Answered step by step

Verified Expert Solution

Question

1 Approved Answer

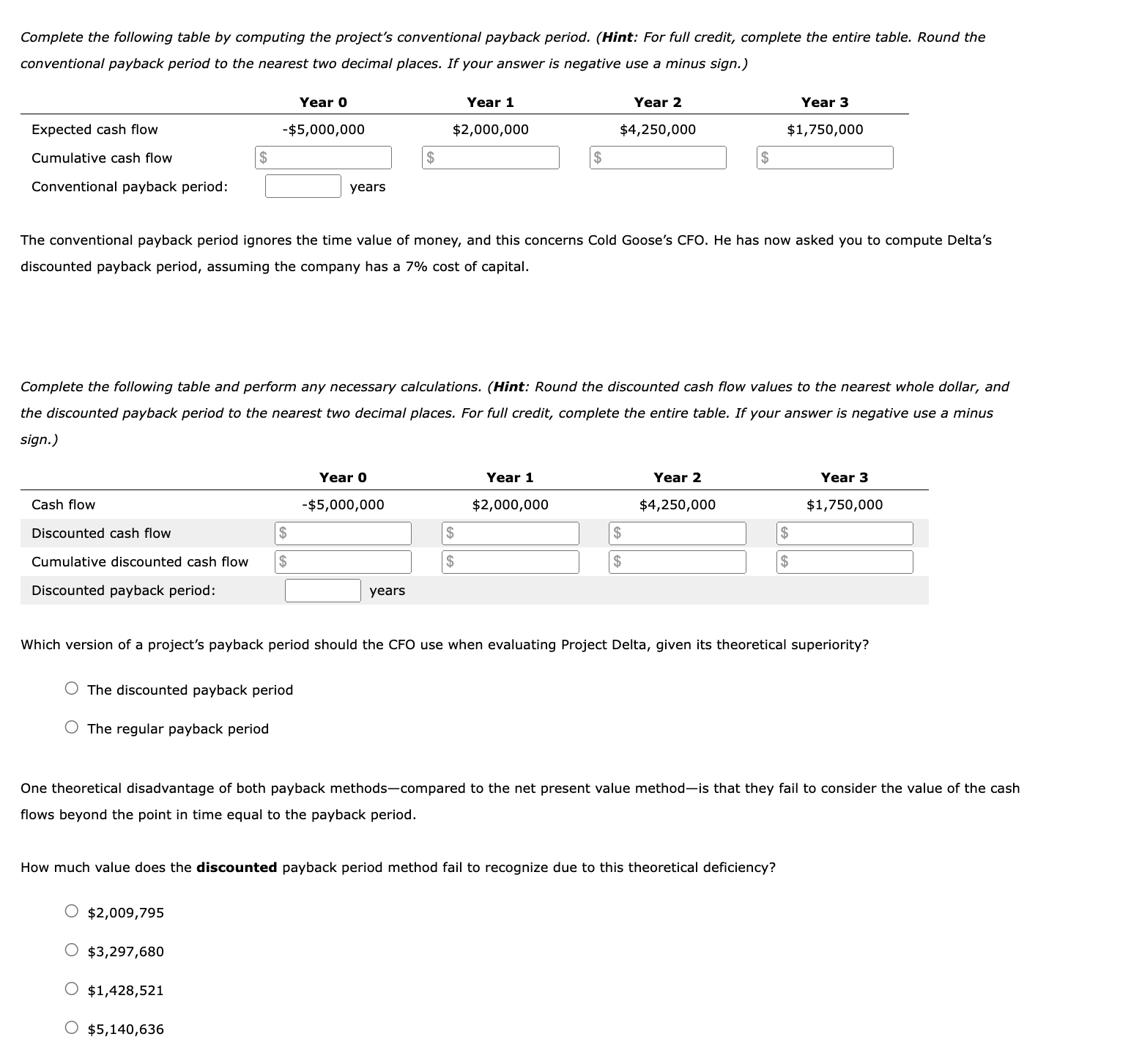

Complete the following table by computing the project's conventional payback period. ( Hint: For full credit, complete the entire table. Round the conventional payback period

Complete the following table by computing the project's conventional payback period. Hint: For full credit, complete the entire table. Round the conventional payback period to the nearest two decimal places. If your answer is negative use a minus sign. The conventional payback period ignores the time value of money, and this concerns Cold Goose's CFO. He has now asked you to compute Delta's discounted payback period, assuming the company has a cost of capital. Complete the following table and perform any necessary calculations. Hint: Round the discounted cash flow values to the nearest whole dollar, and the discounted payback period to the nearest two decimal places. For full credit, complete the entire table. If your answer is negative use a minus sign. Which version of a project's payback period should the CFO use when evaluating Project Delta, given its theoretical superiority? The discounted payback period The regular payback period One theoretical disadvantage of both payback methodscompared to the net present value methodis that they fail to consider the value of the cash flows beyond the point in time equal to the payback period. How much value does the discounted payback period method fail to recognize due to this theoretical deficiency? $ $ $ $

Complete the following table by computing the project's conventional payback period. Hint: For full credit, complete the entire table. Round the

conventional payback period to the nearest two decimal places. If your answer is negative use a minus sign.

The conventional payback period ignores the time value of money, and this concerns Cold Goose's CFO. He has now asked you to compute Delta's

discounted payback period, assuming the company has a cost of capital.

Complete the following table and perform any necessary calculations. Hint: Round the discounted cash flow values to the nearest whole dollar, and

the discounted payback period to the nearest two decimal places. For full credit, complete the entire table. If your answer is negative use a minus

sign.

Which version of a project's payback period should the CFO use when evaluating Project Delta, given its theoretical superiority?

The discounted payback period

The regular payback period

One theoretical disadvantage of both payback methodscompared to the net present value methodis that they fail to consider the value of the cash

flows beyond the point in time equal to the payback period.

How much value does the discounted payback period method fail to recognize due to this theoretical deficiency?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started