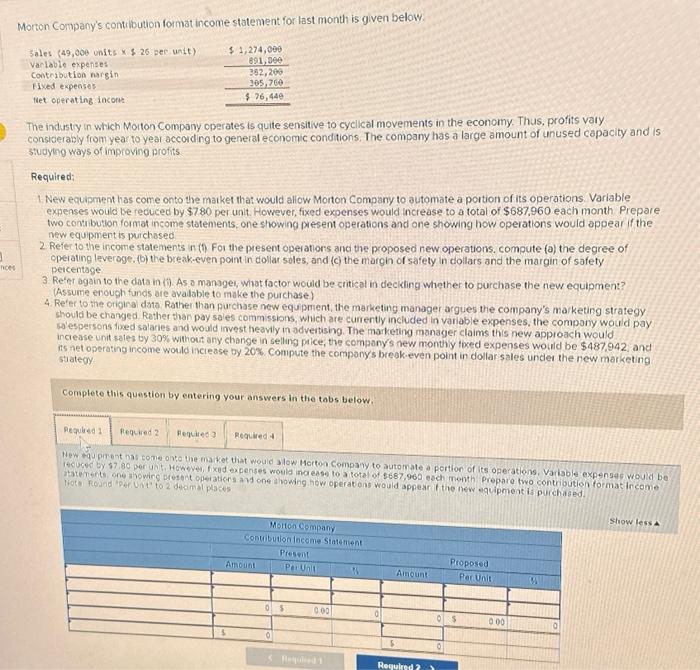

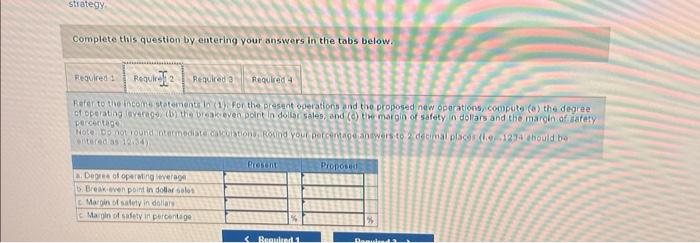

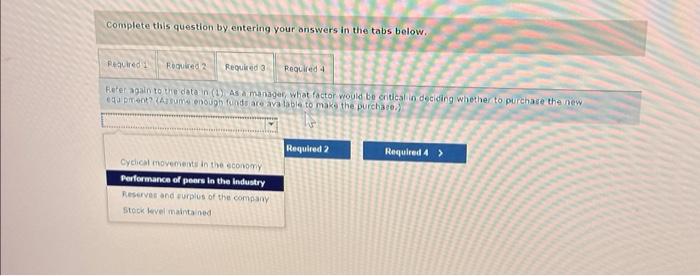

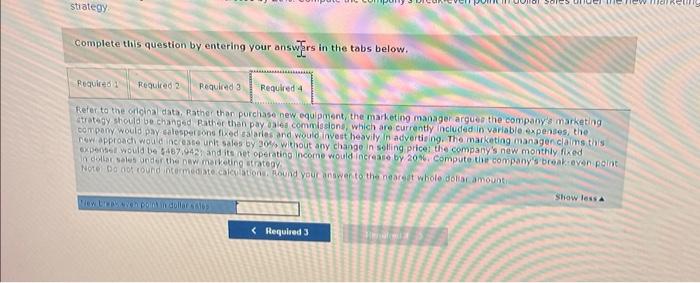

Complete this question by entering your onswers in the tabs below. Feter again to the date in (1) As a manager, what factor would be contical in deciding whether to purchase the new equ prent? (Aisume enough fouds ace ava table to maks the purchase.) Complete this question by entering your answers in the tabs below. Refer to the incomestements in (1), for the present eperations and tho proposed new opecations, computo (o) the degree percertage Gintered as 12.34 ) Complete this question by entering your answ' Trs in the tabs below. Refer to the cloinal data, Rather than purchaso new equipment, the marketing manager arguen the companys marketing strategy should be changed Bather than pay oales commissione, which are currenthy included in variable expenses, the company would pay calesperione fixed ta aries and would invest heavily in advertie ing. The marketiog imanagenclaims this new approadi woul dincresse unk sales by 30%, whout any change in solling price: the company's new monthly fixed ir coltar seles under the Dew meiketing utrategy Morton Company's contibution format income statement for last month is given below. The industly in which Molton Compary operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studyng ways of improving profits Required: 1 New equiment has come onto the matket that would allow Morton Company to automate a portion of its operations. Variable expenses would be recuced by $780 per unit. However, fixed expenses would increase to a total of $687,960 each month Prepare two contsibution format income statements; one showing present operations and one showing how operations would appear if the new equipment is putchesed 2. Refer 10 the income statements in (5) For the present operations and the proposed new operations. compute (a) the degree of operating leveroge, (b) the break-even pont in dollar soles, and (c) the margh of safety in dollars and the margin of safety peicentage 3. Reter again to the data in (i). As o manager, what factor would be critical in deckling whether to purchase the new equipment? (Assume enough funds are avalabie to make the purchase) 4. Refer to the origina dato. Rather than purchase new equipment, the marketing manager argues the company's marketing strategy should be changed. Rether than pay sales commissions, which are currently inciuded in variable expenses, the compony would pay salespersons tixed salaries and would invest heavly in odvertising. The marketing manager claims this new approach would increase unit sales by 30% without any change in selling phice, the companys new monthy fored expenses would be $487,942, and its net operating income would inclease by 20% compute the companys break-even polint in dollar sales under the new marketing stateoy. Complete this question by entering your answers in the tabs below. Hew pqu pirent has come onto the market that would alow Hocton Company to automate o portion of its operations, Variable expensag would be