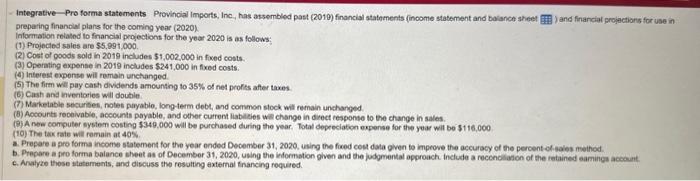

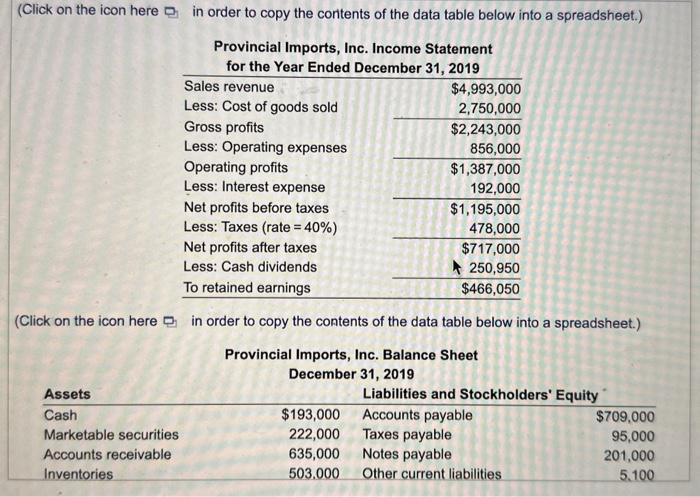

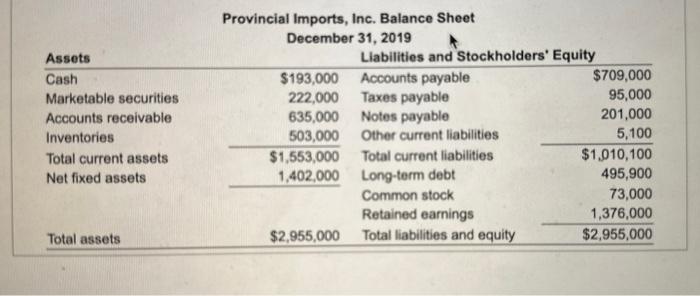

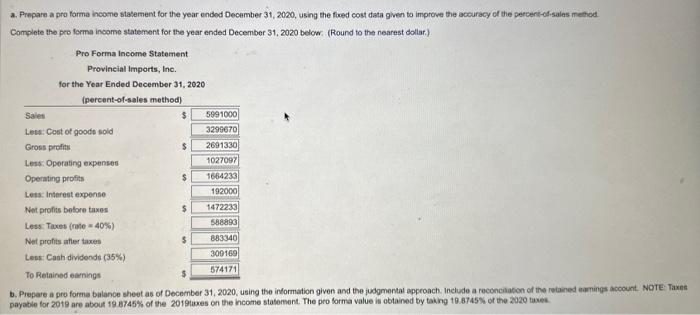

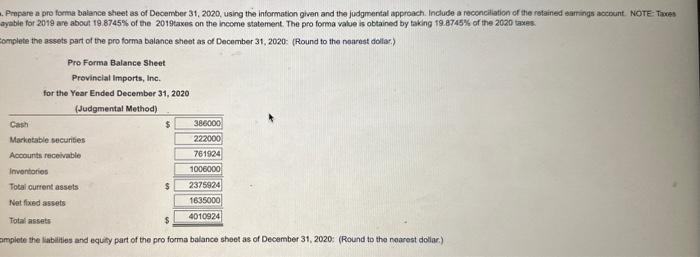

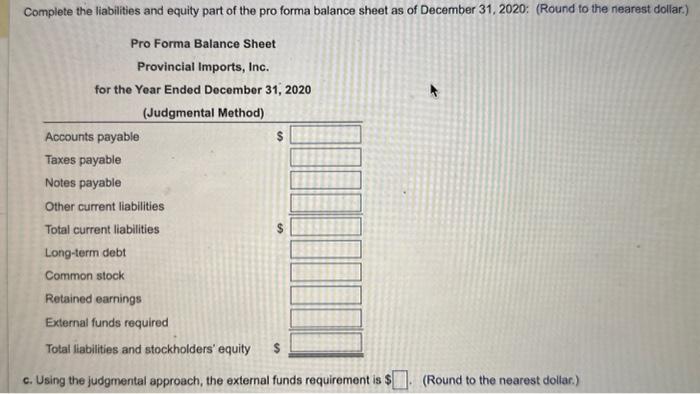

Complete the pro forma income statement for the year ended December 31, 2020 below: (Round to the nearest dollar.) payable for 2019 are about 19.8745% of the 2019 taxes on the hecome statement. The pro forma value is obtained by taking 19.8745% of the 2020 taxes. Provincial Imports, Inc. Balance Sheet December 31, 2019 Assets Llabilities and 'Stockholders' Equity \begin{tabular}{lrlr} \hline Cash & $193,000 & Accounts payable & $709,000 \\ Marketable securities & 222,000 & Taxes payable & 95,000 \\ Accounts receivable & 635,000 & Notes payable & 201,000 \\ Inventories & 503,000 & Other current liabilities & 5,100 \\ \cline { 2 - 2 } Total current assets & $1,553,000 & Total current liabilities & $1,010,100 \\ Net fixed assets & 1,402,000 & Long-term debt & 495,900 \\ & & Common stock & 73,000 \\ & & Retained earnings & 1,376,000 \\ \hline Total assets & $2,955,000 & Total liabilities and equity & $2,955,000 \\ \hline \end{tabular} Integrative - Pro forma statements Provincial imports, Inc, has assembled past (2019) financial statements (income statement and bolanco sheet preparing finanolal plans for the coming year (2020). information related io fnancisi projections for the year 2020 is as follows: (1) Projecled sales are $5,991,000. (2) Cost of goods sold in 2019 includes $1,002,000 in foxed costs. (3) Operating expense in 2019 includes $241,000 in flxed costs. (G) interest exponte will remain unchanged. (5) The firm wil pay cash dividends ameunting to 35% of net profiss after taxes. (6) Cish and inventories will doutile. (7) Marketable securibes, notes payabio, long-term debt, and common stock will remain unchanged. (B) Accounts receivabie, accounts payable, and other current liabileies will change in direct response to the change in sales. (9) A now computer system costing $349,000 will be purchased during the year. Fotal depeciation expense for the yoar wil bo $116,000 (10) The tax rate will ramain at 40%. a. Prepare a pro forma income statement for the year ended December 31, 2020, using the ficed cest data given to improve the accuracy of the percent of asies method. b. Prepare a pro forma balance sheet as of December 31,2020 , using the informbtion given and the judgmental approach inctude a reccholiasion of the ietained eaminga account c. Anatyze those statements, and diveuss tho resulting external fnancing roquired. . Propare a pro forma batance sheet as of December 31, 2020 , using the information ghen and the judgmental approach. Include a reconciliation of the rotained tarrings acciount. NOTE Taxes ayabie for 2019 are about 19.8745% of the 2019 taxes on the income statement. The pro forma value is obtained by taking 19.8745% of the 2020 taxes. complete the assets part of the pro forma balance sheot as of December 31, 2020: (Round to the naarast dolla:) ampiote the lablities and equity part of the pro forma balance sheet as of December 31, 2020: (Round to the noarest dollar.) c. Using the judgmental approach, the external funds requirement is \$ (Round to the nearest dollar.) (Click on the icon here . in order to copy the contents of the data table below into a spreadsheet.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)