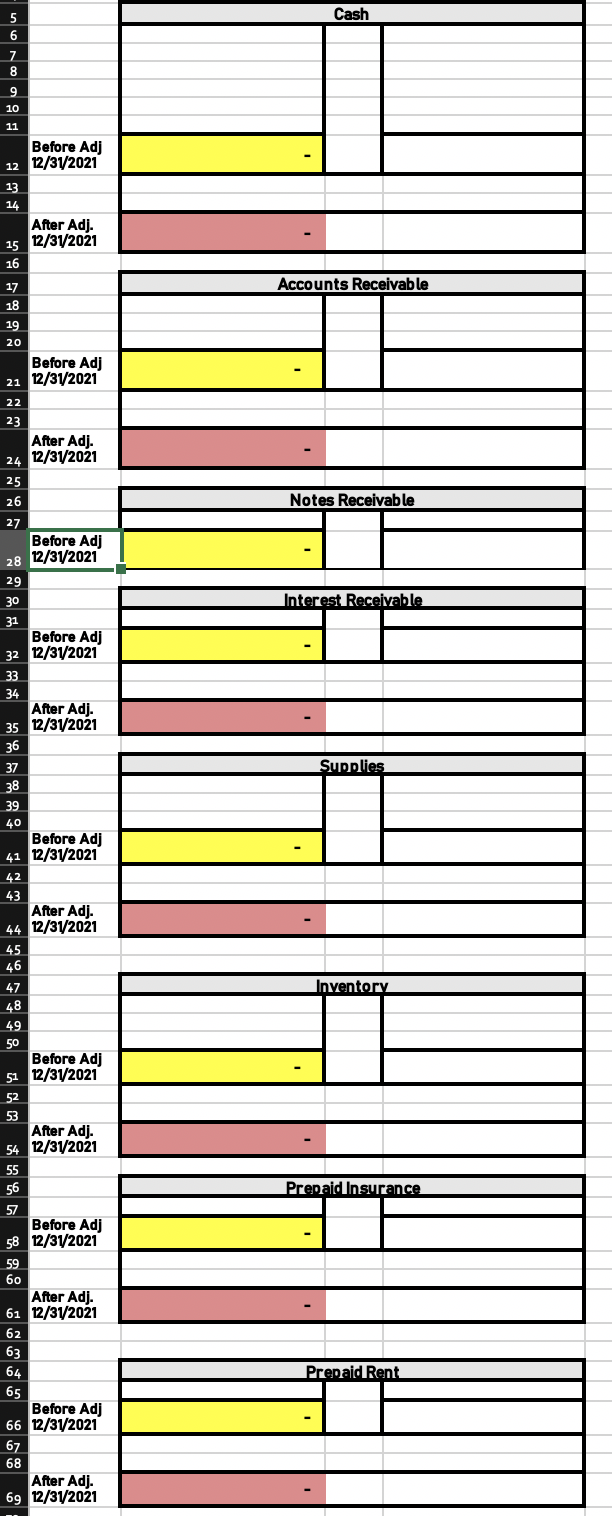

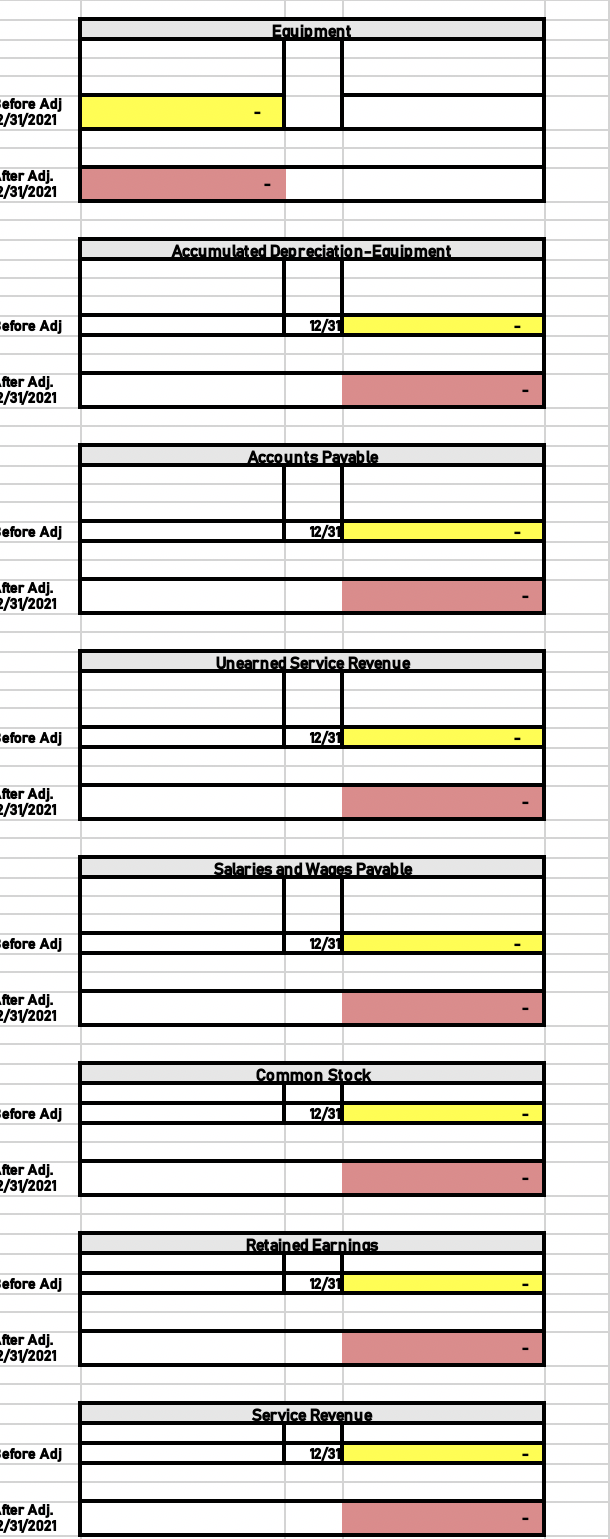

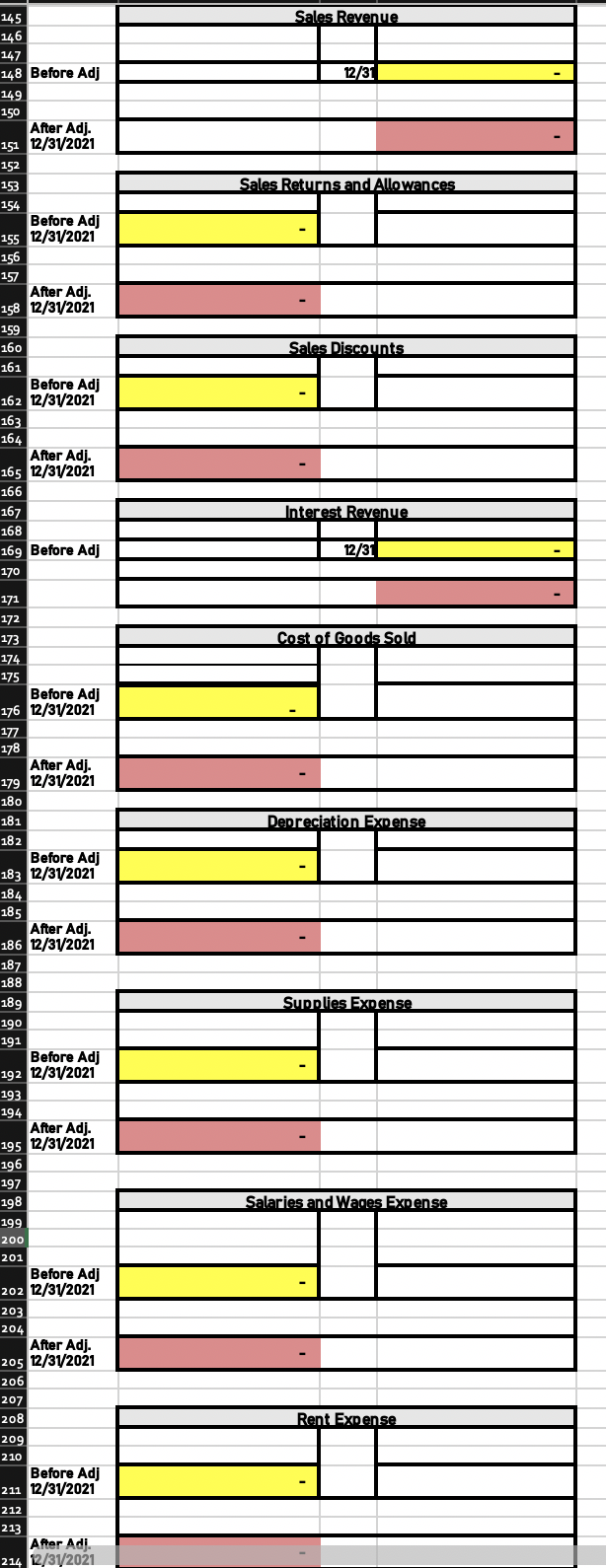

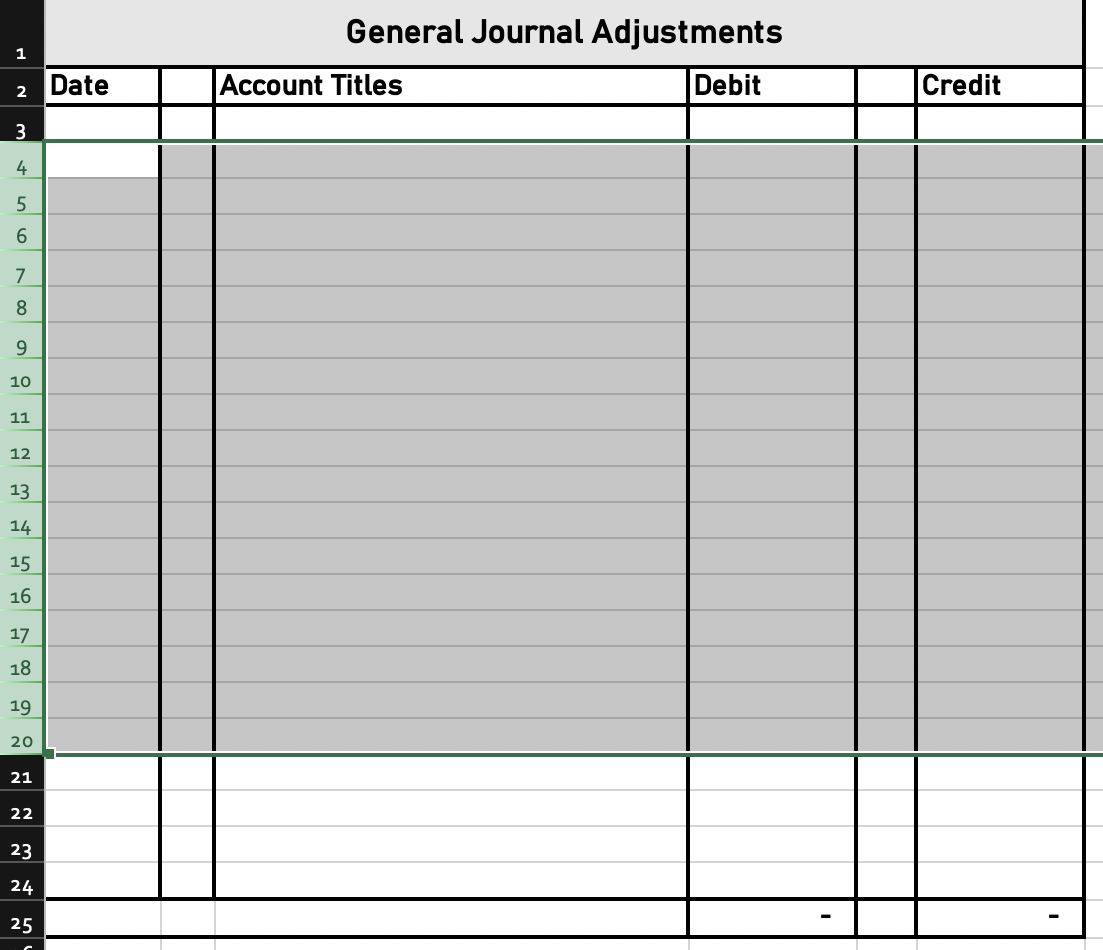

complete the General Journal, the Adjusting Entries and the T-Accounts through the 12/31 Adjusted Balance. Plz Help!!!!

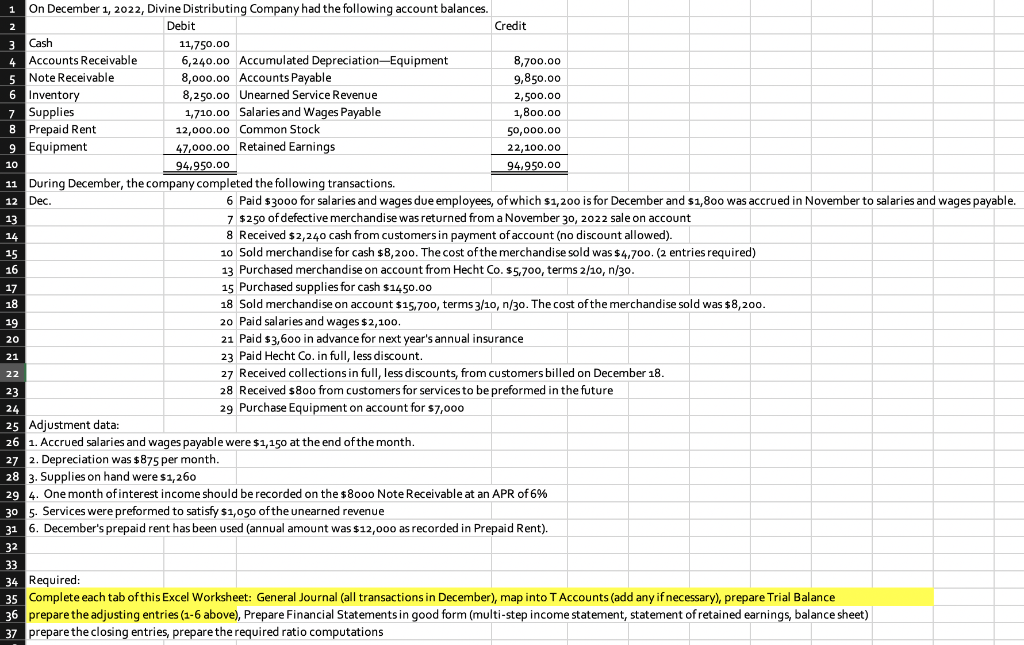

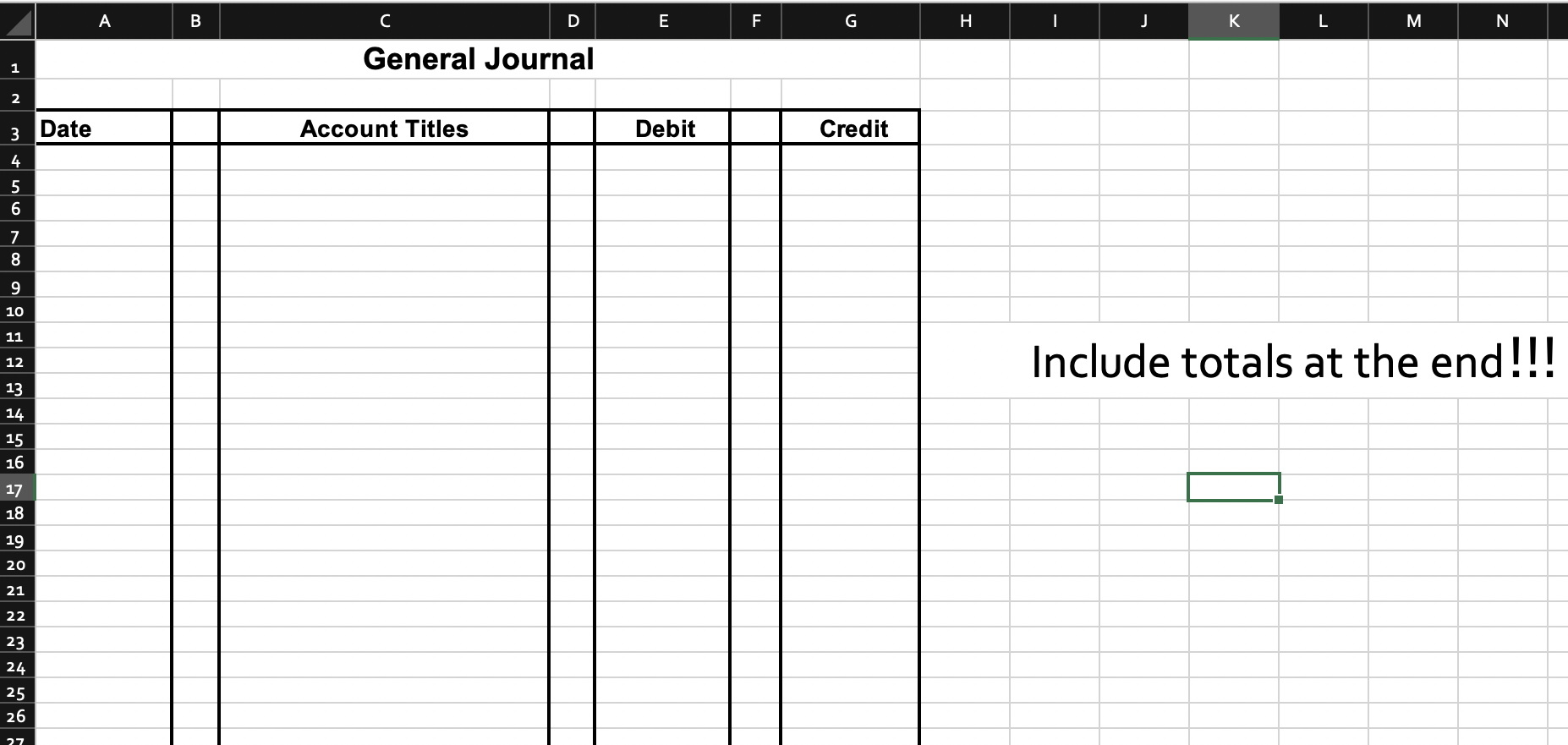

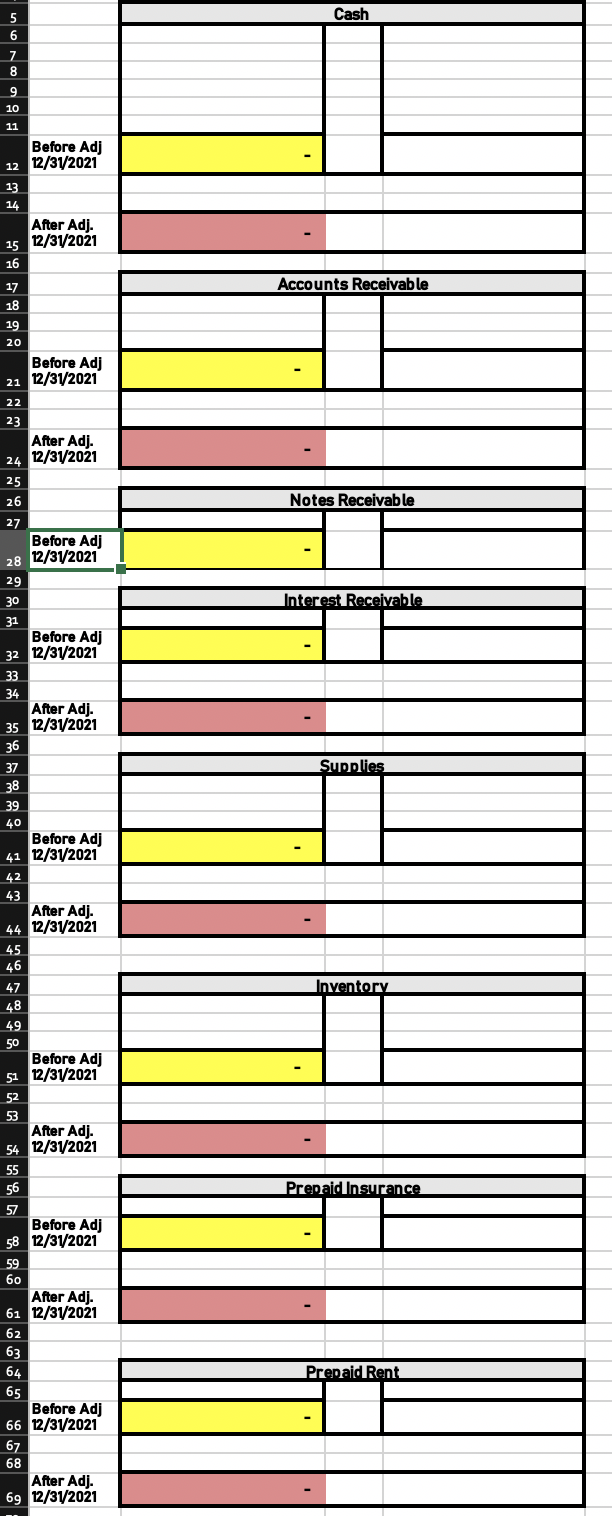

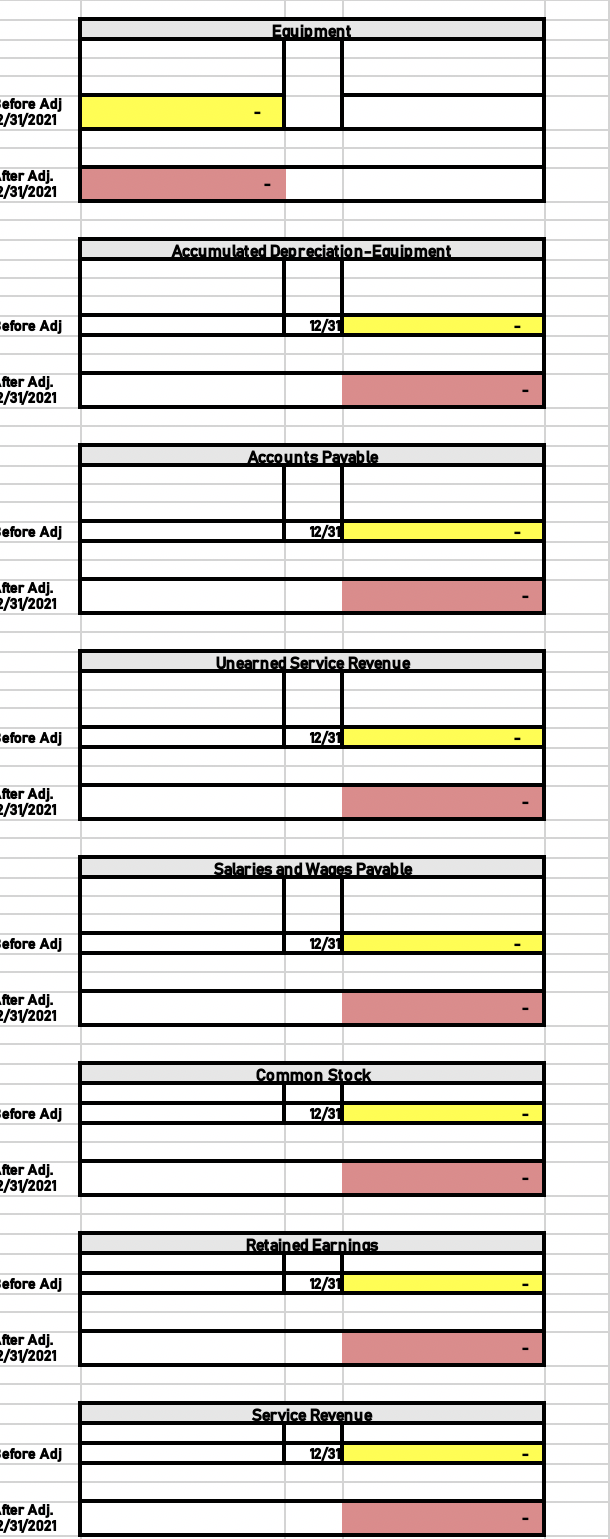

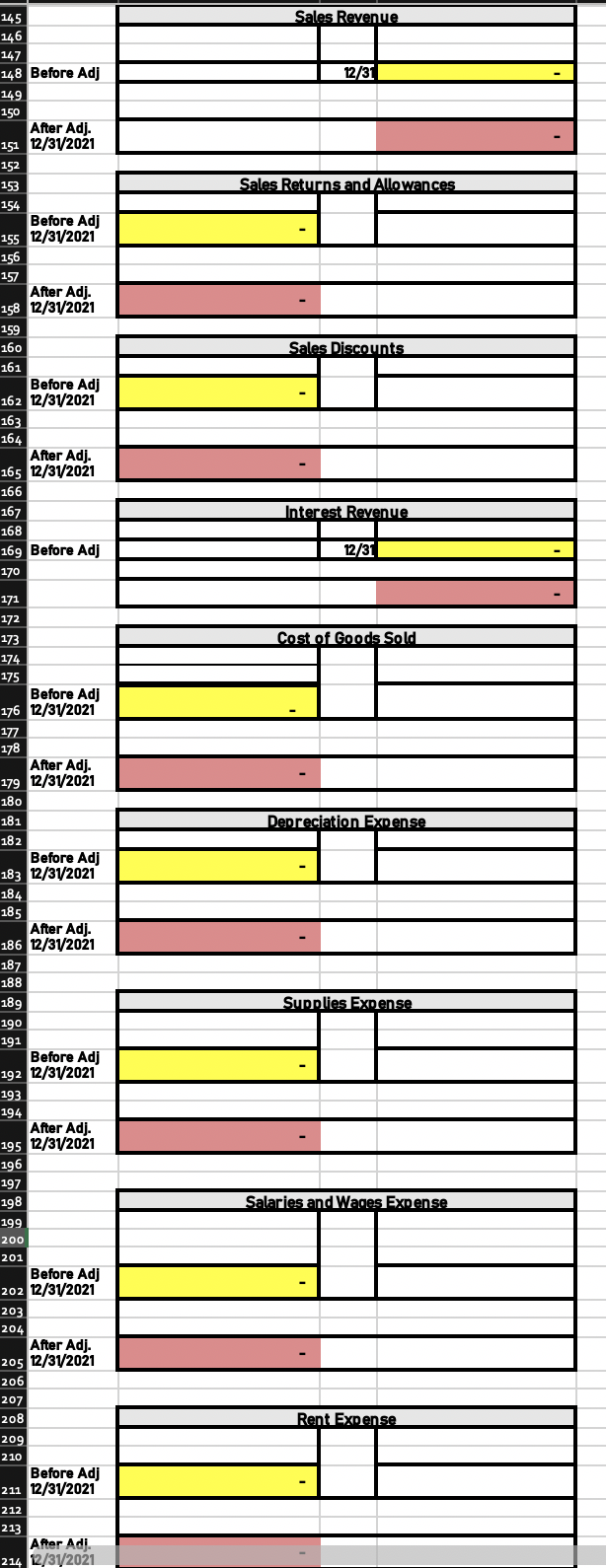

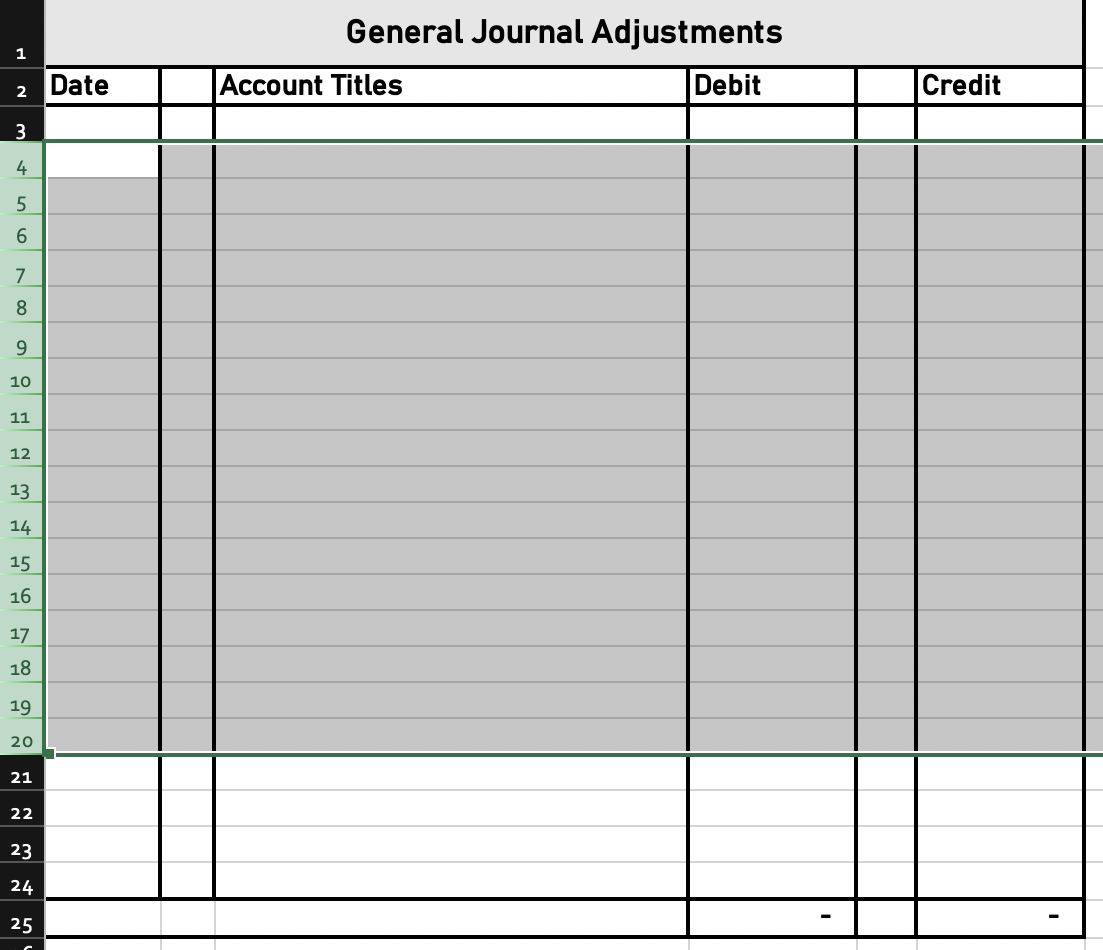

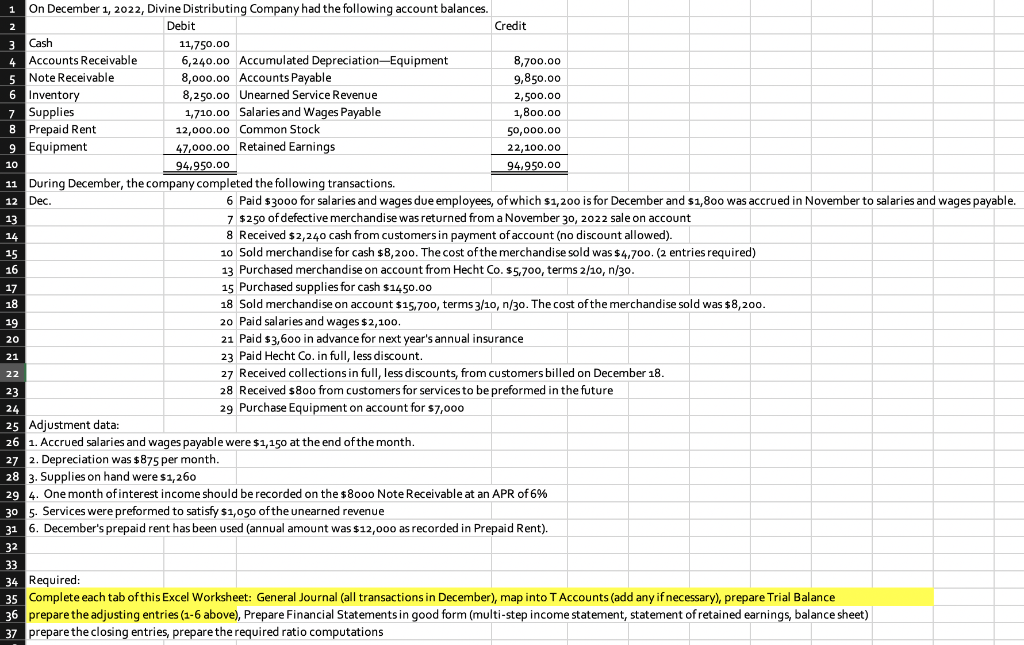

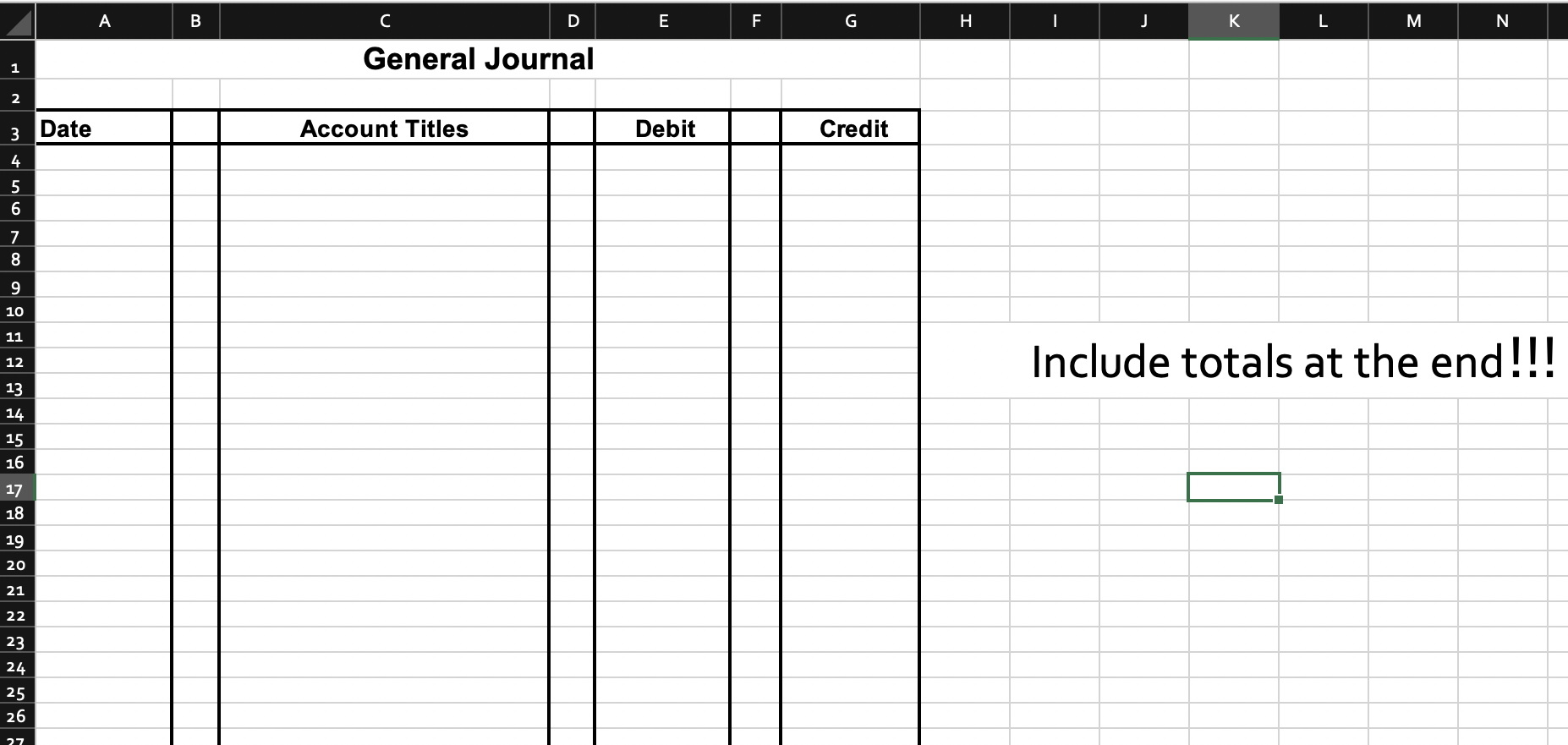

1 On December 1,2022, Divine Distributing Company had the following account balances. \begin{tabular}{|l|l|r|l|} \hline 2 & & Debit & \\ \hline 3 & Cash & 11,750.00 & \\ \hline 4 & Accounts Receivable & 6,240.00 & Accumulated Depreciation-Eq \\ \hline 5 & Note Receivable & 8,000.00 & Accounts Payable \\ \hline 6 & Inventory & 8,250.00 & Unearned Service Revenue \\ \hline 7 & Supplies & 1,710.00 & Salaries and Wages Payable \\ \hline 8 & Prepaid Rent & 12,000.00 & Common Stock \\ \hline 9 & Equipment & 47,000.00 & Retained Earnings \\ \hline 10 & & 94,950.00 \\ \hline 11 & During December, the company completed the following transactions. \\ \hline 12 & Dec. & & \end{tabular} \begin{tabular}{|l|} \hline Credit \\ \hline 8,700.00 \\ \hline 9,850.00 \\ \hline 2,500.00 \\ \hline 1,800.00 \\ \hline 50,000.00 \\ \hline 22,100.00 \\ \hline 94,950.00 \\ \hline \hline \end{tabular} 6 Paid $3000 for salaries and wages due employees, of which $1,200 is for December and $1,800 was accrued in November to salaries and wages payable. 10 Sold merchandise for cash $8,200. The cost of the merchandise sold was $4,700. (2 entries required) 13 Purchased merchandise on account from Hecht C0.$5,700, terms 2/10,n/30. 15 Purchased supplies for cash $1450.00 18 Sold merchandise on account $15,700, terms 3/10,n/30. The cost of the merchandise 20 Paid salaries and wages $2,100. 21 Paid $3,600 in advance for next year's annual insurance 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18 . 28 Received $800 from customers for services to be preformed in the future 29 Purchase Equipment on account for $7,000 Adjustment data: 1. Accrued salaries and wages payable were $1,150 at the end of the month. 2. Depreciation was $875 per month. 3. Supplies on hand were $1,260 4. One month of interest income should be recorded on the $8000 Note Receivable at an APR of 6% 5. Services were preformed to satisfy $1,050 of the unearned revenue 6. December's prepaid rent has been used (annual amount was $12,000 as recorded in Prepaid Rent). Required: Complete each tab of this Excel Worksheet: General Journal (all transactions in December), map into T Accounts (add any if necessary), prepare Trial Balance prepare the adjusting entries (1-6 above), Prepare Financial Statements in good form (multi-step income statement, statement of retained earnings, balance sheet) 37 prepare the closing entries, prepare the required ratio computations \begin{tabular}{l|c|ccc|} \hline & A & B & C & D \\ \hline 1 & & & General Journal \end{tabular} General Journal Adjustments