Answered step by step

Verified Expert Solution

Question

1 Approved Answer

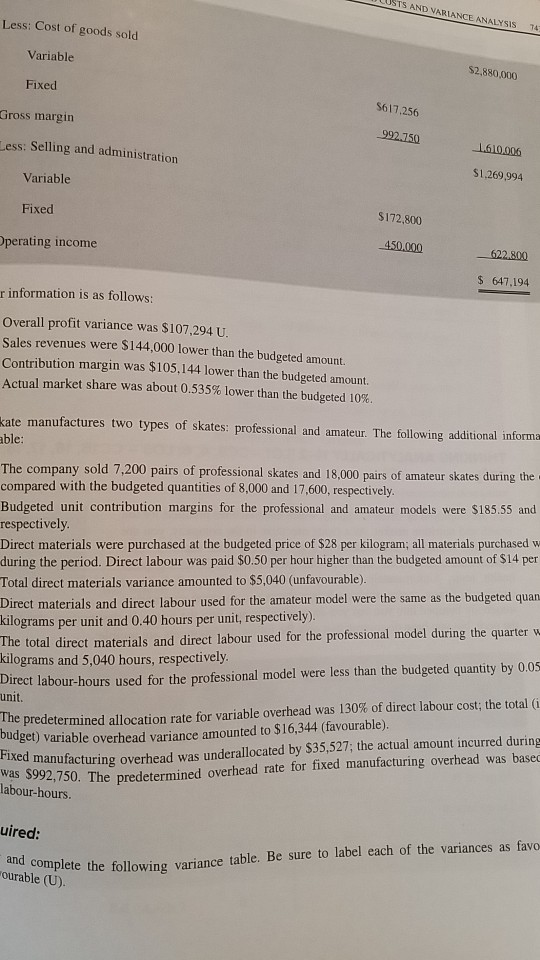

complete variance analysis and prepare a standard cost cards including direct materials, direct labor, variable manufacturing. DLUSTS AND VARIANCE ANALYSIS Less: Cost of goods sold

complete variance analysis and prepare a standard cost cards including direct materials, direct labor, variable manufacturing.

DLUSTS AND VARIANCE ANALYSIS Less: Cost of goods sold 74 Variable $2,880,000 Fixed S617.256 Gross margin 992.750 Less: Selling and administration 1610.006 Variable $1.269,994 Fixed $172,800 Operating income 450.000 622.800 $ 647.194 r information is as follows: Overall profit variance was $107,294 U. Sales revenues were $144,000 lower than the budgeted amount Contribution margin was $105,144 lower than the budgeted amount. Actual market share was about 0.535% lower than the budgeted 10%. kate manufactures two types of skates: professional and amateur. The following additional informa able: The company sold 7,200 pairs of professional skates and 18,000 pairs of amateur skates during the compared with the budgeted quantities of 8,000 and 17,600, respectively. Budgeted unit contribution margins for the professional and amateur models were $185.55 and respectively. Direct materials were purchased at the budgeted price of $28 per kilogram; all materials purchased w during the period. Direct labour was paid $0.50 per hour higher than the budgeted amount of $14 per Total direct materials variance amounted to $5,040 (unfavourable). Direct materials and direct labour used for the amateur model were the same as the budgeted quan kilograms per unit and 0.40 hours per unit, respectively). The total direct materials and direct labour used for the professional model during the quarter kilograms and 5,040 hours, respectively. Direct labour-hours used for the professional model were less than the budgeted quantity by 0.05 unit. ine predetermined allocation rate for variable overhead was 130% of direct labour cost, the total (i budget) variable overhead variance amounted to $16,344 (favourable). med manufacturing overhead was underallocated by $35,527; the actual amount incurred during 992,750. The predetermined overhead rate for fixed manufacturing overhead was based labour-hours. uired: and complete the follow "Ourable (U). omplete the following variance table. Be sure to label each of the variances as favo DLUSTS AND VARIANCE ANALYSIS Less: Cost of goods sold 74 Variable $2,880,000 Fixed S617.256 Gross margin 992.750 Less: Selling and administration 1610.006 Variable $1.269,994 Fixed $172,800 Operating income 450.000 622.800 $ 647.194 r information is as follows: Overall profit variance was $107,294 U. Sales revenues were $144,000 lower than the budgeted amount Contribution margin was $105,144 lower than the budgeted amount. Actual market share was about 0.535% lower than the budgeted 10%. kate manufactures two types of skates: professional and amateur. The following additional informa able: The company sold 7,200 pairs of professional skates and 18,000 pairs of amateur skates during the compared with the budgeted quantities of 8,000 and 17,600, respectively. Budgeted unit contribution margins for the professional and amateur models were $185.55 and respectively. Direct materials were purchased at the budgeted price of $28 per kilogram; all materials purchased w during the period. Direct labour was paid $0.50 per hour higher than the budgeted amount of $14 per Total direct materials variance amounted to $5,040 (unfavourable). Direct materials and direct labour used for the amateur model were the same as the budgeted quan kilograms per unit and 0.40 hours per unit, respectively). The total direct materials and direct labour used for the professional model during the quarter kilograms and 5,040 hours, respectively. Direct labour-hours used for the professional model were less than the budgeted quantity by 0.05 unit. ine predetermined allocation rate for variable overhead was 130% of direct labour cost, the total (i budget) variable overhead variance amounted to $16,344 (favourable). med manufacturing overhead was underallocated by $35,527; the actual amount incurred during 992,750. The predetermined overhead rate for fixed manufacturing overhead was based labour-hours. uired: and complete the follow "Ourable (U). omplete the following variance table. Be sure to label each of the variances as favoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started