Answered step by step

Verified Expert Solution

Question

1 Approved Answer

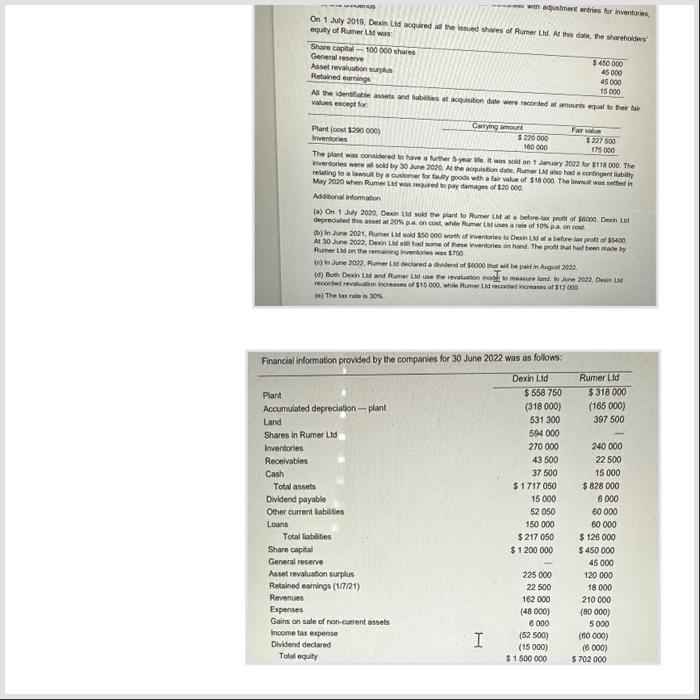

Complete the consolidated worksheet for 30 June 2022. with adjustment entries for inventories, On 1 July 2019, Dexin Ltd acquired all the issued shares of

Complete the consolidated worksheet for 30 June 2022.

with adjustment entries for inventories, On 1 July 2019, Dexin Ltd acquired all the issued shares of Rumer Ltd. At this date, the shareholders equity of Rumer Ltd was Inventories Receivables Share capital-100 000 shares General reserve Asset revaluation surplus Retained earnings Cash Plant (cost $290 000) Inventories All the identifiable assets and abilities at acquisition date were recorded at amounts equal to their fair values except for Plant Accumulated depreciation-plant Land Shares in Rumer Ltd Financial information provided by the companies for 30 June 2022 was as follows: Dexin Lid Carrying amount The plant was considered to have a further 5-year Me it was sold on 1 January 2022 for $118000. The inventories were all sold by 30 June 2020. At the acquisition date, Rumer Lad also had a contingent liability relating to a lawsuit by a customer for faulty goods with a fair value of $18 000. The last was setted in May 2020 when Rumer Ltd was required to pay damages of $20 000 Total assets Dividend payable Other current liabilities Loans $220 000 160 000 Additional information (a) On 1 July 2020, Dexin Lid sold the plant to Rumer Ltd at a before-lax profit of $6000 Dein Lid depreciated this asset at 20% pa, on cost, while Rumer LM uses a rate of 10% pa on co Total liabilities (b) in June 2021, Rumer Lad sold $50 000 worth of inventories to Dexin Lid at a before-las proft of $5400 At 30 June 2022, Dexin Lid will had some of these inventories on hand. The profit that had been made by Rumer Ltd on the remaining inventories was $750 Share capital General reserve Asset revaluation surplus Retained earnings (1/7/21) Revenues Expenses Gains on sale of non-current assets Income tax expense (c) in June 2002, Rumer Ltd declared a dividend of $6000 that will be paid in August 2022 (d) Both Dexin Ltd and Rumer Lid use the revaluation mod to measure land. In June 2022, Dexin Lid recorded revaluation increases of $15 000, while Rumer Lid recorded increases of $12.000 (e) The tax rate in 30% Dividend declared Total equity I $558 750 (318 000) 531 300 $ 450 000 45 000 594 000 270 000 45 000 15 000 43 500 37 500 $1717 050 15 000 52 050 150 000 $217 050 $1.200 000 225 000 22 500 162 000 Far value (48 000) 6 000 $227 500 175 000 (52 500) (15 000) $1.500 000 Rumer Ltd $318 000 (165 000) 397 500 240 000 22 500 15 000 $ 828 000 6 000 60 000 60 000 $ 126 000 $450 000 45 000 120 000 18 000 210 000 (80 000) 5 000 (60 000) (6 000) $ 702 000

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Worksheet 30 June 2022 Assets Cash 37 500 Receiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started