Answered step by step

Verified Expert Solution

Question

1 Approved Answer

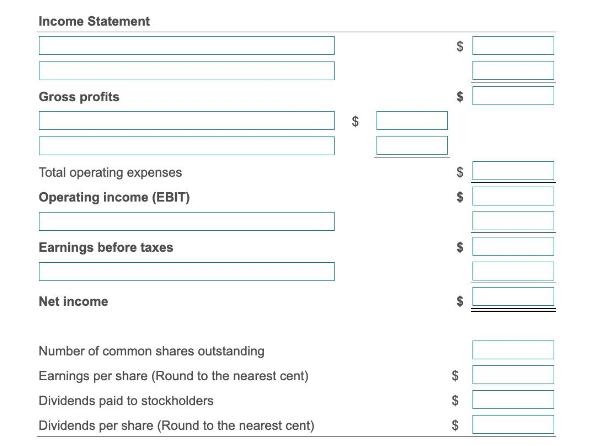

Complete the income statement below. (Round to the nearest dollar. A (1) You may input expense accounts as negative values. (2) Dividends per share

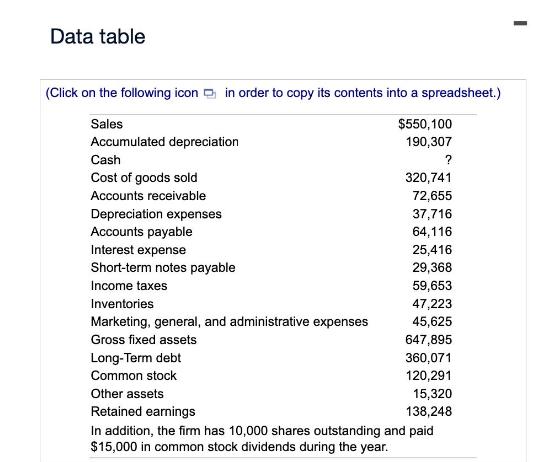

Complete the income statement below. (Round to the nearest dollar. A (1) You may input expense accounts as negative values. (2) Dividends per share and Earnings per share must be rounded to the nearest cent.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Sales $550,100 190,307 Accumulated depreciation Cash ? Cost of goods sold 320,741 Accounts receivable 72,655 Depreciation expenses Accounts payable Interest expense Short-term notes payable Income taxes Inventories Marketing, general, and administrative expenses Gross fixed assets 37,716 64,116 59,653 47,223 45,625 647,895 360,071 120,291 Other assets 15,320 Retained earnings 138,248 In addition, the firm has 10,000 shares outstanding and paid $15,000 in common stock dividends during the year. Long-Term debt Common stock 25,416 29,368 I Income Statement Gross profits Total operating expenses Operating income (EBIT) Earnings before taxes Net income Number of common shares outstanding Earnings per share (Round to the nearest cent) Dividends paid to stockholders Dividends per share (Round to the nearest cent) 67 60 en GA S S 69 60 $ $

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started