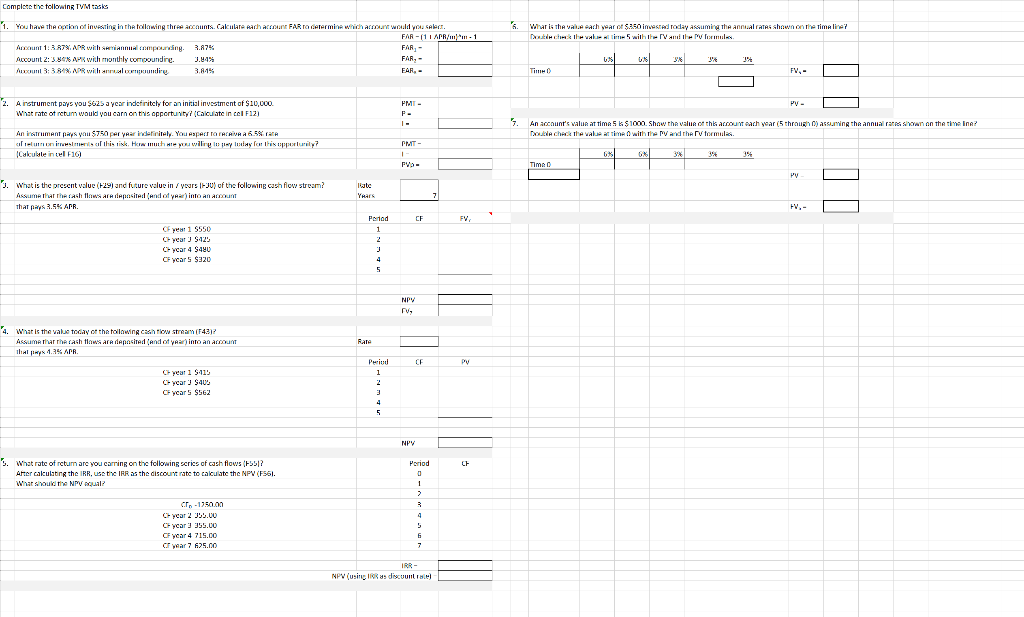

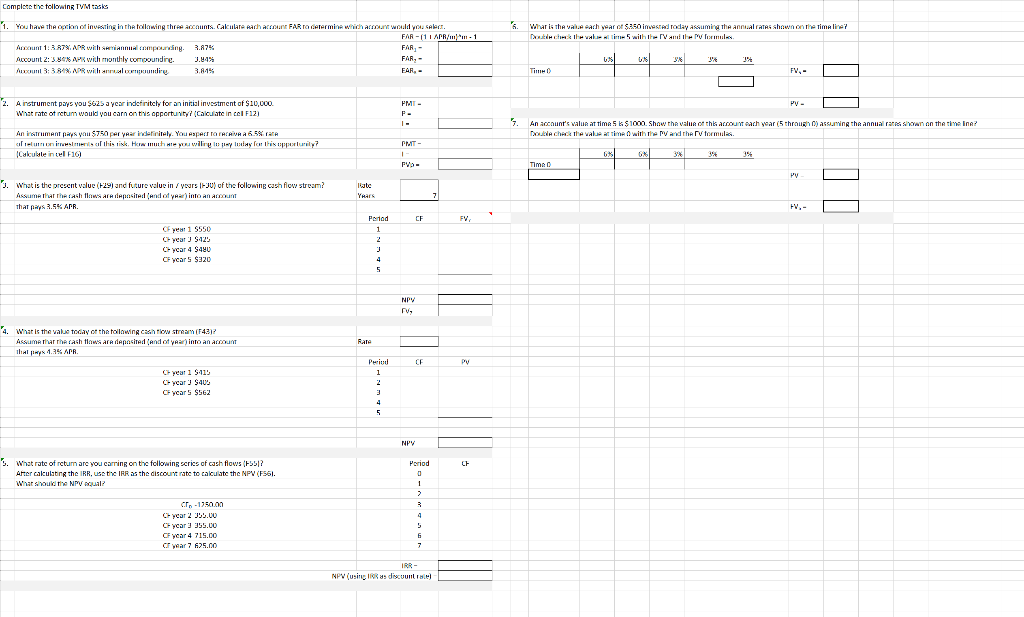

Complete tollowing TVM 5. What is the Valach year of $350 invested raday assuming the annual rates shown on the Timeline Decewalls with tramite ilmu 1. You have the certion of investing in the following three accounts. Cak idare each account FARO termine which arcourt would you selec. FAR-111 APR/... 1 Account 1:37. APR wompounding 2.87% FAR- Account 2: 5.8 APR will monthly combounding 3.44% FAR,- Aucun 3:38 APR will andre 3.815 EAR- US 1% Tim FV, - PV- 2. A instrument pays you $625 aycar indefinitcly for an initial investment of $10,000 What rate of retum would you carn on this opportunity Calculate in cel F12) FM- F- - 5. An account's value at times a $1000. Show the value of the account each year (5 through assuming the annual ras sin on the time ina? DUA check the value at time with her and the formula An instrument you $750 per yerindently. You spectra VAT AIVAA 6.5% freunion serial this link. How much you willing to pay lola for this opportunity? Ikulate in cel F16) PMT- 3% * 35 PV- Time PV 3. What is the procent value (729) and future value in / years (190) of the following cash flow stream? Assume that the cash flows are instalandotinto an art Tharay R.5% ARR. Kate Years 7 CF CF 1 5550 Cyear5425 Cycar 4 $40 CF years $320 Prod 1 2 3 4 5 NPY TV, 4. What is the value today of the following constar (4317 Assume that the cash flows are deposited and of YAZ) into an account THINK 1.1% APR Rare CF PV Periud 1 C-year 1 941 Cycar $402 CF years SSE2 3 4. 5 NP Period CE 5. What rate of rctum are you carring on the following crics of cash flows (5512 After calculating the IRR, use the IRR as the discount rate to calculate the NPV (F561. Whatsaukt NNW 1 ? 3 cr-1350.00 year 2 395.00 Cycar) 355.00 CF year 4 715.00 OF War 7 25.00 4 5 6 6 7 IRR NPV (using a discount Complete tollowing TVM 5. What is the Valach year of $350 invested raday assuming the annual rates shown on the Timeline Decewalls with tramite ilmu 1. You have the certion of investing in the following three accounts. Cak idare each account FARO termine which arcourt would you selec. FAR-111 APR/... 1 Account 1:37. APR wompounding 2.87% FAR- Account 2: 5.8 APR will monthly combounding 3.44% FAR,- Aucun 3:38 APR will andre 3.815 EAR- US 1% Tim FV, - PV- 2. A instrument pays you $625 aycar indefinitcly for an initial investment of $10,000 What rate of retum would you carn on this opportunity Calculate in cel F12) FM- F- - 5. An account's value at times a $1000. Show the value of the account each year (5 through assuming the annual ras sin on the time ina? DUA check the value at time with her and the formula An instrument you $750 per yerindently. You spectra VAT AIVAA 6.5% freunion serial this link. How much you willing to pay lola for this opportunity? Ikulate in cel F16) PMT- 3% * 35 PV- Time PV 3. What is the procent value (729) and future value in / years (190) of the following cash flow stream? Assume that the cash flows are instalandotinto an art Tharay R.5% ARR. Kate Years 7 CF CF 1 5550 Cyear5425 Cycar 4 $40 CF years $320 Prod 1 2 3 4 5 NPY TV, 4. What is the value today of the following constar (4317 Assume that the cash flows are deposited and of YAZ) into an account THINK 1.1% APR Rare CF PV Periud 1 C-year 1 941 Cycar $402 CF years SSE2 3 4. 5 NP Period CE 5. What rate of rctum are you carring on the following crics of cash flows (5512 After calculating the IRR, use the IRR as the discount rate to calculate the NPV (F561. Whatsaukt NNW 1 ? 3 cr-1350.00 year 2 395.00 Cycar) 355.00 CF year 4 715.00 OF War 7 25.00 4 5 6 6 7 IRR NPV (using a discount