Answered step by step

Verified Expert Solution

Question

1 Approved Answer

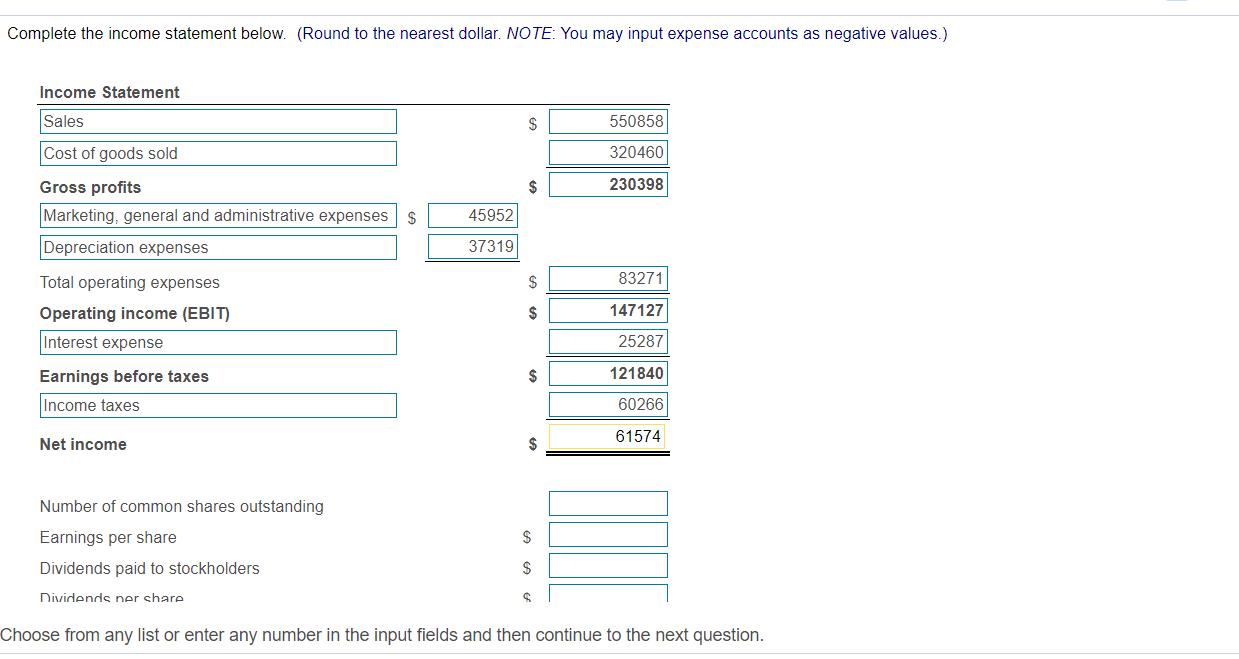

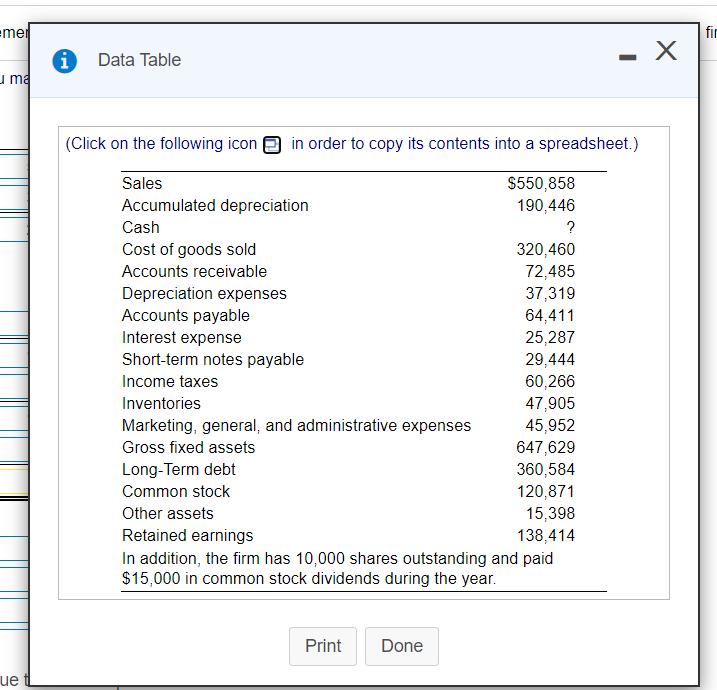

Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense accounts as negative values.) Income Statement Sales $ 550858

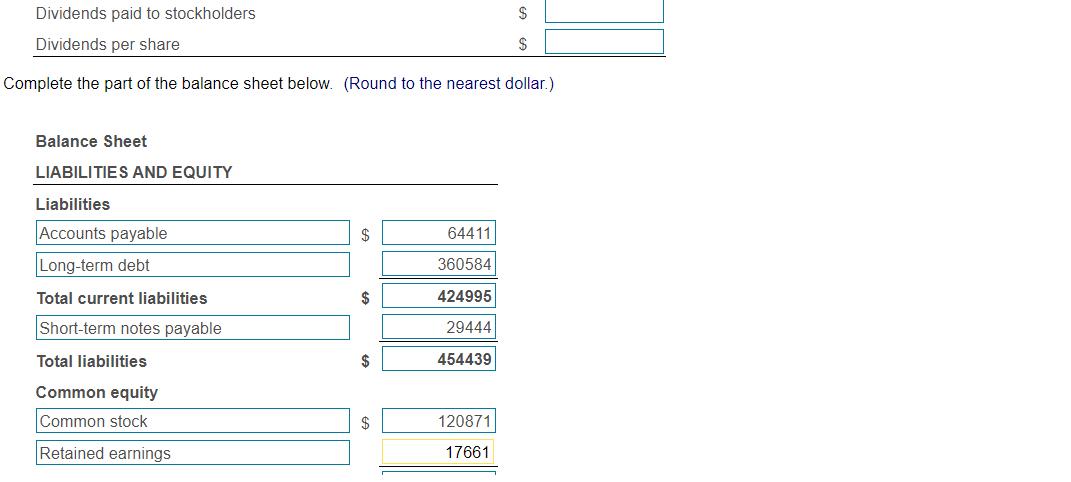

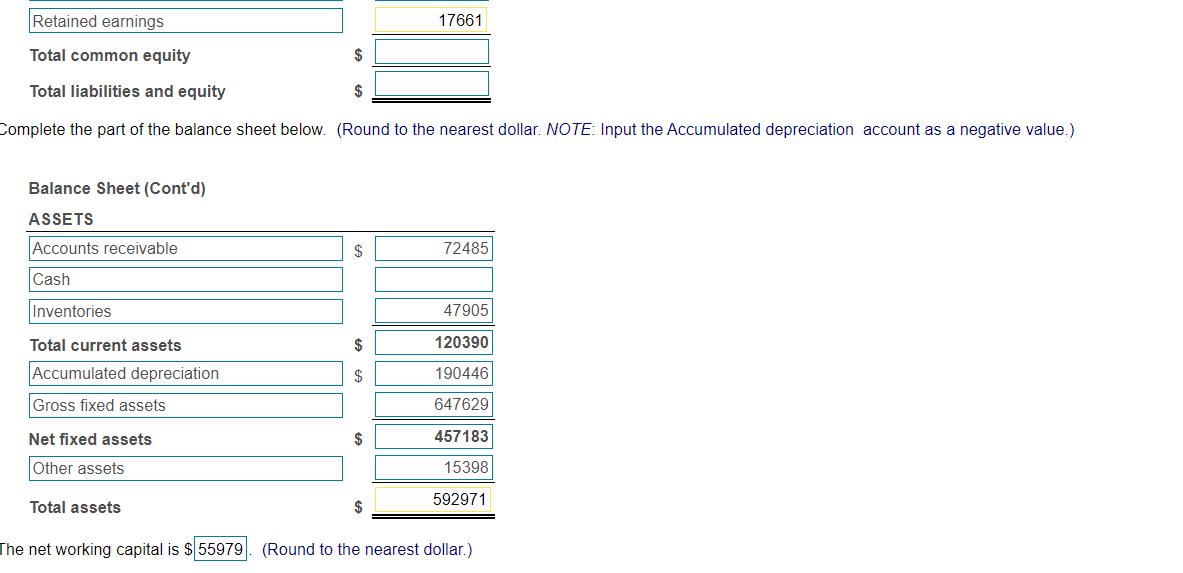

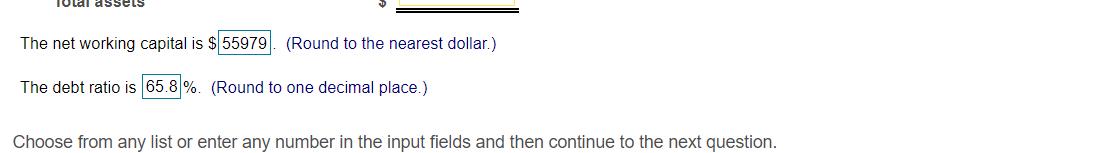

Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense accounts as negative values.) Income Statement Sales $ 550858 Cost of goods sold 320460 Gross profits 230398 Marketing, general and administrative expenses 45952 Depreciation expenses 37319 Total operating expenses $ 83271 Operating income (EBIT) $ 147127 Interest expense 25287 Earnings before taxes 2$ 121840 Income taxes 60266 61574 Net income $ Number of common shares outstanding Earnings per share Dividends paid to stockholders Dividends ner share Choose from any list or enter any number in the input fields and then continue to the next question. Dividends paid to stockholders Dividends per share 2$ Complete the part of the balance sheet below. (Round to the nearest dollar.) Balance Sheet LIABILITIES AND EQUITY Liabilities Accounts payable $ 64411 Long-term debt 360584 Total current liabilities $ 424995 Short-term notes payable 29444 Total liabilities 2$ 454439 Common equity Common stock 2$ 120871 Retained earnings 17661 Retained earnings 17661 Total common equity Total liabilities and equity $ Complete the part of the balance sheet below. (Round to the nearest dollar. NOTE: Input the Accumulated depreciation account as a negative value.) Balance Sheet (Cont'd) ASSETS Accounts receivable $ 72485 Cash Inventories 47905 Total current assets $ 120390 Accumulated depreciation $ 190446 Gross fixed assets 647629 Net fixed assets $ 457183 Other assets 15398 592971 Total assets $ The net working capital is $ 55979. (Round to the nearest dollar.) Total assets The net working capital is $55979. (Round to the nearest dollar.) The debt ratio is 65.8 %. (Round to one decimal place.) Choose from any list or enter any number in the input fields and then continue to the next question. emer fir Data Table u ma (Click on the following icon in order to copy its contents into a spreadsheet.) Sales $550,858 190,446 Accumulated depreciation Cash ? Cost of goods sold 320,460 72,485 37,319 64,411 Accounts receivable Depreciation expenses Accounts payable Interest expense Short-term notes payable 25,287 29,444 60,266 47,905 45,952 647,629 360,584 120,871 15,398 138,414 In addition, the firm has 10,000 shares outstanding and paid Income taxes Inventories Marketing, general, and administrative expenses Gross fixed assets Long-Term debt Common stock Other assets Retained earnings $15,000 in common stock dividends during the year. Print Done ue

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

net working capital current a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started