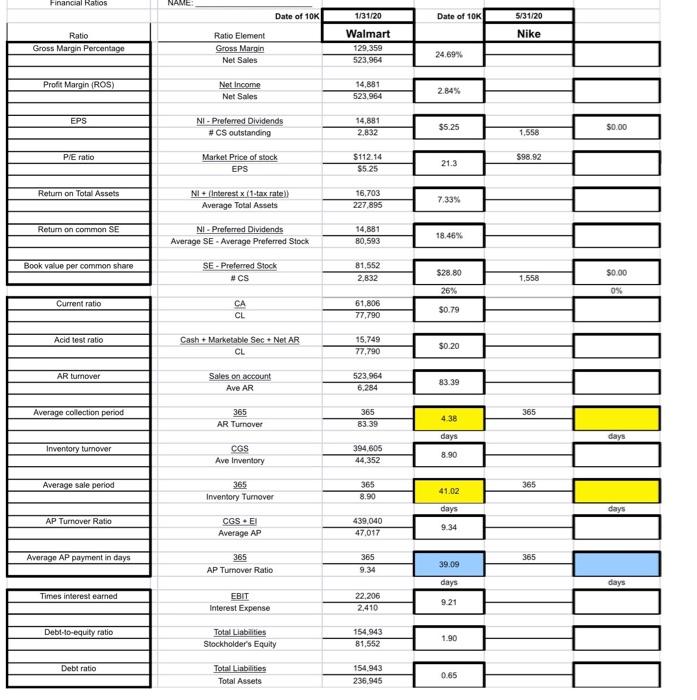

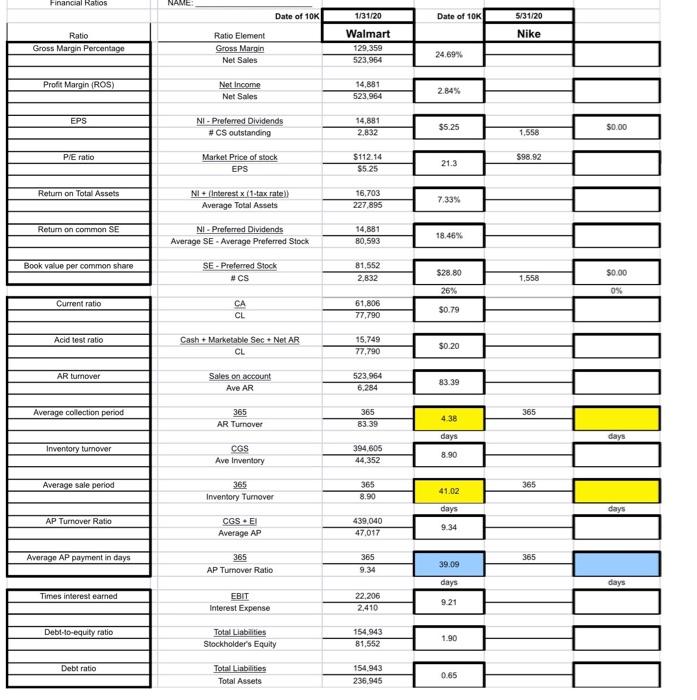

Complete the ratios for Nike. Insert ratio elements in column F and allow excel to auto-calculate the answer in column G. Then circle or highlight the best ration between Walmart and Nike.

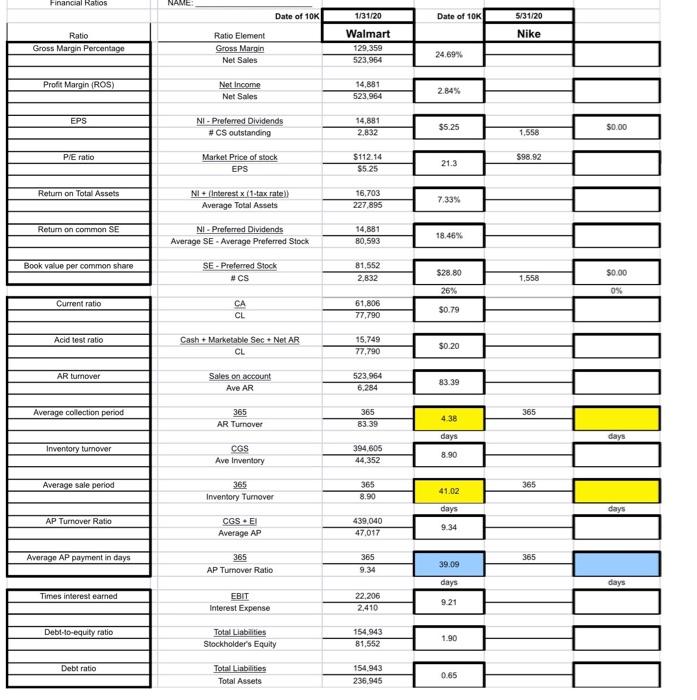

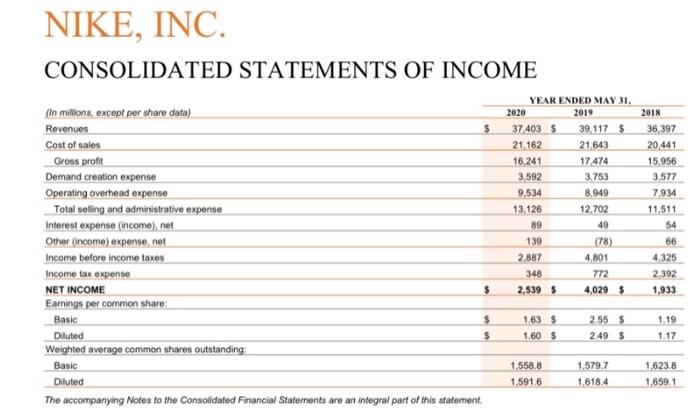

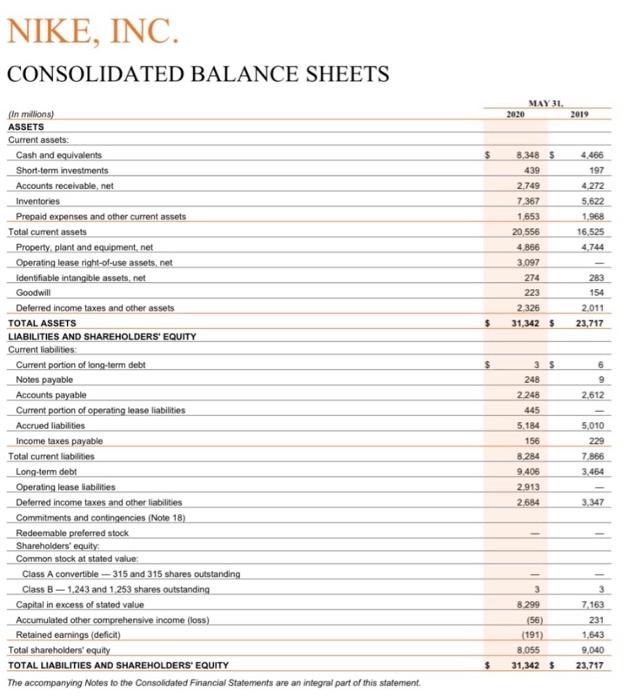

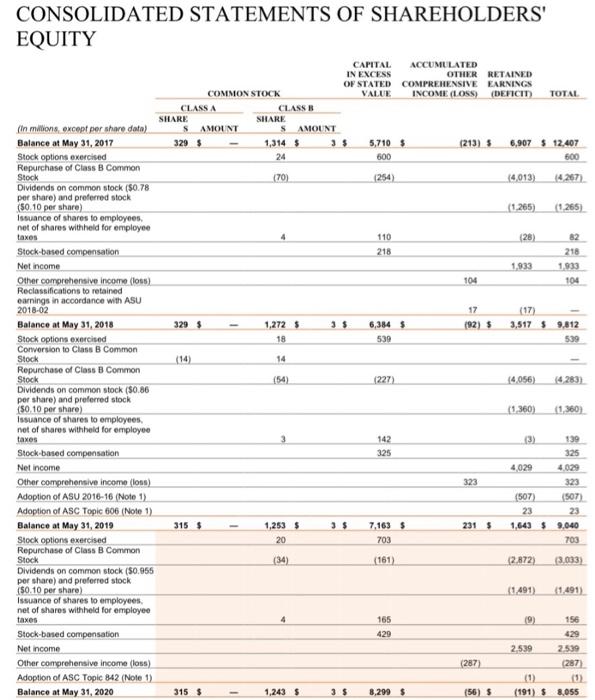

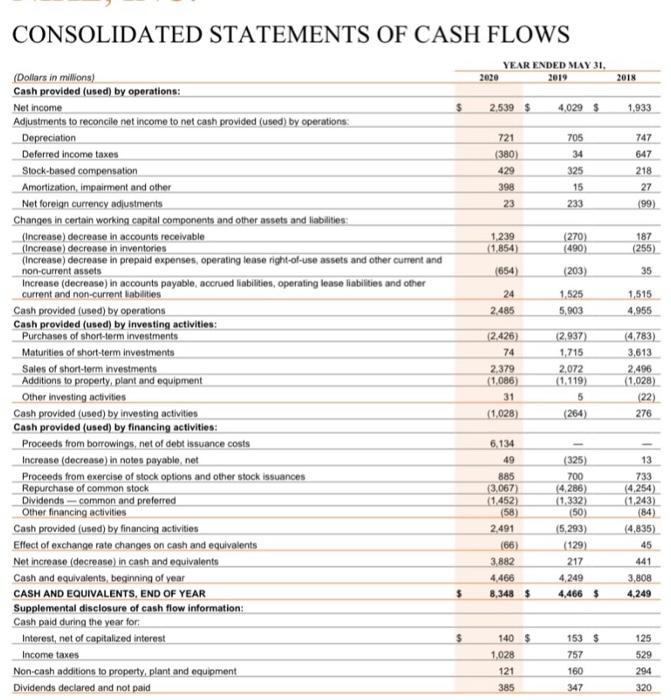

Financial Rabios NAME Date of 10K 1/31/20 Date of 10K 5/31/20 Nike Ratio Gross Margin Percentage Ratio Element Gross Margin Net Sales Walmart 129,359 523,964 24,69% Profit Margin (ROS) Net Income Net Sales 14,881 523,964 2.84% EPS NI - Preferred Dividends #CS outstanding 14,881 2,832 $5.25 $0.00 1.558 PIE ratio $98.92 Market Price of stock EPS $112.14 $5.25 21.3 Return on Total Assets NI + (Interest x (1-tax rate) Average Total Assets 16,703 227.895 7.33% Return on common SE NI - Preferred Dividends Average SE. Average Preferred Stock 14,881 80,593 18.46% Book value per common share SE - Preferred Stock #CS 81,552 2,832 $28.80 $0.00 1,558 26% Current ratio CA CL 61,806 77,790 $0.79 Acid test rabo Cash + Marketable Sec + Net AR CL 15,749 77,790 $0.20 AR turnover Sales on account Ave AR 523.964 6.284 83.39 Average collection period 365 365 AR Turnover 365 83.39 438 0008100100100OO days days Inventory turnover CGS 394.605 44,352 8.90 Ave Inventory Average sale period 365 365 Inventory Turnover 365 8.90 41.02 days days AP Turnover Ratio CGSE Average AP 439.040 47.017 9.34 Average AP payment in days 365 365 AP Turnover Ratio 365 9.34 39.09 days days Times interest earned EBIT Interest Expense 22.206 2,410 9.21 Debt-to-equity ratio Total Liabilities Stockholder's Equity 154.943 81,552 1.90 Debt ratio Total Liabilities Total Assets 154.943 236.945 0.65 NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME YEAR ENDED MAY 31. (in millions, except per share data) 2020 2019 Revenues 37 4035 39,117 $ Cost of sales 21, 162 21.643 Gross profit 16.241 17474 Demand creation expense 3,592 3.753 Operating overhead expense 9.534 8.949 Total seling and administrative expenso 13,126 12.702 Interest expense (income). net 89 49 Other (income) expense, net 139 (78) Income before income taxes 2.887 4.801 Income tax expense 772 NET INCOME $ 2,539 $ 4,029 $ Eamings per common share: Basic $ 1.63 $ 2.55 $ Diluted $ 1.60 $ 2.49 $ Weighted average common shares outstanding Basic 1,558.8 1,579.7 Diluted 1,5916 16184 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 2018 36 397 20,441 15,956 3,577 7934 11,511 54 56 4 325 348 2.392 1,933 1.19 1.17 1,623.8 1.659.1 NIKE, INC. CONSOLIDATED BALANCE SHEETS MAY 31, 2020 2019 $ 8,348 5 439 4 466 197 4.272 5.622 1,968 16 525 4.744 2.749 7367 1553 20 556 4 866 3,097 274 223 2326 31,342 $ 283 154 $ 2011 23,717 6 9 (In millions) ASSETS Current assets: Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease right-of-use assets, net Identifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Current portion of long-term debt Notes payable Accounts payable Current portion of operating lease liabilities Accrued liabilities Income taxes payable Total current liabilities Long-term debt Operating lease liabilities Deferred income taxes and other liabilities Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value Class A convertible --- 315 and 315 shares outstanding Class B - 1,243 and 1 253 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (loss) Retained earnings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 2612 35 248 2248 445 5.184 156 8.284 9406 2.913 2684 5,010 229 7866 3,464 3.347 3 8 299 (56) (191) 8.055 31,342 $ 3 7163 231 1,643 9,040 23,717 $ taxes 1 CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY CAPITAL ACCUMULATED IN EXCESS OTHER RETAINED OF STATED COMPREHENSIVE EARNINGS COMMON STOCK VALUE INCOME (LOSS) (DEFICIT TOTAL CLASSA CLASS B SHARE SHARE (In milionis except per share data) SAMOUNT SAMOUNT Balance at May 31, 2017 3295 1,314 $ 5,710 $ (213) 6,907 $ 12.407 Stock options exercised 24 600 600 Repurchase of Class B Common Stock (70) (254) (4.013) (4267) Dividends on common stock ($0.78 per share) and preferred stock (50.10 per share) (1.265) (1.265) Issuance of shares to employees, net of shares withheld for employee 110 Stock-based compensation 218 218 Not income 1.933 1.933 Other comprehensive income (1) 104 104 Reclassifications to retained earnings in accordance with ASU 2018-02 17 Balance at May 31, 2018 329 $ 1,2725 6,384 $ (92) $ 3,517 59,312 Stock options exercised 18 539 539 Conversion to Class B Common Stock (14) 14 Repurchase of Class B Common Stock (227) (4 056) Dividends on common stock (50.86 por share) and preferred stock (50.10 per share) (1.360) (1.360) Issuance of shares to employees, net of shares withheld for employee taxes 142 (3) Stock-based compensation 325 325 Net income 4,029 4.020 Other comprehensive income (los) 323 323 Adoption of ASU 2016-16 (Note 1) (507) (507) Adoption of ASC Topic 606 (Note 1) 23 23 Balance at May 31, 2019 315$ 1,253 $ 7,163 $ 2315 1,643 $ 9,040 Stock options exercised 20 703 Repurchase of Class B Common Stock (34) (161) (2.872) (3.033) Dividends on common stock ($0.955 per share) and preferred stock (50.10 per share (1.491 (1.491) Issuance of shares to employees, net of shares withheld for employee taxes 4 165 19 156 Stock-based compensation 429 429 Net Income 2.539 2.539 Other comprehensive income (loss) (287) (287 Adoption of ASC Topic 842 (Note 1) (1) 3) Balance at May 31, 2020 315$ 1,2435 3 $ 8,299 $ (56) $ (191) $8,055 703 CONSOLIDATED STATEMENTS OF CASH FLOWS YEAR ENDED MAY 31. 2019 2020 2018 2.539 $ 4,029 $ 1.933 721 (380) 429 398 23 705 34 325 15 233 747 647 218 27 (99) 1,239 (1.854) (270) (490) 187 (255) (654) (203) 35 24 2.485 1,525 5.903 1,515 4,955 (Dollars in millons) Cash provided (used) by operations: Net income Adjustments to reconcile net income to net cash provided (used) by operations; Depreciation Deferred income taxes Stock-based compensation Amortization, impairment and other Net foreign currency adjustments Changes in certain working capital components and other assets and liabilities: (Increase) decrease in accounts receivable (Increase) decrease in inventories (Increase) decrease in prepaid expenses, operating tease right-of-use assets and other current and non-current assets Increase (decrease) in accounts payable, accrued liabilities, operating lease liabilities and other current and non-current abilities Cash provided (used) by operations Cash provided (used) by investing activities: Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Additions to property, plant and equipment Other investing activities Cash provided (used) by investing activities Cash provided (used) by financing activities: Proceeds from borrowings, net of debt issuance costs Increase (decreaso) in notes payablo, net Proceeds from exercise of stock options and other stock issuances Repurchase of common stock Dividends - common and preferred Other financing activities Cash provided (used) by financing activities Effect of exchange rate changes on cash and equivalents Net increase (decrease in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for Interest, net of capitalized interest Income taxes Non-cash additions to property, plant and equipment Dividends declared and not paid (2.426) 74 2,379 (1,086) 31 (1.028) (2.937) 1.715 2.072 (1.119) 5 (4.783) 3,613 2,496 (1.028) (22) 276 (264) 6.134 885 (3.067) (1.452) (58) 2.491 (66) 3.882 4.466 8,348 $ (325) 700 (4.286) (1.332) (50) (5,293) (129) 217 4,249 4,466 $ 13 733 (4,254) (1,243) (84) (4,835) 45 441 3,808 4,249 $ $ 140$ 1.028 121 385 153 $ 757 160 347 125 529 294 320