Answered step by step

Verified Expert Solution

Question

1 Approved Answer

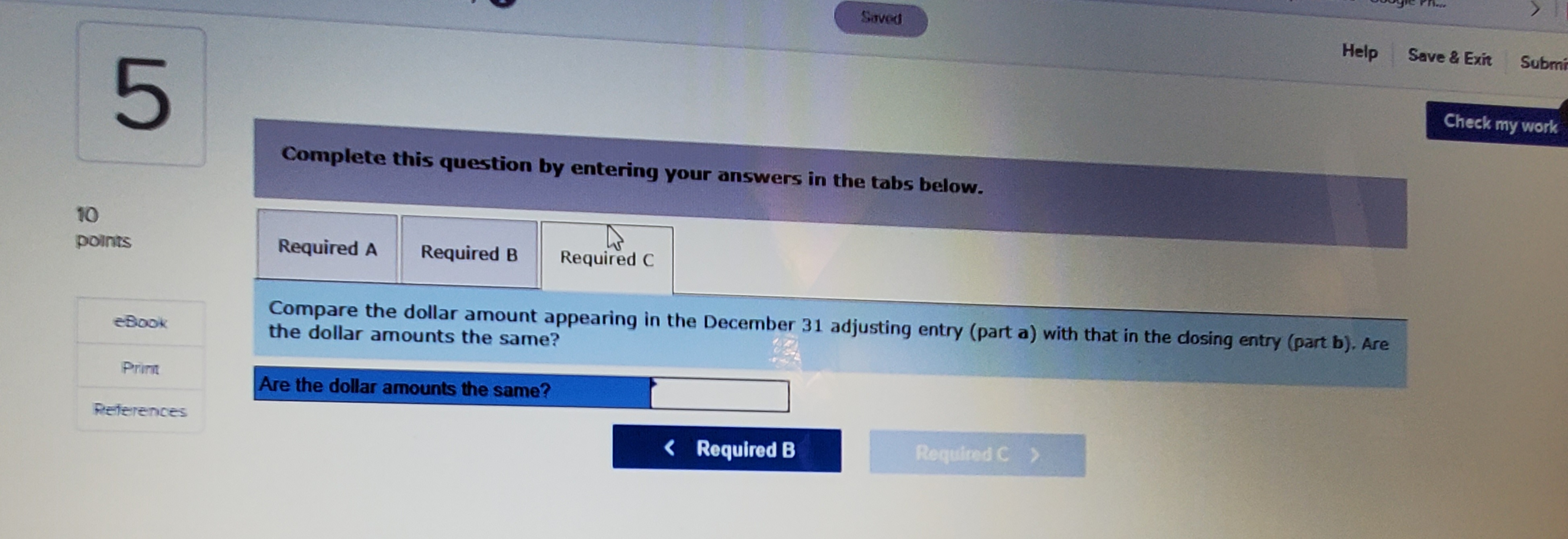

Complete this question by entering your answers in the tabs below. Compare the dollar amount appearing in the December 31 adjusting entry (part a) with

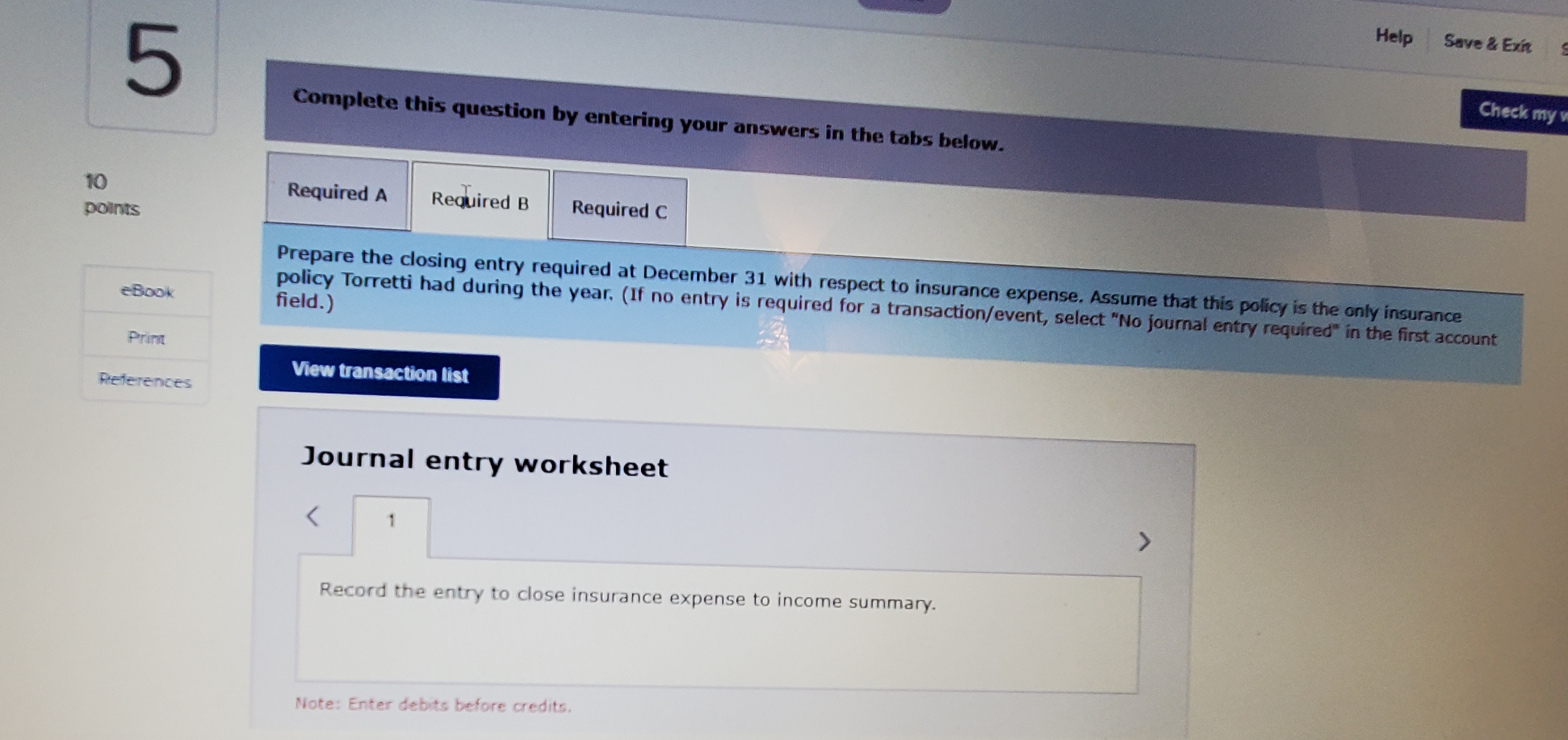

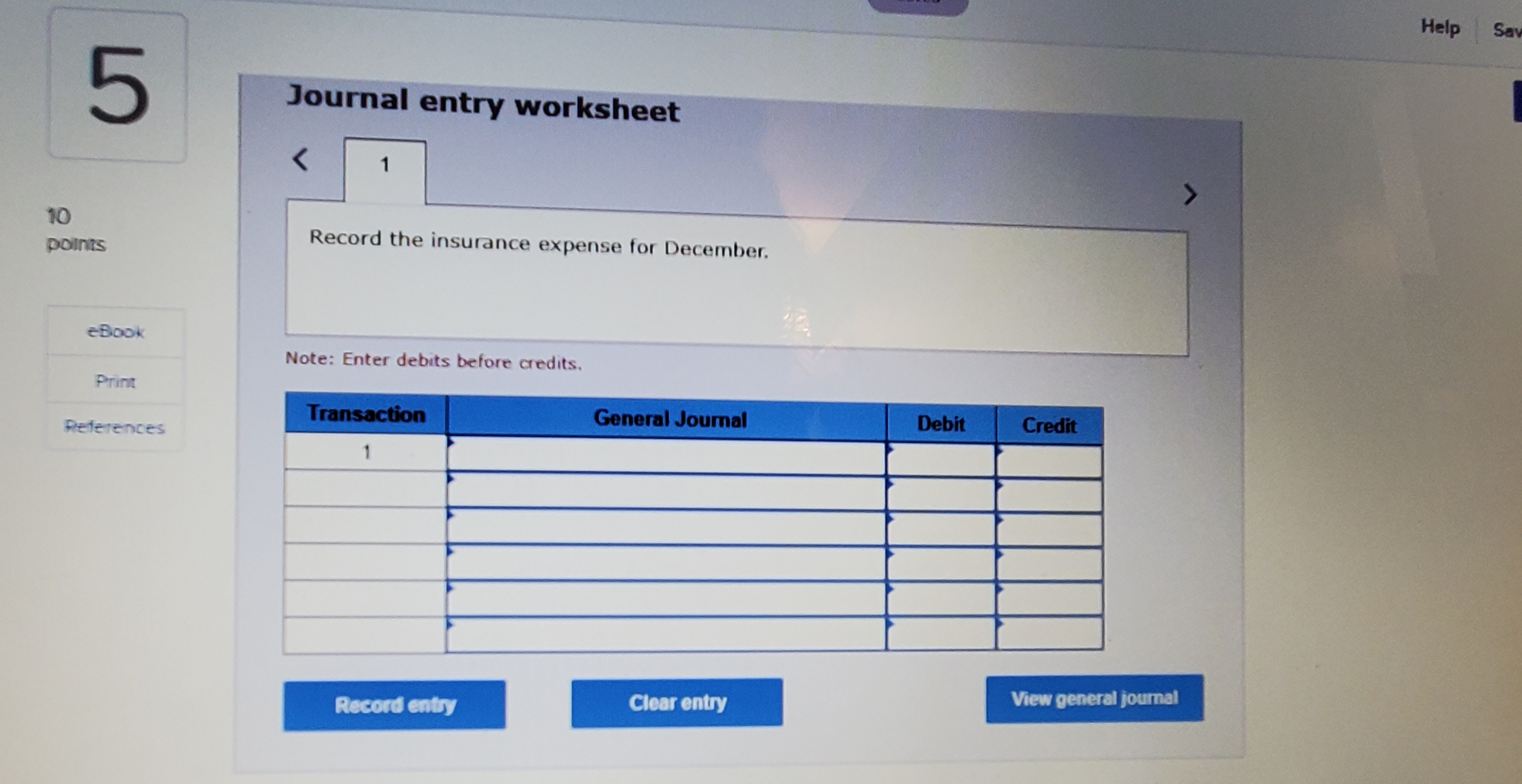

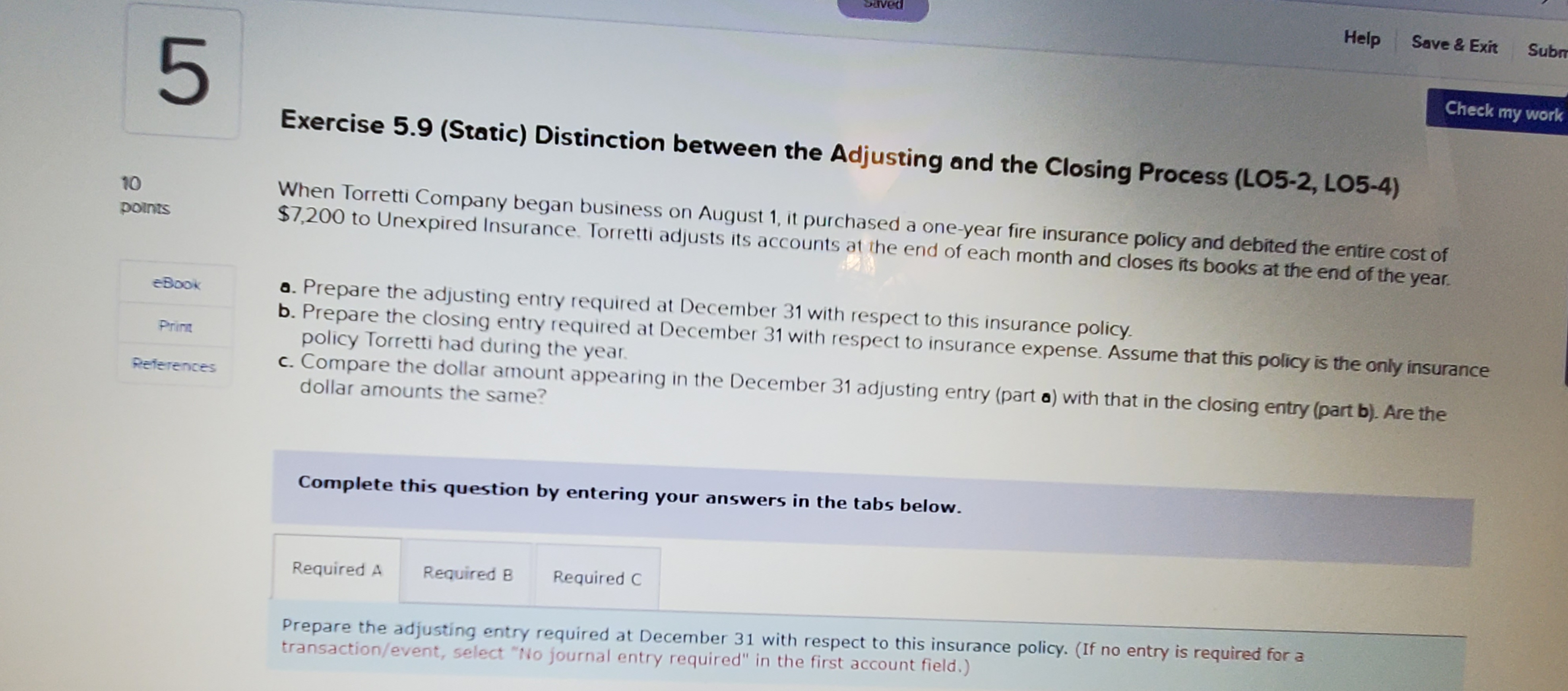

Complete this question by entering your answers in the tabs below. Compare the dollar amount appearing in the December 31 adjusting entry (part a) with that in the dosing entry (part b). Are the dollar amounts the same? Complete this question by entering your answers in the tabs below. Prepare the closing entry required at December 31 with respect to insurance expense. Assume that this policy is the only insurance policy Torretti had during the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) field.) Journal entry worksheet Record the entry to close insurance expense to income summary. Note: Enter debits before credits. Journal entry worksheet Record the insurance expense for December. Note: Enter debits before credits. Exercise 5.9 (Static) Distinction between the Adjusting and the Closing Process (LO5-2, LO5-4) When Torretti Company began business on August 1, it purchased a one-year fire insurance policy and debited the entire cost of $7,200 to Unexpired Insurance. Torretti adjusts its accounts at the end of each month and closes its books at the end of the year. - Prepare the adjusting entry required at December 31 with respect to this insurance policy. b. Prepare the closing entry required at December 31 with respect to insurance expense. Assume that this policy is the only insurance policy Torretti had during the year. c. Compare the dollar amount appearing in the December 31 adjusting entry (part a) with that in the closing entry (part b). Are the dollar amounts the same? Complete this question by entering your answers in the tabs below. Prepare the adjusting entry required at December 31 with respect to this insurance policy. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Complete this question by entering your answers in the tabs below. Compare the dollar amount appearing in the December 31 adjusting entry (part a) with that in the dosing entry (part b). Are the dollar amounts the same? Complete this question by entering your answers in the tabs below. Prepare the closing entry required at December 31 with respect to insurance expense. Assume that this policy is the only insurance policy Torretti had during the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) field.) Journal entry worksheet Record the entry to close insurance expense to income summary. Note: Enter debits before credits. Journal entry worksheet Record the insurance expense for December. Note: Enter debits before credits. Exercise 5.9 (Static) Distinction between the Adjusting and the Closing Process (LO5-2, LO5-4) When Torretti Company began business on August 1, it purchased a one-year fire insurance policy and debited the entire cost of $7,200 to Unexpired Insurance. Torretti adjusts its accounts at the end of each month and closes its books at the end of the year. - Prepare the adjusting entry required at December 31 with respect to this insurance policy. b. Prepare the closing entry required at December 31 with respect to insurance expense. Assume that this policy is the only insurance policy Torretti had during the year. c. Compare the dollar amount appearing in the December 31 adjusting entry (part a) with that in the closing entry (part b). Are the dollar amounts the same? Complete this question by entering your answers in the tabs below. Prepare the adjusting entry required at December 31 with respect to this insurance policy. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started