Answered step by step

Verified Expert Solution

Question

1 Approved Answer

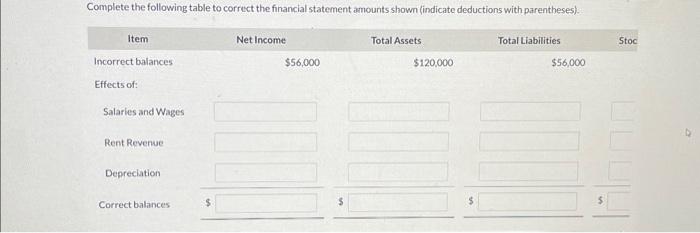

Complete the following table to correct the financial statement amounts shown (indicate deductions with parentheses). Item Incorrect balances Effects of: Salaries and Wages Rent

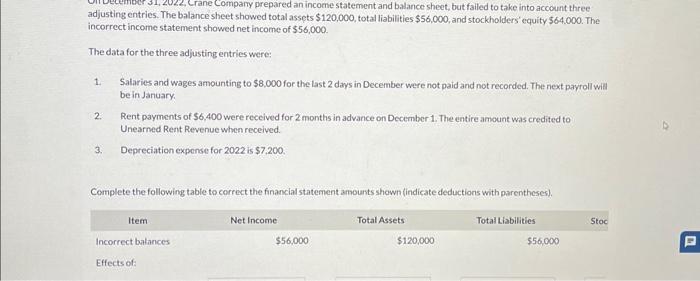

Complete the following table to correct the financial statement amounts shown (indicate deductions with parentheses). Item Incorrect balances Effects of: Salaries and Wages Rent Revenue Depreciation Correct balances Net Income Total Assets Total Liabilities Stoc $56,000 $120,000 $56,000 rane Company prepared an income statement and balance sheet, but failed to take into account three adjusting entries. The balance sheet showed total assets $120,000, total liabilities $56,000, and stockholders' equity $64,000. The incorrect income statement showed net income of $56,000. The data for the three adjusting entries were: 1. 2. Salaries and wages amounting to $8,000 for the last 2 days in December were not paid and not recorded. The next payroll will be in January. Rent payments of $6,400 were received for 2 months in advance on December 1. The entire amount was credited to Unearned Rent Revenue when received. 3. Depreciation expense for 2022 is $7,200. Complete the following table to correct the financial statement amounts shown (indicate deductions with parentheses). Item Incorrect balances Effects of: Net Income Total Assets Total Liabilities Stoc $56,000 $120,000 $56,000 D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started