Answered step by step

Verified Expert Solution

Question

1 Approved Answer

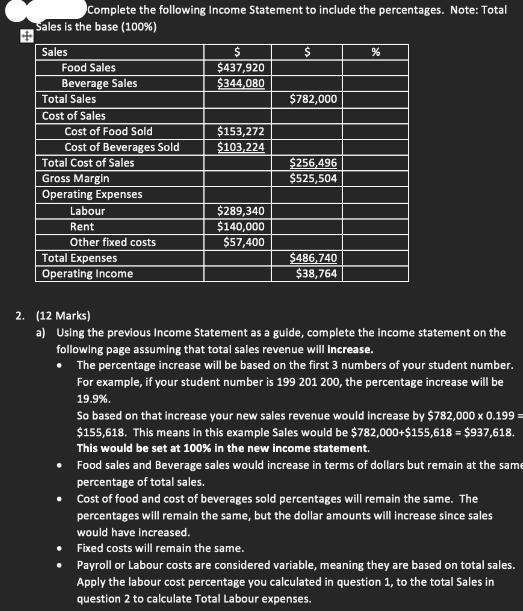

Complete the following Income Statement to include the percentages. Note: Total Sales is the base (100%) Sales Food Sales Beverage Sales Total Sales Cost

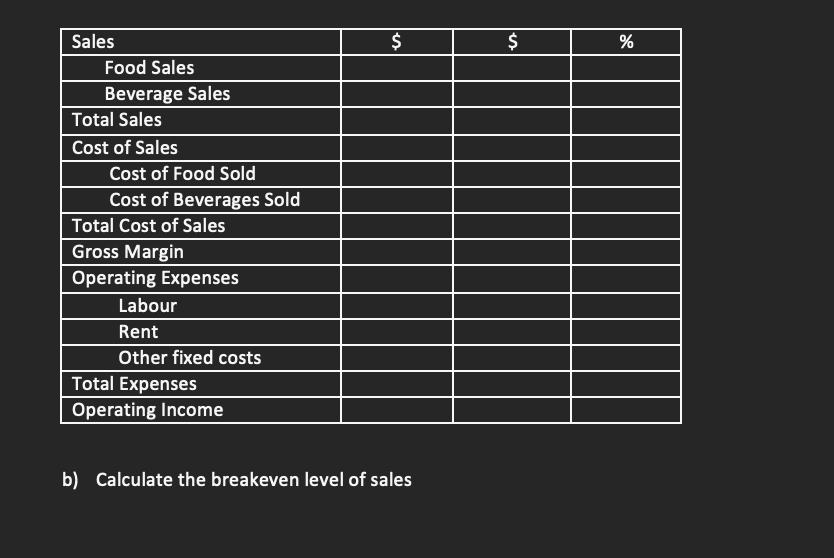

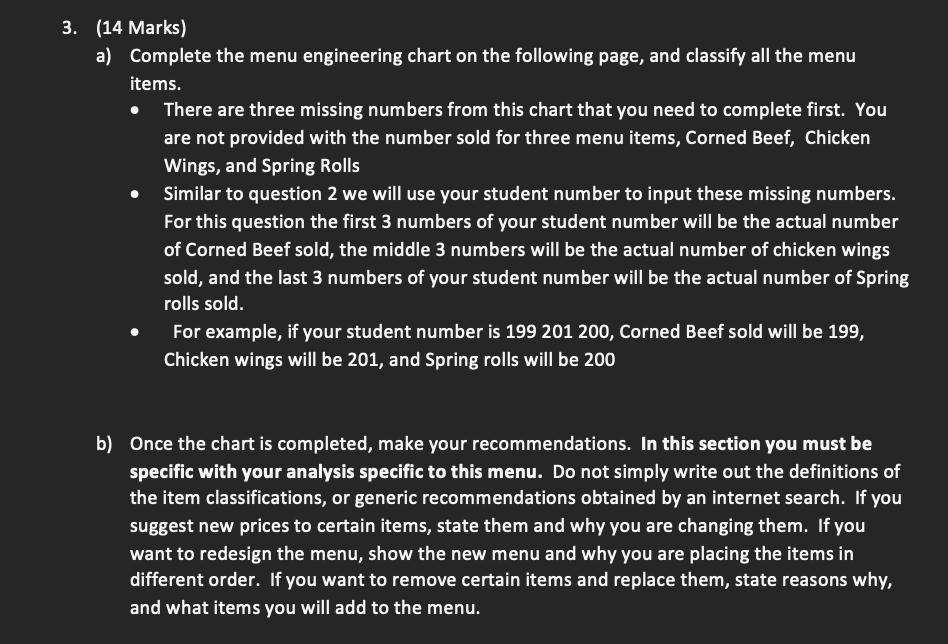

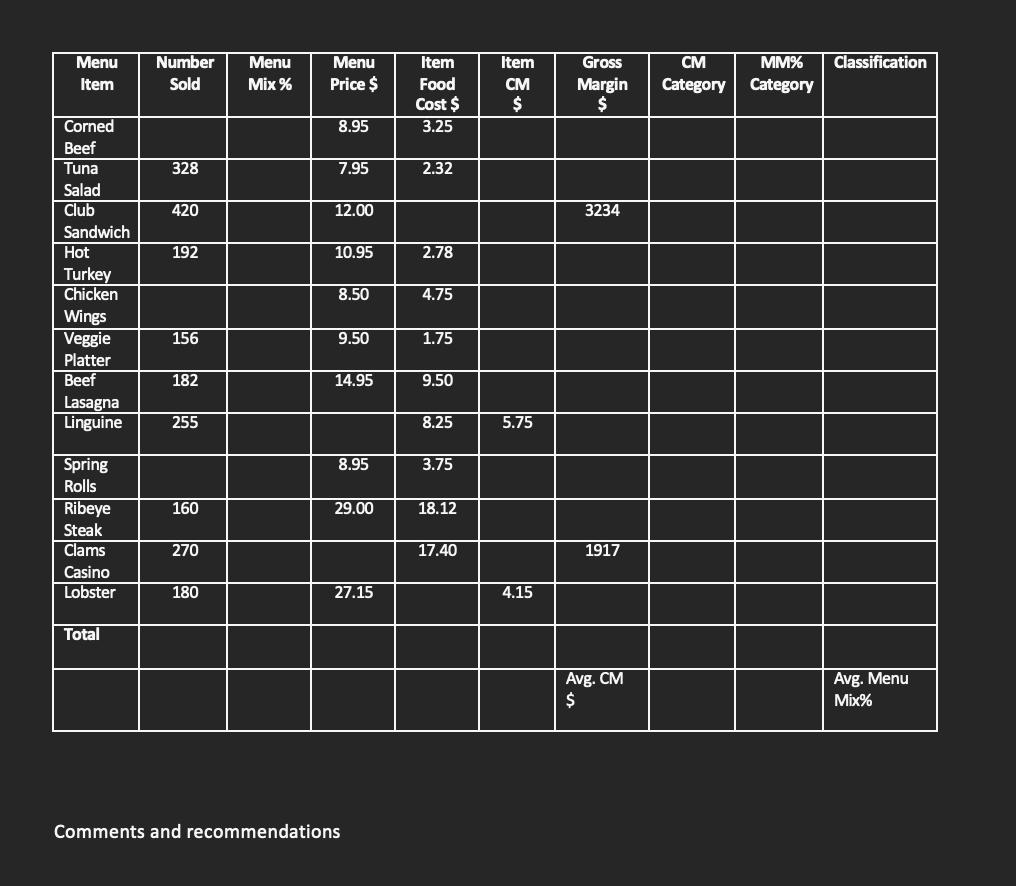

Complete the following Income Statement to include the percentages. Note: Total Sales is the base (100%) Sales Food Sales Beverage Sales Total Sales Cost of Sales Cost of Food Sold Cost of Beverages Sold Total Cost of Sales Gross Margin Operating Expenses Labour Rent Other fixed costs Total Expenses Operating Income $ $437,920 $344,080 $153,272 $103,224 $289,340 $140,000 $57,400 $ $782,000 $256,496 $525,504 $486,740 $38,764 % 2. (12 Marks) a) Using the previous Income Statement as a guide, complete the income statement on the following page assuming that total sales revenue will increase. The percentage increase will be based on the first 3 numbers of your student number. For example, if your student number is 199 201 200, the percentage increase will be 19.9%. So based on that increase your new sales revenue would increase by $782,000 x 0.199= $155,618. This means in this example Sales would be $782,000+$155,618 = $937,618. This would be set at 100% in the new income statement. Food sales and Beverage sales would increase in terms of dollars but remain at the same percentage of total sales. Cost of food and cost of beverages sold percentages will remain the same. The percentages will remain the same, but the dollar amounts will increase since sales would have increased. Fixed costs will remain the same. Payroll or Labour costs are considered variable, meaning they are based on total sales. Apply the labour cost percentage you calculated in question 1, to the total sales in question 2 to calculate Total Labour expenses.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started