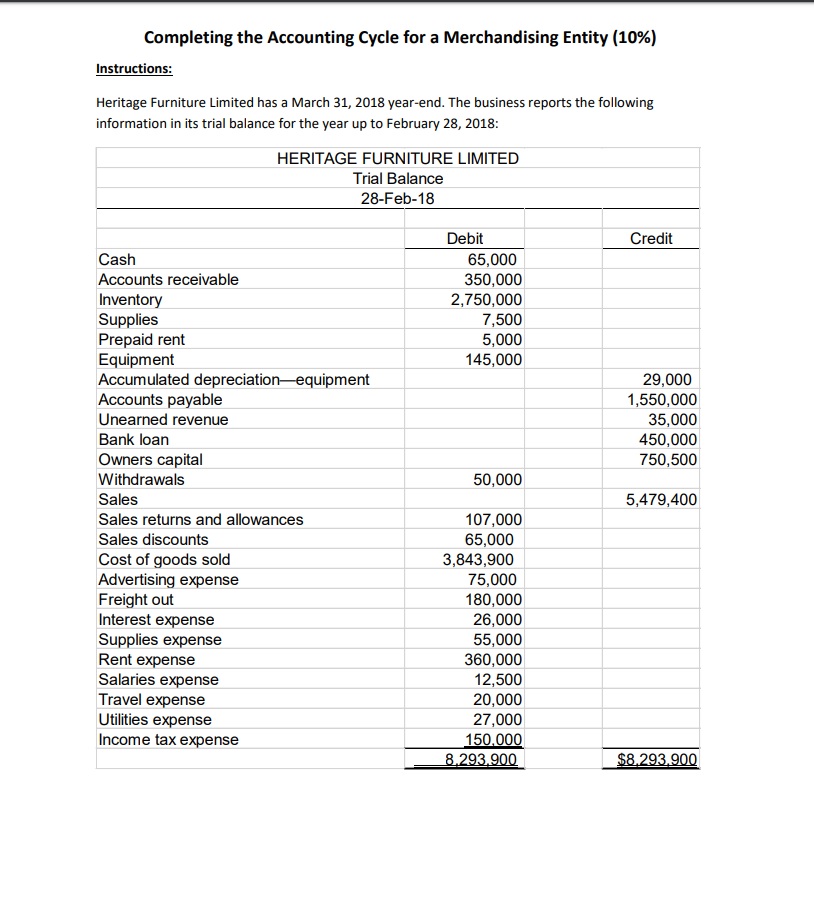

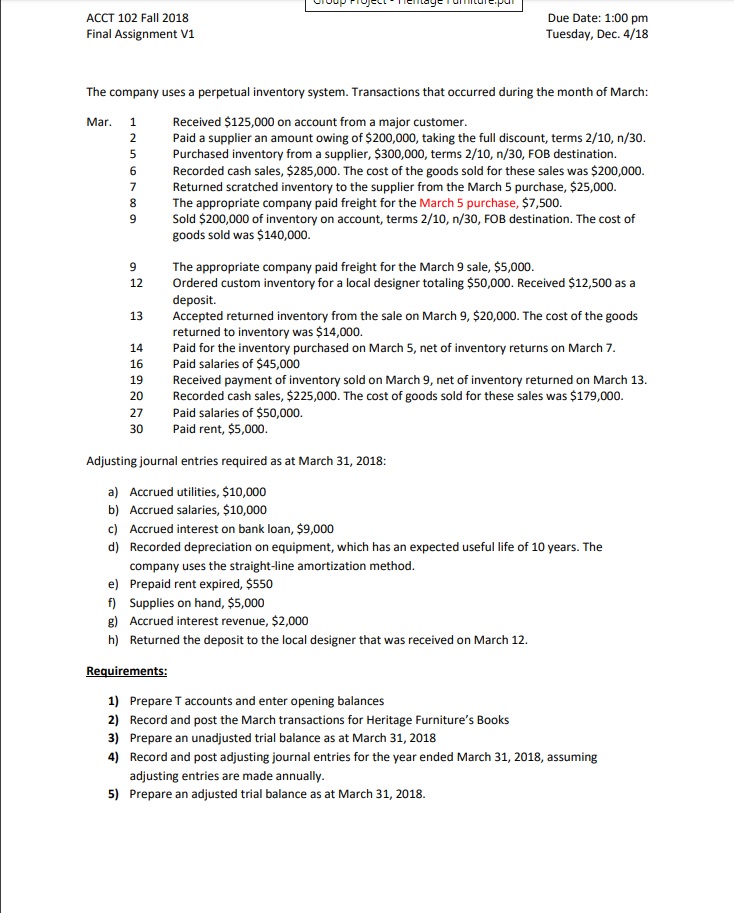

Completing the Accounting Cycle for a Merchandising Entity (10%) Instructions: Heritage Furniture Limited has a March 31, 2018 year-end. The business reports the following information in its trial balance for the year up to February 28, 2018: HERITAGE FURNITURE LIMITED Trial Balance 28-Feb-18 Debit Credit Cash 65,000 Accounts receivable 350,000 Inventory 2,750,000 Supplies 7,500 Prepaid rent 5,000 Equipment 145,000 Accumulated depreciation-equipment 29,000 Accounts payable 1,550,000 Unearned revenue 35,000 Bank loan 450,000 Owners capital 750,500 Withdrawals 50,000 Sales 5,479,400 Sales returns and allowances 107,000 Sales discounts 65,000 Cost of goods sold 3,843,900 Advertising expense 75,000 Freight out 180,000 Interest expense 26,000 Supplies expense 55,000 Rent expense 360,000 Salaries expense 12,500 Travel expense 20,000 Utilities expense 27,000 Income tax expense 150.000 8,293,900 $8,293.900ACCT 102 Fall 2018 Due Date: 1:00 pm Final Assignment V1 Tuesday, Dec. 4/18 The company uses a perpetual inventory system. Transactions that occurred during the month of March: Mar. IUING Received $125,000 on account from a major customer. Paid a supplier an amount owing of $200,000, taking the full discount, terms 2/10, n/30. Purchased inventory from a supplier, $300,000, terms 2/10, n/30, FOB destination. LD DOC Recorded cash sales, $285,000. The cost of the goods sold for these sales was $200,000. Returned scratched inventory to the supplier from the March 5 purchase, $25,000. The appropriate company paid freight for the March 5 purchase, $7,500. Sold $200,000 of inventory on account, terms 2/10, n/30, FOB destination. The cost of goods sold was $140,000. 9 The appropriate company paid freight for the March 9 sale, $5,000. 12 Ordered custom inventory for a local designer totaling $50,000. Received $12,500 as a deposit. 13 Accepted returned inventory from the sale on March 9, $20,000. The cost of the goods returned to inventory was $14,000. 14 Paid for the inventory purchased on March 5, net of inventory returns on March 7. 16 Paid salaries of $45,000 19 Received payment of inventory sold on March 9, net of inventory returned on March 13. 20 Recorded cash sales, $225,000. The cost of goods sold for these sales was $179,000. 27 Paid salaries of $50,000. 30 Paid rent, $5,000. Adjusting journal entries required as at March 31, 2018: a) Accrued utilities, $10,000 b) Accrued salaries, $10,000 ) Accrued interest on bank loan, $9,000 d) Recorded depreciation on equipment, which has an expected useful life of 10 years. The company uses the straight-line amortization method. e) Prepaid rent expired, $550 f) Supplies on hand, $5,000 g) Accrued interest revenue, $2,000 h) Returned the deposit to the local designer that was received on March 12. Requirements: 1) Prepare T accounts and enter opening balances 2) Record and post the March transactions for Heritage Furniture's Books 3) Prepare an unadjusted trial balance as at March 31, 2018 4) Record and post adjusting journal entries for the year ended March 31, 2018, assuming adjusting entries are made annually. 5) Prepare an adjusted trial balance as at March 31, 2018.Grading: The following check figures are provided for you: Net income $619,850 Total assets $3,184,350 Since we have provided check figures, full marks will require the completion and accuracy of all requirements. Understanding the accounting cycle requires the ability to problem solve and find your errors should you not arrive at these figures