Answered step by step

Verified Expert Solution

Question

1 Approved Answer

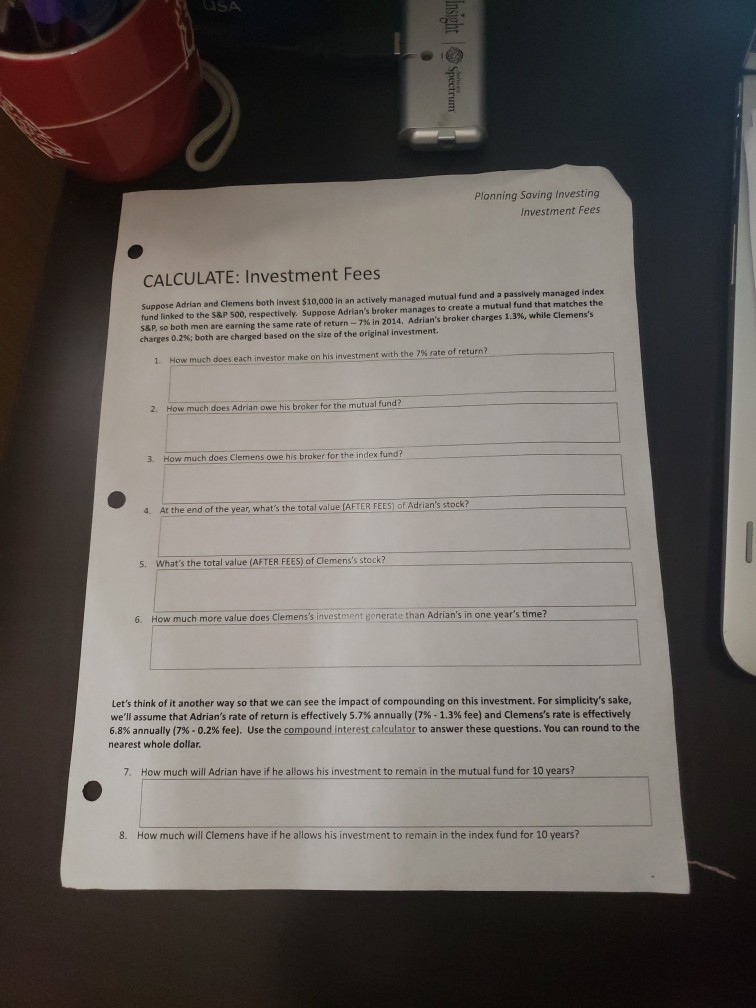

complete this sheet GSA Planning Saving Investing Investment Fees CALCULATE: Investment Fees Suppose Adrian and Clemens both invest $10,000 in an actively managed mutual fund

complete this sheet

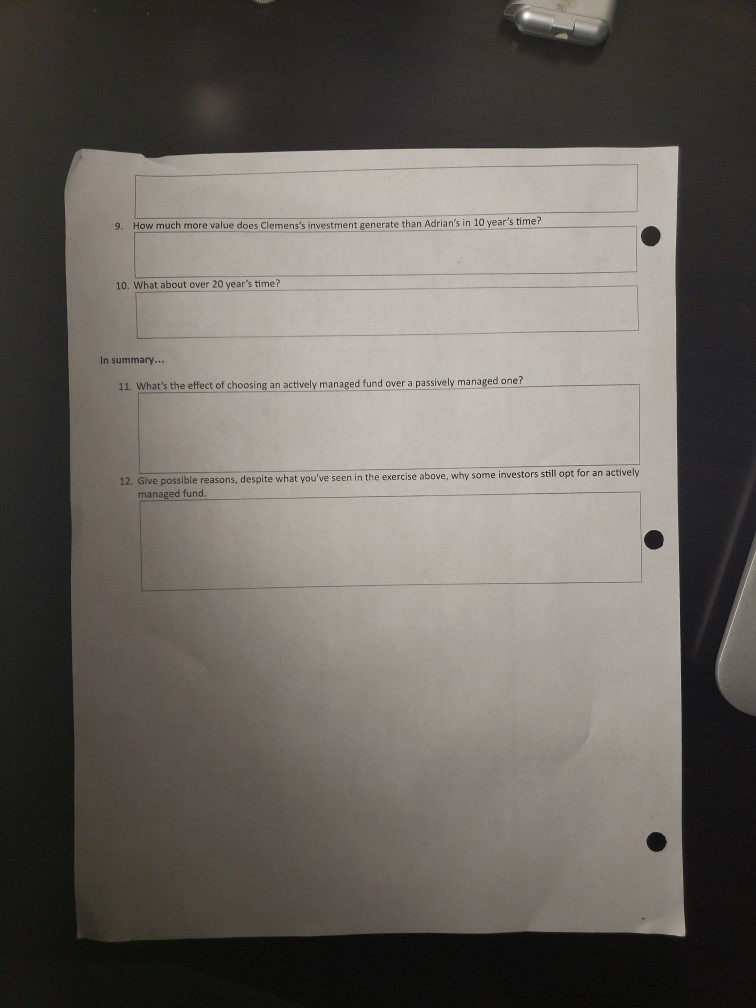

GSA Planning Saving Investing Investment Fees CALCULATE: Investment Fees Suppose Adrian and Clemens both invest $10,000 in an actively managed mutual fund and a passively managed index fund linked to the S&P 500, respectively. Suppose Adrian's broker manages to create a mutual fund that matches the S& P, so both men are earning the same rate of return-7% in 2014, Adrian's broker charges i.3%, while Clemens's charges 0.2%; both are charged based on the size of the original investment. 1, How much does each investor make on his investment with the 7%rate of return? 2. How much does Adrian owe his broker for the mutual fund? 3. How much does Clemens owe his broker for the index fund? 4. At the end of the year, what's the total value (AFTER FEES) of Adrian's stock? 5. What's the total value (AFTER FEES) of Clemens's stock? 6. How much more value does Clemens's investment gonerate than Adrian's in one year's time? Let's think of it another way so that we can see the impact of compounding on this investment. For simplicity's sake, we'll assume that Adrian's rate of return is effectively 5.7% annually (7%-1.3% fee) and Cemens's rate is effectively 6.8% annually (796-0.2% fee). Use the compound interestealculator to answer these questions. You can round to the nearest whole dollar. 7. How much will Adrian have if he allows his investment to remain in the mutual fund for 10 years? 8. How much will Clemens have if he allows his investment to remain in the index fund for 10 years? 9. How much more value does Clemens's investment generate than Adrian's in 10 year's time? 10. What about over 20 year's time? In summary... 11. What's the effect of choosing an actively managed fund over a passively managed one? 12. Give possible reasons, despite what you've seen in the exercise above, why some investors still opt fo managed fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started