Answered step by step

Verified Expert Solution

Question

1 Approved Answer

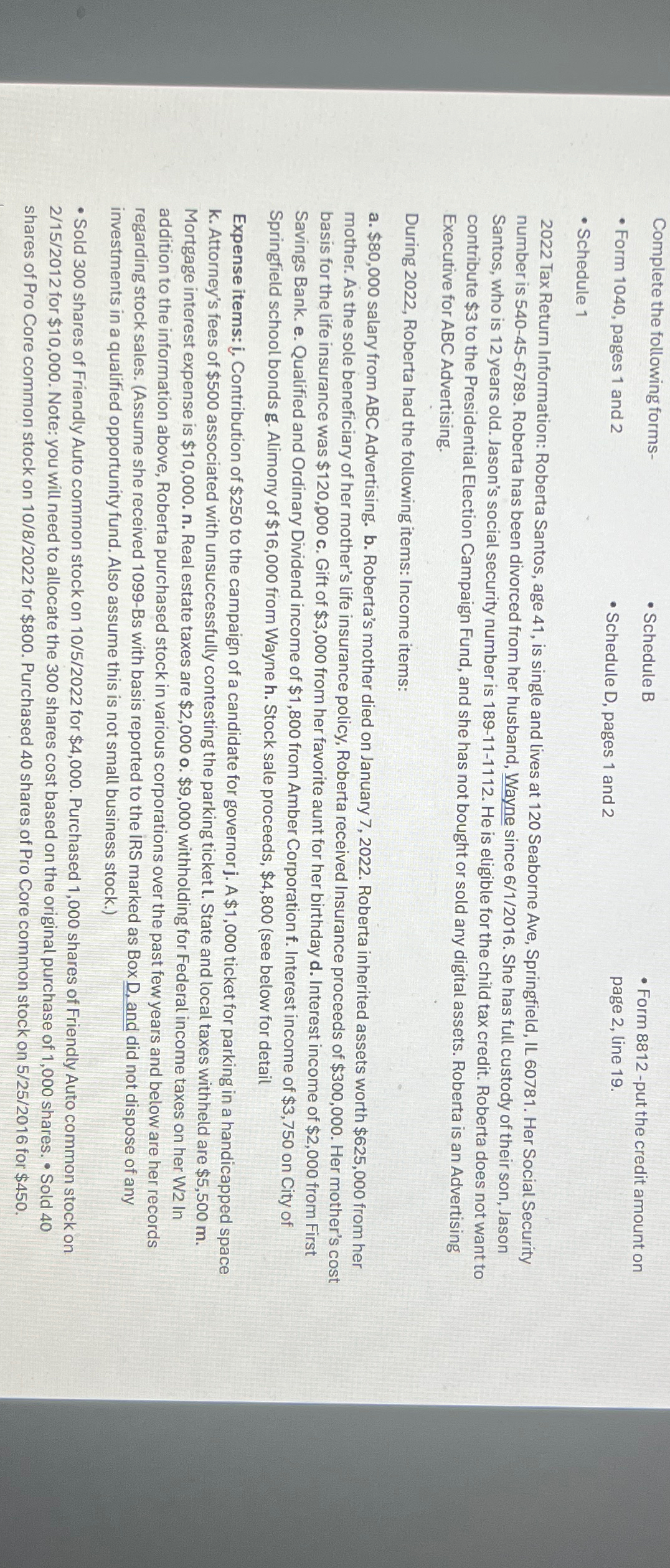

Complete the following forms - Form 1 0 4 0 , pages 1 and 2 Schedule 1 Schedule B Schedule D , pages 1 and

Complete the following forms

Form pages and

Schedule

Schedule B

Schedule D pages and

Form put the credit amount on page line

Tax Return Information: Roberta Santos, age is single and lives at Seaborne Ave, Springfield, IL Her Social Security number is Roberta has been divorced from her husband, Wayne since She has full custody of their son, Jason Santos, who is years old. Jason's social security number is He is eligible for the child tax credit. Roberta does not want to contribute $ to the Presidential Election Campaign Fund, and she has not bought or sold any digital assets. Roberta is an Advertising Executive for ABC Advertising.

During Roberta had the following items: Income items:

a $ salary from ABC Advertising. b Roberta's mother died on January Roberta inherited assets worth $ from her mother. As the sole beneficiary of her mother's life insurance policy, Roberta received Insurance proceeds of $ Her mother's cost basis for the life insurance was $ c Gift of $ from her favorite aunt for her birthday d Interest income of $ from First Savings Bank. e Qualified and Ordinary Dividend income of $ from Amber Corporation Interest income of $ on City of Springfield school bonds g Alimony of $ from Wayne h Stock sale proceeds, $see below for detail

Expense items: i Contribution of $ to the campaign of a candidate for governor $ ticket for parking in a handicapped space k Attorney's fees of $ associated with unsuccessfully contesting the parking ticket l State and local taxes withheld are $ Mortgage interest expense is $ Real estate taxes are $ o $ withholding for Federal income taxes on her In addition to the information above, Roberta purchased stock in various corporations over the past few years and below are her records regarding stock sales. Assume she received Bs with basis reported to the IRS marked as Box D and did not dispose of any investments in a qualified opportunity fund. Also assume this is not small business stock.

Sold shares of Friendly Auto common stock on for $ Purchased shares of Friendly Auto common stock on for $ Note: you will need to allocate the shares cost based on the original purchase of shares. Sold shares of Pro Core common stock on for $ Purchased shares of Pro Core common stock on for $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started