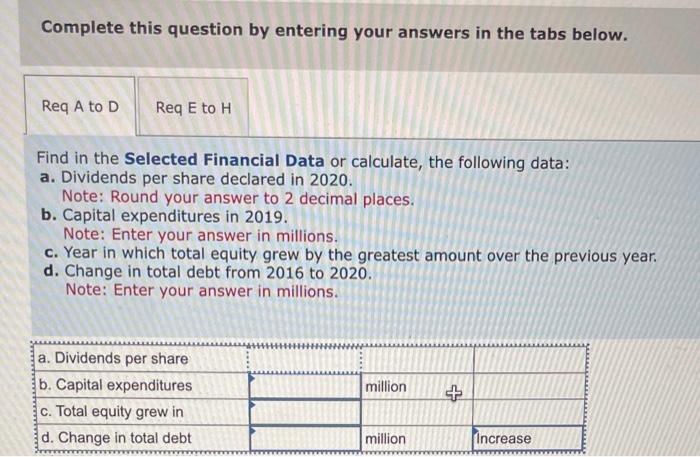

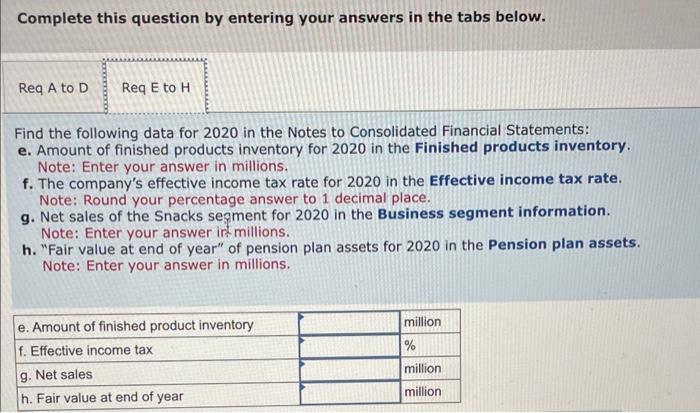

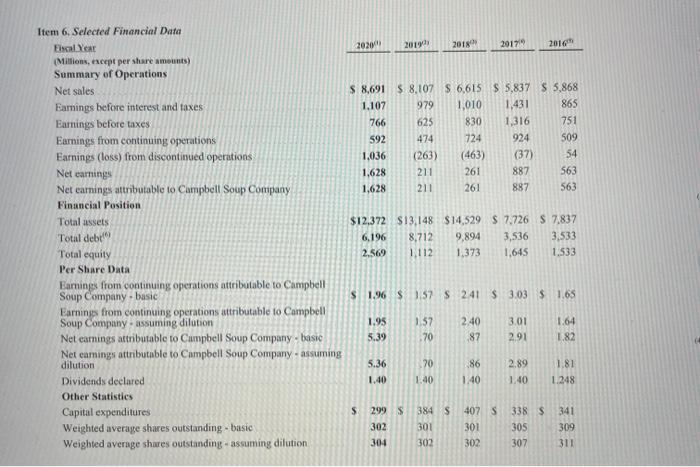

Complete this question by entering your answers in the tabs below. Find in the Selected Financial Data or calculate, the following data: a. Dividends per share declared in 2020. Note: Round your answer to 2 decimal places. b. Capital expenditures in 2019 . Note: Enter your answer in millions. c. Year in which total equity grew by the greatest amount over the previous year. d. Change in total debt from 2016 to 2020. Note: Enter your answer in millions. Complete this question by entering your answers in the tabs below. Find the following data for 2020 in the Notes to Consolidated Financial Statements: e. Amount of finished products inventory for 2020 in the Finished products inventory. Note: Enter your answer in millions. f. The company's effective income tax rate for 2020 in the Effective income tax rate. Note: Round your percentage answer to 1 decimal place. g. Net sales of the Snacks segment for 2020 in the Business segment information. Note: Enter your answer irt millions. h. "Fair value at end of year" of pension plan assets for 2020 in the Pension plan assets. Note: Enter your answer in millions. Item 6, Selected Financial Data Eincal Yeat 20209112019212018129176201601 (Millions, escept per shure ameunts) Summary of Operations Net sales Eamings before interest and taxes Earnings before taxes Earnings from continuing operations Earnings (loss) from discontinued operations Net earnings Net earnings attrbutable to Campbell Soup Company \begin{tabular}{|rrrrrr|r|} $8,691 & 5,8,107 & $ & 6,615 & 5 & 5,837 & 5,868 \\ 1,107 & 979 & 1,010 & 1,431 & 865 \\ 766 & 625 & 830 & 1,316 & 751 \\ 592 & 474 & 724 & 924 & 509 \\ 1,036 & (263) & (463) & (37) & 54 \\ 1,628 & 211 & 261 & 887 & 563 \\ 1,628 & 211 & 261 & 887 & 563 \end{tabular} Financial Position Total assets Total debt 6) Total equity Per Share Data Earmungs from continuing operations attributable to Campbell Soup Company - basic Earminys from continuing operations attributable to Campbell Soup Company - assuming dilution Net carnings astributable to Campbell Soup Company - basic Net camings attributable to Campbell Soup Company - assuming dilution Dividends declared Other Statistics Capital expenditures Weighted average shares outstanding - basic 21 The following is a reconciliation of the effective income tax rate on continuing operations to the U.S. federal statutory income tax rate: (1) The Tax Cuts and Jobs Act of 2017 (the Act) was enacted into law on December 22, 2017, and made significant changes to corporate taxation. Changes under the Act included: - Reducing the federal corporate tax rate from 35% to 21% effective January 1, 2018, A blended rate applied for fiscal 2018 non-calendar year end companies for the fiscal periods that included the effective date of the rate change. The impact of this is shown as "Effect of higher U.S. federal statutory tax rate;" - Repealing the exception for deductibility of performance-based compensation to covered employees, which impacted us beginning in 2019, along with expanding the number of covered employees, - Transitioning to a territorial system for taxation on foreign earnings along with the imposition of a transition tax in 2018 on the deemed repatriation of unremitted foreign earnings; - Immediate expensing of machinery and equipment placed into service after September 27, 2017; - Eliminating the deduction for domestic manufacturing activities, which impacted us beginning in 2019; - Changes to the taxation of multinational companies, including a new minimum tax on Global Intangible Low-Taxed Income, a new Base Erosion Anti-Abuse Tax, and a new U.S. corporate deduction for Foreign-Derived Intangible Income, all of which were effective for us beginning in 2019 ; and - Limiting the deductibility of interest expense to 30% of adjusted taxable income, which was effective for us beginning in 2019. As a result of the Act, we recognized a benefit of $179 in 2018 on the remeasurement of deferred tax assets and liabilities and expenses of $2 in 2019 and $53 in 2018 on the transition tax on unremitted foreign eamings. Net sales Meals \& Beverages Snacks Corporate Total Earnings before interest and taxes Meals \& Beverages Snacks Corporate (1) Restructuring charges (2) Total \begin{tabular}{rrrrr} \multicolumn{2}{c}{2020} & & 2019 \\ \hline \end{tabular} Depreciation and amortization Meals \& Beverages Snacks Corporate (3) Discontinued operations (4) Total Capital expenditures Meals \& Beverages Snacks Corporate (3) Discontinued operations Total benents was due to amortization in 2020 . The following table provides information for pension plans with accumulated benefit obligations in excess of plan assets