Question

Complete the Mini Case in Chapter 2 of your text. Use formulas to calculate the ratios, clearly label the analysis, and round to one decimal

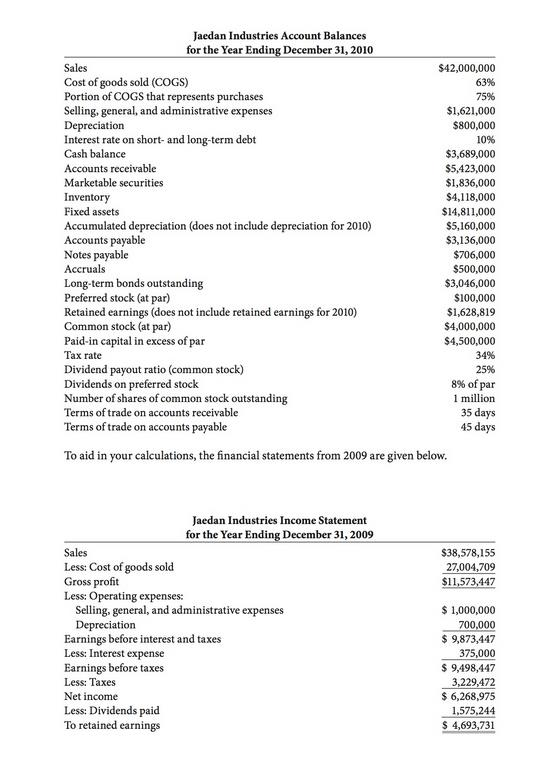

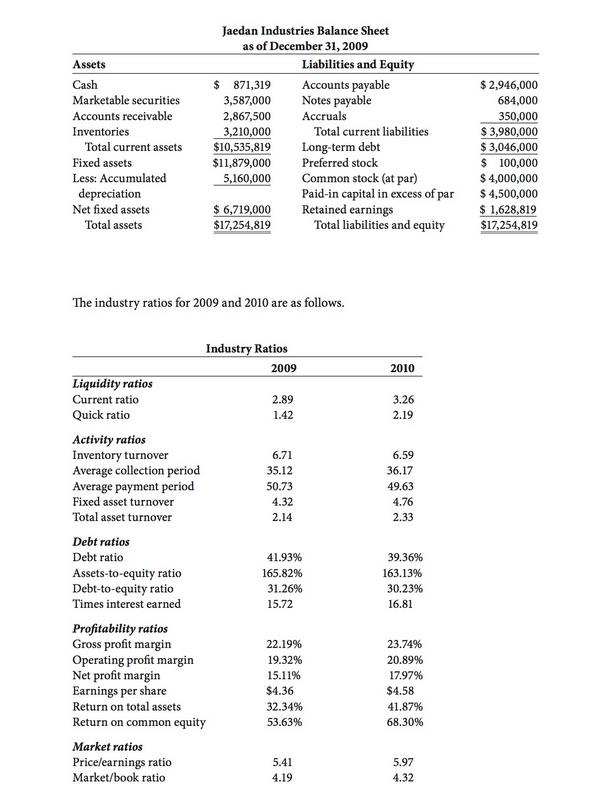

Complete the Mini Case in Chapter 2 of your text. Use formulas to calculate the ratios, clearly label the analysis, and round to one decimal place. You must complete all requirements of the case study. Jaedan Industries has the following account balances as of December 31, 2010 (Found on pages 64-65 of the text). The firms dividend payout ratio is 25% and the tax rate is 34%. The firms stock price on December 31, 2009, was $42.89 and on December 31, 2010, it was $56.82. Construct an income statement, balance sheet, statement of retained earnings, and statement of cash flows for 2010. Also, determine the firms free cash flow and calculate the liquidity, activity, debt, profitability, and market ratios for Jaedan industries. Perform a DuPont analysis and compare the firm to the industry ratios (see last table in this sequence). Evaluate the financial strengths and weaknesses Jaedan Industries may have.

Complete the Mini Case in Chapter 2 of your text. Use formulas to calculate the ratios, clearly label the analysis, and round to one decimal place. You must complete all requirements of the case study. Jaedan Industries has the following account balances as of December 31, 2010 (Found on pages 64-65 of the text). The firms dividend payout ratio is 25% and the tax rate is 34%. The firms stock price on December 31, 2009, was $42.89 and on December 31, 2010, it was $56.82. Construct an income statement, balance sheet, statement of retained earnings, and statement of cash flows for 2010. Also, determine the firms free cash flow and calculate the liquidity, activity, debt, profitability, and market ratios for Jaedan industries. Perform a DuPont analysis and compare the firm to the industry ratios (see last table in this sequence). Evaluate the financial strengths and weaknesses Jaedan Industries may have.

Jaedan Industries Account Balances for the Year Ending December 31, 2010 Sales Cost of goods sold (COGS) Portion of COGS that represents purchases Selling, general, and administrative expenses Depreciation Interest rate on short- and long-term debt Cash balance Accounts receivable Marketable securities Inventory Fixed assets Accumulated depreciation (does not include depreciation for 2010) Accounts payable Notes payable Accruals Long-term bonds outstanding Preferred stock (at par) Retained earnings (does not include retained earnings for 2010) Common stock (at par) Paid-in capital in excess of par Tax rate Dividend payout ratio (common stock) Dividends on preferred stock Number of shares of common stock outstanding Terms of trade on accounts receivable Terms of trade on accounts payable $42,000,000 63% 75% $1,621,000 $800,000 10% $3,689,000 $5,423,000 $1,836,000 $4,118,000 $14,811,000 $5,160,000 $3,136,000 $706,000 $500,000 $3,046,000 $100,000 $1,628,819 $4,000,000 $4,500,000 34% 25% 8% of par 1 million 35 days 45 days To aid in your calculations, the financial statements from 2009 are given below. Jaedan Industries Income Statement for the Year Ending December 31, 2009 Sales Less: Cost of goods sold Gross profit Less: Operating expenses: $38,578,155 27,004,709 $11,573,447 Selling, general, and administrative expenses Depreciation Earnings before interest and taxes Less: Interest expense Earnings before taxes Less: Taxes Net income Less: Dividends paid To retained earnings $ 1,000,000 700,000 9,873,447 375,000 s 9,498,447 3,229,472 6,268,975 1,575,244 S 4,693,731

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started