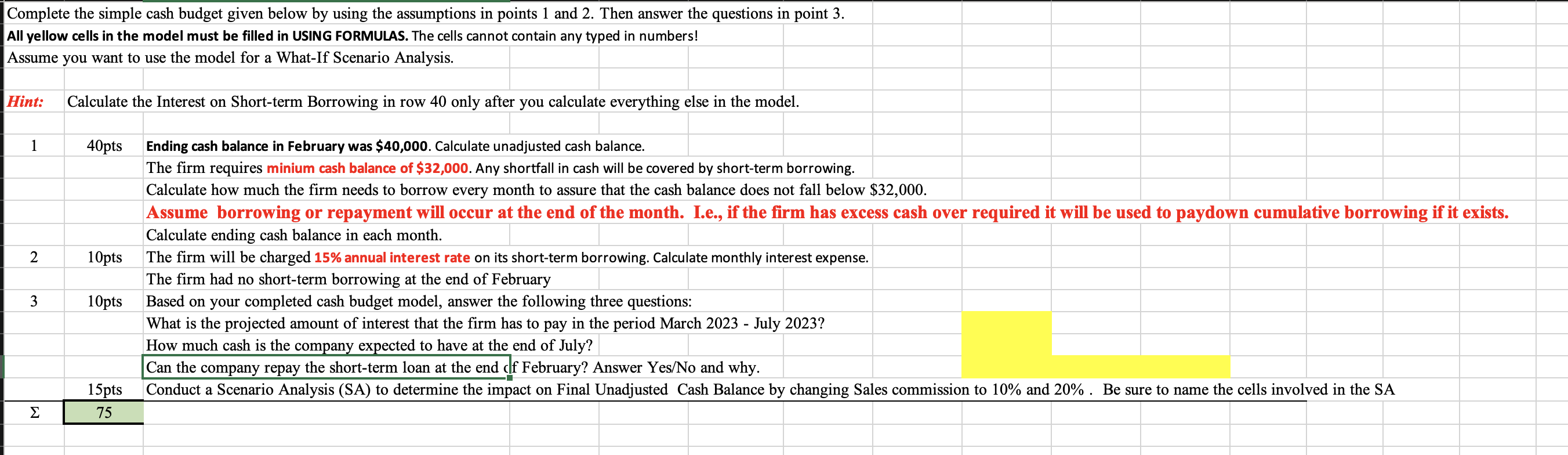

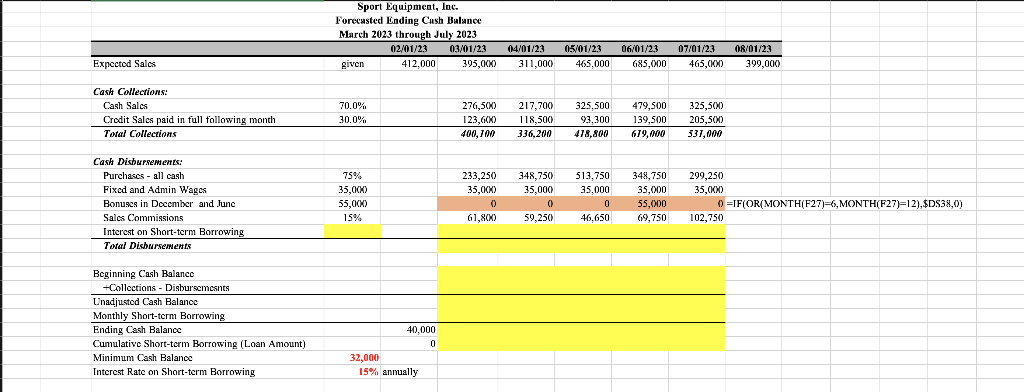

Complete the simple cash budget given below by using the assumptions in points 1 and 2 . Then answer the questions in point 3 . All yellow cells in the model must be filled in USING FORMULAS. The cells cannot contain any typed in numbers! Assume you want to use the model for a What-If Scenario Analysis. Hint: Calculate the Interest on Short-term Borrowing in row 40 only after you calculate everything else in the model. 1 40pts Ending cash balance in February was $$0,000. Calculate unadjusted cash balance. The firm requires minium cash balance of $32,000. Any shortfall in cash will be covered by short-term borrowing. Calculate how much the firm needs to borrow every month to assure that the cash balance does not fall below $32,000. Calculate ending cash balance in each month. The firm will be charged 15% annual interest rate on its short-term borrowing. Calculate monthly interest expense. The firm had no short-term borrowing at the end of February Based on your completed cash budget model, answer the following three questions: What is the projected amount of interest that the firm has to pay in the period March 2023 - July 2023? How much cash is the company expected to have at the end of July? Can the company repay the short-term loan at the end cf February? Answer Yes/No and why. \begin{tabular}{l|c|} \hline & 75 \\ \hline & \end{tabular} Sport Equipment, Inc. Forecasted Ending Cush Balance March 2023 through July 2023 \begin{tabular}{llr|r|r|r|r|r|r|} \hline & & 02/01/23 & 03/01/23 & 04/01/23 & 05/01/23 & 06/01/2,3 & 07/01/2,3 & 08/01/23 \\ \hline Expected Sales & given & 412,000 & 395,000 & 311,000 & 465,000 & 6,05,000 & 465,000 & 399,000 \\ \hline \end{tabular} Cash Collections: \begin{tabular}{l|r|r|r|r|r|r|r|} \hline Cash Sales & 70.0% & 276,500 & 217,700 & 325,500 & 479,500 & 325,500 \\ \hline Crodit Sales paid in full following month & 30.0% & 123,600 & 118,500 & 93,300 & 139,500 & 205,500 \\ \hline Total Collections & & 400,100 & 336,200 & 418,800 & 619,000 & 531,0000 \\ \hline \end{tabular} Cash Dishursements: Beginning Cash Balance +Collections - Disburs: Monthly Shott-term Borrowing Ending Cash Balanoc Cumulative Short-term Borrowing (Loan Amount) MinimumCashBalanceInterestRateonShort-termBorrowing32,00015%annually Complete the simple cash budget given below by using the assumptions in points 1 and 2 . Then answer the questions in point 3 . All yellow cells in the model must be filled in USING FORMULAS. The cells cannot contain any typed in numbers! Assume you want to use the model for a What-If Scenario Analysis. Hint: Calculate the Interest on Short-term Borrowing in row 40 only after you calculate everything else in the model. 1 40pts Ending cash balance in February was $$0,000. Calculate unadjusted cash balance. The firm requires minium cash balance of $32,000. Any shortfall in cash will be covered by short-term borrowing. Calculate how much the firm needs to borrow every month to assure that the cash balance does not fall below $32,000. Calculate ending cash balance in each month. The firm will be charged 15% annual interest rate on its short-term borrowing. Calculate monthly interest expense. The firm had no short-term borrowing at the end of February Based on your completed cash budget model, answer the following three questions: What is the projected amount of interest that the firm has to pay in the period March 2023 - July 2023? How much cash is the company expected to have at the end of July? Can the company repay the short-term loan at the end cf February? Answer Yes/No and why. \begin{tabular}{l|c|} \hline & 75 \\ \hline & \end{tabular} Sport Equipment, Inc. Forecasted Ending Cush Balance March 2023 through July 2023 \begin{tabular}{llr|r|r|r|r|r|r|} \hline & & 02/01/23 & 03/01/23 & 04/01/23 & 05/01/23 & 06/01/2,3 & 07/01/2,3 & 08/01/23 \\ \hline Expected Sales & given & 412,000 & 395,000 & 311,000 & 465,000 & 6,05,000 & 465,000 & 399,000 \\ \hline \end{tabular} Cash Collections: \begin{tabular}{l|r|r|r|r|r|r|r|} \hline Cash Sales & 70.0% & 276,500 & 217,700 & 325,500 & 479,500 & 325,500 \\ \hline Crodit Sales paid in full following month & 30.0% & 123,600 & 118,500 & 93,300 & 139,500 & 205,500 \\ \hline Total Collections & & 400,100 & 336,200 & 418,800 & 619,000 & 531,0000 \\ \hline \end{tabular} Cash Dishursements: Beginning Cash Balance +Collections - Disburs: Monthly Shott-term Borrowing Ending Cash Balanoc Cumulative Short-term Borrowing (Loan Amount) MinimumCashBalanceInterestRateonShort-termBorrowing32,00015%annually