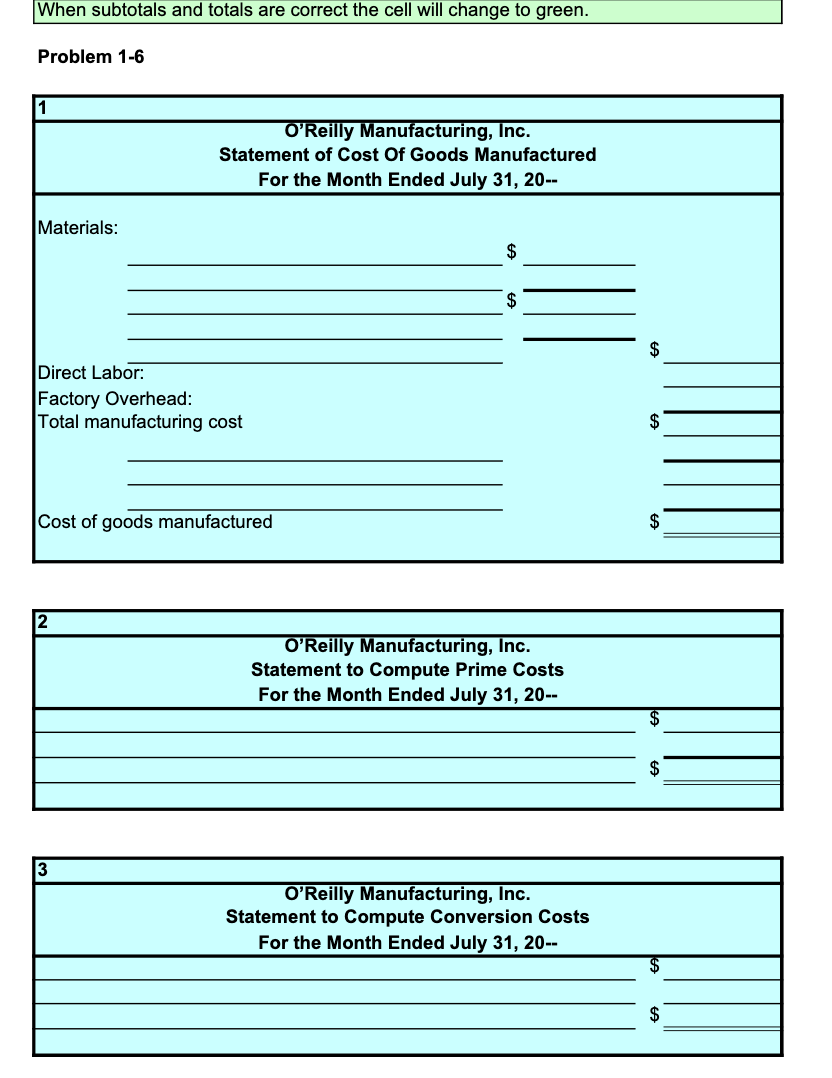

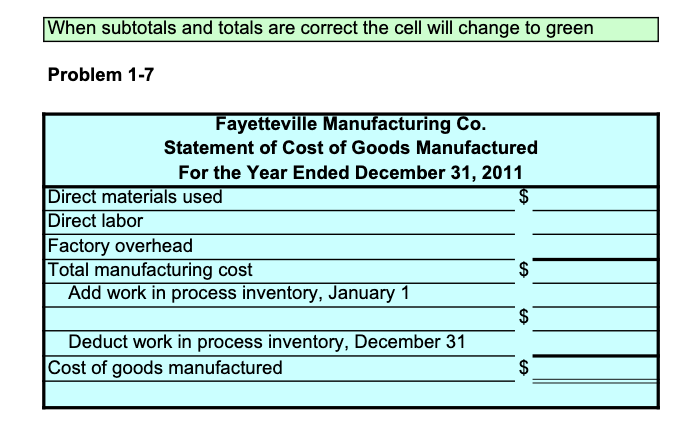

complete the P1-6 and P1-7 Excel template.

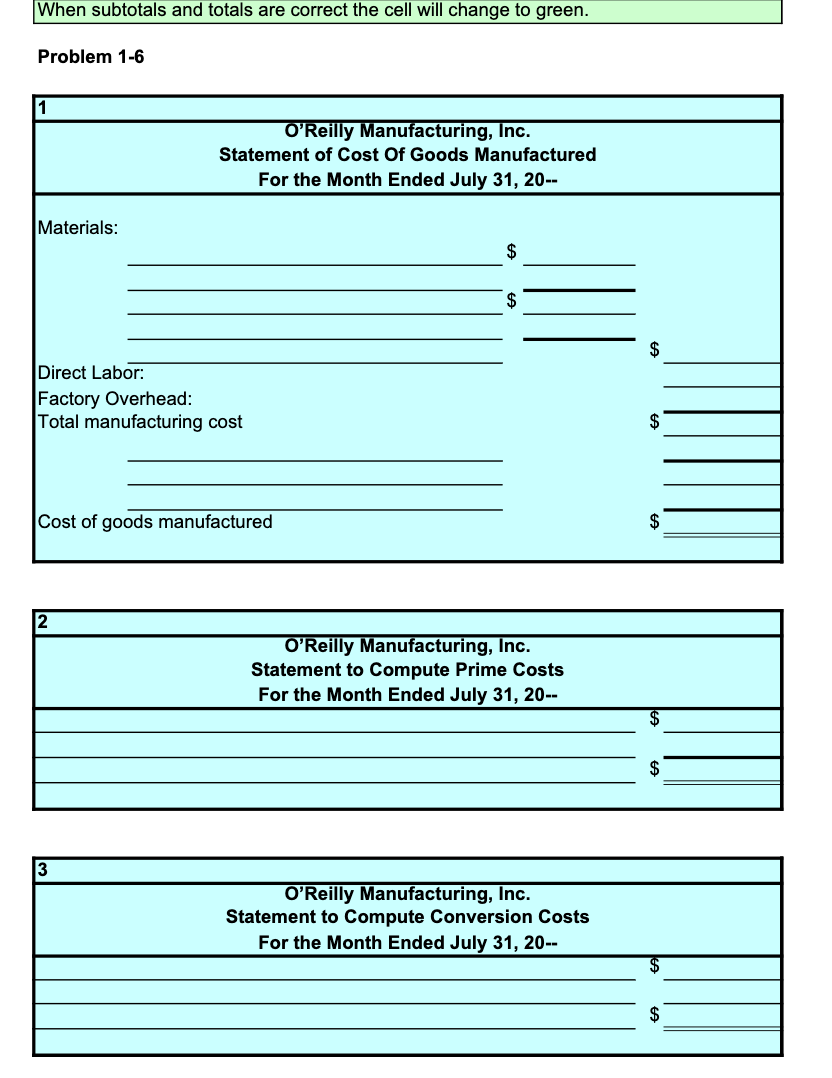

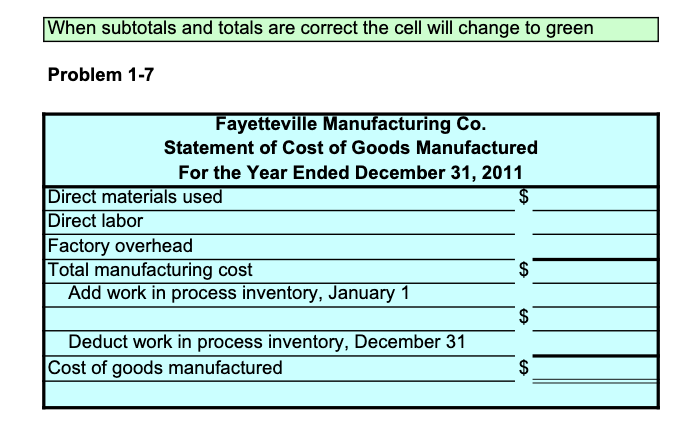

58 Principles of Cost Accounting 7. The adjusting entry for factory overhead. 8. The entry to transfer factory overhead costs to Work in Process. 9. The entry to transfer the cost of completed work to Finished Goods. (Hint: Be sure to consider the beginning and ending balances of Work in Process as well as the costs added to Work in Process this period.) 10. The entry to record the cost of goods sold. (Hint: Be sure to consider the beginning and ending balances of Finished Goods as well as the cost of the goods finished during the month.) Data analysis, manufacturing statement, cost terminology O'Reilly Manufacturing, Inc.'s cost of goods sold for the month ended July 31 was $345,000. The ending work in process inven- tory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. Other infor- mation pertaining to O'Reilly's inventories and production for the month of July is as follows: P1-6 Beginning inventories, July 1: Direct materials $ 20,000 Work in process 40,000 Finished goods 102,000 Purchases of direct materials during July 110,000 Ending inventories, July 31: Direct materiais 26,000 Work in process Finished goods 105,000 Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropri- ate spaces and solving for the unknown information.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July. Data analysis; manufacturing statement Fayetteville Manufacturing Co. produces only one product. You have obtained the following information from the corporation's books and records for the year ended December 31, 2011: a. Total manufacturing cost during the year was $1,000,000, including direct materials, direct labor, and factory overhead. b. Cost of goods manufactured during the year was $970,000. c. Factory overhead charged to work in process was 75% of direct labor cost and 27% of the total manufacturing cost. d. The beginning work in process inventory, January 1, was 40% of the ending work in process inventory, December 31. P1-7 X tion to COST Accounting Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Fayetteville Manufacturing. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information.) P1-8 Job order cost: journal entries; ending work in process; inventory analysis Hidalgo Company manufactures goods to special order and uses a job order cost system. During its first month of operations, the following selected transactions took place: $37,000 $ 2,200 5,700 7,100 1,700 1,350 $ 2,700 6,800 9,200 a. Materials purchased on account b. Materials issued to the factory: Job 101 Job 102 Job 103 Job 104 For general use in the factory c. Factory wages and salaries earned: Job 101 Job 102 Job 103 Job 104 For general work in the factory d. Miscellaneous factory overhead costs on account e. Depreciation of $2,000 on the factory machinery recorded. f. Factory overhead allocated as follows: Job 101 Job 102 Job 103 Job 104 g. Jobs 101, 102, and 103 completed. h. Jobs 101 and 102 shipped to the customer and billed at $39,000. 2,100 2,250 $ 2,400 $ 1,200 2,000 3,800 1,000 Required: 1. Prepare a schedule reflecting the cost of each of the four jobs. 2. Prepare journal entries to record the transactions. 3. Compute the ending balance in Work in Process. 4. Compute the ending balance in Finished Goods. When subtotals and totals are correct the cell will change to green. Problem 1-6 1 O'Reilly Manufacturing, Inc. Statement of Cost Of Goods Manufactured For the Month Ended July 31, 20-- Materials: $ $ Direct Labor: Factory Overhead: Total manufacturing cost $ Cost of goods manufactured $ 2 O'Reilly Manufacturing, Inc. Statement to compute Prime Costs For the Month Ended July 31, 20-- $ $ 3 O'Reilly Manufacturing, Inc. Statement to Compute Conversion Costs For the Month Ended July 31, 20-- $ When subtotals and totals are correct the cell will change to green Problem 1-7 Fayetteville Manufacturing Co. Statement of Cost of Goods Manufactured For the Year Ended December 31, 2011 Direct materials used $ Direct labor Factory overhead Total manufacturing cost $ Add work in process inventory, January 1 $ Deduct work in process inventory, December 31 Cost of goods manufactured $