Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the requirements for the enclosed case, Over-land trucking and freight and upload your answer file(s) here on or before the due date given.

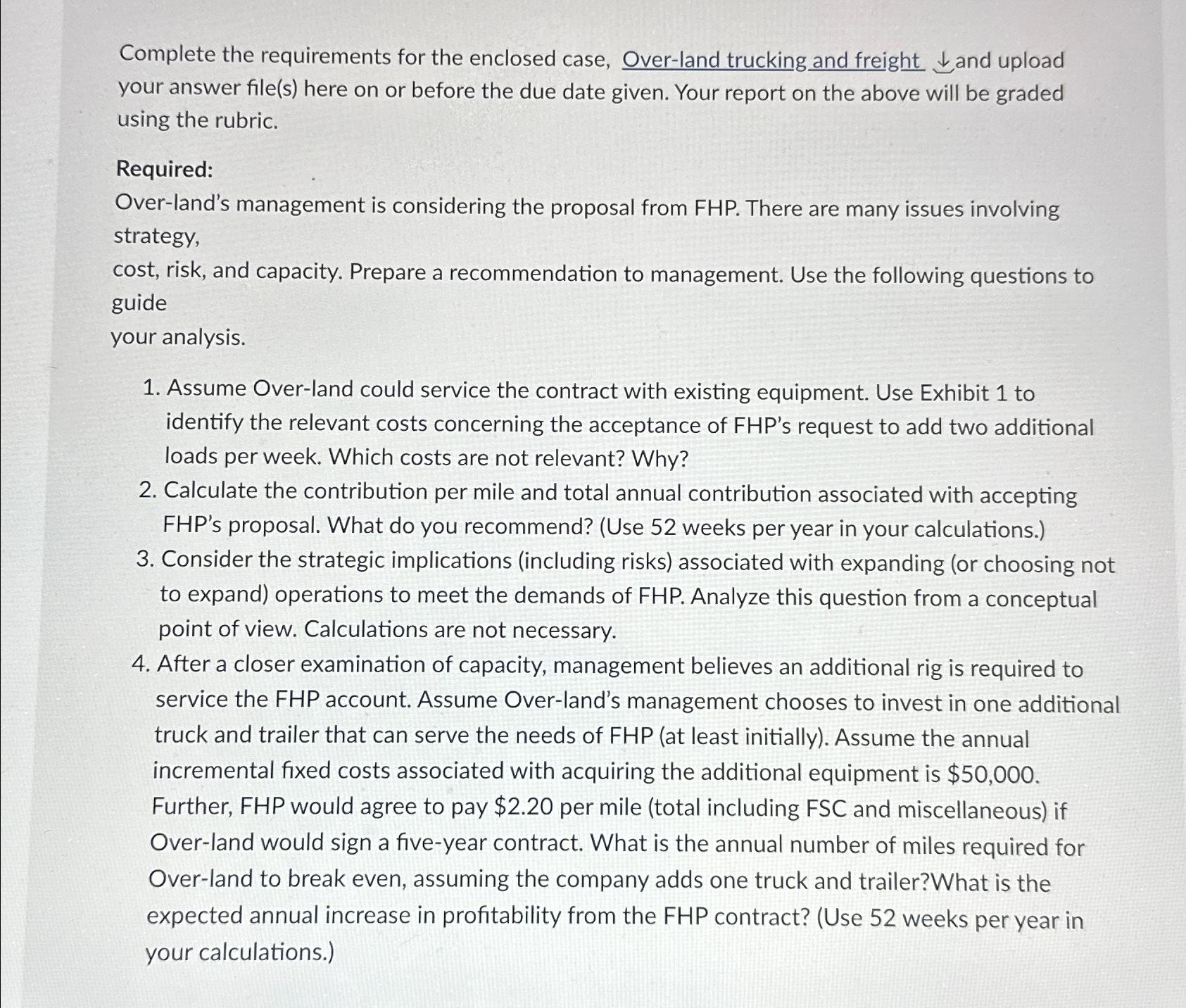

Complete the requirements for the enclosed case, Over-land trucking and freight and upload your answer file(s) here on or before the due date given. Your report on the above will be graded using the rubric. Required: Over-land's management is considering the proposal from FHP. There are many issues involving strategy, cost, risk, and capacity. Prepare a recommendation to management. Use the following questions to guide your analysis. 1. Assume Over-land could service the contract with existing equipment. Use Exhibit 1 to identify the relevant costs concerning the acceptance of FHP's request to add two additional loads per week. Which costs are not relevant? Why? 2. Calculate the contribution per mile and total annual contribution associated with accepting FHP's proposal. What do you recommend? (Use 52 weeks per year in your calculations.) 3. Consider the strategic implications (including risks) associated with expanding (or choosing not to expand) operations to meet the demands of FHP. Analyze this question from a conceptual point of view. Calculations are not necessary. 4. After a closer examination of capacity, management believes an additional rig is required to service the FHP account. Assume Over-land's management chooses to invest in one additional truck and trailer that can serve the needs of FHP (at least initially). Assume the annual incremental fixed costs associated with acquiring the additional equipment is $50,000. Further, FHP would agree to pay $2.20 per mile (total including FSC and miscellaneous) if Over-land would sign a five-year contract. What is the annual number of miles required for Over-land to break even, assuming the company adds one truck and trailer?What is the expected annual increase in profitability from the FHP contract? (Use 52 weeks per year in your calculations.)

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here is my analysis and recommendation for the Overland Trucking and Freight case 1 Relevant and Irrelevant Costs Relevant Costs Variable operating co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started