Answered step by step

Verified Expert Solution

Question

1 Approved Answer

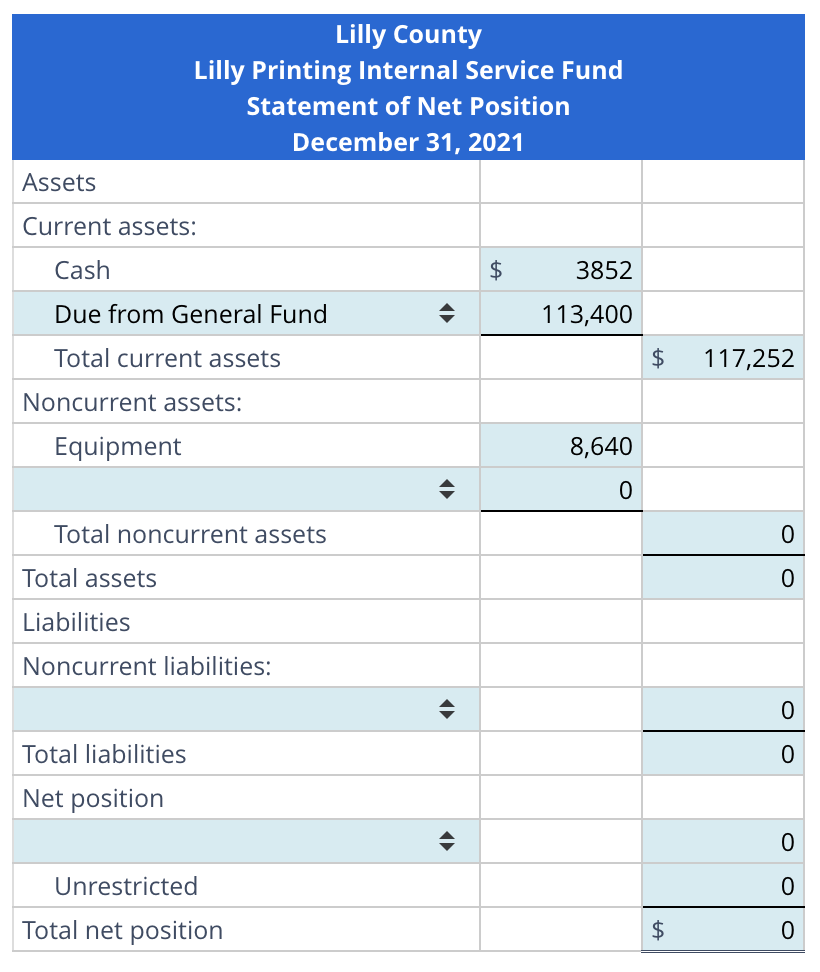

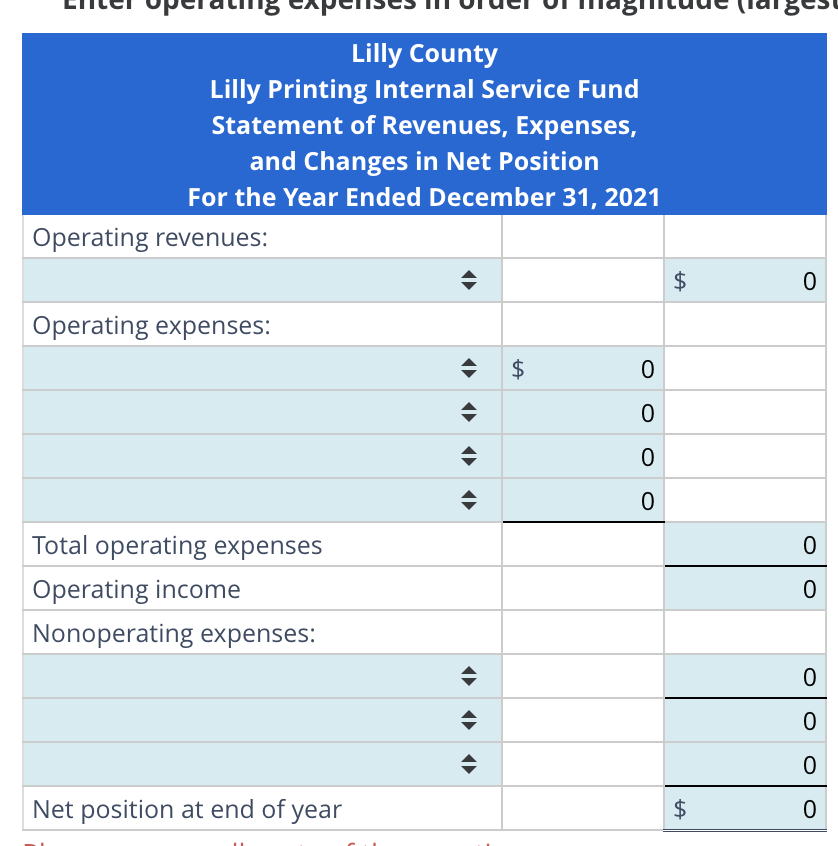

complete the Net Position and the Statement of Revenues, Expenses, and Changes based on the information below: Account Cash Advance from General Fund To record

complete the Net Position and the Statement of Revenues, Expenses, and Changes based on the information below:

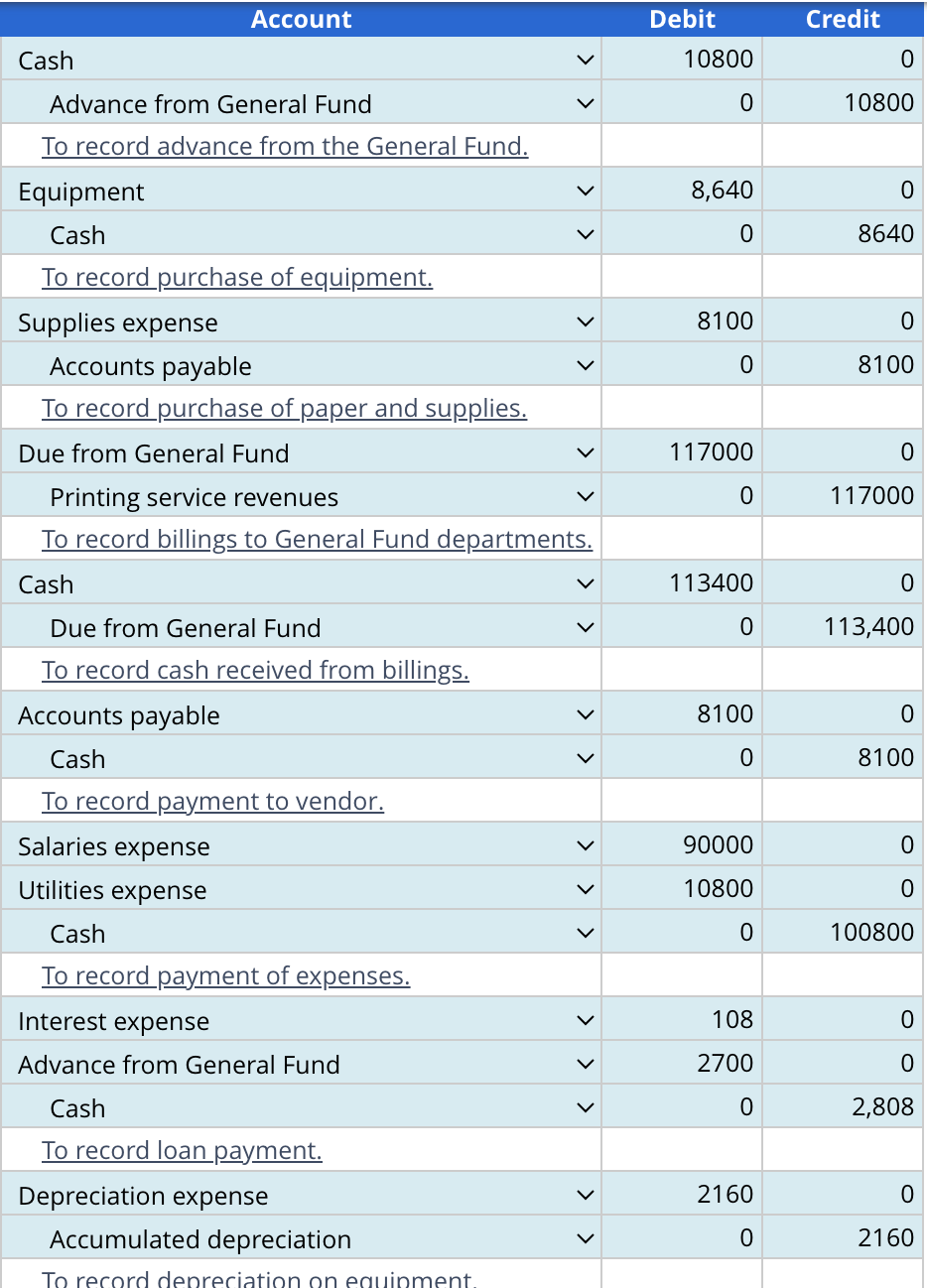

Account Cash Advance from General Fund To record advance from the General Fund. Debit Credit 10800 0 0 10800 Equipment Cash 8,640 0 0 8640 To record purchase of equipment. Supplies expense Accounts payable 8100 0 0 8100 To record purchase of paper and supplies. Due from General Fund 117000 0 0 117000 Printing service revenues To record billings to General Fund departments. Cash Due from General Fund 113400 0 0 113,400 To record cash received from billings. Accounts payable 8100 0 0 8100 > > Cash To record payment to vendor. Salaries expense Utilities expense Cash To record payment of expenses. Interest expense Advance from General Fund Cash To record loan payment. Depreciation expense Accumulated depreciation To record depreciation on equipment. > > 90000 0 10800 0 0 100800 > > > 108 0 2700 0 0 2,808 2160 0 0 2160

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started