Answered step by step

Verified Expert Solution

Question

1 Approved Answer

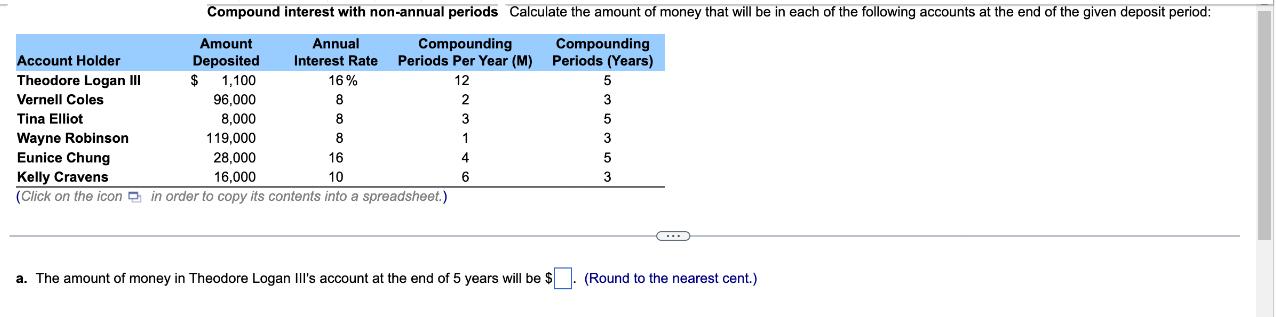

Compound interest with non-annual periods Calculate the amount of money that will be in each of the following accounts at the end of the

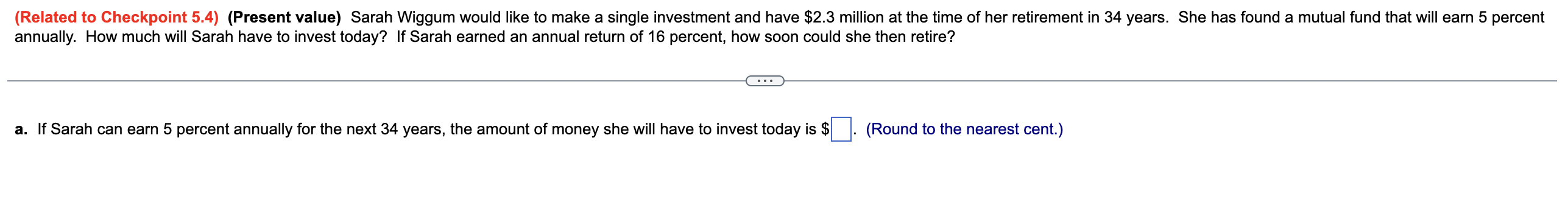

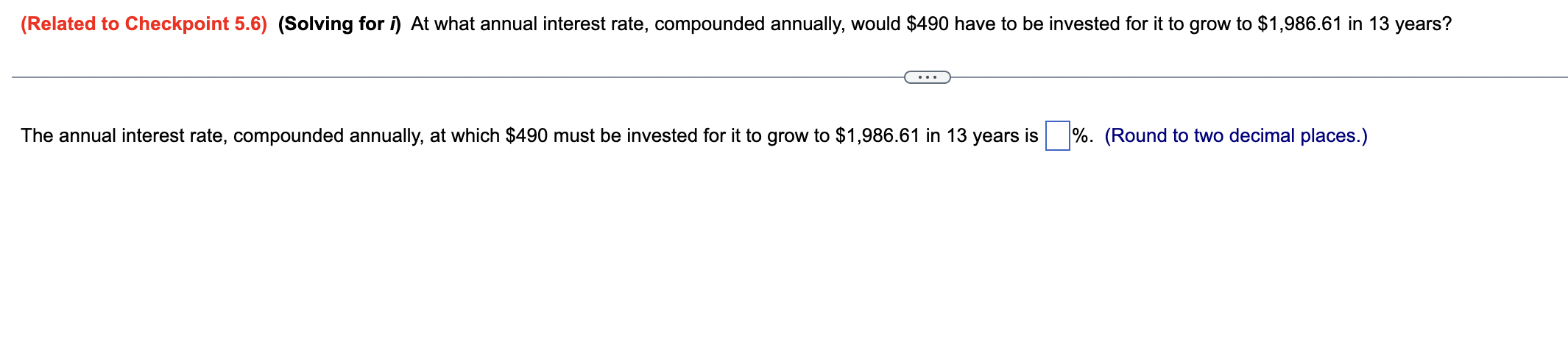

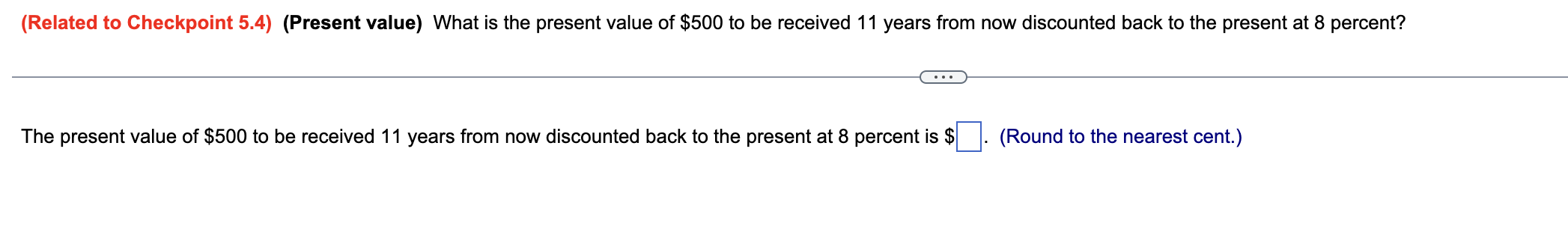

Compound interest with non-annual periods Calculate the amount of money that will be in each of the following accounts at the end of the given deposit period: Compounding Compounding Periods (Years) Amount Annual Account Holder Theodore Logan III $ Vernell Coles Deposited 1,100 96,000 Interest Rate Periods Per Year (M) 16% 12 5 8 2 3 Tina Elliot Wayne Robinson 8,000 8 3 5 119,000 8 1 3 Eunice Chung Kelly Cravens 28,000 16,000 16 10 6 5 3 (Click on the icon in order to copy its contents into a spreadsheet.) a. The amount of money in Theodore Logan III's account at the end of 5 years will be $ (Round to the nearest cent.) (Related to Checkpoint 5.4) (Present value) Sarah Wiggum would like to make a single investment and have $2.3 million at the time of her retirement in 34 years. She has found a mutual fund that will earn 5 percent annually. How much will Sarah have to invest today? If Sarah earned an annual return of 16 percent, how soon could she then retire? a. If Sarah can earn 5 percent annually for the next 34 years, the amount of money she will have to invest today is $ (Round to the nearest cent.) (Related to Checkpoint 5.6) (Solving for i) At what annual interest rate, compounded annually, would $490 have to be invested for it to grow to $1,986.61 in 13 years? The annual interest rate, compounded annually, at which $490 must be invested for it to grow to $1,986.61 in 13 years is %. (Round to two decimal places.) (Related to Checkpoint 5.4) (Present value) What is the present value of $500 to be received 11 years from now discounted back to the present at 8 percent? The present value of $500 to be received 11 years from now discounted back to the present at 8 percent is $ (Round to the nearest cent.) (Related to Checkpoint 5.6) (Solving for i) Kirk Van Houten, who has been married for 22 years, would like to buy his wife an expensive diamond ring with a platinum setting on their 30-year wedding anniversary. Assume that the cost of the ring will be $11,000 in 8 years. Kirk currently has $4,432 to invest. What annual rate of return must Kirk earn on his investment to accumulate enough money to pay for the ring? The annual rate of return Kirk must earn on his investment to accumulate enough money to pay for the ring is %. (Round to two decimal places.) (Related to Checkpoint 5.5) (Solving for n) Jack asked Jill to marry him, and she has accepted under one condition: Jack must buy her a new $350,000 Rolls-Royce Phantom. Jack currently has $17,710 that he may invest. He has found a mutual fund with an expected annual return of 7 percent in which he will place the money. How long will it take Jack to win Jill's hand in marriage? Ignore taxes and inflation. The number of years it will take for Jack to win Jill's hand in marriage is years. (Round to one decimal place.) (Related to Checkpoint 5.6) (Solving for i) If you were offered $531.10 16 years from now in return for an investment of $100 currently, what annual rate of interest would you earn if you took the offer? The annual rate of interest you would earn if you took the offer is %. (Round to the nearest whole percent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started