Question

Complete the following using the information from the Study Questions and Problems at the end of Chapter 3, on pages 145 - 147, as indicated

Complete the following using the information from the Study Questions and Problems at the end of Chapter 3, on pages 145 - 147, as indicated below:

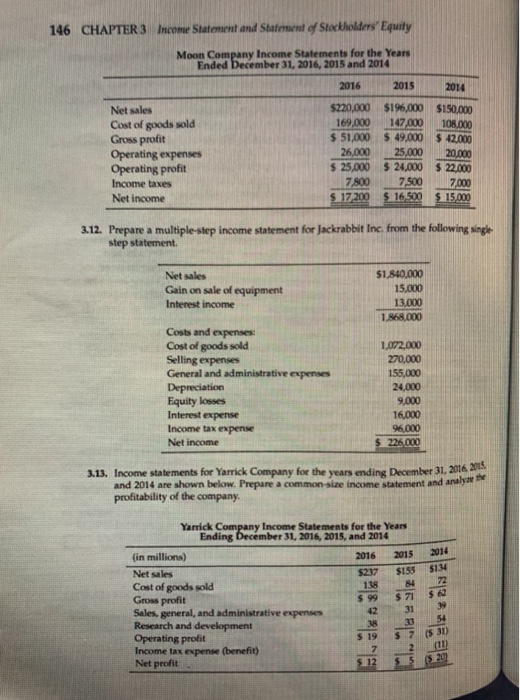

Question 3.11- Using the information provided in the problem on page 145, calculate/answer the following:

a. Sales growth percentage from 2014 to 2015.

b. Sales growth percentage from 2015 to 2016.

c. Cost of goods sold percentage for 2014.

d. Cost of goods sold percentage for 2015.

e. Cost of goods sold percentage for 2016.

f. Gross profit margin percentage for 2014.

g. Gross profit margin percentage for 2015.

h. Gross profit marginpercentage for 2016.

i. Operating profit margin percentage for 2014.

j. Operating profit margin percentage for 2015.

k. Operating profit margin percentage for 2016.

l. Average tax rate percentage for 2014.

m. Average tax rate percentage for 2015.

n. Average tax rate percentage for 2016.

o. Net profit margin percentage for 2014.

p. Net profit margin percentage for 2015.

q. Net profit margin percentage for 2016.

r - t. Answer the multiple choice questions using the information you calculated in parts a - k.

Question 3.12- Prepare a multiple-step income statement for JackRabbit, Inc. from the single-step statement provided on Page 146 and answer the following questions using the multiple-step statement.

a. The gross profit.

b. Operating profit.

c. Other income (expense) total.

d. Pre-tax income.

Question 3.13- Prepare common-size income statements for December 31, 2016, 2015, and 2014 using the income statements for Yarrick Company on Page 146 of your text and answer the following questions:

a. Cost of goods sold percentage for 2014.

b. Cost of goods sold percentage for 2015.

c. Cost of goods sold percentage for 2016.

d. Gross profit percentage for 2014.

e. Gross profit percentage for 2015.

f. Gross profit percentage for 2016.

g. Selling, general and administrative expenses percentage for 2014.

h. Selling, general and administrative expenses percentage for 2015.

i. Selling, general and administrative expenses percentage for 2016.

j. Research and development percentage for 2014.

k. Research and development percentage for 2015.

l. Research and development percentage for 2016.

m. Operating profit percentage for 2014.

n. Operating profit percentage for 2015.

o. Operating profit percentage for 2016.

p. Income tax expense (benefit) percentage for 2014.

q. Income tax expense (benefit) percentage for 2015.

r. Income tax expense (benefit) percentage for 2016.

s. Net profit percentage for 2014.

t. Net profit percentage for 2015.

u. Net profit percentage for 2016.

v - x. Answer the multiple choice questions using the information from the common-size income statement information.

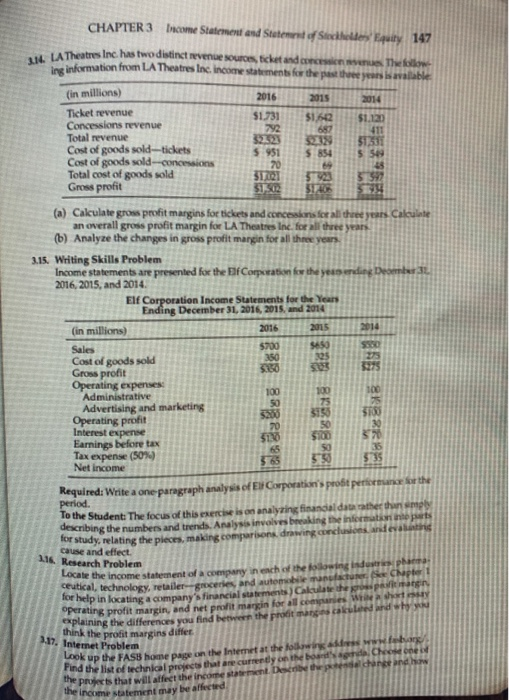

Question 3.14- Calculate the gross profit margins for tickets and concessions for all three years (2014, 2015, 2016). Calculate an overall gross profit margin for LA Theatres for all three years using the information provided on page 147 and answer the following questions:

a. Gross profit margin for tickets for 2014.

b. Gross profit margin for tickets for 2015.

c. Gross profit margin for tickets for 2016.

d. Gross profit margin for concessions for 2014.

e. Gross profit margin for concessions for 2015.

f. Gross profit margin for concessions for 2016.

g. Total gross profit margin for 2014.

h. Total gross profit margin for 2015.

i. Total gross profit margin for 2016.

j - l. Answer the multiple choice questions using the information you calculated in parts a - i above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started