Completed first part, need help on rest !

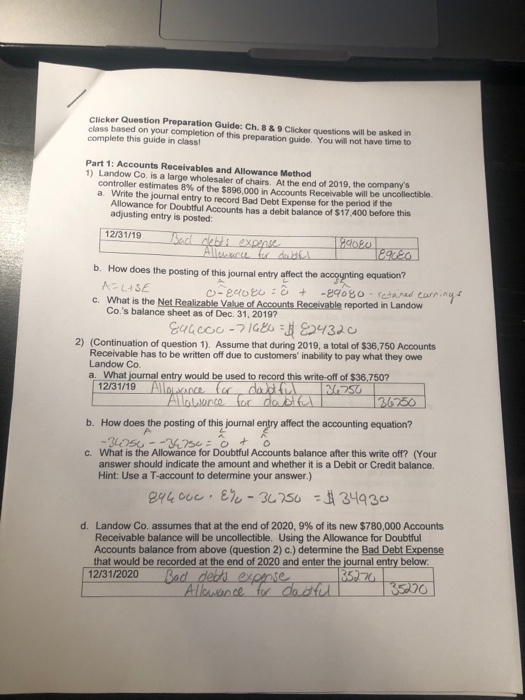

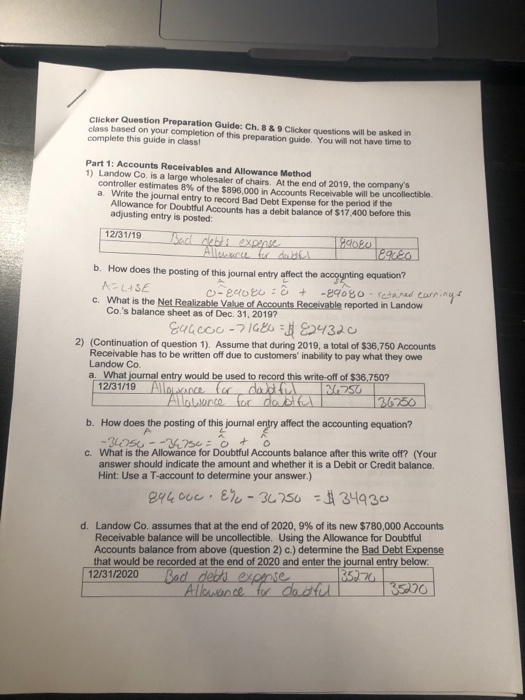

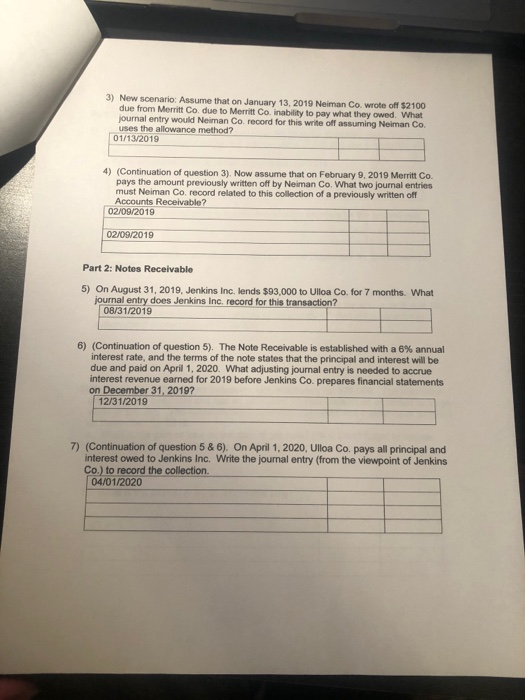

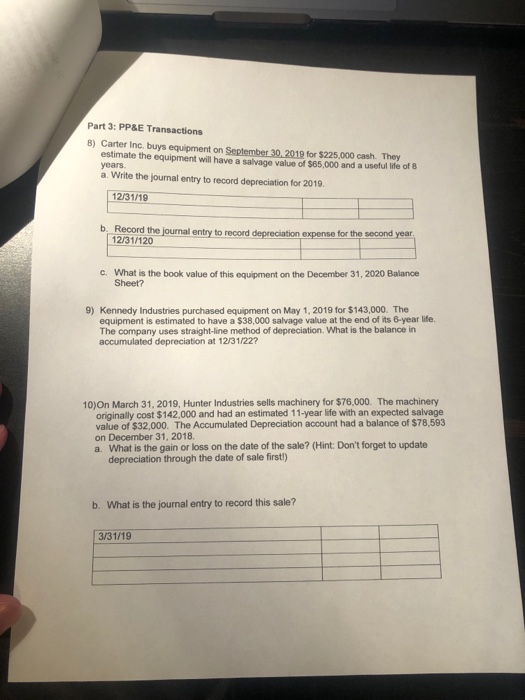

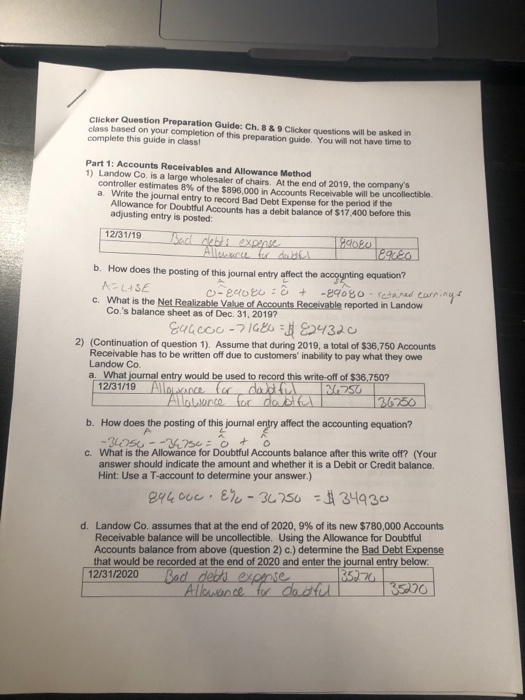

Cuckor Question Preparation Guide Ch889 de gestions will be used in as based on your completion of this preparation guide you will not have time to complete this guide in class! Part 1: Accounts Receivables and Allowance Method 1) Landow Co. is a large wholesaler of chars Atheend of 2019, the company's controller estimates 8% of the 5898 000 in Accounts Receivable will be uncollectible a Write the journal entry to record Bad Debt Expense for the period the Allowance for Doubtful Accounts has a debit balance of $17.400 before this adjusting entry is posted: 12/31/19 SMS 1180080 lewance for dadel b. How does the posting of this journal entry affect the accounting equation? ALSE o cuoro = t -8400o- retained earrings c. What is the Net Realizable Value of Accounts Receivable reported in Landow Co.'s balance sheet as of Dec. 31, 2019? Eucooo-71680 = $824320 2) (Continuation of question 1). Assume that during 2019, a total of $36.750 Accounts Receivable has to be written off due to customers' inability to pay what they owe Landow Co. a. What journal entry would be used to record this write-off of $36,750? 12/31/19 Aloncu doudll 250 Allowance for dabtful b. How does the posting of this journal entry affect the accounting equation? - 34250 --34250E + c. What is the Allowance for Doubtful Accounts balance after this write off? (Your answer should indicate the amount and whether it is a Debitor Credit balance. Hint: Use a T-account to determine your answer.) 244 COL. E7 - 36750 - 34930 d. Landow Co. assumes that at the end of 2020,9% of its new $780,000 Accounts Receivable balance will be uncollectible. Using the Allowance for Doubtful Accounts balance from above (question 2) c.) determine the Bad Debt Expense that would be recorded at the end of 2020 and enter the journal entry below 12/31/2020 Bod ded's expense Allowance for dette 35200 3) New scenario: Assume that on January 13, 2019 Neiman Co wrote off 52100 due from Merritt Co due to Merritt Co. inability to pay what they owed What journal entry would Neiman Co record for this write off assuming Neiman Co uses the allowance method? 01/112019 4) (Continuation of question 3). Now assume that on February 9, 2019 Merritt Co. pays the amount previously written off by Neiman Co. What two journal entries must Neiman Co record related to this collection of a previously written off Accounts Receivable? 02/09/2019 02/09/2019 Part 2: Notes Receivable 5) On August 31, 2019, Jenkins Inc. lends $93,000 to Ulloa Co. for 7 months. What journal entry does Jenkins Inc. record for this transaction? 08/31/2019 6) (Continuation of question 5). The Note Receivable is established with a 6% annual interest rate, and the terms of the note states that the principal and interest will be due and paid on April 1, 2020. What adjusting journal entry is needed to accrue interest revenue earned for 2019 before Jenkins Co, prepares financial statements on December 31, 2019? 12/31/2019 7) (Continuation of question 5 & 6). On April 1, 2020, Ulloa Co. pays all principal and interest owed to Jenkins Inc. Write the journal entry (from the viewpoint of Jenkins Co.) to record the collection 04/01/2020 Part 3: PP&E Transactions 8) Carter Inc. buys equipment on September 30, 2019 for $225.000 cash. They estimate the equipment will have a salvage value of $65 000 and a useful life of 8 years a. Write the journal entry to record depreciation for 2019 12/31/19 b. Record the journal entry to record depreciation expense for the second year. 12/31/120 c. What is the book value of this equipment on the December 31, 2020 Balance Sheet? 9) Kennedy Industries purchased equipment on May 1, 2019 for $143,000. The equipment is estimated to have a $38,000 salvage value at the end of its 6-year life. The company uses straight-line method of depreciation. What is the balance in accumulated depreciation at 12/31/22? 10) On March 31, 2019, Hunter Industries sells machinery for $76,000. The machinery originally cost $142,000 and had an estimated 11-year life with an expected salvage value of $32,000. The Accumulated Depreciation account had a balance of $78,593 on December 31, 2018 a. What is the gain or loss on the date of the sale? (Hint: Don't forget to update depreciation through the date of sale first!) b. What is the journal entry to record this sale? 3/31/19 Cuckor Question Preparation Guide Ch889 de gestions will be used in as based on your completion of this preparation guide you will not have time to complete this guide in class! Part 1: Accounts Receivables and Allowance Method 1) Landow Co. is a large wholesaler of chars Atheend of 2019, the company's controller estimates 8% of the 5898 000 in Accounts Receivable will be uncollectible a Write the journal entry to record Bad Debt Expense for the period the Allowance for Doubtful Accounts has a debit balance of $17.400 before this adjusting entry is posted: 12/31/19 SMS 1180080 lewance for dadel b. How does the posting of this journal entry affect the accounting equation? ALSE o cuoro = t -8400o- retained earrings c. What is the Net Realizable Value of Accounts Receivable reported in Landow Co.'s balance sheet as of Dec. 31, 2019? Eucooo-71680 = $824320 2) (Continuation of question 1). Assume that during 2019, a total of $36.750 Accounts Receivable has to be written off due to customers' inability to pay what they owe Landow Co. a. What journal entry would be used to record this write-off of $36,750? 12/31/19 Aloncu doudll 250 Allowance for dabtful b. How does the posting of this journal entry affect the accounting equation? - 34250 --34250E + c. What is the Allowance for Doubtful Accounts balance after this write off? (Your answer should indicate the amount and whether it is a Debitor Credit balance. Hint: Use a T-account to determine your answer.) 244 COL. E7 - 36750 - 34930 d. Landow Co. assumes that at the end of 2020,9% of its new $780,000 Accounts Receivable balance will be uncollectible. Using the Allowance for Doubtful Accounts balance from above (question 2) c.) determine the Bad Debt Expense that would be recorded at the end of 2020 and enter the journal entry below 12/31/2020 Bod ded's expense Allowance for dette 35200 3) New scenario: Assume that on January 13, 2019 Neiman Co wrote off 52100 due from Merritt Co due to Merritt Co. inability to pay what they owed What journal entry would Neiman Co record for this write off assuming Neiman Co uses the allowance method? 01/112019 4) (Continuation of question 3). Now assume that on February 9, 2019 Merritt Co. pays the amount previously written off by Neiman Co. What two journal entries must Neiman Co record related to this collection of a previously written off Accounts Receivable? 02/09/2019 02/09/2019 Part 2: Notes Receivable 5) On August 31, 2019, Jenkins Inc. lends $93,000 to Ulloa Co. for 7 months. What journal entry does Jenkins Inc. record for this transaction? 08/31/2019 6) (Continuation of question 5). The Note Receivable is established with a 6% annual interest rate, and the terms of the note states that the principal and interest will be due and paid on April 1, 2020. What adjusting journal entry is needed to accrue interest revenue earned for 2019 before Jenkins Co, prepares financial statements on December 31, 2019? 12/31/2019 7) (Continuation of question 5 & 6). On April 1, 2020, Ulloa Co. pays all principal and interest owed to Jenkins Inc. Write the journal entry (from the viewpoint of Jenkins Co.) to record the collection 04/01/2020 Part 3: PP&E Transactions 8) Carter Inc. buys equipment on September 30, 2019 for $225.000 cash. They estimate the equipment will have a salvage value of $65 000 and a useful life of 8 years a. Write the journal entry to record depreciation for 2019 12/31/19 b. Record the journal entry to record depreciation expense for the second year. 12/31/120 c. What is the book value of this equipment on the December 31, 2020 Balance Sheet? 9) Kennedy Industries purchased equipment on May 1, 2019 for $143,000. The equipment is estimated to have a $38,000 salvage value at the end of its 6-year life. The company uses straight-line method of depreciation. What is the balance in accumulated depreciation at 12/31/22? 10) On March 31, 2019, Hunter Industries sells machinery for $76,000. The machinery originally cost $142,000 and had an estimated 11-year life with an expected salvage value of $32,000. The Accumulated Depreciation account had a balance of $78,593 on December 31, 2018 a. What is the gain or loss on the date of the sale? (Hint: Don't forget to update depreciation through the date of sale first!) b. What is the journal entry to record this sale? 3/31/19