Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compound Interest Application Imagine you start with $1.00 in a bank account that pays 100% interest per year. If the interest is credited once

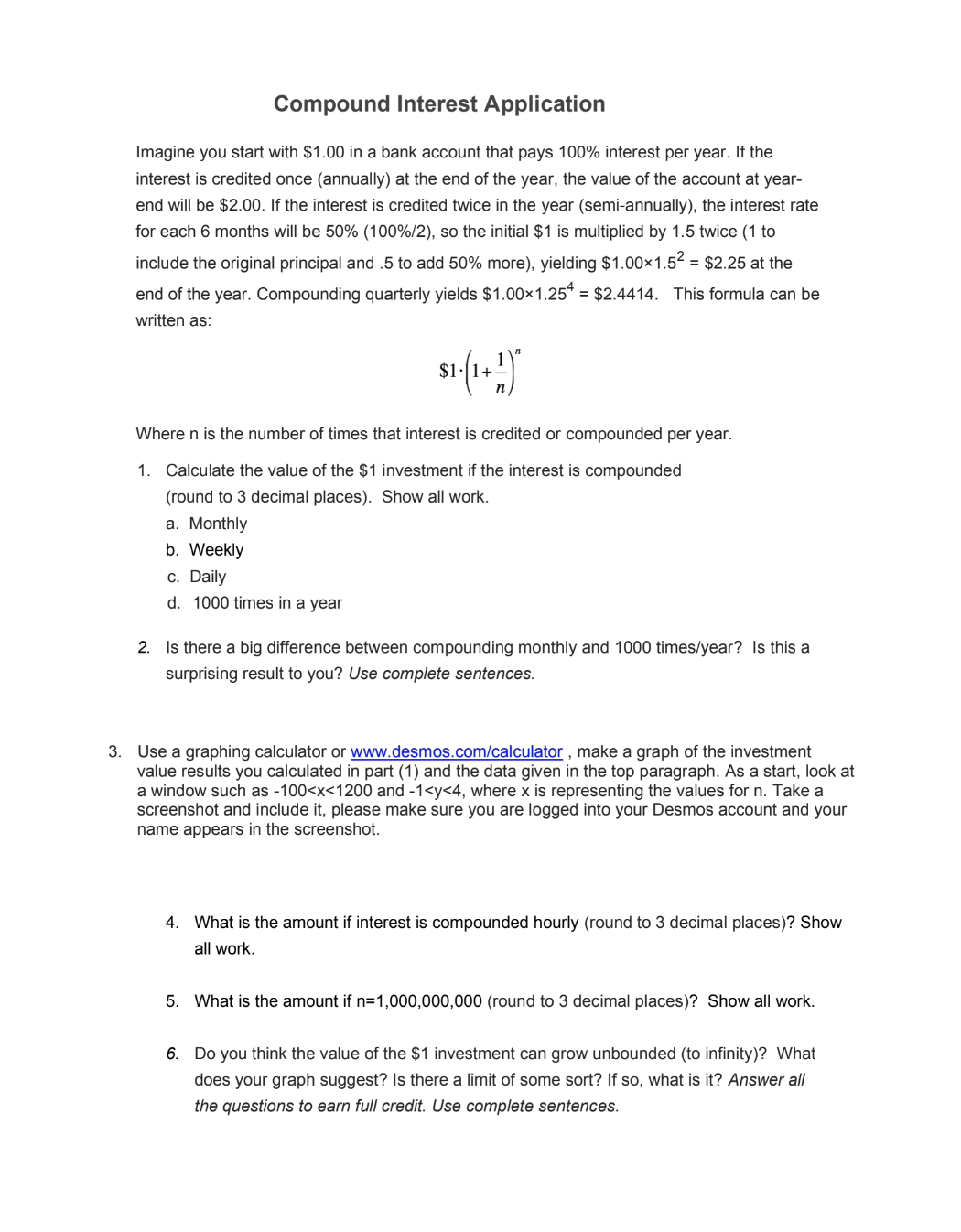

Compound Interest Application Imagine you start with $1.00 in a bank account that pays 100% interest per year. If the interest is credited once (annually) at the end of the year, the value of the account at year- end will be $2.00. If the interest is credited twice in the year (semi-annually), the interest rate for each 6 months will be 50% (100%/2), so the initial $1 is multiplied by 1.5 twice (1 to include the original principal and .5 to add 50% more), yielding $1.00x1.5 = $2.25 at the end of the year. Compounding quarterly yields $1.001.254 = $2.4414. This formula can be written as: $1 Where n is the number of times that interest is credited or compounded per year. 1. Calculate the value of the $1 investment if the interest is compounded (round to 3 decimal places). Show all work. a. Monthly b. Weekly c. Daily d. 1000 times in a year 2. Is there a big difference between compounding monthly and 1000 times/year? Is this a surprising result to you? Use complete sentences. 3. Use a graphing calculator or www.desmos.com/calculator, make a graph of the investment value results you calculated in part (1) and the data given in the top paragraph. As a start, look at a window such as -100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started