Question

Complete the following table : Features Face Value Coupon rate Compounding Frequency Time to maturity Case 1 Yield to maturity PV Case 2 Yield

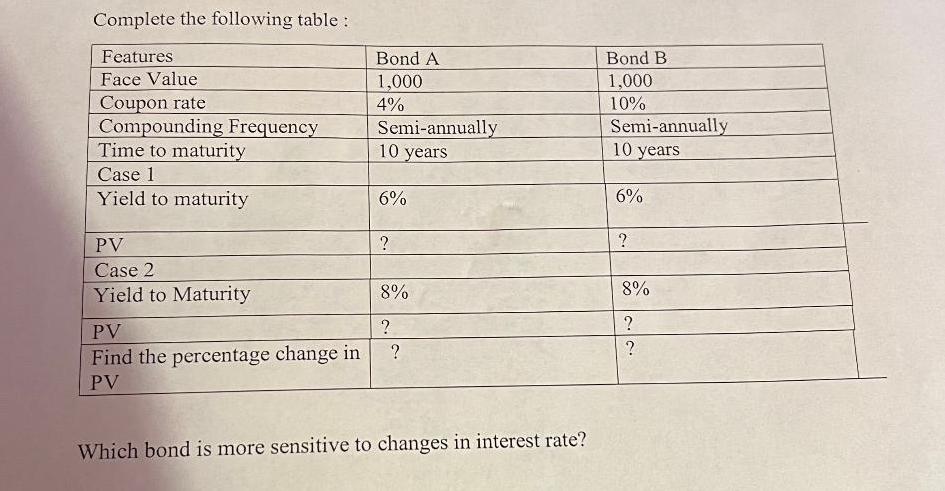

Complete the following table : Features Face Value Coupon rate Compounding Frequency Time to maturity Case 1 Yield to maturity PV Case 2 Yield to Maturity PV Find the percentage change in PV Bond A 1,000 4% Semi-annually 10 years 6% ? 8% ? ? Which bond is more sensitive to changes in interest rate? Bond B. 1,000 10% Semi-annually 10 years 6% ? 8% ? ?

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the present value PV for each bond in Case 1 and Case 2 Where PV Present value C Coupon pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App