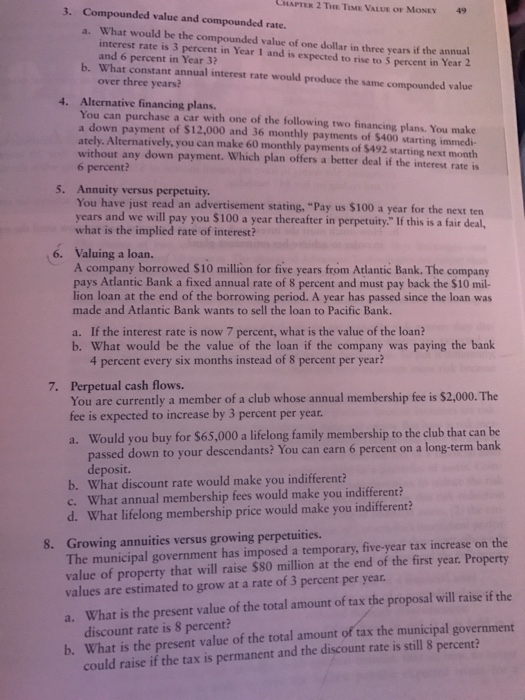

Compounded value and compounded rate. a. What would be the compounded value of one dollar in three years if the annual interest rate is 3 percent in Year 1 and is expected to rise to 5 percent in Year 2 and 6 percent in Year 3? b. What constant annual interest rate would produce the same compounded value over three years? Alternative financing plans. You can purchase a car with one of the following two financing plans. You make a down payment of $12,000 and 36 monthly payments of $400 starting immediately. Alternatively, you can make 60 monthly payments of $492 starting next month without any down payment. Which plan offers a better deal if the interest rate is 6 percent? Annuity versus perpetuity. You have just read an advertisement Mating, "Pay us $100 a year for the next ten years and we will pay you $100 a year thereafter in perpetuity." If this is a fair deal what is the implied rare of interest? Valuing a loan. A company borrowed $10 million for five years from Atlantic Bank. The company pays Atlantic Bank a fixed annual rate of 8 percent and must pay hack the $10 million loan at the end of the borrowing period. A year has passed since the loan was made and Atlantic Bank wants to sell the loan to Pacific Bank. a. If the interest rate is now 7 percent, what is the value of the loan? b. What would be the value of the loan if the company was paying the bank 4 percent every six months instead of 8 percent per year? Perpetual cash flows. You are currently a member of a club whose annual membership fee is $2,000. The fee is expected to increase by 3 percent per year. a. Would you buy for $65,000 a lifelong family membership to the club that can be passed down to your descendants? You can earn 6 percent on a long-term bank deposit. b What discount rate would make you indifferent? c. What annual membership fees would make you indifferent. d. What lifelong membership price would make you indifferent. Growing annuities versus growing perpetuities. The municipal government has imposed a temporary, five year tax increase on the value of property that will raise $80 million at the end of the first year. Property values are estimated to grow at a rate of 3 percent per year. a. What is the present value of the total amount of tax the proposal will raise if the discount rate is 8 percent? b. What is the present value of the total amount of tax the municipal government could raise if the tax is permanent and the discount rate is still 8 percent