Answered step by step

Verified Expert Solution

Question

1 Approved Answer

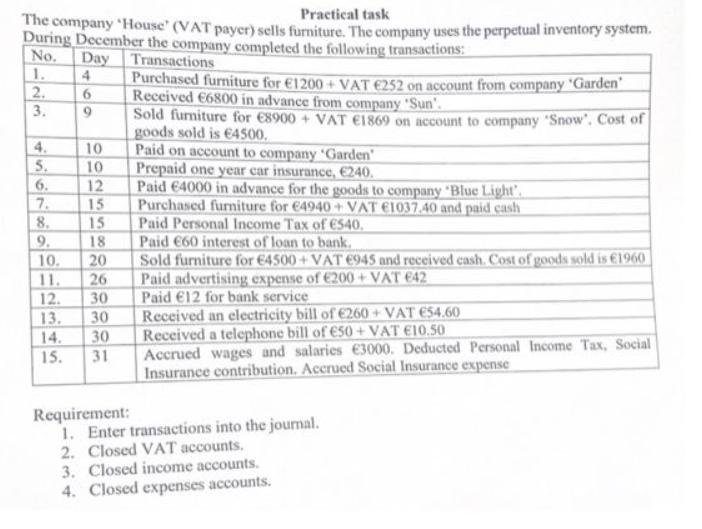

Complete the Requirements Practical task The company House' (VAT payer) sells furniture. The company uses the perpetual inventory system. During December the company completed the

Complete the Requirements

Practical task The company House' (VAT payer) sells furniture. The company uses the perpetual inventory system. During December the company completed the following transactions: No. Day Transactions 1. 4 2. 3. 4. 5. 6. 7. 8. 9. 6 9 10 10 12 15 15 18 10. 20 11. 26 12. 30 13. 30 14. 30 15. 31 Requirement: Purchased furniture for 1200 + VAT 252 on account from company 'Garden' Received 6800 in advance from company "Sun". Sold furniture for 8900 + VAT E1869 on account to company "Snow". Cost of goods sold is 4500. Paid on account to company 'Garden' Prepaid one year car insurance, 240. Paid 4000 in advance for the goods to company "Blue Light'. Purchased furniture for 4940+ VAT 1037.40 and paid cash Paid Personal Income Tax of 540. Paid 60 interest of loan to bank. Sold furniture for 4500+VAT 945 and received cash. Cost of goods sold is 1960 Paid advertising expense of 200 + VAT 42 Paid 12 for bank service Received an electricity bill of 260+VAT 54.60 Received a telephone bill of 50+VAT 10.50 Accrued wages and salaries 3000. Deducted Personal Income Tax, Social Insurance contribution. Accrued Social Insurance expense 1. Enter transactions into the journal. 2. Closed VAT accounts. 3. Closed income accounts. 4. Closed expenses accounts.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Enter transactions into the journal Accounting Date DebitCredit 1 2 Dec 1200 Furniture252 VAT 2 4 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started