Answered step by step

Verified Expert Solution

Question

1 Approved Answer

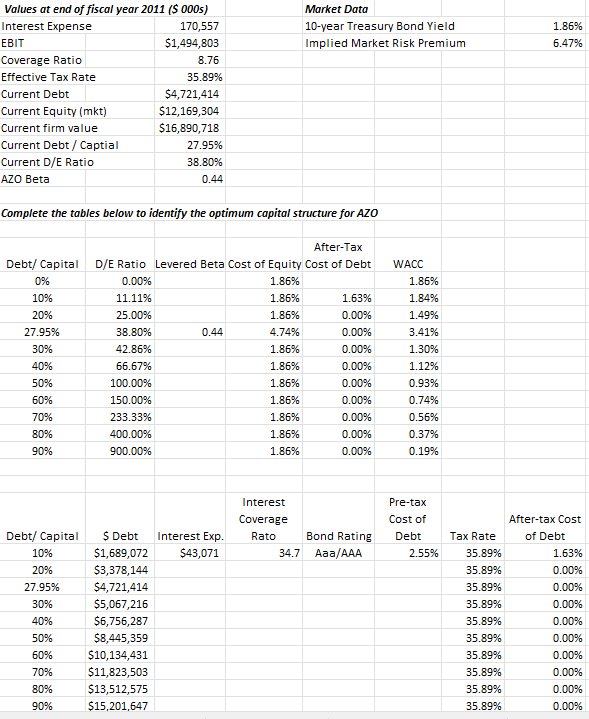

Complete the tables below to identify the optimum capital structure for AZO Cost of Debt for Bond Ratings and Coverage Ratios Schedule of defualt risk

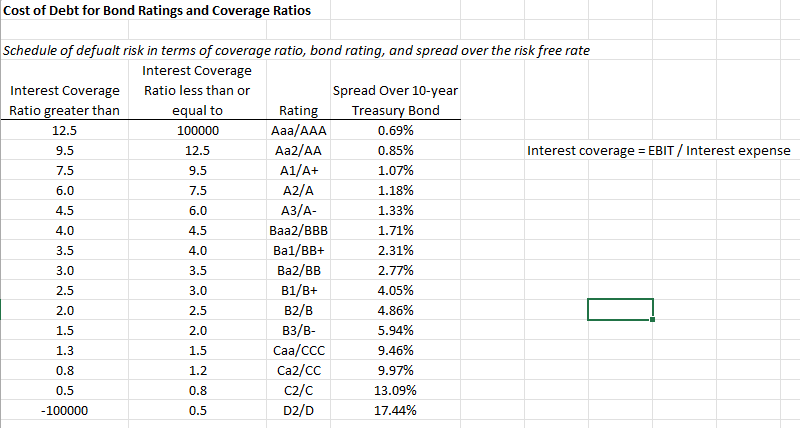

Complete the tables below to identify the optimum capital structure for AZO Cost of Debt for Bond Ratings and Coverage Ratios Schedule of defualt risk in terms of coverage ratio, bond rating, and spread over the risk free rate \begin{tabular}{|c|c|c|c|c|c|} \hline \begin{tabular}{l} Interest Coverage \\ Ratio greater than \end{tabular} & \begin{tabular}{c} Interest Coverage \\ Ratio less than or \\ equal to \end{tabular} & Rating & \begin{tabular}{c} Spread Over 10-year \\ Treasury Bond \\ \end{tabular} & & \\ \hline 12.5 & 100000 & Aaa/AAA & 0.69% & & \\ \hline 9.5 & 12.5 & Aa2/AA & 0.85% & \multicolumn{2}{|c|}{ Interest coverage = EBIT / Interest expense } \\ \hline 7.5 & 9.5 & A1/A+ & 1.07% & & \\ \hline 6.0 & 7.5 & A2/A & 1.18% & & \\ \hline 4.5 & 6.0 & A3/A- & 1.33% & & \\ \hline 4.0 & 4.5 & Baa2/BBB & 1.71% & & \\ \hline 3.5 & 4.0 & Ba1/BB+ & 2.31% & & \\ \hline 3.0 & 3.5 & Ba2/BB & 2.77% & & \\ \hline 2.5 & 3.0 & B1/B+ & 4.05% & & \\ \hline 2.0 & 2.5 & B2/B & 4.86% & & \\ \hline 1.5 & 2.0 & B3/B- & 5.94% & & \\ \hline 1.3 & 1.5 & Caa/CCC & 9.46% & & \\ \hline 0.8 & 1.2 & Ca2/CC & 9.97% & & \\ \hline 0.5 & 0.8 & C2/C & 13.09% & & \\ \hline-100000 & 0.5 & D2/D & 17.44% & & \\ \hline \end{tabular}

Complete the tables below to identify the optimum capital structure for AZO Cost of Debt for Bond Ratings and Coverage Ratios Schedule of defualt risk in terms of coverage ratio, bond rating, and spread over the risk free rate \begin{tabular}{|c|c|c|c|c|c|} \hline \begin{tabular}{l} Interest Coverage \\ Ratio greater than \end{tabular} & \begin{tabular}{c} Interest Coverage \\ Ratio less than or \\ equal to \end{tabular} & Rating & \begin{tabular}{c} Spread Over 10-year \\ Treasury Bond \\ \end{tabular} & & \\ \hline 12.5 & 100000 & Aaa/AAA & 0.69% & & \\ \hline 9.5 & 12.5 & Aa2/AA & 0.85% & \multicolumn{2}{|c|}{ Interest coverage = EBIT / Interest expense } \\ \hline 7.5 & 9.5 & A1/A+ & 1.07% & & \\ \hline 6.0 & 7.5 & A2/A & 1.18% & & \\ \hline 4.5 & 6.0 & A3/A- & 1.33% & & \\ \hline 4.0 & 4.5 & Baa2/BBB & 1.71% & & \\ \hline 3.5 & 4.0 & Ba1/BB+ & 2.31% & & \\ \hline 3.0 & 3.5 & Ba2/BB & 2.77% & & \\ \hline 2.5 & 3.0 & B1/B+ & 4.05% & & \\ \hline 2.0 & 2.5 & B2/B & 4.86% & & \\ \hline 1.5 & 2.0 & B3/B- & 5.94% & & \\ \hline 1.3 & 1.5 & Caa/CCC & 9.46% & & \\ \hline 0.8 & 1.2 & Ca2/CC & 9.97% & & \\ \hline 0.5 & 0.8 & C2/C & 13.09% & & \\ \hline-100000 & 0.5 & D2/D & 17.44% & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started