Answered step by step

Verified Expert Solution

Question

1 Approved Answer

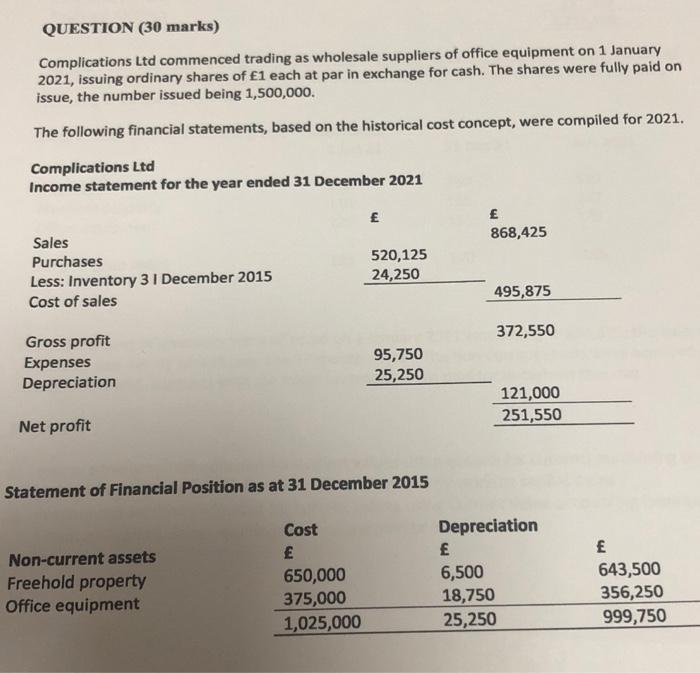

QUESTION (30 marks) Complications Ltd commenced trading as wholesale suppliers of office equipment on 1 January 2021, issuing ordinary shares of 1 each at

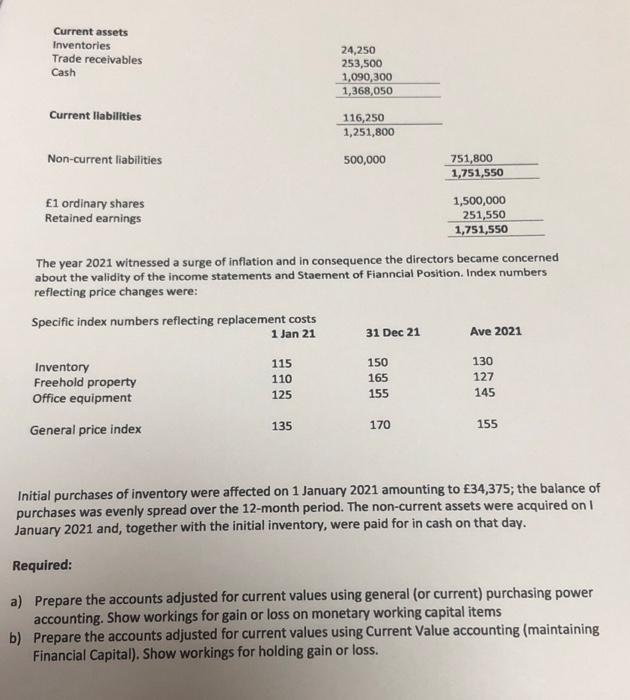

QUESTION (30 marks) Complications Ltd commenced trading as wholesale suppliers of office equipment on 1 January 2021, issuing ordinary shares of 1 each at par in exchange for cash. The shares were fully paid on issue, the number issued being 1,500,000. The following financial statements, based on the historical cost concept, were compiled for 2021. Complications Ltd Income statement for the year ended 31 December 2021 Sales 868,425 Purchases 520,125 Less: Inventory 31 December 2015 24,250 Cost of sales 495,875 Gross profit 372,550 Expenses Depreciation 95,750 25,250 121,000 Net profit 251,550 Statement of Financial Position as at 31 December 2015 Non-current assets Freehold property Office equipment Cost Depreciation 650,000 6,500 643,500 375,000 18,750 356,250 1,025,000 25,250 999,750 Current assets Inventories Trade receivables Cash 24,250 253,500 1,090,300 Current liabilities Non-current liabilities 1 ordinary shares Retained earnings 1,368,050 116,250 1,251,800 500,000 751,800 1,751,550 1,500,000 251,550 1,751,550 The year 2021 witnessed a surge of inflation and in consequence the directors became concerned about the validity of the income statements and Staement of Fianncial Position. Index numbers reflecting price changes were: Specific index numbers reflecting replacement costs Inventory Freehold property Office equipment General price index 1 Jan 21 31 Dec 21 Ave 2021 115 150 130 110 165 127 125 155 145 135 170 155 Initial purchases of inventory were affected on 1 January 2021 amounting to 34,375; the balance of purchases was evenly spread over the 12-month period. The non-current assets were acquired on I January 2021 and, together with the initial inventory, were paid for in cash on that day. Required: a) Prepare the accounts adjusted for current values using general (or current) purchasing power accounting. Show workings for gain or loss on monetary working capital items b) Prepare the accounts adjusted for current values using Current Value accounting (maintaining Financial Capital). Show workings for holding gain or loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement a Adjusting for Current Values Using General Purchasing Power Accounting Step 1 Identify the Adjustment Requirement The task requires adjusting the financial statements for inflation using ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started