Complete the blue boxes. Thanks

Complete the blue boxes. Thanks

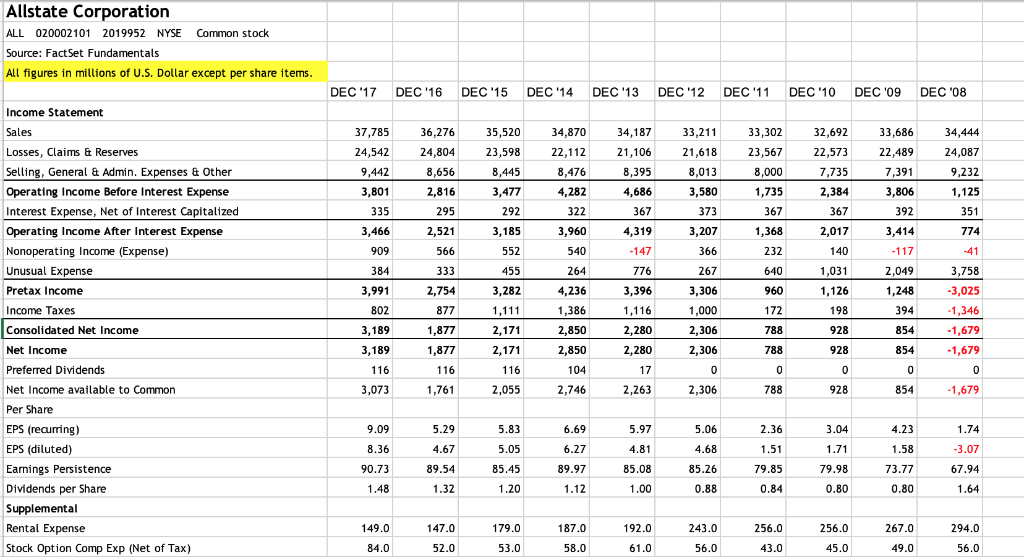

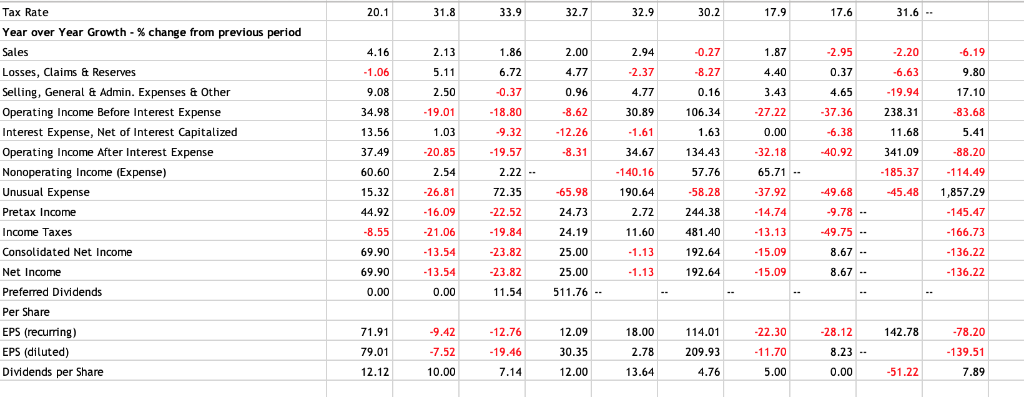

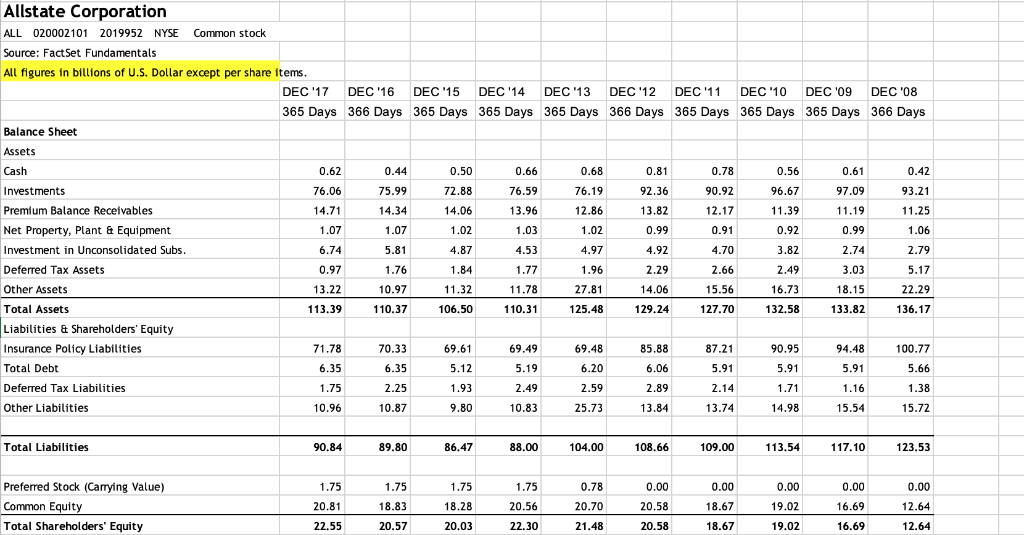

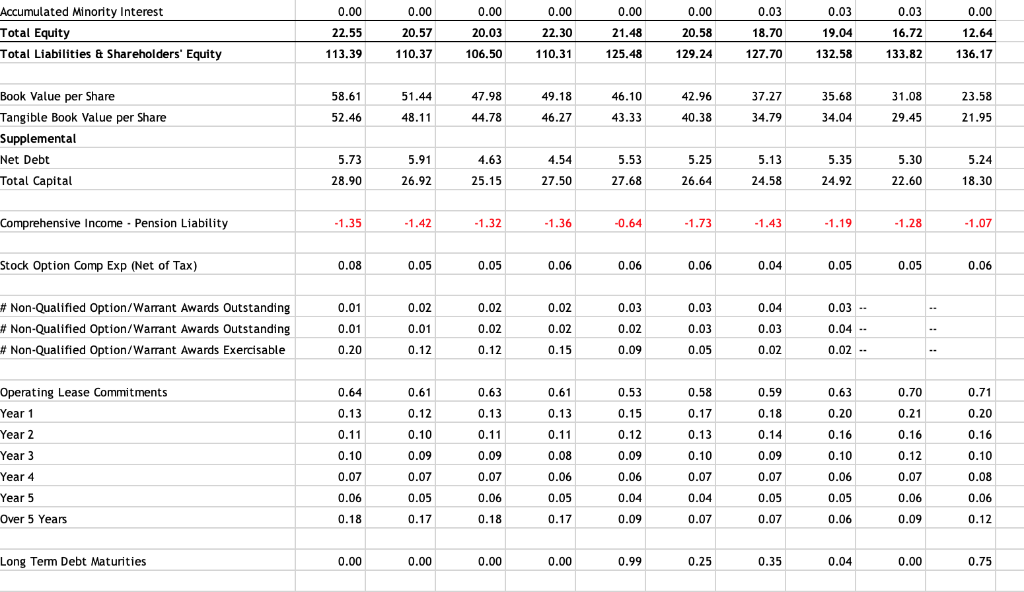

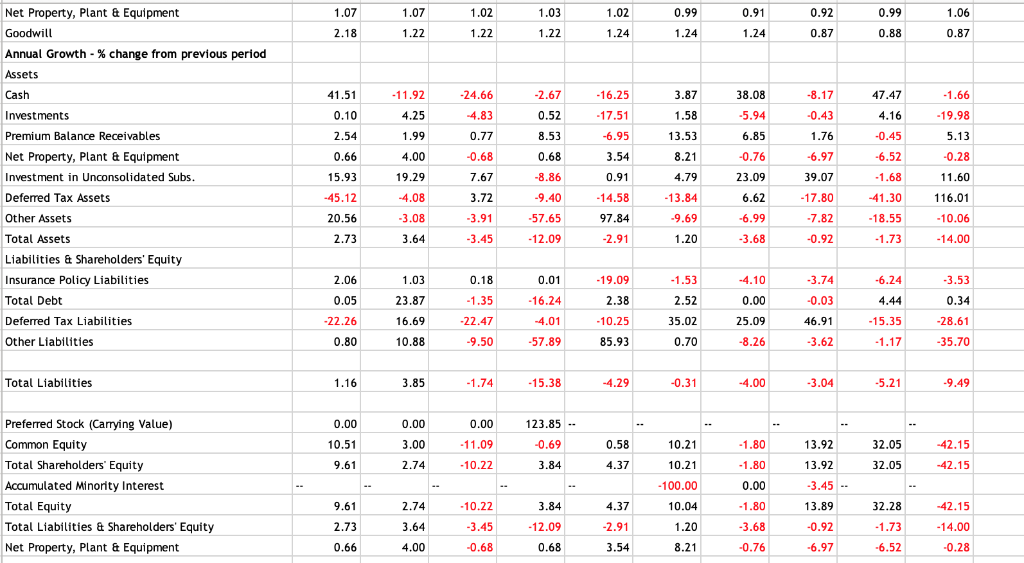

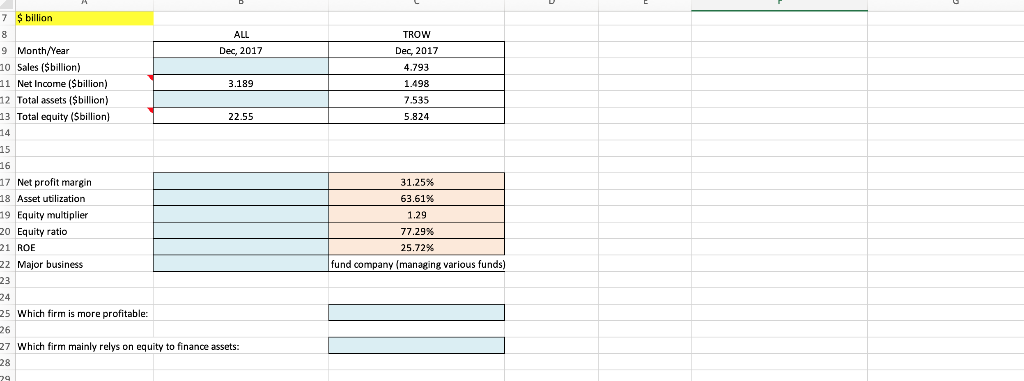

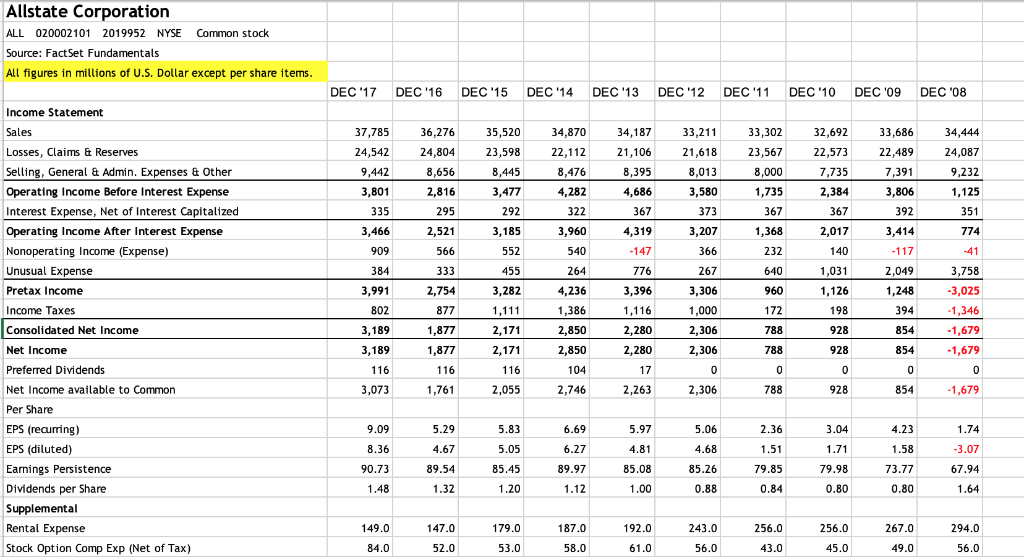

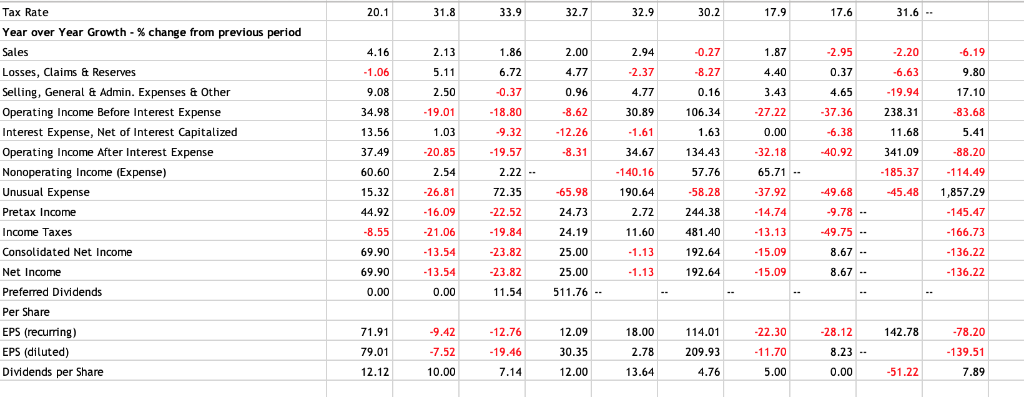

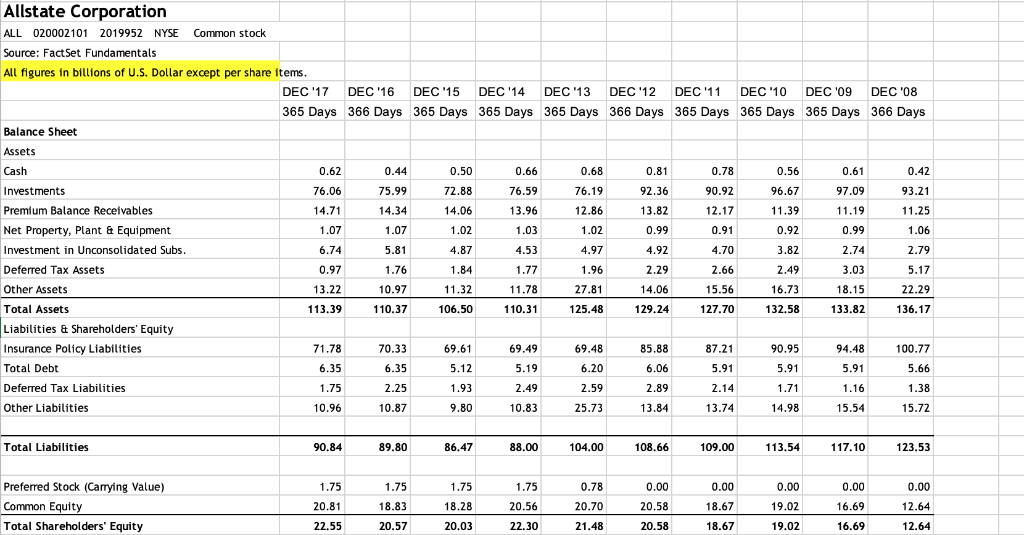

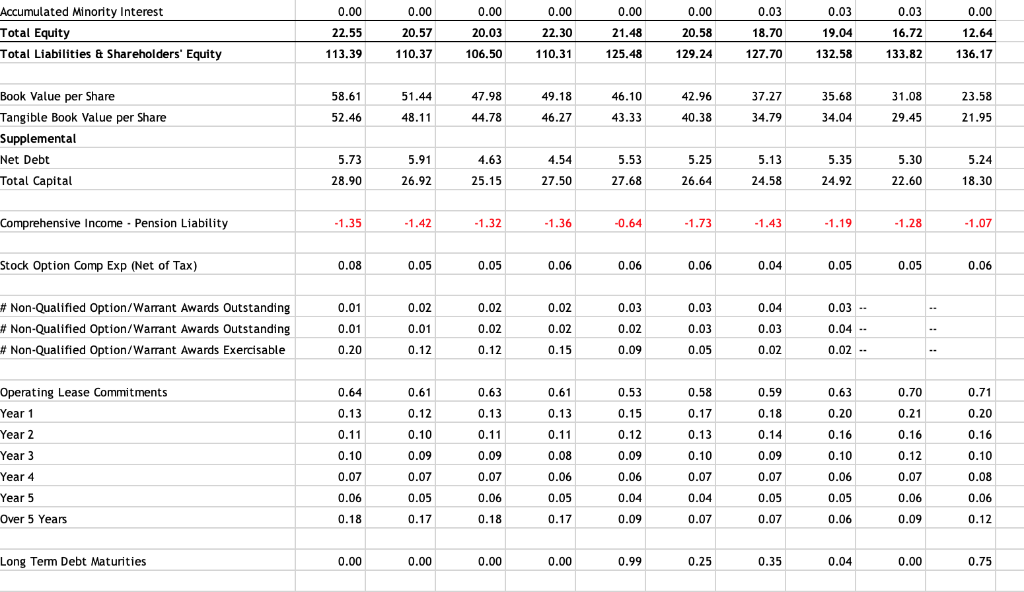

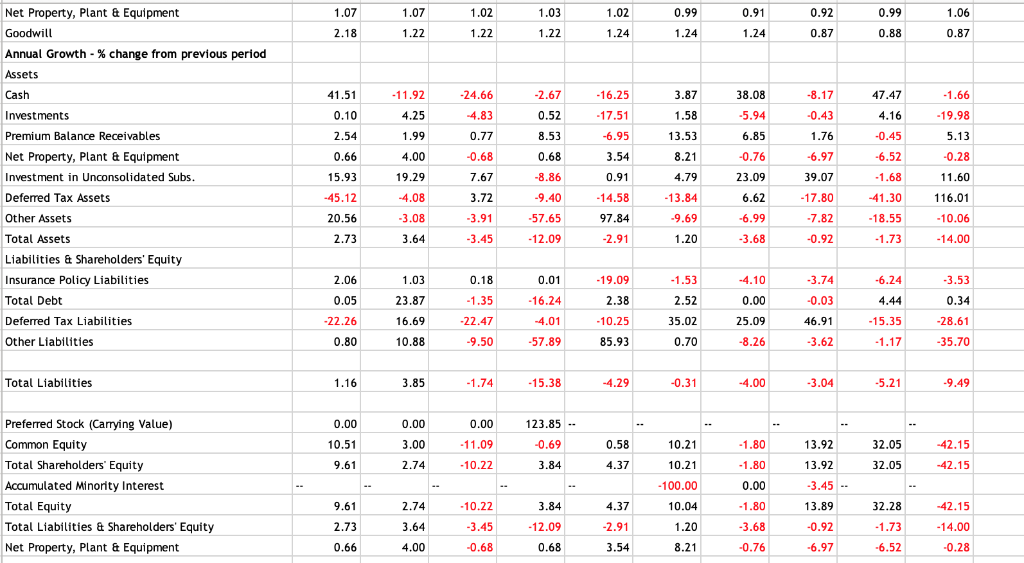

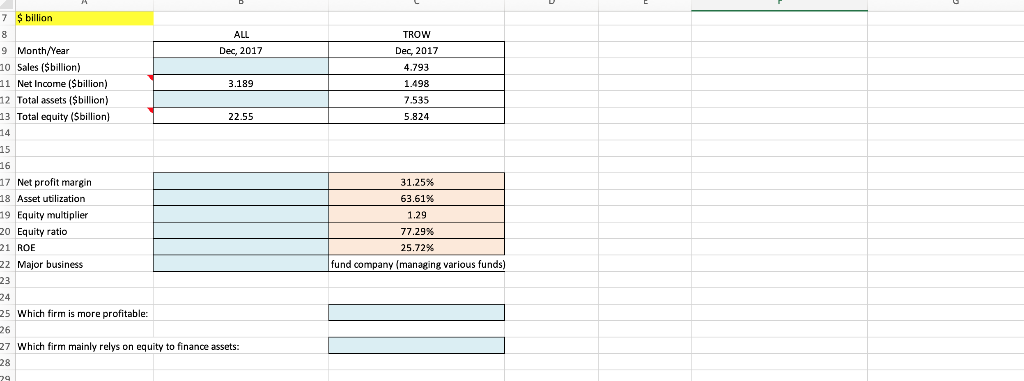

Allstate Corporation ALL 020002101 2019952 NYSE Common stock Source: FactSet Fundamentals All figures in millions of U.S. Dollar except per share items DEC '17 DEC'16 DEC '15 DEC '4 DEC '13 DEC '12 DEC'11 DEC '10 DEC '09 DEC '08 Income Statement Sales Losses, Claims & Reserves Selling, General&Admin. Expenses & Other Operating Income Before Interest Expense Interest Expense, Net of Interest Capitalized Operating Income After Interest Expense Nonoperating Income (Expense) Unusual Expense Pretax Income Income Taxes Consolidated Net Income Net Income Preferred Dividends Net Income available to Common Per Share EPS (recuring) EPS (diluted) Earnings Persistence Dividends per Share Supplemental Rental Expense Stock Option Comp Exp (Net of Tax) 7,785 36,276 35,52034,87034,187 33,21133,302 32,69233,686 34,444 24,54224,80423,59822,11221,106 21,61823,56722,57322,489 24,087 9,232 1,125 7,735 2,384 367 2,017 9,442 3,801 8,656 8,476 4,282 322 3,960 8,000 1,735 367 1,368 232 4,686 3,580 373 3,207 3,806 292 3,466 2,521 566 3,185 909 267 3,306 1,000 2,306 2,306 2,049 1,248 394 3,758 3,025 1,346 1,679 -1,679 455 3,991 4,236 1,386 2,850 2,850 2,754 3,282 960 1,126 3,189 3,189 1,877 1,877 2,171 2,171 2,280 2,280 928 928 854 3,073 2,055 2,263 788 928 854 90.73 85.45 89.97 85.08 1.48 1.20 147.0 179.0 187.0 192.0 Tax Rate 32.7 17.9 Year over Year Growth . % change from previous period 0.27 8.27 1.86 1.87 2.95 2.20 es Losses, Claims& Reserves Selling, General & Admin. Expenses& Other Operating Income Before Interest Expense Interest Expense, Net of Interest Capitalized Operating Income After Interest Expense Nonoperating Income (Expense) Unusual Expense Pretax Income Income Taxes Consolidated Net Income Net Income Preferred Dividends Per Share 1.06 2.37 9.08 4.65 19.94 19.01 18.80 30.89 106.34 27.22 37.36 238.31 83.68 -12.26 34.67 -140.16 190.64 19.57 2.22 72.35 22.52 19.84 23.82 23.82 134.43 57.76 58.28 244.38 481.40 192.64 192.64 -88.20 114.49 45.48 1,857.29 145.47 166.73 136.22 136.22 37.49 20.85 8.31 32.18 65.71 37.92 14.74 -40.92 341.09 60.60 185.37 26.81 16.09 21.06 -49.68 9.78 -49.75 -65.98 44.92 11.60 69.90 25.00 15.09 69.90 13.54 25.00 EPS (recuring) 71.91 12.76 12.09 30.35 12.00 18.00 2.78 13.64 114.01 209.93 4.76 22.30 28.12 142.78 78.20 EPS (diluted) Dividends per Share 79.01 19.46 11.70 8.23 139.51 10.00 51.22 Allstate Corporation ALL 020002101 2019952 NYSE Common stock Source: FactSet Fundamentals All figures in billions of U.S. Dollar except per share items DEC '17 DEC'16 DEC '15 DEC '14 DEC '3DEC '12 DEC11 DEC '10 DEC '09 DEC '08 365 Days 366 Days 365 Days 365 Days 365 Days 366 Days 365 Days 365 Days 365 Days 366 Days Balance Sheet Assets Cash Investments Premium Balance Recefvables Net Property, Plant & Equipment Investment in Unconsolidated Subs Deferred Tax Assets Other Assets Total Assets Liabilities & Shareholders Equity Insurance Policy Liabilities Total Debt Deferred Tax Liabilities Other Liabilities 72.88 14.06 1.02 76.06 75.99 76.59 92.36 90.92 96.67 97.09 93.21 13.96 12.86 13.82 11.39 1.07 4.97 4.92 2.29 3.03 13.22 16.73 10.97 110.37 27.81 22.29 113.39 106.50 125.48 129.24 127.70 132.58 133.82 136.17 71.78 70.33 69.61 69.49 69.48 85.88 87.21 90.95 100.77 6.20 10.87 25.73 13.84 13.74 15.54 15.72 Total Liabilities 90.84 89.80 86.47 88.00 104.00 108.66 109.00 113.54 117.10 123.53 Preferred Stock (Carying Value) Common Equity Total Shareholders' Equity 0.78 18.28 20.56 20.70 20.58 18.67 19.02 22.55 20.57 20.03 22.30 20.58 18.67 19.02 16.69 12.64 Accumulated Minority Interest Total Equity Total Liabilities & Shareholders' Equity 0.03 0.03 19.04 132.58 0.03 22.55 20.57 20.03 22.30 20.58 113.39 110.37 106.50 110.31 125.48 129.24 127.70 133.82 136.17 51.44 47.98 44.78 42.96 35.68 31.08 29.45 Book Value per Share Tangible Book Value per Share Supplemental Net Debt Total Capital 58.61 37.27 23.58 52.46 46.27 43.33 40.38 34.04 4.63 5.24 28.90 26.92 25.15 27.50 27.68 26.64 24.58 24.92 22.60 18.30 Comprehensive Income Penson Liability Stock Option Comp Exp (Net of Tax) 0.08 0.05 0.05 0.06 0.05 0.05 0.06 # Non-Qualified Option/warrant Awards Outstanding # Non-Qualified Option/warant Awards Outstanding # Non-Qualified Option/wamant Awards Exercisable 0.02 0.02 0.02 0.03 0.03 0.03 0.05 0.03 0.02 0.02 0.02 0.03 0.20 0.02 0.02 0.53 Operating Lease Commitments ear 1 Year 2 Year 3 Year 4 Year 5 Over 5 Years 0.58 0.59 0.70 0.20 0.20 0.08 0.07 0.07 0.07 0.07 0.07 0.05 0.07 0.06 0.05 0.06 0.07 0.08 0.05 0.05 0.06 0.07 Long Term Debt Maturities 0.99 0.25 0.35 1.02 Net Property, Plant &Equipment Goodwill Annual Growth - change from previous period Assets Cash Investments Premium Balance Receivables Net Property, Plant &Equipment Investment in Unconsolidated Subs Deferred Tax Assets Other Assets Total Assets Liabilities &Shareholders' Equity Insurance Policy Liabilities Total Debt Deferred Tax Liabilities Other Liabilities 1.07 1.07 0.92 0.99 1.06 1.22 1.22 1.22 11.92 24.66 16.25 17.51 6.95 2.67 3.87 38.08 47.47 4.25 19.98 13.53 6.85 0.66 0.28 11.60 116.01 10.06 14.00 4.00 39.07 17.80 7.82 1.68 -41.30 18.55 1.73 4.08 14.58 13.84 20.56 3.08 57.65 12.09 97.84 3.68 19.09 3.74 6.24 0.05 22.26 0.80 23.87 16.69 10.88 16.24 22.47 10.25 35.02 46.91 28.61 57.89 85.93 0.70 3.62 35.70 Total Liabilities 15.38 4.29 5.21 Preferred Stock (Carrying Value) Common Equity Total Shareholders Equity Accumulated Minority Interest Total Equity Total Liabilities & Shareholders Equity Net Property, Plant & Equipment 0.00 0.00 123.85 - 0.00 11.09 10.22 3.00 13.92 32.05 10.21 10.21 100.00 10.04 42.15 32.05 42.15 10.22 13.89 32.28 2.73 3.45 12.09 3.68 1.73 14.00 4.00 7 $ billiorn ALL TROW Dec, 2017 4.793 1.498 7.535 5.824 9 Month/Year 0 Sales ($billion) 11 Net Income (Sbillion) 12 Total assets ($billion) 13 Total equity (Sbillion) 14 15 16 17 Net profit margin 18 Asset utlization 9Equity multiplier 20 Equity ratio 21 ROE 22 Major business 23 24 25 Which firm is more profitable: 26 27 Which firm mainly relys on equity to finance assets: 28 Dec, 2017 3.189 22.55 31.25% 63.61% 1.29 77.29% 25.72% fund company (managing various funds) Allstate Corporation ALL 020002101 2019952 NYSE Common stock Source: FactSet Fundamentals All figures in millions of U.S. Dollar except per share items DEC '17 DEC'16 DEC '15 DEC '4 DEC '13 DEC '12 DEC'11 DEC '10 DEC '09 DEC '08 Income Statement Sales Losses, Claims & Reserves Selling, General&Admin. Expenses & Other Operating Income Before Interest Expense Interest Expense, Net of Interest Capitalized Operating Income After Interest Expense Nonoperating Income (Expense) Unusual Expense Pretax Income Income Taxes Consolidated Net Income Net Income Preferred Dividends Net Income available to Common Per Share EPS (recuring) EPS (diluted) Earnings Persistence Dividends per Share Supplemental Rental Expense Stock Option Comp Exp (Net of Tax) 7,785 36,276 35,52034,87034,187 33,21133,302 32,69233,686 34,444 24,54224,80423,59822,11221,106 21,61823,56722,57322,489 24,087 9,232 1,125 7,735 2,384 367 2,017 9,442 3,801 8,656 8,476 4,282 322 3,960 8,000 1,735 367 1,368 232 4,686 3,580 373 3,207 3,806 292 3,466 2,521 566 3,185 909 267 3,306 1,000 2,306 2,306 2,049 1,248 394 3,758 3,025 1,346 1,679 -1,679 455 3,991 4,236 1,386 2,850 2,850 2,754 3,282 960 1,126 3,189 3,189 1,877 1,877 2,171 2,171 2,280 2,280 928 928 854 3,073 2,055 2,263 788 928 854 90.73 85.45 89.97 85.08 1.48 1.20 147.0 179.0 187.0 192.0 Tax Rate 32.7 17.9 Year over Year Growth . % change from previous period 0.27 8.27 1.86 1.87 2.95 2.20 es Losses, Claims& Reserves Selling, General & Admin. Expenses& Other Operating Income Before Interest Expense Interest Expense, Net of Interest Capitalized Operating Income After Interest Expense Nonoperating Income (Expense) Unusual Expense Pretax Income Income Taxes Consolidated Net Income Net Income Preferred Dividends Per Share 1.06 2.37 9.08 4.65 19.94 19.01 18.80 30.89 106.34 27.22 37.36 238.31 83.68 -12.26 34.67 -140.16 190.64 19.57 2.22 72.35 22.52 19.84 23.82 23.82 134.43 57.76 58.28 244.38 481.40 192.64 192.64 -88.20 114.49 45.48 1,857.29 145.47 166.73 136.22 136.22 37.49 20.85 8.31 32.18 65.71 37.92 14.74 -40.92 341.09 60.60 185.37 26.81 16.09 21.06 -49.68 9.78 -49.75 -65.98 44.92 11.60 69.90 25.00 15.09 69.90 13.54 25.00 EPS (recuring) 71.91 12.76 12.09 30.35 12.00 18.00 2.78 13.64 114.01 209.93 4.76 22.30 28.12 142.78 78.20 EPS (diluted) Dividends per Share 79.01 19.46 11.70 8.23 139.51 10.00 51.22 Allstate Corporation ALL 020002101 2019952 NYSE Common stock Source: FactSet Fundamentals All figures in billions of U.S. Dollar except per share items DEC '17 DEC'16 DEC '15 DEC '14 DEC '3DEC '12 DEC11 DEC '10 DEC '09 DEC '08 365 Days 366 Days 365 Days 365 Days 365 Days 366 Days 365 Days 365 Days 365 Days 366 Days Balance Sheet Assets Cash Investments Premium Balance Recefvables Net Property, Plant & Equipment Investment in Unconsolidated Subs Deferred Tax Assets Other Assets Total Assets Liabilities & Shareholders Equity Insurance Policy Liabilities Total Debt Deferred Tax Liabilities Other Liabilities 72.88 14.06 1.02 76.06 75.99 76.59 92.36 90.92 96.67 97.09 93.21 13.96 12.86 13.82 11.39 1.07 4.97 4.92 2.29 3.03 13.22 16.73 10.97 110.37 27.81 22.29 113.39 106.50 125.48 129.24 127.70 132.58 133.82 136.17 71.78 70.33 69.61 69.49 69.48 85.88 87.21 90.95 100.77 6.20 10.87 25.73 13.84 13.74 15.54 15.72 Total Liabilities 90.84 89.80 86.47 88.00 104.00 108.66 109.00 113.54 117.10 123.53 Preferred Stock (Carying Value) Common Equity Total Shareholders' Equity 0.78 18.28 20.56 20.70 20.58 18.67 19.02 22.55 20.57 20.03 22.30 20.58 18.67 19.02 16.69 12.64 Accumulated Minority Interest Total Equity Total Liabilities & Shareholders' Equity 0.03 0.03 19.04 132.58 0.03 22.55 20.57 20.03 22.30 20.58 113.39 110.37 106.50 110.31 125.48 129.24 127.70 133.82 136.17 51.44 47.98 44.78 42.96 35.68 31.08 29.45 Book Value per Share Tangible Book Value per Share Supplemental Net Debt Total Capital 58.61 37.27 23.58 52.46 46.27 43.33 40.38 34.04 4.63 5.24 28.90 26.92 25.15 27.50 27.68 26.64 24.58 24.92 22.60 18.30 Comprehensive Income Penson Liability Stock Option Comp Exp (Net of Tax) 0.08 0.05 0.05 0.06 0.05 0.05 0.06 # Non-Qualified Option/warrant Awards Outstanding # Non-Qualified Option/warant Awards Outstanding # Non-Qualified Option/wamant Awards Exercisable 0.02 0.02 0.02 0.03 0.03 0.03 0.05 0.03 0.02 0.02 0.02 0.03 0.20 0.02 0.02 0.53 Operating Lease Commitments ear 1 Year 2 Year 3 Year 4 Year 5 Over 5 Years 0.58 0.59 0.70 0.20 0.20 0.08 0.07 0.07 0.07 0.07 0.07 0.05 0.07 0.06 0.05 0.06 0.07 0.08 0.05 0.05 0.06 0.07 Long Term Debt Maturities 0.99 0.25 0.35 1.02 Net Property, Plant &Equipment Goodwill Annual Growth - change from previous period Assets Cash Investments Premium Balance Receivables Net Property, Plant &Equipment Investment in Unconsolidated Subs Deferred Tax Assets Other Assets Total Assets Liabilities &Shareholders' Equity Insurance Policy Liabilities Total Debt Deferred Tax Liabilities Other Liabilities 1.07 1.07 0.92 0.99 1.06 1.22 1.22 1.22 11.92 24.66 16.25 17.51 6.95 2.67 3.87 38.08 47.47 4.25 19.98 13.53 6.85 0.66 0.28 11.60 116.01 10.06 14.00 4.00 39.07 17.80 7.82 1.68 -41.30 18.55 1.73 4.08 14.58 13.84 20.56 3.08 57.65 12.09 97.84 3.68 19.09 3.74 6.24 0.05 22.26 0.80 23.87 16.69 10.88 16.24 22.47 10.25 35.02 46.91 28.61 57.89 85.93 0.70 3.62 35.70 Total Liabilities 15.38 4.29 5.21 Preferred Stock (Carrying Value) Common Equity Total Shareholders Equity Accumulated Minority Interest Total Equity Total Liabilities & Shareholders Equity Net Property, Plant & Equipment 0.00 0.00 123.85 - 0.00 11.09 10.22 3.00 13.92 32.05 10.21 10.21 100.00 10.04 42.15 32.05 42.15 10.22 13.89 32.28 2.73 3.45 12.09 3.68 1.73 14.00 4.00 7 $ billiorn ALL TROW Dec, 2017 4.793 1.498 7.535 5.824 9 Month/Year 0 Sales ($billion) 11 Net Income (Sbillion) 12 Total assets ($billion) 13 Total equity (Sbillion) 14 15 16 17 Net profit margin 18 Asset utlization 9Equity multiplier 20 Equity ratio 21 ROE 22 Major business 23 24 25 Which firm is more profitable: 26 27 Which firm mainly relys on equity to finance assets: 28 Dec, 2017 3.189 22.55 31.25% 63.61% 1.29 77.29% 25.72% fund company (managing various funds)

Complete the blue boxes. Thanks

Complete the blue boxes. Thanks