Answered step by step

Verified Expert Solution

Question

1 Approved Answer

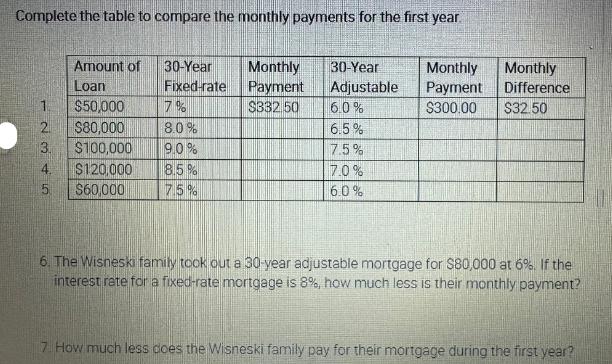

Complete the table to compare the monthly payments for the first year. Amount of 30-Year Monthly 30-Year Loan Fixed-rate Payment 1 $50,000 7% $332

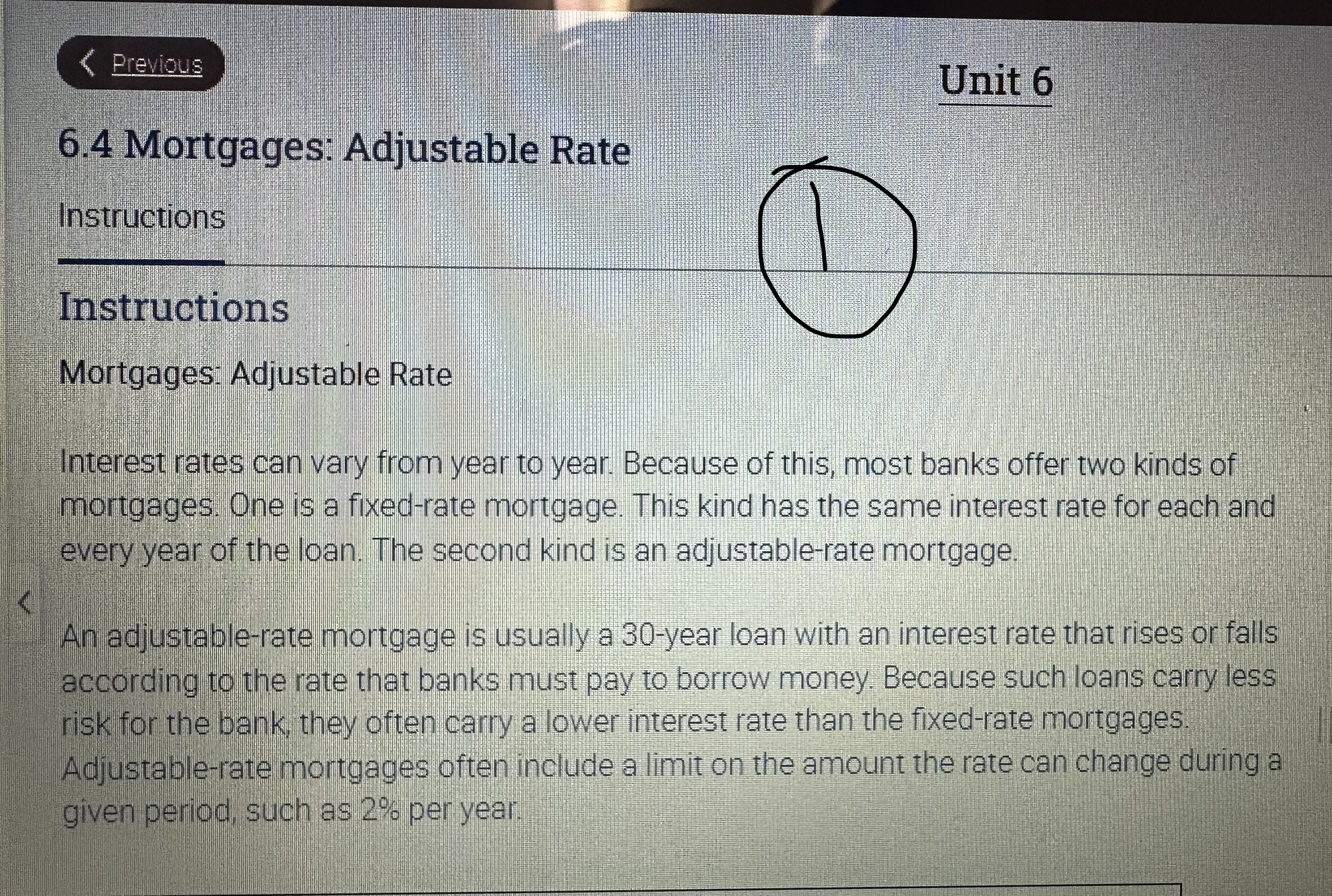

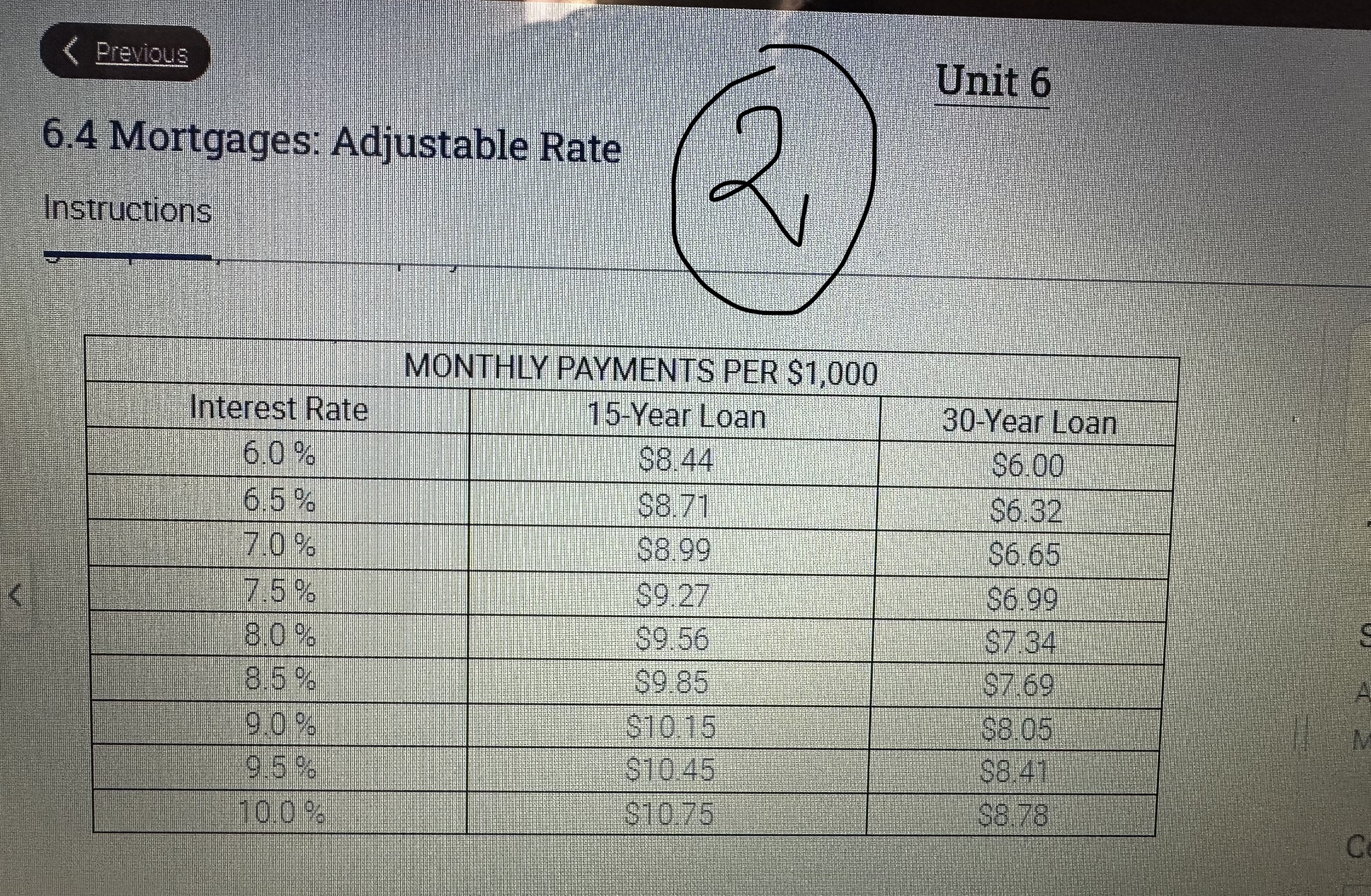

Complete the table to compare the monthly payments for the first year. Amount of 30-Year Monthly 30-Year Loan Fixed-rate Payment 1 $50,000 7% $332 50 6.0% Monthly Monthly Adjustable Payment Difference $300.00 $32.50 2 $80,000 8.0% 6.5% 3. $100,000 9.0% 7.5% 4. $120,000 8.5% 7.0% 5 LO $60,000 7.5% 6.0% 6. The Wisneski family took out a 30-year adjustable mortgage for $80,000 at 6%. If the interest rate for a fixed-rate mortgage is 8%, how much less is their monthly payment? 7. How much less does the Wisneski family pay for their mortgage during the first year? < Previous 6.4 Mortgages: Adjustable Rate Instructions Instructions Mortgages: Adjustable Rate Unit 6 Interest rates can vary from year to year. Because of this, most banks offer two kinds of mortgages. One is a fixed-rate mortgage. This kind has the same interest rate for each and every year of the loan. The second kind is an adjustable-rate mortgage. An adjustable-rate mortgage is usually a 30-year loan with an interest rate that rises or falls according to the rate that banks must pay to borrow money. Because such loans carry less risk for the bank, they often carry a lower interest rate than the fixed-rate mortgages. Adjustable-rate mortgages often include a limit on the amount the rate can change during a given period, such as 2% per year. < Previous 6.4 Mortgages: Adjustable Rate Instructions 2 Unit 6 MONTHLY PAYMENTS PER $1,000 Interest Rate 15-Year Loan 30-Year Loan 6.0% $8.44 $6.00 6.5 % $8.71 $6.32 7.0% $8.99 $6.65 7.5% $9.27 $6.99 80% $9.56 $7.34 8.5 % $9.85 $7.69 9.0% $10.15 $8.05 M 9.5% $10.45 $8.41 10.0 % $10.75 $8.78 C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started