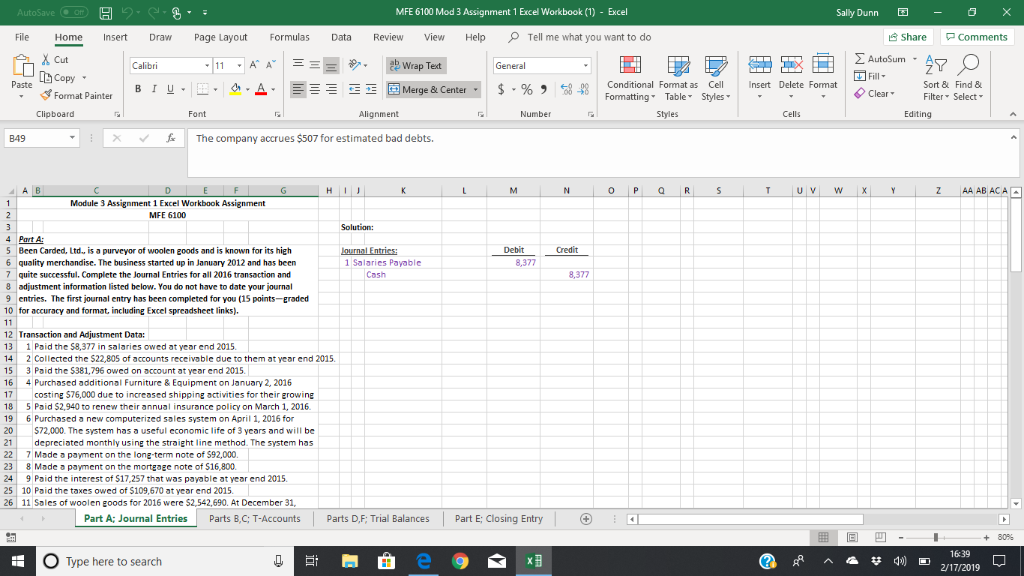

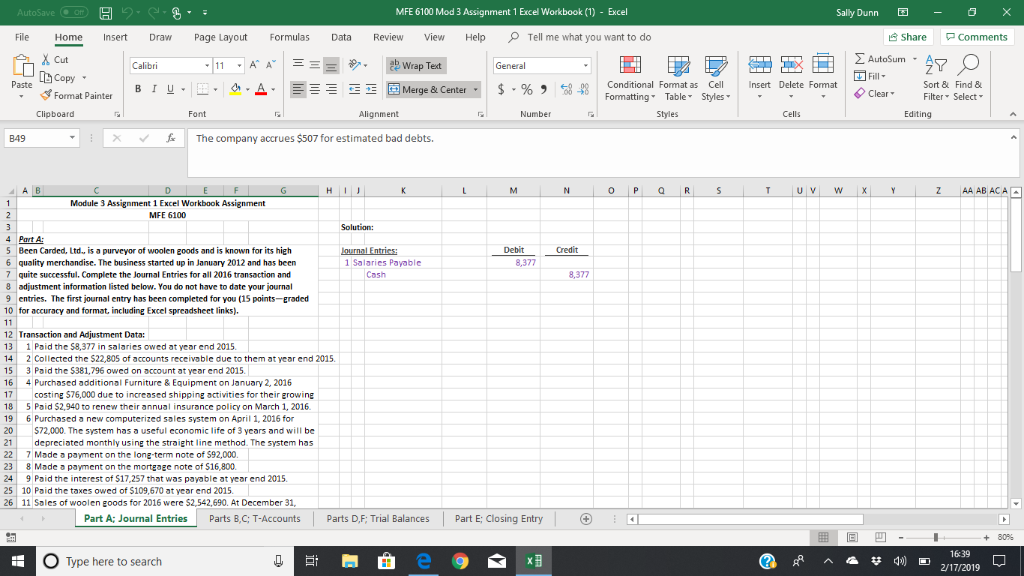

complete the Journal Entries for all transactions listed.

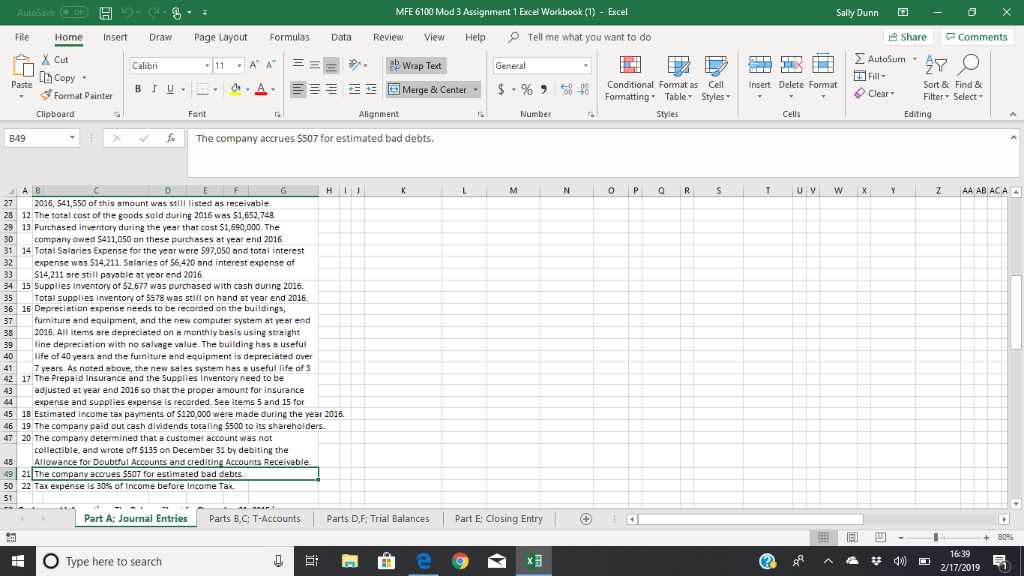

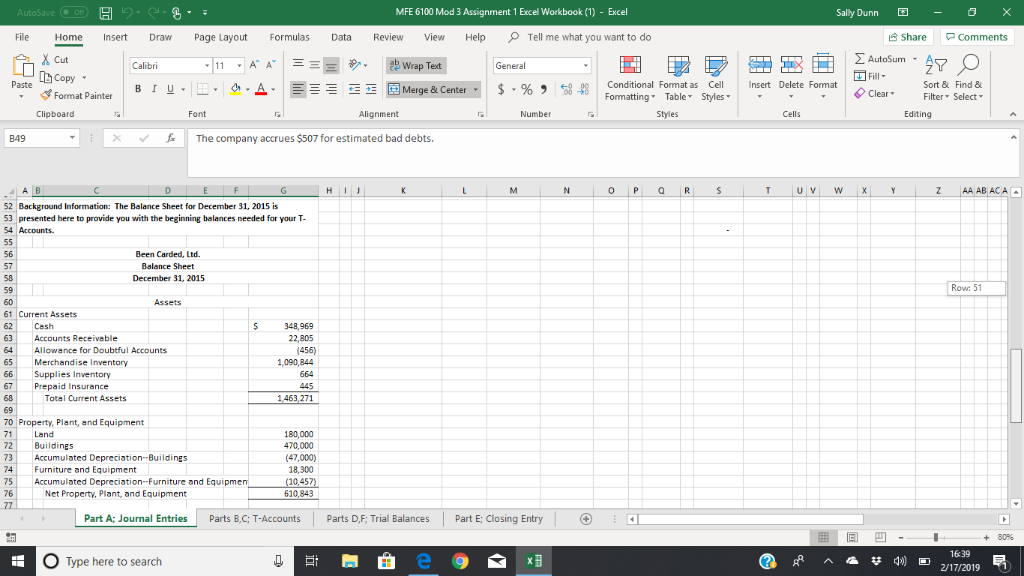

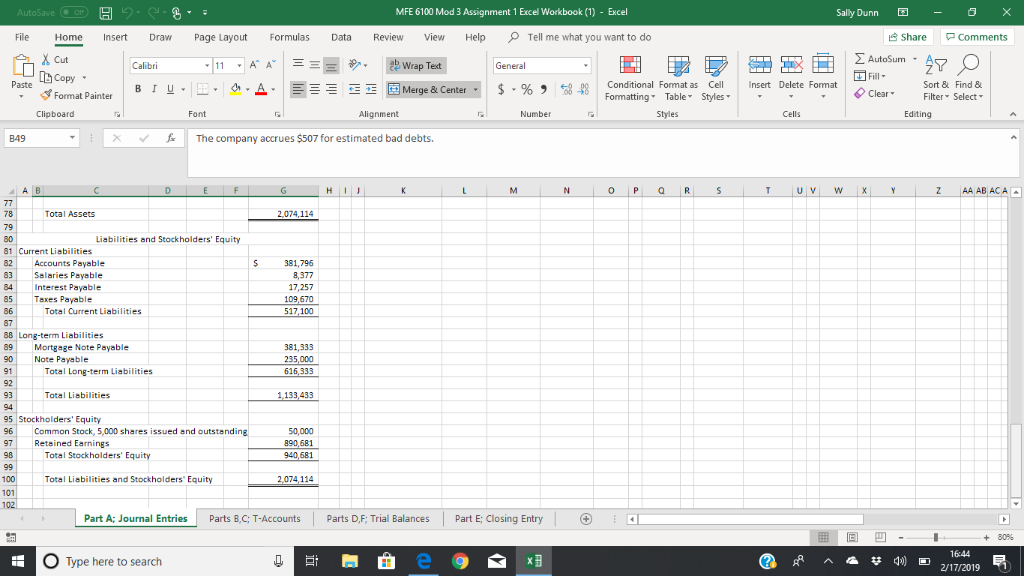

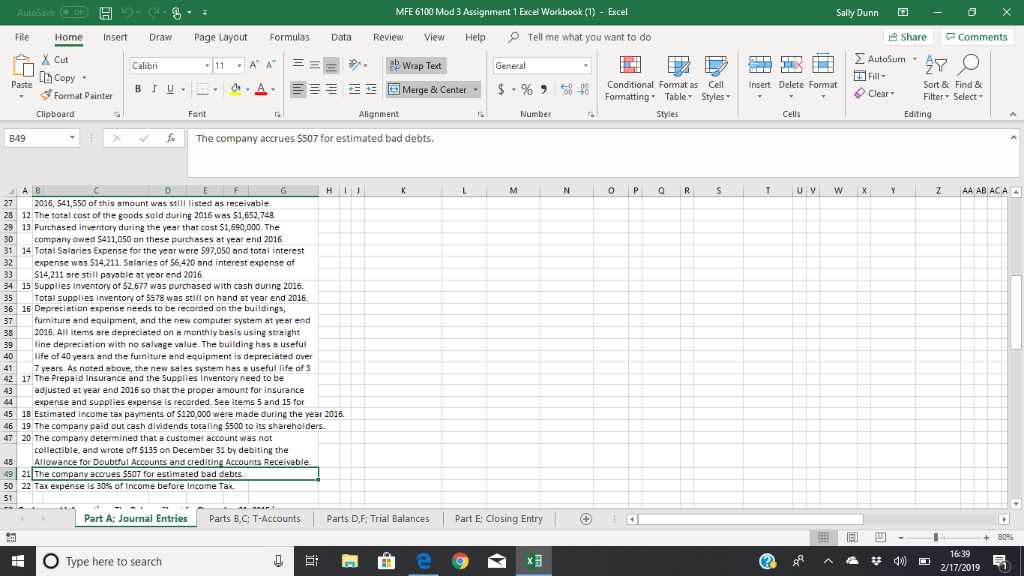

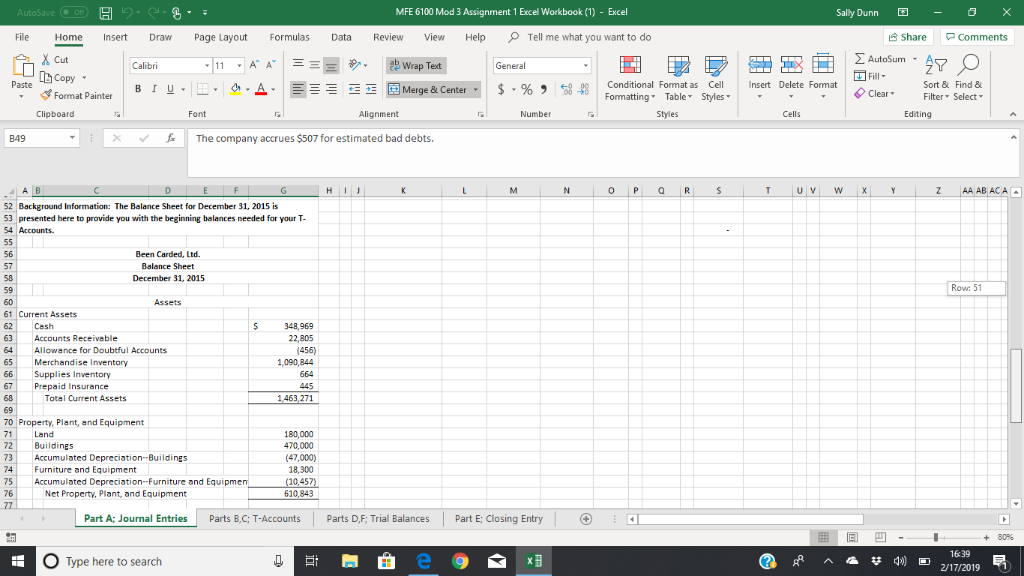

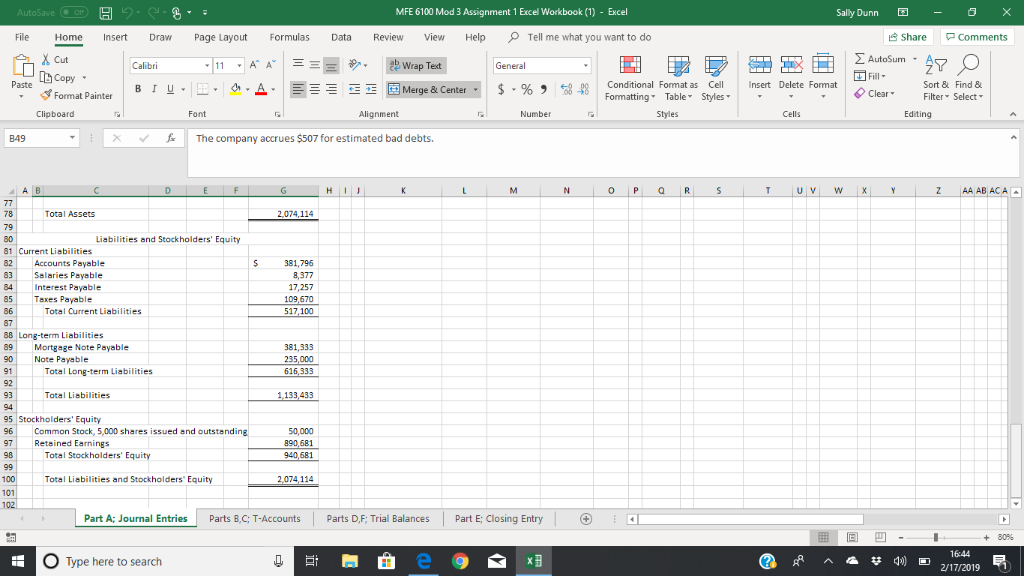

MFE 6100 Mod 3 Assignment 1 Excel Workbook (1) Excel Sally Dunn-X File Home Insert Draw Page Layout Formulas Data Review iew Help Tell me what you want to do Share Comments X Cut 9- rewrap Tet AutoSum-A Calibri A" A" General Paste Copy Paste Format Painter Conditional FT batas Styles . Insert Delete Fom at Blu--2. TER Merge & Center. Fort& Send& $.%,,, . Formatting Table Styles Clear . ClrFilterSelect Clipboard Font Alignment Number Styles xThe company accrues $507 for estimated bad debts. A B ZAA AB ACA Module 3 Assignment 1 Excel Workbook Assignment MFE 6100 Solution 4 Part A Been Carded, Ltd., is a purveyor of woolen goods and is known for its high 6 Debit quality merchandise. The business started up in January 2012 and has been 1 Salaries Payable 8,377 quite successful. Complete the Journal Entries for all 2016 transaction and 8 adjustment information listed below. You do not have to date your journal 9 entries. The first journal entry has been completed for you (15 points-eraded 10 for accuracy and format, including Excel spreadsheet links) Cash 13 1 Paid the $8,377 in salaries owed at year end 2015 14 2 Collected the $22,80S of accounts receivable due to them at year end 2015 5 3 Paid the $381,796 owed on account at year end 2015. 16 4 Purchased additional Furniture & Equipment on January 2, 2016 17 Costing 576,000 due to increased shipping activities for their growing 185 Paid $2,940 to renew their annual insurance policy on March 1, 2016 19 6 Purchased a new computerized sales system on April 1, 2016 for 20 S72,000. The system has a useful economic life of 3 years and will be 21 depreciated monthly using the straight line method. The system has 2 7 Made a payment on the long-term note of $92,000 23 8 Made a payment on the mortgagc note of $16,800 24 9 Paid the interest of S17,257 that was payable at year end 2015 5 10 Paid the taxes owed of $109,670 at year end 2015 26 11 Sales of woolen goods for 2016 were S2,542,690. At December 31, Part A: Journal Entries Parts B,C TAccountsrD,F: Trial Balances Part E Closing Entry 80% 16:39 O Type here to search MFE 6100 Mod 3 Assignment 1 Excel Workbook (1) Excel Sally Dunn-X Home Insert Draw Page Layout Formulas Review iew Help Tell me what you want to do Share Comments Paste Conditional FT batas Styles . Insert Delete Format Blu--. 2.A. Merge & Center $.%,,, Fort& Selec& . Format Painter Formatting Table Styles Clear . ClrFilterSelect Alignment Number Editing fThe company accrues $507 for estimated bad debts. 27 2016, $41,550 of this amount was still listed as receivable 2812 The total cost of the goods sold during 2016 was $1,652,748 2913 Purchased inventory during the year that cost $1,690,000. The company owed $411,050 on these purchases at year end 2016 1 14 Total Salaries Expense for the year were S97,050 and total interest 32expense was $14,211. Salaries of $6,420 and interest expense of 33 S ble at year end 2016 34 15 Supplies inventory ot $2,677 was purchased with cash during 2016. 35 Total supplies inventory of $578 was still on hand at year end 2016 36 16 Depreciation expense needs to be recorded on the buildings, 37 furniture and equipment, and the new computer system at year end 38 2016. All items are depreciated on a monthly basis using straight 514,211 are still payo line depreciation with no salvage value. The building has a useful 40life of 40 years and the furniture and equipment is depreciated over 417 years. As noted above, the new sales system has a useful life of 42 17 The Prepaid Insurance and the Supplies Inventory need to be 43 adjusted at year end 2016 so that the proper amount for insurance 44expense and supplies expense is recorded. See items 5 and 15 for 45 18 Estimated income tax payments of $120,000 were made during the year 2016 46 19 The company paid out cash dividends totaling $500 to its shareholders. 7 20 The company determined that a customer account was not collectible, and wrote off $135 on December 31 by debiting the Allowance for Doubtful Accounts and crediting Accounts Receivable. The company accrues $507 for estimated bad debts 50-22 Tax expense is 30% of Income before Income Tax. Part A: Journal EntriesParts B,C;T-Accounts Parts D,F: Trial BalancesPart E Closing Entry 16:39 O Type here to search AZ MFE 6100 Mod 3 Assignment 1 Excel Workbook (1) Excel Sally Dunn File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to do Share Comments X Cut AutoSum . A Calibri Fill Paste conditional Fo batas Styles . Insert Delete Format Blu-- 2.A.. -E E] Merge & Center $.%,,, s-96 ,48 Fort& Selec& Merge & Center . . . Format Painter Formatting Table Styles Clear . Filter Select Clipboard Font Number Cells Editing B49 xhe company accrues $507 for estimated bad debts. O P QR S Z AA AB ACAA 52 Background Information: The Balance Sheet for December 31, 2015 is 53 presented here to provide you with the beginning balances needed for your T 54 Accounts. 56 57 58 Been Carded, Ltd. Balance Sheet December 31, 2015 Row: 51 60 61 Current Assets 62 Cash 63 Accounts Receiveble 64 Allowance for Doubtful Accounts 65 Merchandise Inventory 66 Supplies Inventory 67 Prepaid Insurance 68 348,969 22,805 ,090,844 445 Total Current Assets 1463,271 70 Property, Plant, and Equipment 71 Land 72 Buildings 73Accumulated Depreciation-Buildings 4 Furniture and Equipment 5Accumulated Depreciation--Furniture and Equip 76 180,000 470,000 (47,000) 18,300 (10,457 610,843 Net Property, Plant, and Equipment Part A: Journal Entries Parts B,C; T-AccountsParts D,F: Trial Balances Part E Closing Entry 80% 16:39 O Type here to search V4)2/17/2019 MFE 6100 Mod 3 Assignment 1 Excel Workbook (1) Excel Sally Dunn-X File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to do Share Comments AutoSum A Fill X Cut A'A" e-.tbwrapTet Calibri General Paste conditional Fo batas Styles . Insert Delete Format Blu-- 2... Merge & Center $.%,,, Fort& Selec& . . Format Painter Formatting Table Styles Clear . Filter Select Clipboard Font Number Styles Editing xhe company accrues $507 for estimated bad debts. A B Total Assets 2,074,114 Liabilities and Stockholders' Equity 81 Current Liabilities 82Accounts Payable 83 Sealaries Payable 84Interest Payable 85 Taxes Payable 81,796 8,377 17,257 109,670 517,100 Total Current Liabilities 88 Long-term Liabilities 9 Mortgage Note Payable 381,333 235,000 Note Payable Total Long-term Liabilities Total Liabilities 133,433 95 Stockholders' Equity 6Common Stock, 5,000 shares issued and outstanding 97 Retained Earnings 50,000 890,681 940,681 Total Stockholders' Equity 100 Total Liabilities and Stockholders Equity 2,074,11 101 Part A: Journal Entries Parts B,C; T-AccountsParts D,F: Trial Balances Part E Closing Entry 80% 1644 O Type here to search rP ^ F 2/17/2019