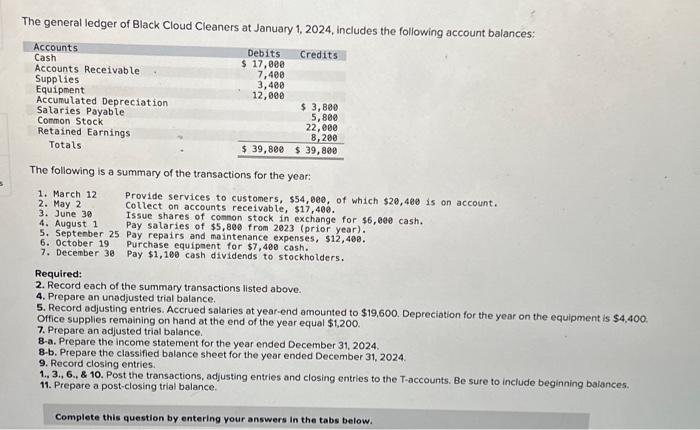

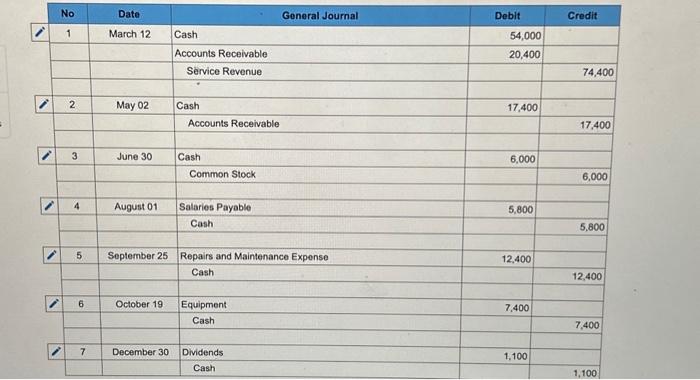

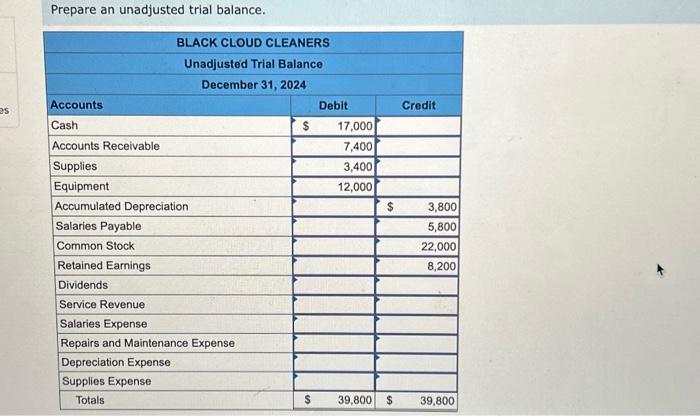

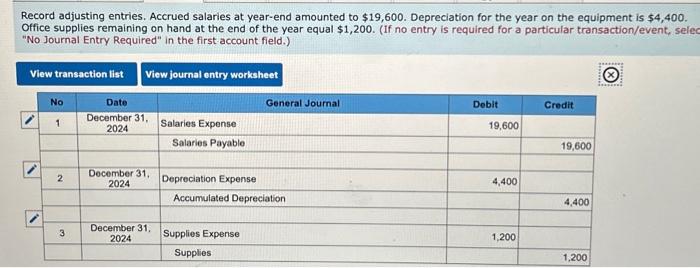

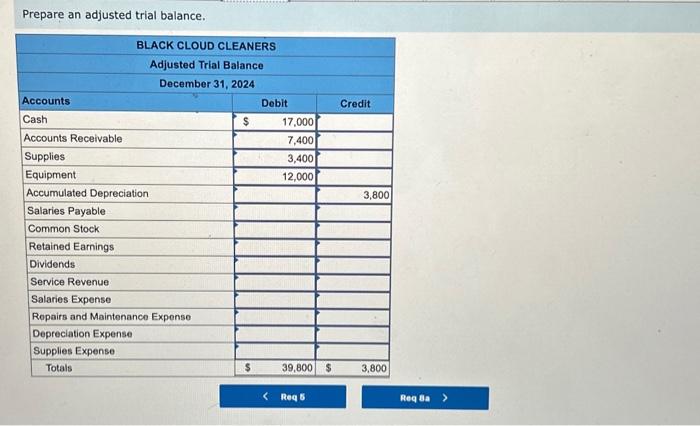

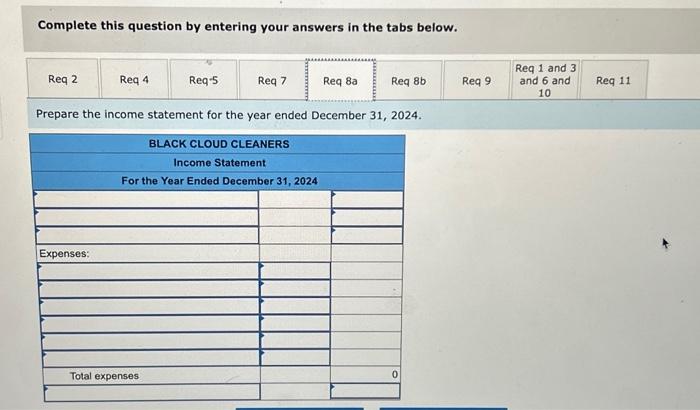

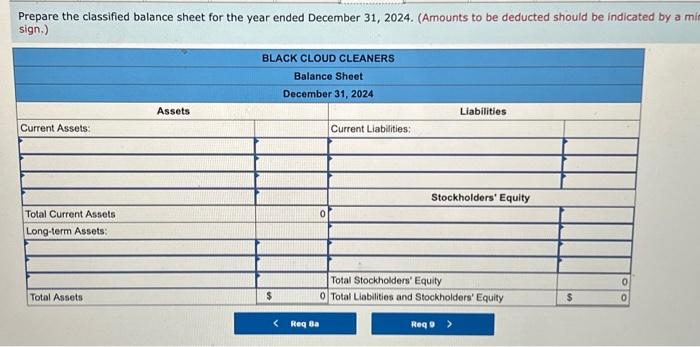

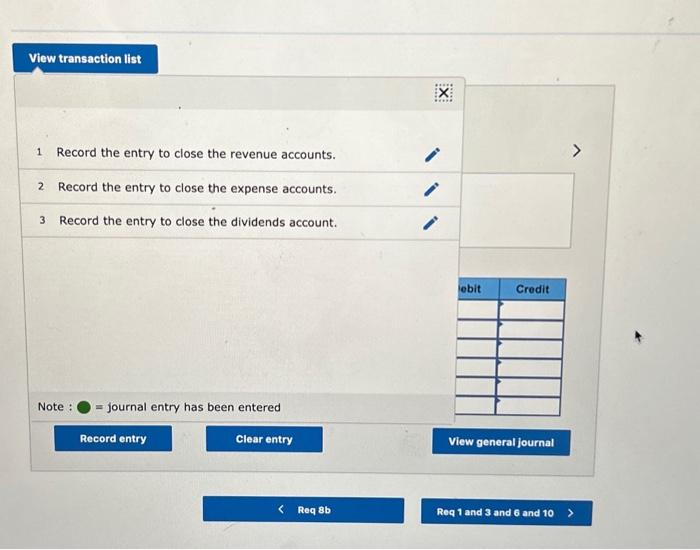

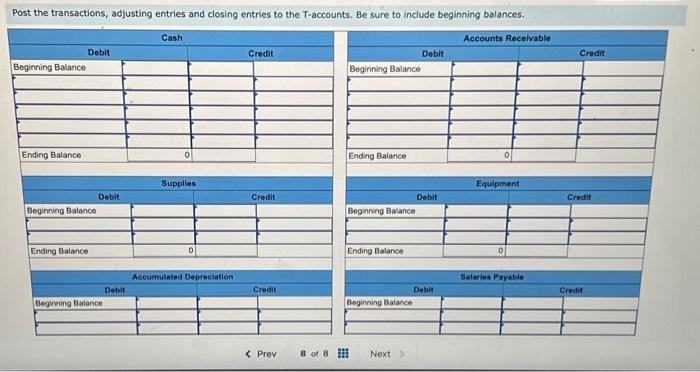

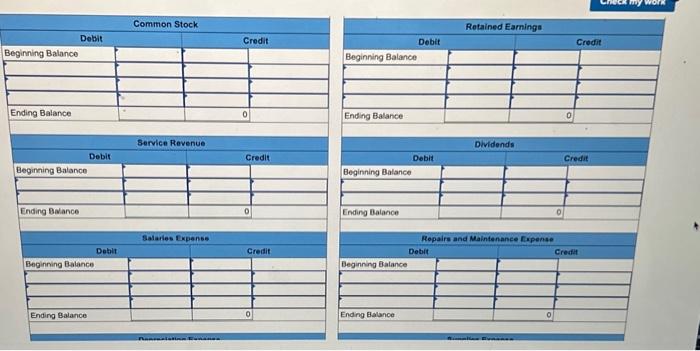

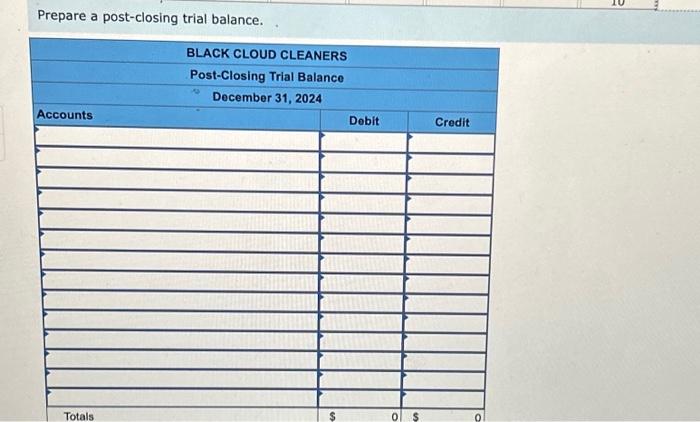

Complete this question by entering your answers in the tabs below. Prepare the income statement for the year ended December 31, 2024. \begin{tabular}{|c|c|c|c|c|c|} \hline & No & Date & Goneral Journal & Debit & Credit \\ \hline \multirow[t]{4}{*}{i} & 1 & March 12 & Cash & 54,000 & \\ \hline & & & Accounts Receivable & 20,400 & \\ \hline & & & Service Revenue & & 74,400 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{i} & 2 & May 02 & Cash & 17,400 & + \\ \hline & & & Accounts Receivable & & 17,400 \\ \hline \multirow[t]{2}{*}{1} & 3 & June 30 & Cash & 6,000 & \\ \hline & & & Common Stock & & 6,000 \\ \hline \multirow[t]{2}{*}{7} & 4 & August 01 & Salaries Payable & 5,800 & \\ \hline & & & Cash & & 5,800 \\ \hline \multirow[t]{3}{*}{} & 5 & September 25 & Repairs and Maintenance Expense & 12,400 & \\ \hline & & & Cash & & 12,400 \\ \hline & & & & & \\ \hline & 6 & October 19 & Equipment & 7,400 & \\ \hline & & & Cash & & 7,400 \\ \hline & & & & & \\ \hline & 7 & December 30 & Dividends & 1,100 & \\ \hline & & & Cash & & 1,100 \\ \hline \end{tabular} Prepare a post-closing trial balance. Record adjusting entries. Accrued salaries at year-end amounted to $19,600. Depreciation for the year on the equipment is $4,400. Office supplies remaining on hand at the end of the year equal $1,200. (If no entry is required for a particular transaction/event, selec "No Journal Entry Required" in the first-account field.) Prepare an adjusted trial balance. Repairs and Maintenance Frpense 1 Record the entry to close the revenue accounts. 2 Record the entry to close the expense accounts. 3 Record the entry to close the dividends account. Note : = = journal entry has been entered Prepare the classified balance sheet for the year ended December 31, 2024. (Amounts to be deducted should be indicated by a sign The general ledger of Black Cloud Cleaners at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. March 12 2. May 2 3. June 38 4. August 1 5. Septenber 25 6. October 19 7. December 36 Provide services to custoners, $54,000, of which $20,400 is on account. Collect on accounts receivable, $17,400. Issue shares of comnon stock in exchange for $6,000 cash. Pay salaries of $5,800 from 2023 (prior year). Pay repairs and maintenance expenses, $12,460. Purchase equipaent for $7,480 cash. pay $1,100 cash dividends to stockholders. Required: 2. Record each of the summary transactions listed above. 4. Prepare an unadjusted trial balance. 5. Record adjusting entries. Accrued salaries at year-end amounted to $19,600. Depreciation for the year on the equipment is $4,400 Office supplies remaining on hand at the end of the year equal $1,200. 7. Prepare an adjusted trial balance. 8-a. Prepare the income statement for the year ended December 31, 2024. 8.b. Prepare the classified balance sheet for the year ended December 31,2024. 9. Record closing entries. 1., 3., 6., \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. 11. Prepare a post-closing trial balance. Post the transactions; adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. Prepare an unadjusted trial balance