Answered step by step

Verified Expert Solution

Question

1 Approved Answer

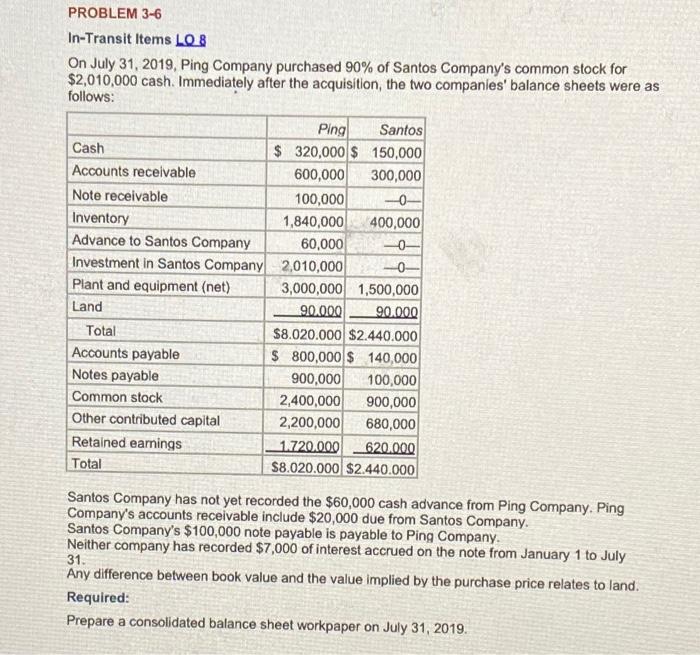

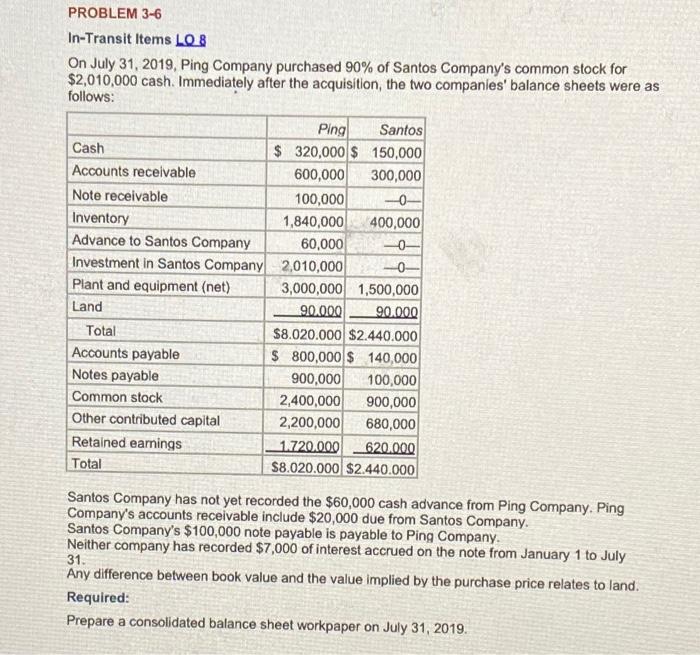

complete the table -0 PROBLEM 3-6 In-Transit Items LO 8 On July 31, 2019, Ping Company purchased 90% of Santos Company's common stock for $2,010,000

complete the table

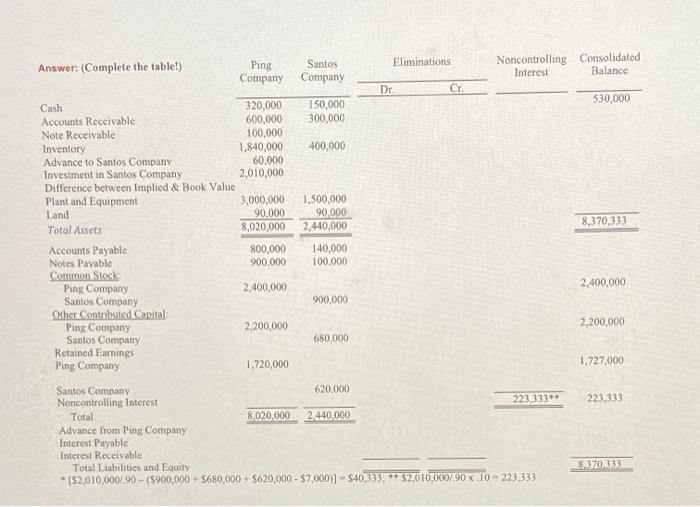

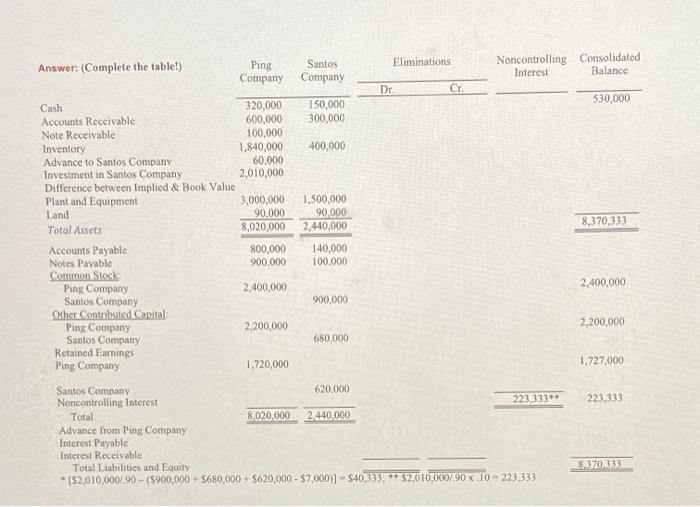

-0 PROBLEM 3-6 In-Transit Items LO 8 On July 31, 2019, Ping Company purchased 90% of Santos Company's common stock for $2,010,000 cash. Immediately after the acquisition, the two companies' balance sheets were as follows: Ping Santos Cash $ 320,000 $ 150,000 Accounts receivable 600,000 300,000 Note receivable 100,000 Inventory 1,840,000 400,000 Advance to Santos Company 60,000 0 Investment in Santos Company 2,010,000 0 Plant and equipment (net) 3,000,000 1,500,000 Land 90.000 90.000 Total $8.020.000 $2.440.000 Accounts payable $ 800,000 $ 140,000 Notes payable 900,000 100,000 Common stock 2,400,000 900,000 Other contributed capital 2,200,000 680,000 Retained earnings 1720.000 620.000 Total $8.020.000 $2.440.000 Santos Company has not yet recorded the $60,000 cash advance from Ping Company. Ping Company's accounts receivable include $20,000 due from Santos Company. Santos Company's $100,000 note payable is payable to Ping Company. Neither company has recorded $7,000 of interest accrued on the note from January 1 to July Any difference between book value and the value implied by the purchase price relates to land. Required: Prepare a consolidated balance sheet workpaper on July 31, 2019. 31. Answer: (Complete the table!) Ping Santos Eliminations Noncontrolling Consolidated Interest Balance Company Company Dr. Cr, Cash 320,000 150,000 530,000 Accounts Receivable 600,000 300,000 Note Receivable 100,000 Inventory 1.840,000 400,000 Advance to Santos Company 60,000 Investment in Santos Company 2,010,000 Difference between Implied & Book Value Plant and Equipment 3,000,000 1,500,000 Land 90,000 90,000 Total Assets 8,020,000 2,440,000 8,370,333 Accounts Payable 800,000 140,000 Notes Payable 900.000 100,000 Common Stock Ping Company 2,400,000 2,400,000 Santos Company 900,000 Other Contributed Capital Ping Company 2,200,000 2,200,000 Santos Company 680,000 Retained Earnings Ping Company 1.720,000 1,727,000 Santos Company 620.000 Noncontrolling Interest 223333 223,333 Total 8,020,000 2,440,000 Advance from Ping Company Interest Payable Interest Receivable Total Liabilities and Equity 8.3702333 * 152,010,000/90 - (5900,000 - 5680,000 + 5620,000 - $7,000)) - $40,333 ** 52,010,000/.90 X 10 - 223,333

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started