Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complexico mine Consider the Complexico mine and assume a 10% constant interest rate; also assume the price of gold is constant at $400/oz. (a)

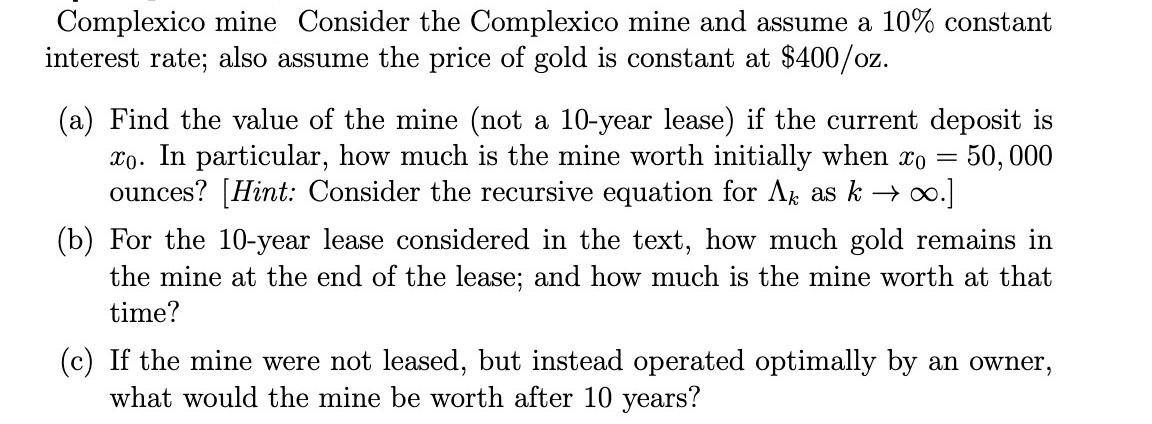

Complexico mine Consider the Complexico mine and assume a 10% constant interest rate; also assume the price of gold is constant at $400/oz. (a) Find the value of the mine (not a 10-year lease) if the current deposit is xo. In particular, how much is the mine worth initially when x0 = = 50,000 ounces? [Hint: Consider the recursive equation for Ak as k .] (b) For the 10-year lease considered in the text, how much gold remains in the mine at the end of the lease; and how much is the mine worth at that time? (c) If the mine were not leased, but instead operated optimally by an owner, what would the mine be worth after 10 years?

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the value of the mine without a lease we can use the formula for the present value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started