Question: Complete these questions with complete working and formulas. Strictly no excel or financial calculators! QUESTION 2 There are two assets and three states of the

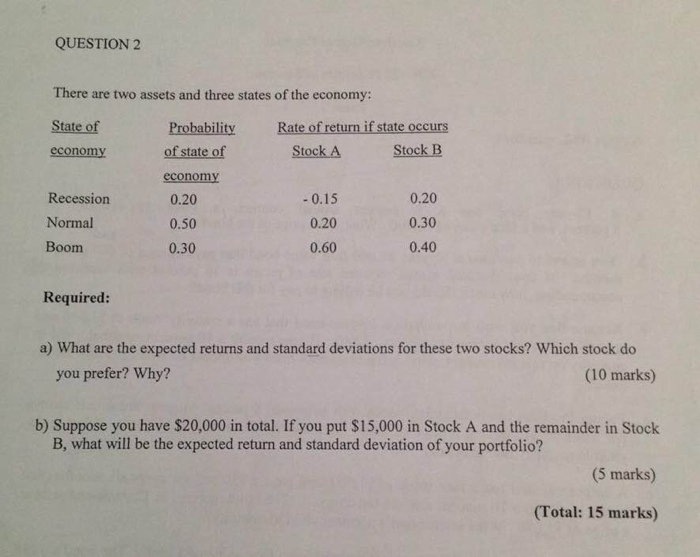

QUESTION 2 There are two assets and three states of the economy: State of economy Probability of state of economy Rate of return if state occurs Stock B Stock A Recession Normal Boom 0.20 0.50 0.30 -0.15 0.20 0.60 0.20 0.30 0.40 Required: a) What are the expected returns and standard deviations for these two stocks? Which stock do (10 marks) b) Suppose you have $20,000 in total. If you put $15,000 in Stock A and the remainder in Stock (5 marks) (Total: 15 marks) you prefer? Why? B, what will be the expected return and standard deviation of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts