Answered step by step

Verified Expert Solution

Question

1 Approved Answer

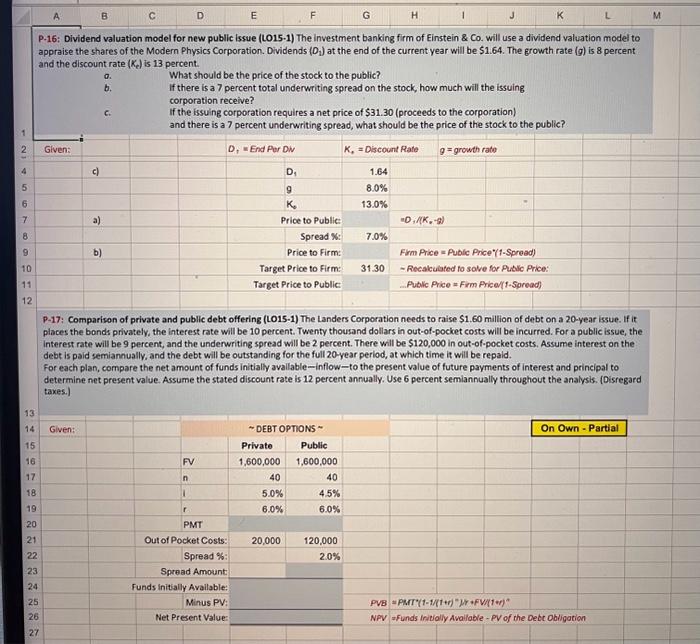

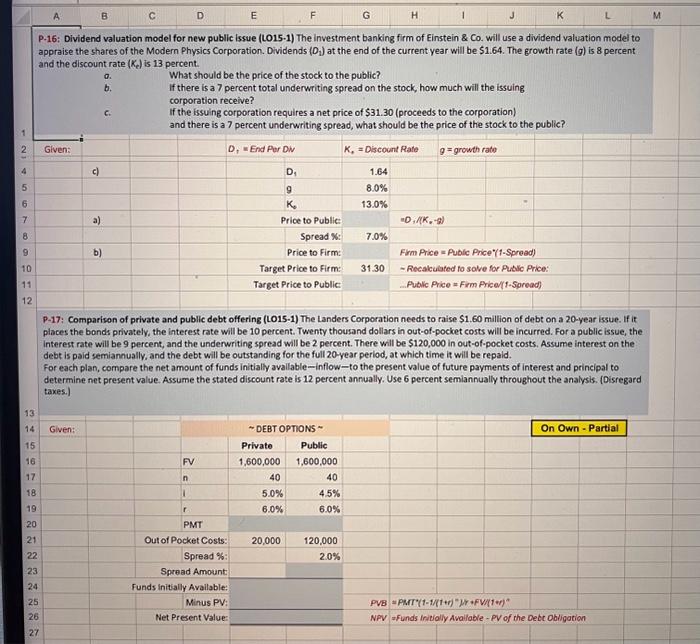

complete the problems using Excel formula P-16: Dividend valuation model for new public issue (LO15-1) The investment banking firm of Einstein & Co. will use

complete the problems using Excel formula

P-16: Dividend valuation model for new public issue (LO15-1) The investment banking firm of Einstein \& Co. will use a dividend valuation model to appraise the shares of the Modern Physics Corporation. Dividends (D1) at the end of the current year will be $1.64. The growth rate (g) is 8 percent and the discount rate (Ke) is 13 percent. o. What should be the price of the stock to the public? b. If there is a 7 percent total underwriting spread on the stock, how much will the issuing corporation receive? c. If the issuing corporation requires a net price of $31.30 (proceeds to the corporation) and there is a 7 percent underwriting spread, what should be the price of the stock to the public? P-17: Comparison of private and public debt offering (LO15-1) The Landers Corporation needs to raise $1.60 million of debt on a 20-year issue. If it places the bonds privately, the interest rate will be 10 percent. Twenty thousand dollars in out-of-pocket costs will be incurred. For a public issue, the interest rate will be 9 percent, and the underwriting spread will be 2 percent. There will be $120,000 in out-of-pocket costs. Assume interest on the debt is paid semiannually, and the debt will be outstanding for the full 20 -year period, at which time it will be repaid. for each plan, compare the net amount of funds initially avallable-inflow - to the present value of future payments of interest and principal to determine net present value. Assume the stated discount rate is 12 percent annually. Use 6 percent semiannually throughout the analysis. (Disregard taxes.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started