Complete the acquisition analysis in relation to this business combination and calculate the goodwill or

gain on bargain purchase.

Do part (a) please

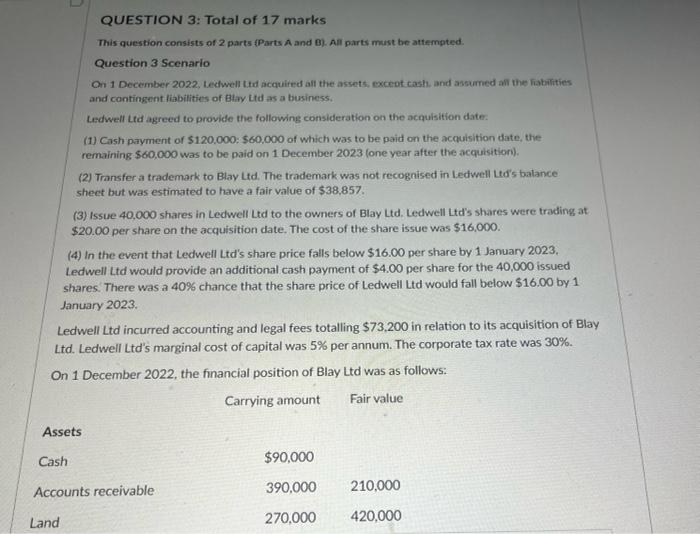

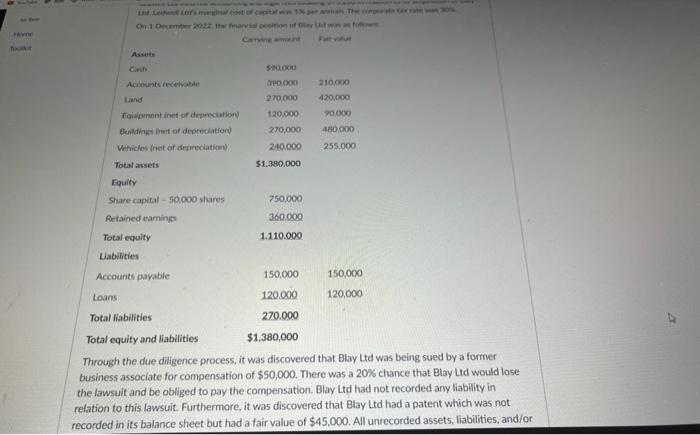

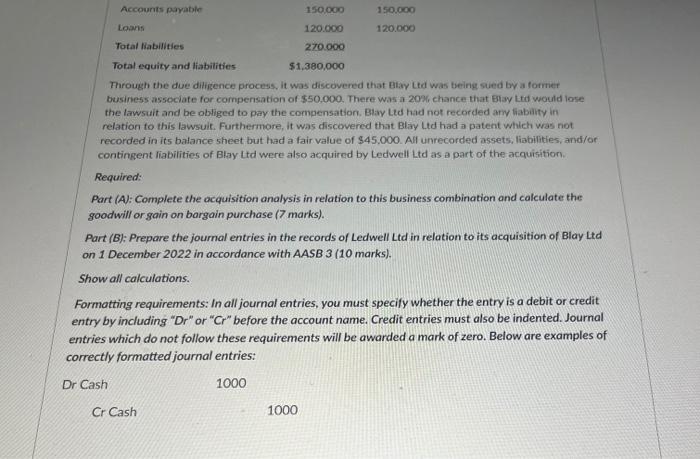

QUESTION 3: Total of 17 marks This question consists of 2 parts \{Parts A and B). All parts must be attempted. Question 3 Scenario On 1 December 2022 , Leclwell t.tud acquited all the assets, exceet cash. and assumed ant the fiatilities and contingent liabilities of Blay Ltd as a business. Ladwell Ltd agreed to provide the following consideration on the acquisition date. (1) Cash payment of $120,000:$60,000 of which was to be paid on the acquisition date, the remaining $60,000 was to be paid on 1 December 2023 (one year after the acquisitiori). (2) Transfer a trademark to Biay Ltd. The trademark was not recognised in bedwell Lit's balance sheet but was estimated to have a fair value of $38,857. (3) Issue 40,000 shares in Ledwell Ltd to the owners of Blay Ltd. Ledwell Ltd's shares were trading at $20.00 per share on the acquisition date. The cost of the share issue was $16,000. (4) In the event that Ledwell Ltd's share price falls below $16.00 per share by 1 January 2023. Ledwell Ltd would provide an additional cash payment of $4.00 per share for the 40,000 issued shares. There was a 40% chance that the share price of Ledwell Ltd would fall below $16.00 by 1 antary 2023. edwell Ltd incurred accounting and legal fees totalling $73,200 in relation to its acquisition of Blay d. Ledwell Ltd's marginal cost of capital was 5% per annum. The corporate tax rate was 30%. 1 December 2022 , the financial position of Blay Ltd was as follows: Through the due diligence process, it was discovered that Blay Ltd was being sued by a former business associate for compensation of $50,000. There was a 20% chance that Blay Ltd would lose the lawsult and be obliged to pay the compensation. Blay Ltd had not recorded any liability in relation to this lawsuit. Furthermore, it was discovered that Blay Ltd had a patent which was not recorded in its balance sheet but had a fair value of $45,000. All unrecorded assets, liabilities, and/or Through the due diligence process, it was discovered that Blay Ltd was being stied by a former business associate for compersation of $50,000. There was a 209 , chance that Blay trid would lose the lawsuit and be obliged to pay the compensation. Blay Lted had not recorded ary liability in relation to this lawsuit. Furthermore, it was discovered that Blay Ltd had a patent which was not recorded in its balance sheet but had a fair value of $45.000. All unrecorded assets, liabilities, and/or: contingent liabilities of Blay Ltd were also acquired by Ledwell Ltd as a part of the acquisition. Required: Part (A): Complete the acquisition analysis in relation to this business combination and calculate the goodwill or gain on bargain purchase (7 marks). Part (B): Prepare the journal entries in the records of Ledwell Ltd in relation to its acquisition of Blay Ltd on 1 December 2022 in accordance with AASB 3 (10 marks). Show all calculations. Formatting requirements: In all journal entries, you must specify whether the entry is a debit or credit entry by including "Dr" or "Cr" before the account name. Credit entries must also be indented. Journal entries which do not follow these requirements will be awarded a mark of zero. Below are examples of correctly formatted journal entries: Cash 1000 Cr Cash 1000 Question 3 Part (A) Complete the acquisition analysis in relation to this business combination and calculate the zoodwill or gain on bargain purchase. Edit View Insert Format Tools Table QUESTION 3: Total of 17 marks This question consists of 2 parts \{Parts A and B). All parts must be attempted. Question 3 Scenario On 1 December 2022 , Leclwell t.tud acquited all the assets, exceet cash. and assumed ant the fiatilities and contingent liabilities of Blay Ltd as a business. Ladwell Ltd agreed to provide the following consideration on the acquisition date. (1) Cash payment of $120,000:$60,000 of which was to be paid on the acquisition date, the remaining $60,000 was to be paid on 1 December 2023 (one year after the acquisitiori). (2) Transfer a trademark to Biay Ltd. The trademark was not recognised in bedwell Lit's balance sheet but was estimated to have a fair value of $38,857. (3) Issue 40,000 shares in Ledwell Ltd to the owners of Blay Ltd. Ledwell Ltd's shares were trading at $20.00 per share on the acquisition date. The cost of the share issue was $16,000. (4) In the event that Ledwell Ltd's share price falls below $16.00 per share by 1 January 2023. Ledwell Ltd would provide an additional cash payment of $4.00 per share for the 40,000 issued shares. There was a 40% chance that the share price of Ledwell Ltd would fall below $16.00 by 1 antary 2023. edwell Ltd incurred accounting and legal fees totalling $73,200 in relation to its acquisition of Blay d. Ledwell Ltd's marginal cost of capital was 5% per annum. The corporate tax rate was 30%. 1 December 2022 , the financial position of Blay Ltd was as follows: Through the due diligence process, it was discovered that Blay Ltd was being sued by a former business associate for compensation of $50,000. There was a 20% chance that Blay Ltd would lose the lawsult and be obliged to pay the compensation. Blay Ltd had not recorded any liability in relation to this lawsuit. Furthermore, it was discovered that Blay Ltd had a patent which was not recorded in its balance sheet but had a fair value of $45,000. All unrecorded assets, liabilities, and/or Through the due diligence process, it was discovered that Blay Ltd was being stied by a former business associate for compersation of $50,000. There was a 209 , chance that Blay trid would lose the lawsuit and be obliged to pay the compensation. Blay Lted had not recorded ary liability in relation to this lawsuit. Furthermore, it was discovered that Blay Ltd had a patent which was not recorded in its balance sheet but had a fair value of $45.000. All unrecorded assets, liabilities, and/or: contingent liabilities of Blay Ltd were also acquired by Ledwell Ltd as a part of the acquisition. Required: Part (A): Complete the acquisition analysis in relation to this business combination and calculate the goodwill or gain on bargain purchase (7 marks). Part (B): Prepare the journal entries in the records of Ledwell Ltd in relation to its acquisition of Blay Ltd on 1 December 2022 in accordance with AASB 3 (10 marks). Show all calculations. Formatting requirements: In all journal entries, you must specify whether the entry is a debit or credit entry by including "Dr" or "Cr" before the account name. Credit entries must also be indented. Journal entries which do not follow these requirements will be awarded a mark of zero. Below are examples of correctly formatted journal entries: Cash 1000 Cr Cash 1000 Question 3 Part (A) Complete the acquisition analysis in relation to this business combination and calculate the zoodwill or gain on bargain purchase. Edit View Insert Format Tools Table