Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the missing general journal entries below based on the following balance day adjustments as at 30 June 2023. . Equipment purchased on 01/07/2022

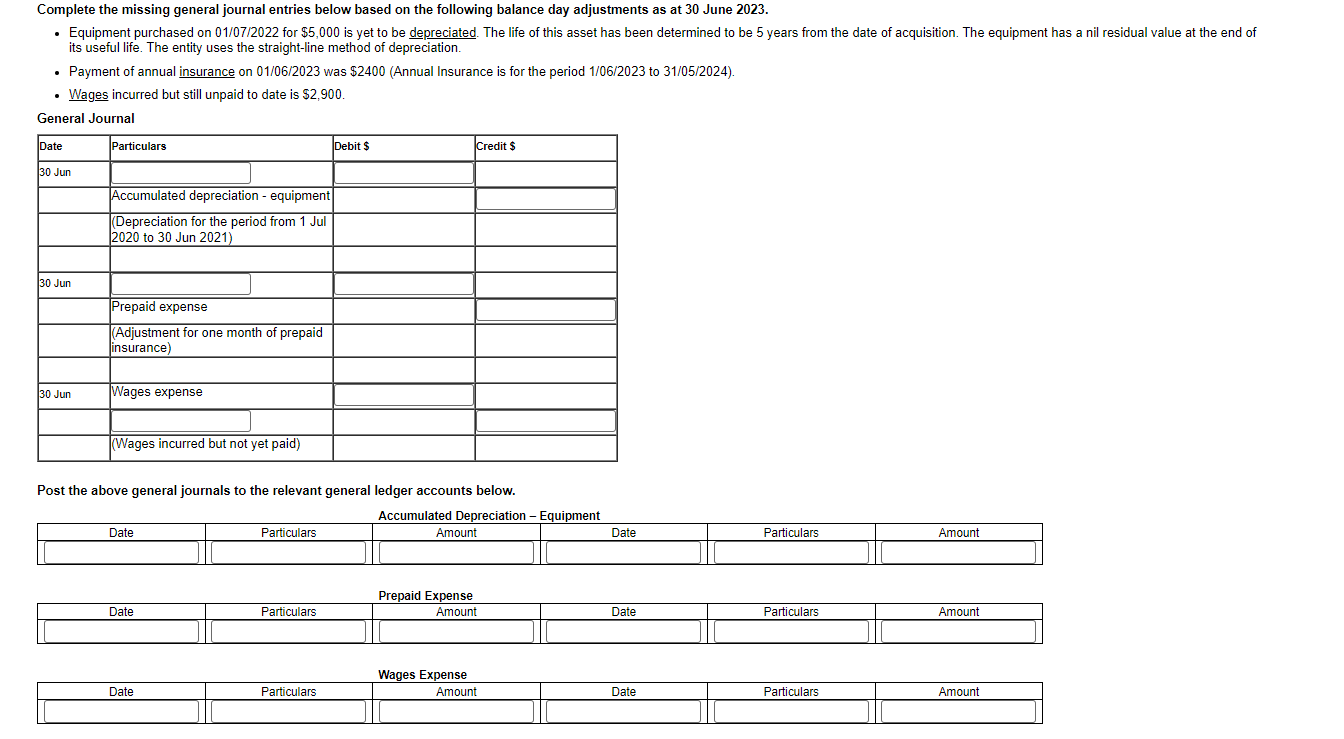

Complete the missing general journal entries below based on the following balance day adjustments as at 30 June 2023. . Equipment purchased on 01/07/2022 for $5,000 is yet to be depreciated. The life of this asset has been determined to be 5 years from the date of acquisition. The equipment has a nil residual value at the end of its useful life. The entity uses the straight-line method of depreciation. Payment of annual insurance on 01/06/2023 was $2400 (Annual Insurance is for the period 1/06/2023 to 31/05/2024). Wages incurred but still unpaid to date is $2,900. General Journal Date 30 Jun 30 Jun 30 Jun Particulars Accumulated depreciation - equipment (Depreciation for the period from 1 Jul 2020 to 30 Jun 2021) Prepaid expense (Adjustment for one month of prepaid insurance) Wages expense (Wages incurred but not yet paid) Date Post the above general journals to the relevant general ledger accounts below. Date Date Particulars Particulars Debit $ Particulars Credit $ Accumulated Depreciation - Equipment Amount Prepaid Expense Amount Wages Expense Amount Date Date Date Particulars Particulars Particulars Amount Amount Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

General Journal Date Particulars Debit Credit 30 Jun Accumulated DepreciationEquipment 500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started