Answered step by step

Verified Expert Solution

Question

1 Approved Answer

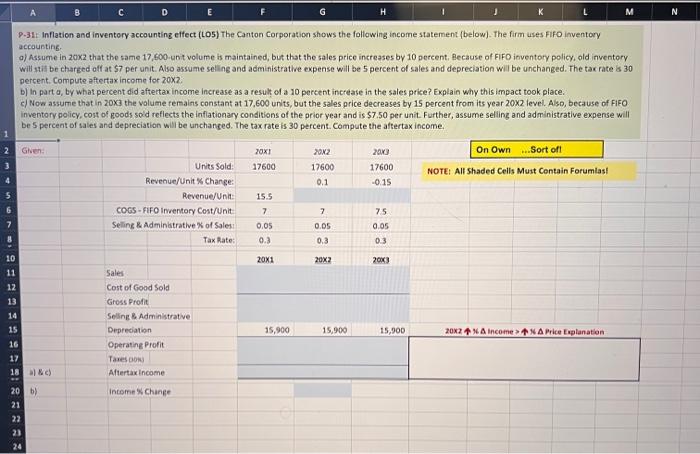

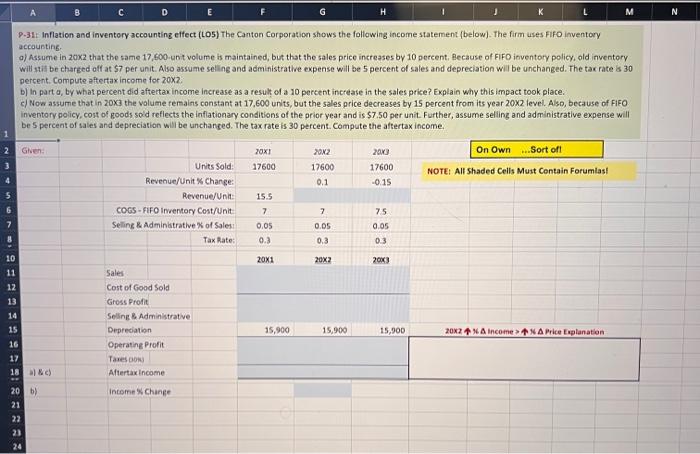

Complete the problem using Excel formulas. P-31: Inflation and inventery accounting effect (LO5) The Canton Corporation shows the following income statement (below). The firm uses

Complete the problem using Excel formulas.

P-31: Inflation and inventery accounting effect (LO5) The Canton Corporation shows the following income statement (below). The firm uses FiFo inventory accasting. a) Assume in 20x2 that the same 17,800-unit volume is maintained, but that the sales price increases by 10 percent, flecause of FiFO inventory policy, old inventory Will stil be chareed aff at $7 per unit. Also assume seling and administratwe expense will be 5 percent of sales and depreciation will be unchanged. The tax rate is 30 percent, Compute aftertaxincome for 20x2. b) In part a, by what percent did aftertaxincome increase as a result of a 10 percent increase in the sales price? Explain why this impact took place. c) Now assume that in 20x3 the volume temains constant at 17,600 units, but the sales price decreases by 15 percent from its year 20x2 level. Also, because of FiFO inventory policy, cost of goods sold reflects the inflationary conditions of the prior year and is $7.50 per unit. Further, assume seliling and administrative expense will be 5 percent of sales and depreciation wil be unchanged. The tax rate is 30 percent Compute the aftertax income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started