Question

Complete the following integrative practical exercises. The purpose of this exercise is to examine the diversification potential for an investor developing an investment strategy based

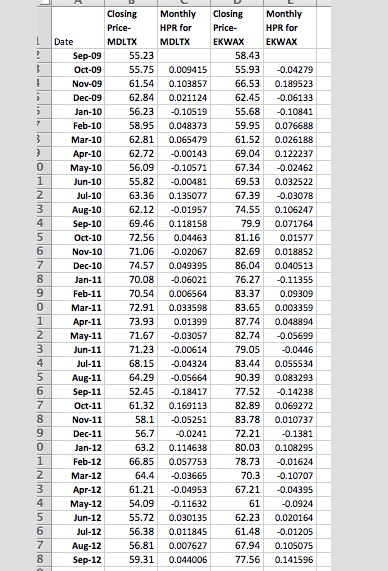

Complete the following integrative practical exercises. The purpose of this exercise is to examine the diversification potential for an investor developing an investment strategy based on two very different mutual funds. The Black Rock Latin America fund (MDLTX) invests in Latin American securities. The Wells Fargo Advantage Precious Metals fund (EKWAX) invests in precious metals. Is there a significant opportunity to enhance return and/or reduce risk by holding a combination of these funds versus holding just one of them? Monthly price data for MDLTX and EKWAX from Yahoo Finance is contained in the Excel spreadsheet for this exercise. There are 37 months of price data for the period from September 2009 to September 2012. (Note: These prices already incorporate dividend payments.) The 36 monthly returns for each fund are also provided. Calculate average (arithmetic) monthly return and standard deviation for each fund. You can use the Excel functions AVERAGE, STDEV to derive these stats. Annualize these statistics. Use the CORREL function in Excel to derive the correlation coefficient between the two sets of returns. (Annual correlation is the same as monthly correlation. Hence, no need to annualize this stat.) Using the annualized statistics derived in step 1, compute the expected return and standard deviation for portfolios containing from 0% to 100% MDLTX (and 100% to 0% EKWAX) by 10% increments. Graph the resulting portfolios. Based on your analysis, is there any potential benefit to diversification across these two funds? Explain. Of the 11 portfolios you graphed, which are efficient?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started