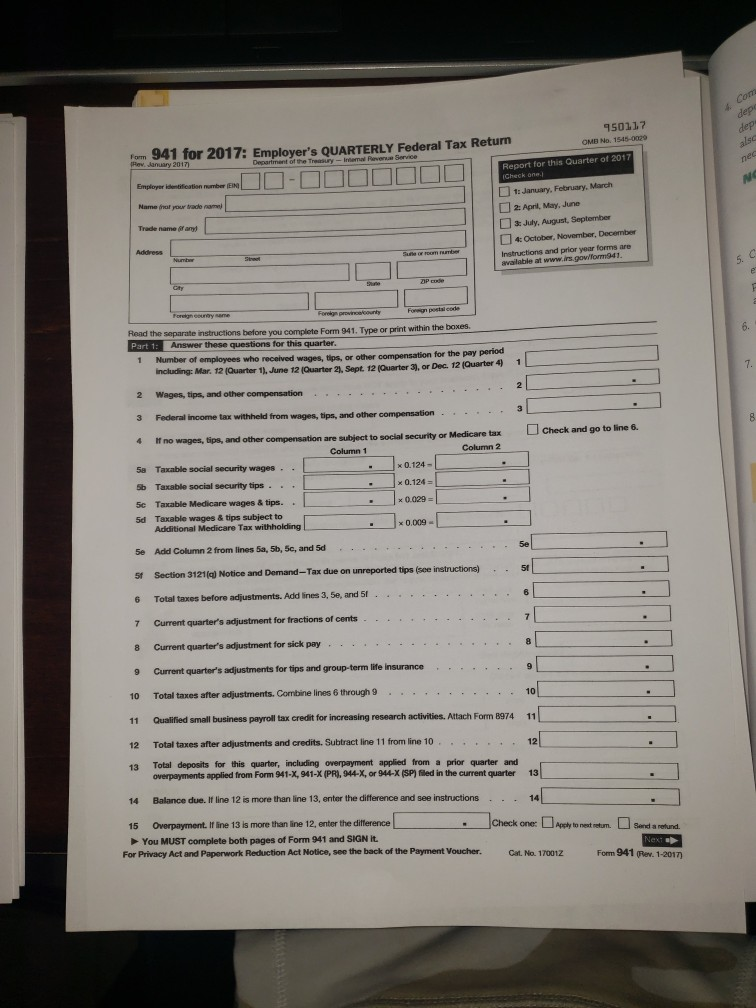

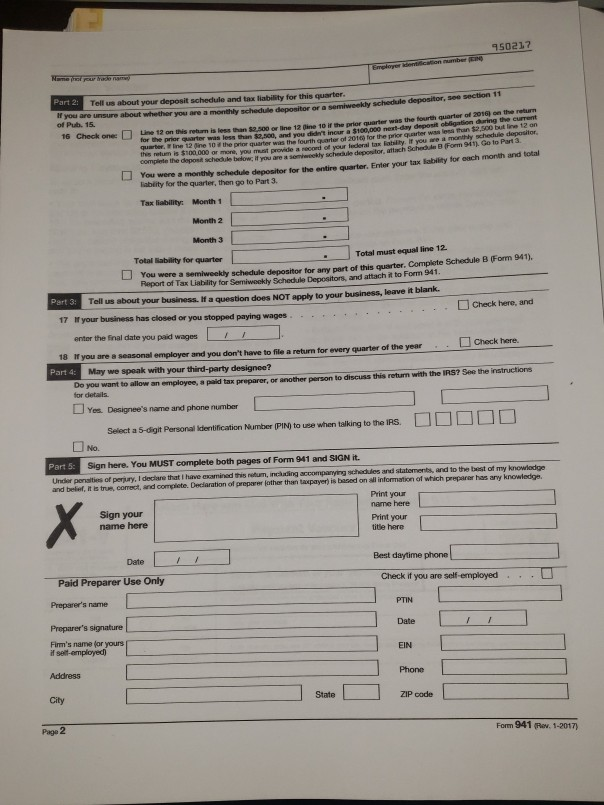

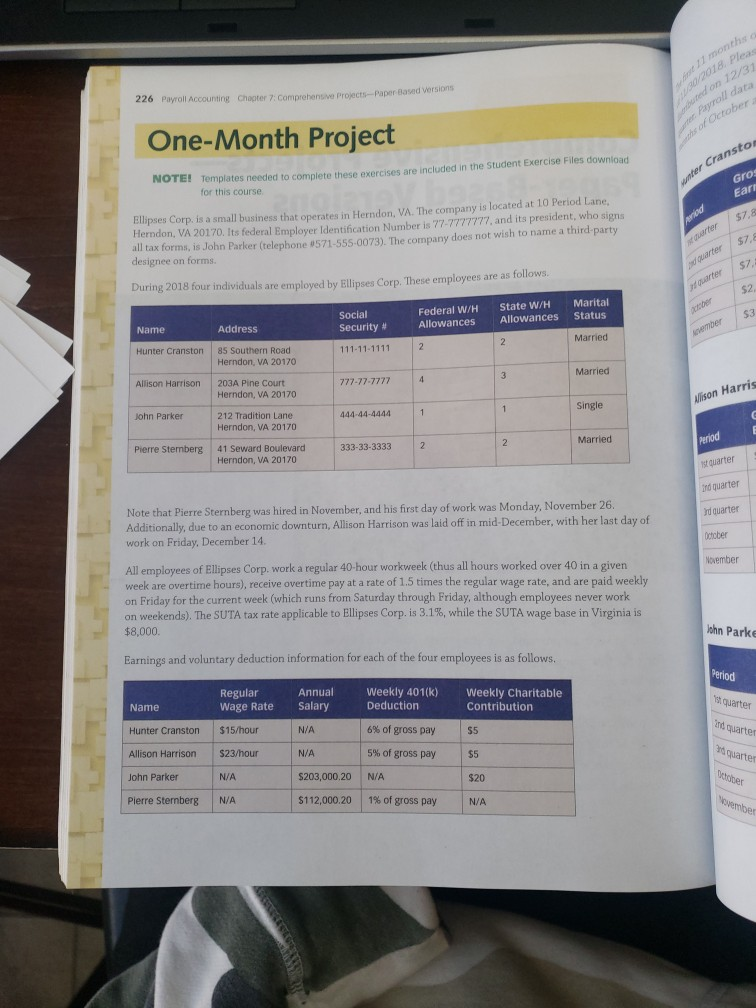

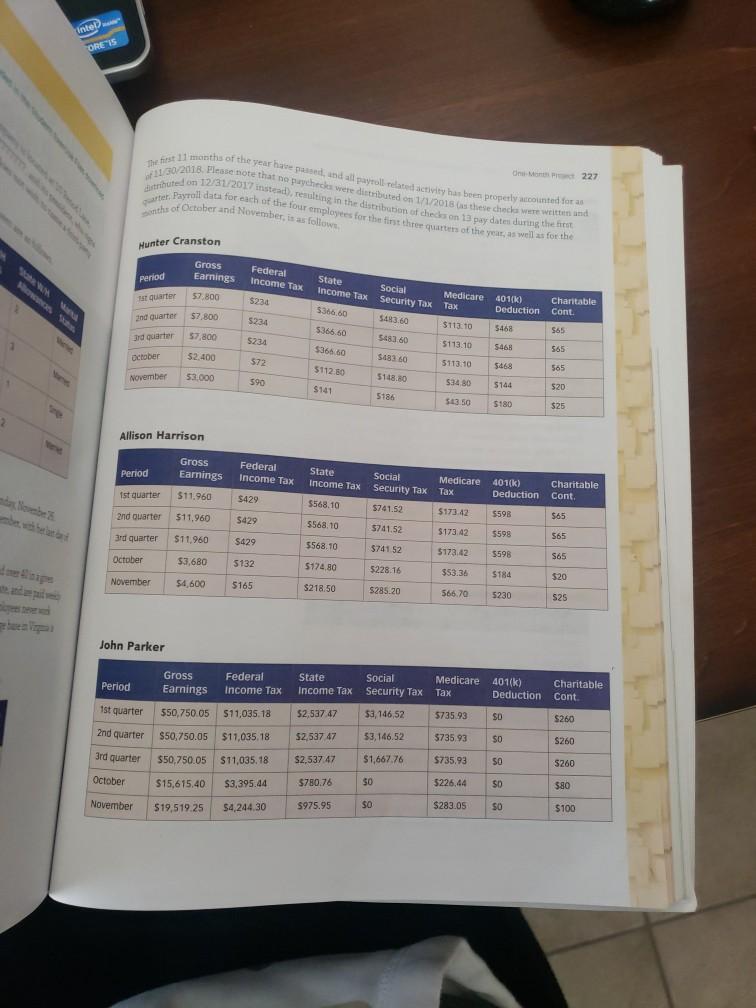

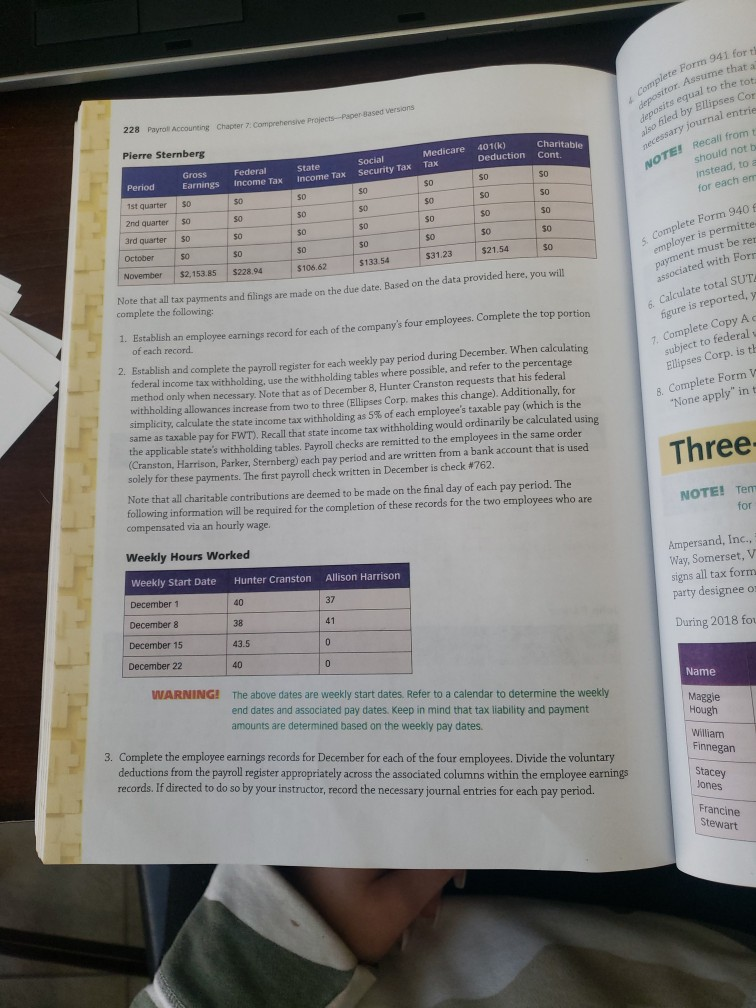

complete Form 941 for the 4th quarter. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for the quarter. Although Virginia quarterly state payroll forms are also filed by Ellipses Corp., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with Form 941 (including those required for any tax payments made). NOTE! Recall from the Form 941 Rounding Considerations section that quarter- and year-end tax figures should not be calculated based on the total taxable earnings for the respective quarter or year. Instead, to avoid rounding discrepancies, tax figures within Part 2 of Form 941 should be determined for each employee by adding the individual taxes across each pay period. Com dep dep als OOOODOOD 950117 Form 941 for 2017: Employer's QUARTERLY Federal Tax Return Rev. January 2017) OMB No 1545-0029 Department of the Treasury - Internal Revenue Service Report for this Quarter of 2017 Check on Nume freat your dado normal 1: January, February March Trade name any 2. April, Mary, June D 3: July August September 4 October, November, December Instructions and prior year forms are available at www.is.govilom941. Address Foro postal code Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4 1 .. 2 2 Wages, tips, and other compensation . . - - - - . . . . . 3 3 Federal income tax withheld from wages, tips, and other compensation Check and go to line 6. If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 58 Taxable social security wages.. x 0.124-1 Sb Taxable social security tips... * 0.124 = 5c Taxable Medicare wages & tips.. * 0.029 = 5d Taxable wages & tips subject to Additional Medicare Tax withholding x 0.000 - 1 . . . . . . 50 Se . . 5e . . Add Column 2 from lines 5a, 5b, 5c, and 5d . . , 51 5 Section 31211) Notice and Demand-Tax due on unreported tips (see instructions) 8 Total taxes before adjustments. Add lines 3,5e, and 51. ........... Current quarter's adjustment for fractions of cents ............. 8 Current quarter's adjustment for sick pay .............. , 91 Current quarter's adjustments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9 ...... .... . 10 111 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 1974 12 12 13 Total taxes after adjustments and credits. Subtract line 11 from line 10 . Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 1-X,941-X (PR), 944-X, or 4-X (SP) filed in the current quarter 13 14 Balance due. If line 12 is more than line 13, enter the difference and see instructions... 14 Check one: A to nest situ. Send a rotund. 15 Overpayment. If line 13 is more than line 12, enter the difference You MUST complete both pages of Form 941 and SIGN It. For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Next Form 941 Rev. 1-2017 Cat. No. 170012 - STOJI Summarized information for the 941: FWT Earnings Federal Inc Tax Name Soc Sec Earnings Soc Sec Tax Medicare Earnings Medicare Tax 401K Source 2,256.00 3,496.00 15,615.40 72.00 132.00 3,395.44 2,400.00 3,680.00 148.80 228.16 - 2,400.00 3,680.00 15,615.40 34.80 53.36 226.44 144.00 Book 184.00 Book Book 3,000.00 4,600.00 186.00 285.20 October Payroll H Cranston A Harrison J Parker November Payroll H Cranston A Harrison J Parker P Sternberg December Payroll H Cranston A Harrison J Parker P Sternberg 2,820.00 4,370.00 19,519.25 2,132.31 90.00 165.00 4,244.30 228.94 3,000.00 4,600.00 19,519.25 2,153.85 2,153.85 7200 66.00 133.54 16.80 111.08 43.50 180.00 Book 66.70 230.00 Book 283.05 - Book 31.23 21.54 Book 34.80 144.60 21.63 92.00 Dec. Earnings Record a 26.440 Dec. Earnings Record Dec. Earnings Record 124.9L Blo. Dec. Earnings Record 739.08 3400.00 1840. 15.615.40 3395.44 3245.44 915 76 1534.110 981.70 50,208.96 8,327.68 15,833.85 50,968.50 FWT SS employee SS employer Med employee Med employer Deposits October 3,599.44 376.96 376.96 314.60 314.60 4,982.56 November 4,728.24 604.74 604.74 424.48 424.48 6,786.68 December Totals 8,327.68 981.70 981.70 739.08 739.08 11,769.24 226 Payroll Accounting Chapter 7: Comprehensive Projects-Paper Based versions buted on 12/31 One-Month Project download wer Cranstor NOTE! Templates needed to complete these exercises are included in the Student Exerce for this course Gro Ear 57 Ellipses Corp. is a small business that operates in Herndon, VA. The company is located at 10 Period Lane, Herndon, VA 20170. Its federal Employer Identification Number is 77-7777777 and its president, who signs all tax forms, is John Parker (telephone 0571-555-0073). The company does not wish to name a third party designee on forms 57 57 During 2018 four individuals are employed by Ellipses Corp. These employees are as follows. 52 Federal W/H Allowances State W/H Allowances Marital Status Social Security $3 Name Address Married Hunter Cranston 111-11-1111 85 Southern Road Herndon, VA 20170 Married Allison Harrison 777-77-7777 203A Pine Court Herndon, VA 20170 Alison Harris Single John Parker 444-44-4444 212 Tradition Lane Herndon, VA 20170 Married period Pierre Stemberg 333-33-3333 41 Seward Boulevard Herndon, VA 20170 touarter Ind quarter quarter Note that Pierre Sternberg was hired in November, and his first day of work was Monday, November 26, Additionally, due to an economic downturn, Allison Harrison was laid off in mid-December, with her last day of work on Friday, December 14. October November All employees of Ellipses Corp. work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Friday for the current week (which runs from Saturday through Friday, although employees never work! on weekends). The SUTA tax rate applicable to Ellipses Corp. is 3.1%, while the SUTA wage base in Virginia is $8,000 John Parke Earnings and voluntary deduction information for each of the four employees is as follows. Period Regular Wage Rate Annual Salary Weekly 401(K) Deduction Weekly Charitable Contribution arter Name Hunter Cranston The quarter $15/hour 6% of gross pay N/A Allison Harrison $23/hour N/A $5 ate John Parker NA NA $203,000 20 $112,000.20 5% of gross pay NA 1% of gross pay $20 N/A Pierre Sternberg Intel ORE IS The first 11 mont 1/30/2018. Please note th 11 months of the year have passed, and all payroll related activity been properly acco o paychecks were distributed 1/1/2018 checks were written on 12/31/2017 instead, resulting in the distribution of checks on 13 paydates during Payroll data for each of the tour employees for the th r ters of the year, as well as to of October and November, is as folle One Mont Project 227 distributed on y has been properly accounted for as months of y dates during the first Hunter Cranston Gross Earnings Period Federal income Tax State Income Tax 1st quarter S7,800 Social Security Tax $234 Medicare Tax 401(k) Deduction Charitable Cont. 2nd quarter 5366 60 57.800 $234 5483.60 5113.10 5468 $65 3rd quarter October $7.800 $2,400 $234 5483.60 5366.60 $366.60 $113.10 5468 $4183 60 $72 5113.10 5468 $112.80 November 53,000 $148.80 90 565 $20 $34.80 $144 $141 5186 $43.50 $180 $25 Allison Harrison Period Gross Earnings $11.960 Federal Income Tax State Income Tax Social Security Tax Medicare Tax 401(k) Charitable Deduction Cont. 1st quarter $429 5741.52 2nd quarter $568.10 $568.10 $11.960 $173.42 5598 $429 565 $741.52 $173.42 $11.960 $598 565 $568.10 $429 5132 $741.52 $173.42 3rd quarter October November 5598 $3,680 565 $174.80 $53.36 $184 $4,600 $228.16 $285.20 $165 $218.50 $20 $25 566,70 $230 John Parker Period Gross Earnings Federal Income Tax State Income Tax Social Security Tax Medicare Tax 401(k) Deduction Charitable Cont $260 SO 50 $260 1st quarter 2nd quarter 3rd quarter October November $50,750.05 $50,750.05 $50,750.05 $15,615.40 $19,519.25 S11,035.18 $11,035.18 $11,035.18 $3,395.44 $4,244.30 $2,537.47 $2,537.47 $2,537.47 $780.76 $975.95 $3,146.52 $3,146.52 $1,667.76 $0 $0 5735.93 $735.93 $735.93 $226,44 $260 $80 $100 $283.05 941 for Complete Form 94 depositor sitor Assume that osits equal to the te op filed by Ellipses Cor acessary journal entrie 228 Payroll Accounting Chapter 7 Comprehensive Projects Paper Based ve Social Security Tax NOTE! Recall from should not Instead, to for each em Pierre Sternberg Medicare 401(k) Charitable Gross Federal State Deduction Cont. Tax Period Income Tax Income Tax Earnings 1st quarter SO 2nd quarter $0 50 SO 3rd quarter SO $0 October $0 $21.54 $31.23 $0 November $2.153.85 $228.94 $133.54 $106.62 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following: 50 50 Complete Form 940 employer is permitte payment must be rer associated with Form 6. Calculate total SUTA figure is reported, 7. Complete Copy A subject to federal Ellipses Corp. is the 8. Complete Form 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion "None apply" int of each record 2. Establish and complete the payroll register for each weekly pay period during December. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of December 8, Hunter Cranston requests that his federal withholding allowances increase from two to three (Ellipses Corp. makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Cranston, Harrison, Parker, Sternberg) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in December is check N762. Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage. Three NOTE! Tem for Weekly Hours Worked Ampersand, Inc., Way, Somerset, V signs all tax form party designee o Hunter Cranston Allison Harrison Weekly Start Date December 1 December 8 40 38 During 2018 fou December 15 43.5 December 22 40 Name WARNING! The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates. Keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. Maggie Hough William Finnegan 3. Complete the employee earnings records for December for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period. Stacey Jones Francine Stewart complete Form 941 for the 4th quarter. Note that based on the lookback period, the company is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for the quarter. Although Virginia quarterly state payroll forms are also filed by Ellipses Corp., you will not complete these. If directed to do so by your instructor, record the necessary journal entries associated with Form 941 (including those required for any tax payments made). NOTE! Recall from the Form 941 Rounding Considerations section that quarter- and year-end tax figures should not be calculated based on the total taxable earnings for the respective quarter or year. Instead, to avoid rounding discrepancies, tax figures within Part 2 of Form 941 should be determined for each employee by adding the individual taxes across each pay period. Com dep dep als OOOODOOD 950117 Form 941 for 2017: Employer's QUARTERLY Federal Tax Return Rev. January 2017) OMB No 1545-0029 Department of the Treasury - Internal Revenue Service Report for this Quarter of 2017 Check on Nume freat your dado normal 1: January, February March Trade name any 2. April, Mary, June D 3: July August September 4 October, November, December Instructions and prior year forms are available at www.is.govilom941. Address Foro postal code Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4 1 .. 2 2 Wages, tips, and other compensation . . - - - - . . . . . 3 3 Federal income tax withheld from wages, tips, and other compensation Check and go to line 6. If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 58 Taxable social security wages.. x 0.124-1 Sb Taxable social security tips... * 0.124 = 5c Taxable Medicare wages & tips.. * 0.029 = 5d Taxable wages & tips subject to Additional Medicare Tax withholding x 0.000 - 1 . . . . . . 50 Se . . 5e . . Add Column 2 from lines 5a, 5b, 5c, and 5d . . , 51 5 Section 31211) Notice and Demand-Tax due on unreported tips (see instructions) 8 Total taxes before adjustments. Add lines 3,5e, and 51. ........... Current quarter's adjustment for fractions of cents ............. 8 Current quarter's adjustment for sick pay .............. , 91 Current quarter's adjustments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9 ...... .... . 10 111 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 1974 12 12 13 Total taxes after adjustments and credits. Subtract line 11 from line 10 . Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 1-X,941-X (PR), 944-X, or 4-X (SP) filed in the current quarter 13 14 Balance due. If line 12 is more than line 13, enter the difference and see instructions... 14 Check one: A to nest situ. Send a rotund. 15 Overpayment. If line 13 is more than line 12, enter the difference You MUST complete both pages of Form 941 and SIGN It. For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Next Form 941 Rev. 1-2017 Cat. No. 170012 - STOJI Summarized information for the 941: FWT Earnings Federal Inc Tax Name Soc Sec Earnings Soc Sec Tax Medicare Earnings Medicare Tax 401K Source 2,256.00 3,496.00 15,615.40 72.00 132.00 3,395.44 2,400.00 3,680.00 148.80 228.16 - 2,400.00 3,680.00 15,615.40 34.80 53.36 226.44 144.00 Book 184.00 Book Book 3,000.00 4,600.00 186.00 285.20 October Payroll H Cranston A Harrison J Parker November Payroll H Cranston A Harrison J Parker P Sternberg December Payroll H Cranston A Harrison J Parker P Sternberg 2,820.00 4,370.00 19,519.25 2,132.31 90.00 165.00 4,244.30 228.94 3,000.00 4,600.00 19,519.25 2,153.85 2,153.85 7200 66.00 133.54 16.80 111.08 43.50 180.00 Book 66.70 230.00 Book 283.05 - Book 31.23 21.54 Book 34.80 144.60 21.63 92.00 Dec. Earnings Record a 26.440 Dec. Earnings Record Dec. Earnings Record 124.9L Blo. Dec. Earnings Record 739.08 3400.00 1840. 15.615.40 3395.44 3245.44 915 76 1534.110 981.70 50,208.96 8,327.68 15,833.85 50,968.50 FWT SS employee SS employer Med employee Med employer Deposits October 3,599.44 376.96 376.96 314.60 314.60 4,982.56 November 4,728.24 604.74 604.74 424.48 424.48 6,786.68 December Totals 8,327.68 981.70 981.70 739.08 739.08 11,769.24 226 Payroll Accounting Chapter 7: Comprehensive Projects-Paper Based versions buted on 12/31 One-Month Project download wer Cranstor NOTE! Templates needed to complete these exercises are included in the Student Exerce for this course Gro Ear 57 Ellipses Corp. is a small business that operates in Herndon, VA. The company is located at 10 Period Lane, Herndon, VA 20170. Its federal Employer Identification Number is 77-7777777 and its president, who signs all tax forms, is John Parker (telephone 0571-555-0073). The company does not wish to name a third party designee on forms 57 57 During 2018 four individuals are employed by Ellipses Corp. These employees are as follows. 52 Federal W/H Allowances State W/H Allowances Marital Status Social Security $3 Name Address Married Hunter Cranston 111-11-1111 85 Southern Road Herndon, VA 20170 Married Allison Harrison 777-77-7777 203A Pine Court Herndon, VA 20170 Alison Harris Single John Parker 444-44-4444 212 Tradition Lane Herndon, VA 20170 Married period Pierre Stemberg 333-33-3333 41 Seward Boulevard Herndon, VA 20170 touarter Ind quarter quarter Note that Pierre Sternberg was hired in November, and his first day of work was Monday, November 26, Additionally, due to an economic downturn, Allison Harrison was laid off in mid-December, with her last day of work on Friday, December 14. October November All employees of Ellipses Corp. work a regular 40-hour workweek (thus all hours worked over 40 in a given week are overtime hours), receive overtime pay at a rate of 1.5 times the regular wage rate, and are paid weekly on Friday for the current week (which runs from Saturday through Friday, although employees never work! on weekends). The SUTA tax rate applicable to Ellipses Corp. is 3.1%, while the SUTA wage base in Virginia is $8,000 John Parke Earnings and voluntary deduction information for each of the four employees is as follows. Period Regular Wage Rate Annual Salary Weekly 401(K) Deduction Weekly Charitable Contribution arter Name Hunter Cranston The quarter $15/hour 6% of gross pay N/A Allison Harrison $23/hour N/A $5 ate John Parker NA NA $203,000 20 $112,000.20 5% of gross pay NA 1% of gross pay $20 N/A Pierre Sternberg Intel ORE IS The first 11 mont 1/30/2018. Please note th 11 months of the year have passed, and all payroll related activity been properly acco o paychecks were distributed 1/1/2018 checks were written on 12/31/2017 instead, resulting in the distribution of checks on 13 paydates during Payroll data for each of the tour employees for the th r ters of the year, as well as to of October and November, is as folle One Mont Project 227 distributed on y has been properly accounted for as months of y dates during the first Hunter Cranston Gross Earnings Period Federal income Tax State Income Tax 1st quarter S7,800 Social Security Tax $234 Medicare Tax 401(k) Deduction Charitable Cont. 2nd quarter 5366 60 57.800 $234 5483.60 5113.10 5468 $65 3rd quarter October $7.800 $2,400 $234 5483.60 5366.60 $366.60 $113.10 5468 $4183 60 $72 5113.10 5468 $112.80 November 53,000 $148.80 90 565 $20 $34.80 $144 $141 5186 $43.50 $180 $25 Allison Harrison Period Gross Earnings $11.960 Federal Income Tax State Income Tax Social Security Tax Medicare Tax 401(k) Charitable Deduction Cont. 1st quarter $429 5741.52 2nd quarter $568.10 $568.10 $11.960 $173.42 5598 $429 565 $741.52 $173.42 $11.960 $598 565 $568.10 $429 5132 $741.52 $173.42 3rd quarter October November 5598 $3,680 565 $174.80 $53.36 $184 $4,600 $228.16 $285.20 $165 $218.50 $20 $25 566,70 $230 John Parker Period Gross Earnings Federal Income Tax State Income Tax Social Security Tax Medicare Tax 401(k) Deduction Charitable Cont $260 SO 50 $260 1st quarter 2nd quarter 3rd quarter October November $50,750.05 $50,750.05 $50,750.05 $15,615.40 $19,519.25 S11,035.18 $11,035.18 $11,035.18 $3,395.44 $4,244.30 $2,537.47 $2,537.47 $2,537.47 $780.76 $975.95 $3,146.52 $3,146.52 $1,667.76 $0 $0 5735.93 $735.93 $735.93 $226,44 $260 $80 $100 $283.05 941 for Complete Form 94 depositor sitor Assume that osits equal to the te op filed by Ellipses Cor acessary journal entrie 228 Payroll Accounting Chapter 7 Comprehensive Projects Paper Based ve Social Security Tax NOTE! Recall from should not Instead, to for each em Pierre Sternberg Medicare 401(k) Charitable Gross Federal State Deduction Cont. Tax Period Income Tax Income Tax Earnings 1st quarter SO 2nd quarter $0 50 SO 3rd quarter SO $0 October $0 $21.54 $31.23 $0 November $2.153.85 $228.94 $133.54 $106.62 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following: 50 50 Complete Form 940 employer is permitte payment must be rer associated with Form 6. Calculate total SUTA figure is reported, 7. Complete Copy A subject to federal Ellipses Corp. is the 8. Complete Form 1. Establish an employee earnings record for each of the company's four employees. Complete the top portion "None apply" int of each record 2. Establish and complete the payroll register for each weekly pay period during December. When calculating federal income tax withholding, use the withholding tables where possible, and refer to the percentage method only when necessary. Note that as of December 8, Hunter Cranston requests that his federal withholding allowances increase from two to three (Ellipses Corp. makes this change). Additionally, for simplicity, calculate the state income tax withholding as 5% of each employee's taxable pay (which is the same as taxable pay for FWT). Recall that state income tax withholding would ordinarily be calculated using the applicable state's withholding tables. Payroll checks are remitted to the employees in the same order (Cranston, Harrison, Parker, Sternberg) each pay period and are written from a bank account that is used solely for these payments. The first payroll check written in December is check N762. Note that all charitable contributions are deemed to be made on the final day of each pay period. The following information will be required for the completion of these records for the two employees who are compensated via an hourly wage. Three NOTE! Tem for Weekly Hours Worked Ampersand, Inc., Way, Somerset, V signs all tax form party designee o Hunter Cranston Allison Harrison Weekly Start Date December 1 December 8 40 38 During 2018 fou December 15 43.5 December 22 40 Name WARNING! The above dates are weekly start dates. Refer to a calendar to determine the weekly end dates and associated pay dates. Keep in mind that tax liability and payment amounts are determined based on the weekly pay dates. Maggie Hough William Finnegan 3. Complete the employee earnings records for December for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period. Stacey Jones Francine StewartStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started