Answered step by step

Verified Expert Solution

Question

1 Approved Answer

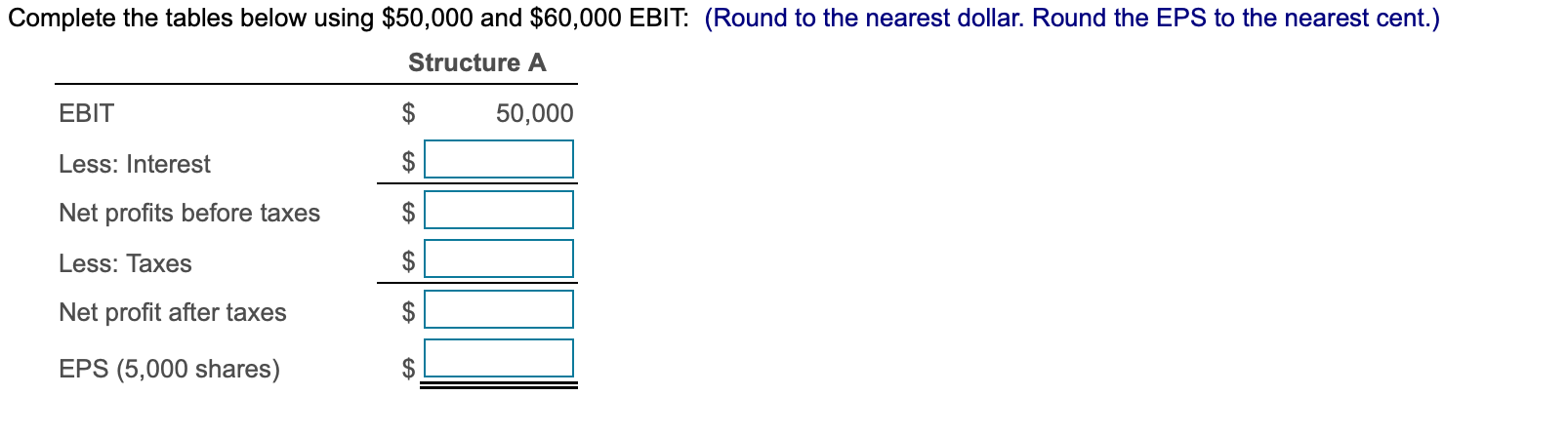

Complete the tables below using $50,000 and $60,000 EBIT: (Round to the nearest dollar. Round the EPS to the nearest cent.) Structure A EBIT

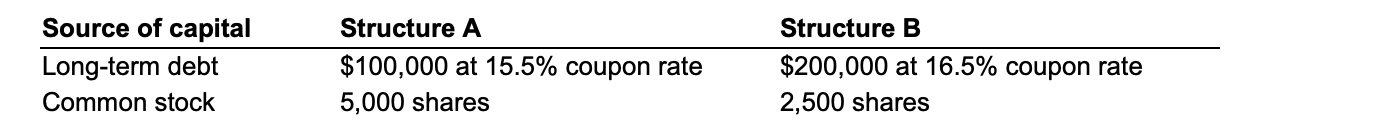

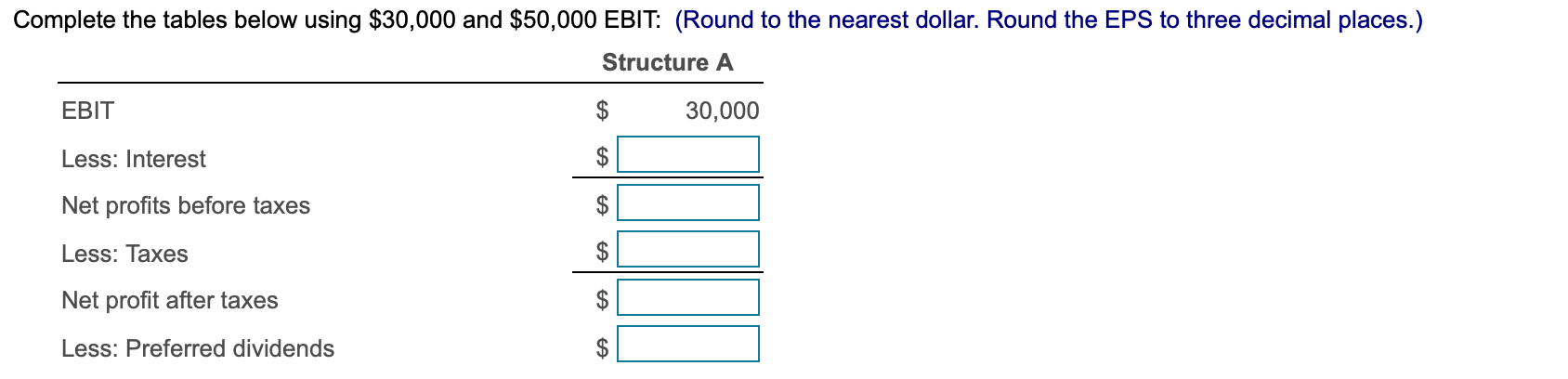

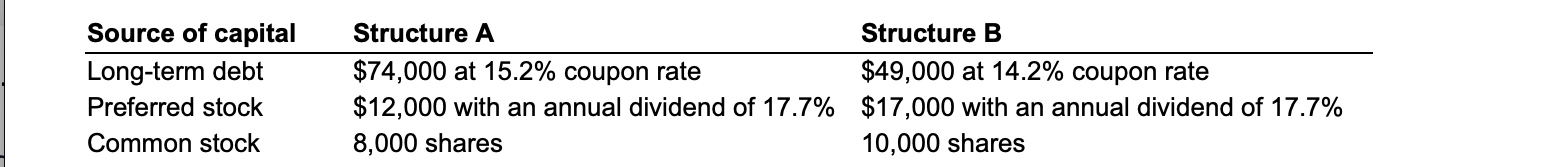

Complete the tables below using $50,000 and $60,000 EBIT: (Round to the nearest dollar. Round the EPS to the nearest cent.) Structure A EBIT Less: Interest Net profits before taxes Less: Taxes Net profit after taxes EPS (5,000 shares) $ $ $ GA $ GA SA 50,000 Source of capital Long-term debt Common stock Structure A $100,000 at 15.5% coupon rate 5,000 shares Structure B $200,000 at 16.5% coupon rate 2,500 shares Complete the tables below using $30,000 and $50,000 EBIT: (Round to the nearest dollar. Round the EPS to three decimal places.) Structure A EBIT Less: Interest Net profits before taxes Less: Taxes Net profit after taxes Less: Preferred dividends $ GA $ $ $ 30,000 Source of capital Long-term debt Preferred stock Common stock Structure A Structure B $74,000 at 15.2% coupon rate $49,000 at 14.2% coupon rate $12,000 with an annual dividend of 17.7% $17,000 with an annual dividend of 17.7% 8,000 shares 10,000 shares

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Structure A EBIT 50000 Less Interest 15500 Net profits before taxes 34500 Less Taxes Tax calculation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started